Macquarie (MQG) cops upgrade from Morgan Stanley

Stock

Macquarie (MQG) $118.71 as at 19/06/2018Event

Morgan Stanley have put out a bullish note on Macquarie (MQG) today, pinning a $130.00 price target on the stock. They give 10 reasons to underpin their bullish stance, notably - (1) Earnings and ROE upgrade cycle continues; (2) Geared to the real economy, not just financial markets; (3) Leading Alternative Asset Manager; (4) Lumpy revenues pipeline is growing, reducing near-term earnings risk; (5) Initial guidance is usually conservative, implying upside risk to consensus; (6) 5 year growth potential gives us longer term confidence; (7) Offshore earner; (8) Leveraged to segments with structural growth; (9) Flexibility on the compensation ratio; and (10) Strong capital position. (source Morgan Stanley) Macquarie (MQG) Chart Their earnings expectations now sit about 10% above consensus – a bullish stance (clearly)!

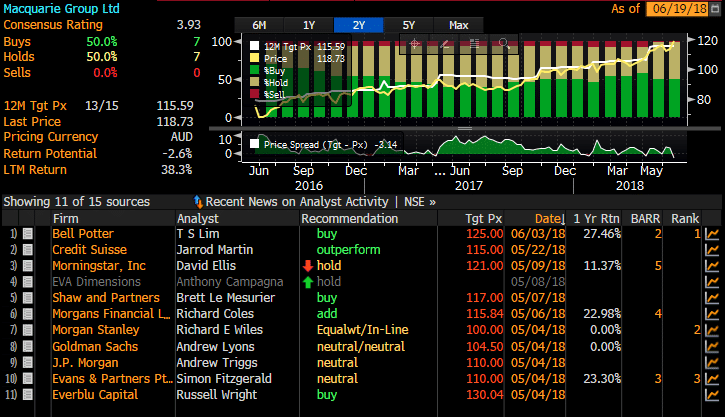

Here’s current broker calls…although Morgan Stanley is hot off the press so has not yet been updated on Bloomberg

Their earnings expectations now sit about 10% above consensus – a bullish stance (clearly)!

Here’s current broker calls…although Morgan Stanley is hot off the press so has not yet been updated on Bloomberg

Source; Bloomberg

Source; Bloomberg