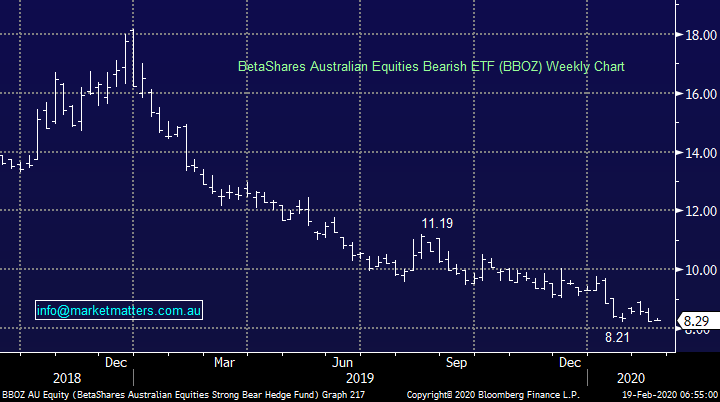

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (CBA, BEN, GDX US, PDL, BBOZ, GOLD US, SH US, SLVP US, TBF US, BBG)

The ASX200 drifted lower yesterday finally closing down less than -0.2%, on balance it felt like a solid result considering losers outstripped winners 2:1 and the intra-day sentiment was significantly dampened by a coronavirus inspired earnings downgrade by Apple (AAPL US) – I question what did the market expect, the company still has 35 of its 42 stores on the mainland closed for business before we even consider the huge disruption to production & demand of the iPhone, China is the primary producer of its flagship product and the countries struggling to get people back to work.

At MM we’ve been increasing cash levels of late as we perceive the risk / reward for buyers has become far less attractive at current elevated levels, simply we don’t believe the risks around the coronavirus are adequately being built into stocks with Apple, the world largest company, being a great example. The death toll from the virus is now approaching 1900, around 75,000 people are reported as infected and 150 million people are in lockdown, I ask again what statistics will scare this market! Perhaps we will see a straw that break the camel’s back style of news story and the jitters of 2-3 weeks ago will return in force.

Importantly we want to clarify that MM feels any pullback, if and when it unfolds remains a buying opportunity, our medium term outlook for stocks remains bullish – the central banks and bond yields / interest rates tailwind is too large a force to fight in our opinion.

MM remains short-term bullish the ASX200 looking for only ~1% more upside but overall were cautious.

Overnight US stocks followed the futures from our day session to drift lower but there was no follow through selling with Apple (AAPL US) down less than 2% and our SPI futures calling the local index to open unchanged although CBA trading ex-dividend will make this a big ask.

Today we’ve again focused on our thoughts moving forward the Overseas & ETF Portfolio’s as we position ourselves for what MM believes is a likely pullback / period of consolidation for risk / assets.

Reporting schedule available here: CLICK HERE

Today we have a long list of companies reporting…. Accent Group (AX1), Asaleo Care (AHY), Crown (CWN),Cleanaway (CWY), Domino's Pizza (DMP), Fletcher Building (FBU), Fortescue Metals (FMG), Lovisa (LOV), Pact group (PGH), McPherson's (MCP), Mount Gibson (MGX), McMillan Shakespeare (MMS), Nearmap (NEA), Regis Resources (RRL), Seven Group (SVW), Sonic Healthcare (SHL), St Barbara (SBM), Stockland (SGP), Vicinty Centres (VCX), Wesfarmers (WES), Western Areas (WSA), WiseTech (WTC).

We haven’t had a chance to review as yet…more to come later in the income note.

ASX200 Chart

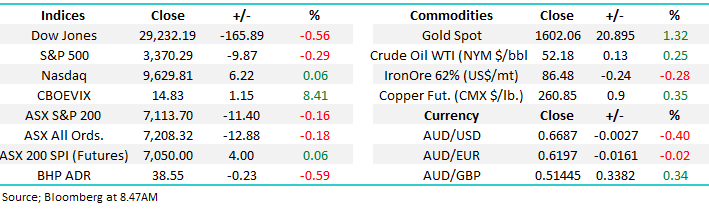

The Tech based NASDAQ Index remains around fresh all-time highs but ever increasingly we believe the markets showing classic topping like characteristics in these technology & quality growth stocks which fits the later stages of a major bull market. The continuous marginal new highs in the indices like the S&P500 and NASDAQ are selective and mega cap driven, whereas the overall market momentum is waning which is not a good sign for the bulls from a risk / reward perspective.

MM is now transitioning to neutral / bearish stance on US equities in the short term.

NB We continue to believe the next 5% correction is again a buy, not time to throw in the towel.

US NASDAQ Index Chart

The Australian banks are back in vogue which is not surprising with the big bertha of the sector Commonwealth Bank (CBA) trading ex-dividend $2 fully franked today, putting it on an enviable 4.78% fully franked yield in today’s ultra-low interest rate environment. We recently took a nice profit on CBA, a few days early in hindsight, but we do intend to again go overweight banks in the coming months – the sectors current market weight is ~22% while MM now only holds 18% exposure.

The regionals have been serial sector underperformers with Bendigo Bank (BEN) up 1% over the last year compared to CBA which is up almost 26% but these respective price movements has seen CBA’s yield fall below 5% while BEN’s is forecast to be 6.2% fully franked, a far from immaterial differential.

At current prices BEN is starting to look attractive compared to CBA.

Commonwealth Bank (CBA) v Bendigo Bank (BEN) Chart

I was surprised to see gold rally $US19/oz overnight when stocks were quiet and the $US strong, it feels like the final leg up in the sector is finally unfolding – our target for the gold miners ETF is ~10% higher after it rallied a solid 3% last night. In our opinion an ideal time for the gold bugs to go long, I wouldn’t be surprised to see Newcrest (NCM) which we recently sold bounce but MM’s still happy to be out of this underperformer, retaining our gold exposure in Evolution (EVN) which is performing better at the operational level.

MM is bullish gold stocks short-term.

VanEck Gold Miners ETF (GDX US) Chart

2 local stocks / ETF’s that remain in the MM “headlights.”

After the last few weeks market recovery MM is increasingly transitioning to “sell mode” but obviously this doesn’t mean we turn our backs on the whole market. However short-term our most likely action in the Growth Portfolio is on the sell side to tweak our cash position up from its current 12%.

1 Pendal Group (PDL) $8.83

PDL has hit our initial target area and backed off reasonably fast, along with Janus Henderson (JHG) which we also hold i.e. the markets taking some $$ off the table from its pro-UK bets. This investment management business has already recovered 45% from its lows so a rest / pullback is no surprise, especially if MM is correct and a market pullback feels increasingly likely in the next few months.

MM is considering cutting our PDL position.

Pendal Group (PDL) Chart

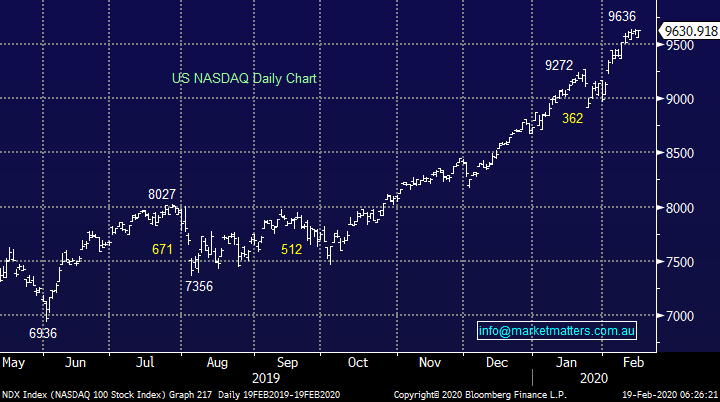

2 Bearish Leveraged ASX200 ETF (BBOZ) $8.48

No change here, MM is looking to reduce our market exposure into current strength with our ideal scenario a test towards 7200 by the ASX200 which should enable us to buy the BBOZ into fresh all-time lows.

MM is bullish the BBOZ ~4% lower.

BetaShares Australian Equities Leveraged Bearish ETF (BBOZ) Chart

MM International Equites Portfolio

No change to our MM International Portfolio, our cash position remains at a relatively conservative 21% : https://www.marketmatters.com.au/new-international-portfolio/

The last 2 weeks we have written / quoted the below and nothing’s changed:

“Our current thoughts are aligned with how MM sees equities in general - the recent pullback was a buying opportunity but we aren’t interested in chasing strength believing that when many indices / stocks scale fresh all-time highs it will be a time to take some money from the table.”

However, whenever we feel the index is most likely going rise / fall or even do nothing doesn’t mean that there’s not areas that can be improved in our portfolio (s) plus of course planning for what might come next is always high on our priorities.

S&P500 Index Chart

At this stage we are considering ways to reduce our market exposure as opposed to pressing the “buy button” but we already have a decent cash position hence we will be very fussy with regard to any selling. There are 2 existing holdings are catching our attention in different ways:

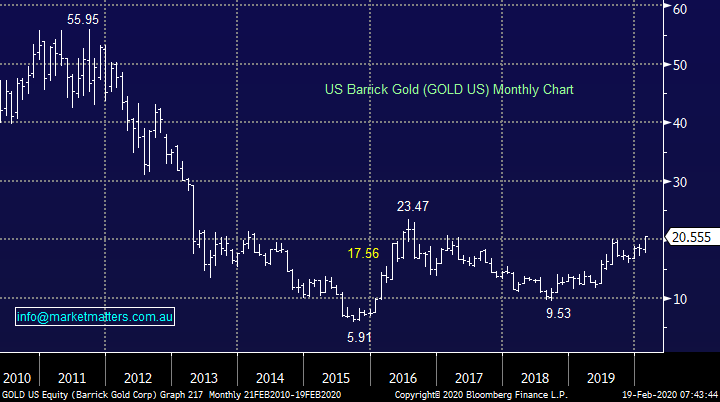

1 Barrick Gold (GOLD US) $US20.55

Barrick Gold has broken out to fresh 3-year highs putting the Australian sector to shame in the process. Our position is showing us a nice profit but that’s most definitely no reason to be taking profit. In line with the GDX ETF discussed earlier MM will consider taking profit on this position when the sector has rallied ~10% higher.

Considering the mix of stocks in our portfolio and cash position I can see this being the first stock that departs the MM International Portfolio.

MM is considering taking profit on GOLD position at higher levels.

Barrick Gold (GOLD US) Chart

2 ProShares Short S&P500 ETF (SH US) $US22.95

Another simple manner for MM to reduce our market exposure is to increase our position in the ProShares bearish ETF (SH US), a similar concept to the BBOZ but on this occasion without any leverage.

MM is considering increasing our bearish SH US ETF position.

ProShares Short S&P500 ETF (SH US) Chart

Conclusion (s)

No change, MM continues to believe 2020 will be a volatile year where investors should be active - sell strength and buy weakness. Hence if we are correct now is more a time for selling, not buying.

The MM Global Macro ETF Portfolio

Also no change with the MM Global Macro Portfolio where our cash position remains at 41.5% . : https://www.marketmatters.com.au/new-global-portfolio/

We continue to feel like things are slowly coming together for the MM viewpoint as equities experience increased volatility at the start of 2020, not unusual from a seasonal perspective. MM anticipates being fairly busy in the coming weeks / months assuming our outlook remains on-point, but we feel there’s no reason to force the issue. Hence sorry but not a great deal of the below is different to last week:

1 – MM is looking to sell our positions in the iShares MSCI Silver ETF (SLVP US) and Van Eck Gold Miners ETF (GDX US) into strength and this appears to be now unfolding as anticipated, finally!

iShares MSCI Global Silver Miners ETF (SLVP US) Chart

2 - MM may increase our short S&P500 ProShares ETF position into fresh highs as discussed with the International Portfolio.

3 – MM is looking to fade a new low in bond yields, our preferred ETF is the ProShares short 20+ Treasury ETF (TBF US) : https://etfdb.com/etf/TBF/#etf-ticker-profile

MM is still looking to buy the TBF below 18.

ProShares Short 20+year US Treasury ETF Chart

4 – MM remains very keen on the Agricultural Index, from an investors risk / reward perspective, its looking exciting following its more than 50% plunge over the last 8-years, our preferred vehicle of choice is now the Invesco DB Agriculture Fund (DB US): https://etfdb.com/etf/DBA/#etf-ticker-profile

MM is bullish the Agricultural Index which should eventually increase both inflation and bond yields.

NB The BBG Agricultural Index includes the likes of coffee, corn, soybeans, cotton, sugar and wheat.

BBG Agricultural Index Chart

Conclusion (s)

MM believes the next 5% move for US stocks is more likely to be down as opposed to up but no sell signals have unfolded to-date. Hence, we have been quiet in both our International & ETF Portfolios as markets start to rotate with a slight upside bias but with limited attraction from a risk / reward angle.

Overnight Market Matters Wrap

- The European equity markets were lower across the board, while US markets were mixed as investors assess the corporate earnings effect in conjunction with the coronavirus.

- So far, nearly 80% of S&P 500 companies have reported so far, with 70% beating analyst expectations in the US, while locally the following are expected to report today - Accent Group (AX1), Asaleo Care (AHY), Crown (CWN),Cleanaway (CWY), Domino's Pizza (DMP), Fletcher Building (FBU), Fortescue Metals (FMG), Lovisa (LOV), McPherson's (MCP), Mount Gibson (MGX), McMillan Shakespeare (MMS), Nearmap (NEA), Regis Resources (RRL), Seven Group (SVW), Sonic Healthcare (SHL), St Barbara (SBM), Stockland (SGP), Vicinty Centres (VCX), Wesfarmers (WES), Western Areas (WSA), WiseTech (WTC).

- BHP is expected to underperform the broader market, after ending its US session off an equivalent of -0.59% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 10 points lower, still testing the 7100 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.