Does MM see any opportunities amongst the “dogs” of the last week (CWY, AAPL US, BEN, TAH, NHC, SXL,VCX)

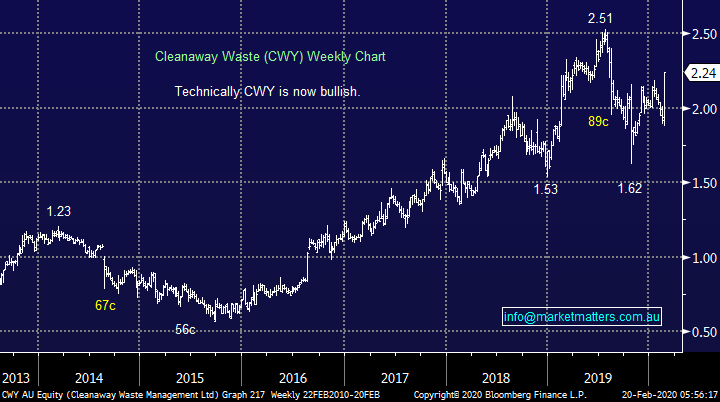

The ASX200 put in a stellar performance yesterday rallying 30-points ignoring both a negative session on Wall Street and Commonwealth Bank (CBA) trading ex-dividend $2 in the process. Gains were broad-based with ~70% of the ASX200 rallying during a solid day on the reporting front which helped 16 stocks to rally by over 4% while only 6 members declined to the same degree. The standout theme to us was beats where expectations weren’t too elevated sent stocks like Cleanaway (CWY), Cochlear (COH) and Webjet (WEB) soaring, all up by over 10%, while tech players Wisetech (WTC) and EML Payments (EML) were hammered as their outlook statements simply didn’t justify lofty valuations.

Yet again the market bottomed at midday, it was slightly in the red around 12.30pm before rallying over 40-points off its low to close on both the days and its all-time high - the market seems determined to test our short-term 7200 targets. At this stage the only sniff that the markets considering a pullback is a reinvigorated gold sector and a stalling IT space. This characteristic of regularly squeezing higher throughout the day rings of local fund managers caught underweight the market being forced to chase the market higher, while it also speaks the reliance / influence from local interest rates. Yesterday wages data was soft showing that wages in real terms (i.e. post inflation) are going backwards and that re-stoked the embers of a looming rate cut.

The markets rhythm currently feels entrenched to the upside but we all know this can change in a heartbeat, but at this stage with the coronavirus being treated as old news and Chinese stimulus now the main talking point it’s hard to imagine what would send the buyers scurrying back down their burrows. This morning we will likely test fresh all-time highs and there are no signs the bulls should lose their smile.

Another very big day of reporting, and we’ll be really interested to look at results from Bingo (BIN) – with the conference call at 10am, NRW Holdings (NWH), Perpetual (PPT) while we also have results from Santos (STO), Lend Lease (LLC), Medibank (MPL), Origin (ORG), Qantas (QAN), Star (SGR), Super Retail (SUL), Sydney Airports (SYD) & Whitehaven Coal (WHC)

Bingo (BIN) just out: 1H20 EBITDA was a beat printing $78.8m v $77m exp. They reconfirmed they were on track to meet full year guidance. Margins were really strong for the half although they said they would moderate. All okay

Reporting schedule available here: CLICK HERE

MM has increased our cash holding to 12%, we may do a little more if a suitable opportunity arises into strength.

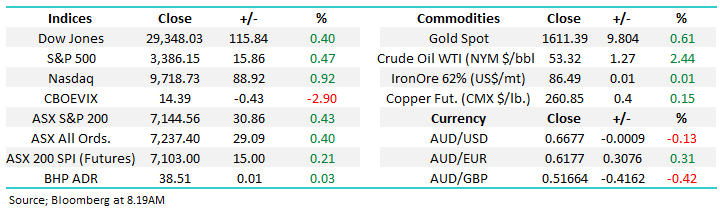

Overnight US stocks were higher with the S&P500 up +0.4%, the Energy & IT sectors leading the gains, the SPI futures pointing to a local open up another 15-points.

Arguably the standout characteristic of this bull market is quality stocks continuing to rally in ever increasing P/E expansion (rising valuations) while the underperformers continually get overlooked – perfect price action for the momentum players. Like all trends this will eventually change hence today we’ve looked at 5 of the poorest performing stocks over the last 5-days – the ones we’ve focused on are down between 6 & 7% in the week but remember the trend says we’re looking for a needle in the proverbial haystack.

ASX200 Chart

Global Indices

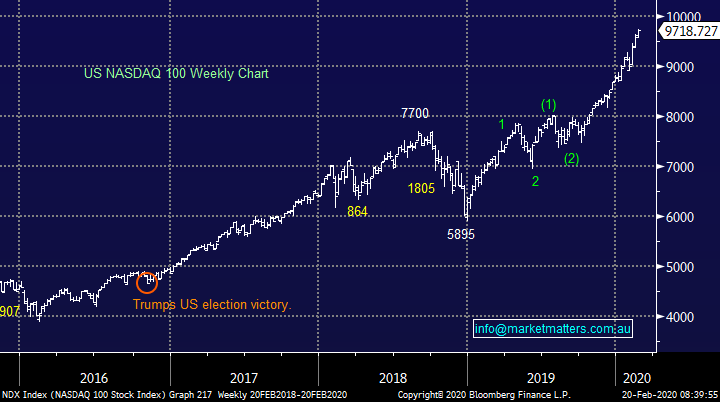

US equities continue to charge higher in what technical analysts would call a classic 3rd wave / acceleration phase, the tech-based NASDAQ is clearly accelerating to the upside. Assuming this interpretation is correct there are 2 important points to bear in mind:

1 – the NASDAQ should soon experience a fairly sharp 6-8% correction.

2 – The trend is up, and such a pullback is another buying opportunity, not a time to panic.

MM is short-term neutral US stocks as they approach our Q1 target area.

US NASDAQ Index Chart

Similarly, our Q1 target for the German DAX is now only one big day away and considering it missed (slept through) a major portion of US gains last night the psychological 14,000 area will probably be challenged sooner rather than later.

German Dax Index Chart

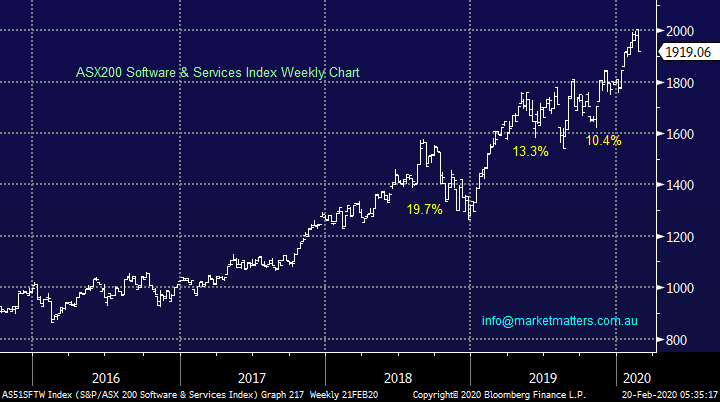

The local IT sector has caught our attention of late as its started to show “cracks” as it underperforms the ASX200 – this week the ASX200 is up marginally but the Software & Services Index has declined by over 4% with 85% of the sector falling over the last 5-days, unusually ignoring the US NASDAQ’s all-time highs. This high growth / valuation sector has led the local P/E expansion bull market, especially over the last few years, MM thinks it might be close to another short sharp +10% correction – don’t forget we’ve already experienced 3 such corrections in 2018 and 2019, its not a big call.

MM is wary of high valuation IT stocks at this point in time.

ASX200 Software & Services Index Chart

Yesterday Cleanaway Waste delivered a strong beat at the profit line, the market was looking for 1H NPAT of ~$65m and they printed $76.2m, plus the integration of Tox Free was a concern in the mkt however they say that is on track. FY20 EBITDA guidance of ~$515-525m, market was sitting at $505m, a 3% upgrade.

We hold rival Bingo (BIN) in the Growth Portfolio, which report today but this is an area we like for the future and MM would not be against increasing our exposure to the sector, these stocks certainly won’t have any crosses on the ethical investors list!

MM is bullish CWY targeting new all-time highs.

Cleanaway Waste (CWY) Chart

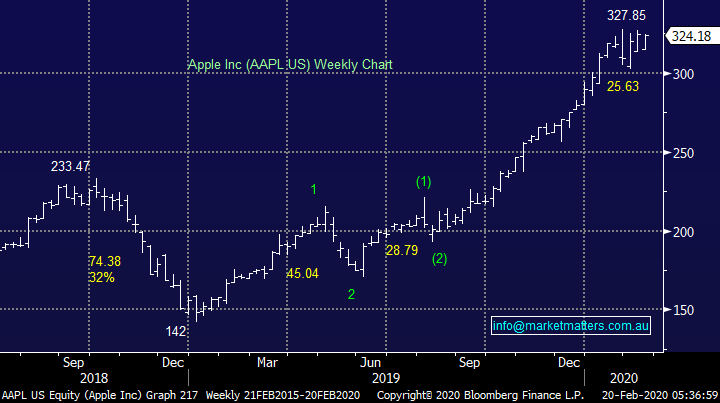

The Apple share price is shouting loud and clear “what China slowdown / coronavirus/ downgrade!”. Just a few days after its downgrade the world’s largest company has recovered and is now only 1% below its all-time high. A quality stock ignoring bad news is a bullish sign.

MM remains bullish Apple short-term targeting fresh all-time highs, but we still envisage another test of the $US300 area before it continues on its merry way. Hence, we don’t advocate chasing strength, but we certainly have no interest in taking profit on our position.

MM is bullish Apple medium term regarding pullbacks as buying opportunities.

Apple (AAPL US) Chart

A quick look at 5 recent underperformers.

The ASX200 has rallied strongly since Christmas yet 33 / 16.5% members of the ASX200 are down by over 10% in the last 3-months, there’s probably no better advert for active investing with attention firmly fixed on stock selection.

As we said earlier the markets remained comfortable chasing quality stocks to almost dizzy valuations, justified by ultra-low interest rates, but those companies not performing have clearly been left for dust. Hence when I started todays exercise my expectations weren’t too elevated – let’s see how I went.

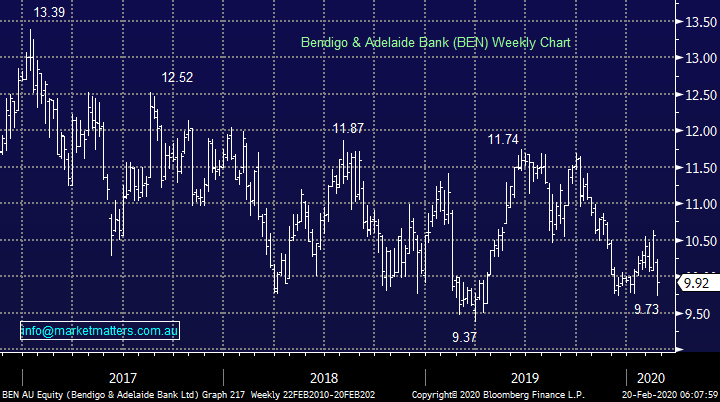

1 Bendigo Bank (BEN) $9.92

MM has flagged regional bank BEN a few times in recent reports and following its $300m capital raise its fallen -5.8% over the last week but it remains impressively well above its $9.34 issue price. We feel the banks estimated 6.25% fully franked dividend moving forward is now sustainable with more cash on hand making the shares attractive below $10. Hence while Australian regional banks are not as well positioned as the cream of the “Big 4” they are becoming discounted enough on a relative basis to be on our radar.

MM is bullish the banking sector looking for a pullback to increase our exposure.

Bendigo Bank (BEN) Chart

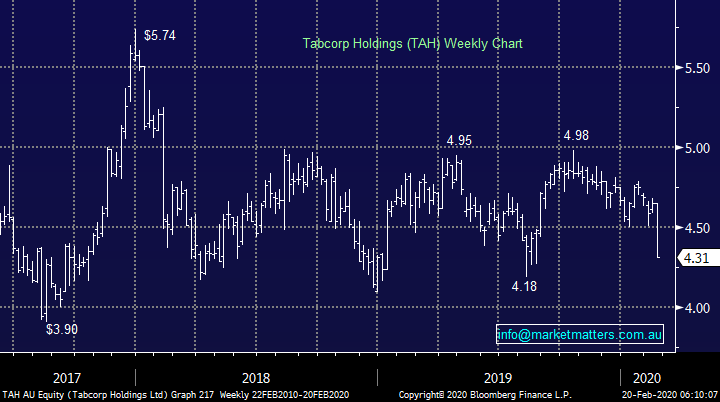

2 Tabcorp (TAH) $4.31

TAH is down -7.1% over the last week with the damage inflicted yesterday after the company released its half-year result which showed NPAT growth of almost 3% to $213.5m. The diversified business produced a mixed performance with the gaming services and Tatts integration clearly disappointing shareholders. We remind subscribers that gaming stocks don’t sit well with ethical funds hence they need to perform extremely well operationally for the shares to deliver and TAH has failed in this regard – we’re happy to have taken profit on our position above $4.80 last year.

Interestingly the AFR ran an article today suggesting that private equity might be circling TAH’s gaming services division, I doubt if the company will be keen to sell the asset cheaply although shareholder pressure can always throw up surprises.

MM is neutral TAH at current levels.

Tabcorp (TAH) Chart

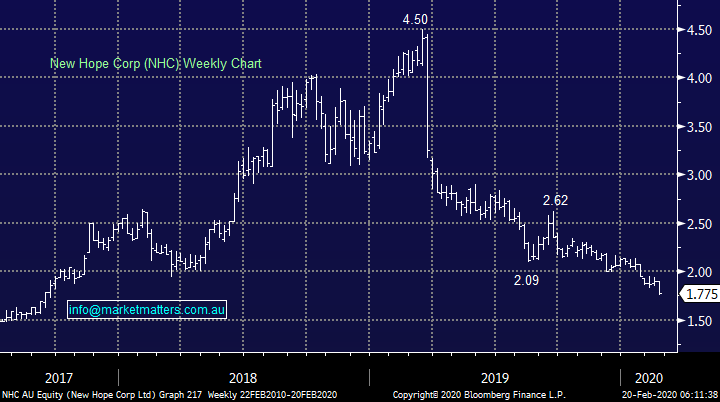

3 New Hope Coal (NHC) $1.77

No clues required why some of NHC underperformance has been evident of late with the word coal in bright lights bringing out sellers from all over the globe. The decline of -6.6% over the last week was amplified yesterday after a weak quarterly activities report sending it lower when the rest of the Energy Sector enjoyed a rare day in the sun.

NHC is expected to yield around 10% fully franked, with its next dividend due in April. This is a fascinating scenario as the company appears good value as it heads to fresh multi-year lows but as we know there are huge / active sellers of coal on the horizon.

Coal prices have remained fairly weak although there are some signs of bottoming, at some stage a portfolio of “unethical” high yielding assets will find a level where they become irresistible to the dividend hungry Australian investor but that time doesn’t feel imminent just yet – the elastic band can stretch further.

MM is not keen on NHC, but we do see value slowly emerging.

New Hope Coal (NHC) Chart

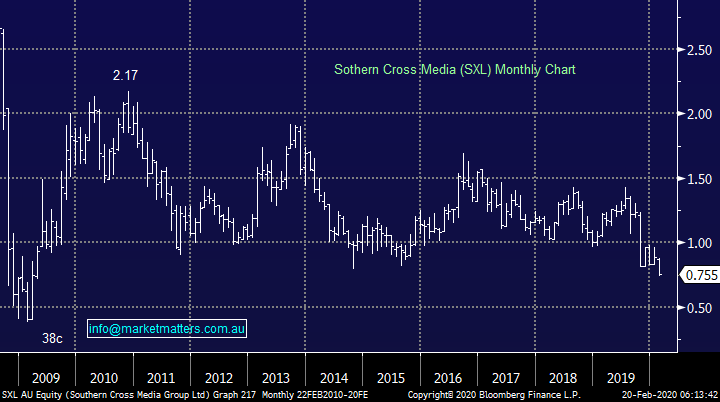

4 Southern Cross Media (SXL) 75.5c

SXL shares are plumbing multi-year lows as this Australian media group continues to lose fans, its down a painful -7.4% in just 5-days. The stock hasn’t recovered after announcing a downgrade last October – the company reports today, and expectations are certainly low, perhaps the stocks best hope! This is another stock trading on a low valuation while it yields strongly but capital losses are currently eradicating any benefits.

MM has no interest in SXL.

Southern Cross Media (SXL) Chart

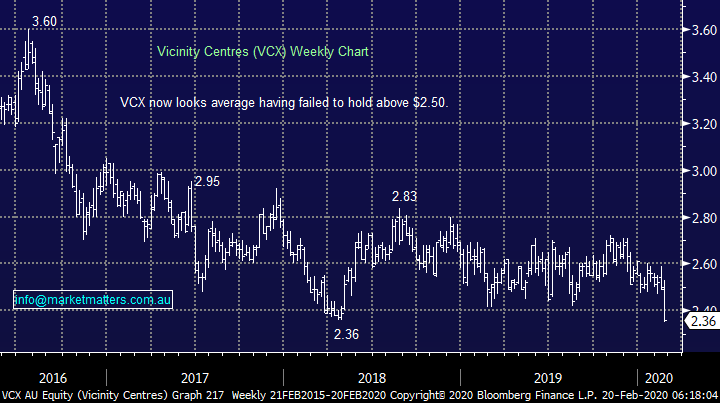

5 Vicinity Centres (VCX) $2.36

VCX has struggled for a few years, it’s the worst performing stock in the large Real Estate sector over the last 6-months, not being helped by its -6.7% drop over the last week. This retail property management company has been struggling because of the Sydney light rail construction, shopping migration away from bricks and mortar to the more convenient on-line option and now its being hit by the coronavirus as the upmarket centres it controls like the Strand Arcade in Sydney lose their Chinese shoppers.

The companies report this week showed a net profit of over $240m and while we feel the management are doing an admirable job of running the operations it does feel to us like they are swimming into the tide at present.

MM is neutral VCX & retail exposed REITS more generally

Vicinity Centres (VCX) Chart

Conclusion (s)

MM likes BEN below $10.

We feel the trend remains that we should be buying pullbacks in the quality end of town as opposed to picking bottoms with the dogs.

Overnight Market Matters Wrap

- Global equity markets rose as investors believe China may plan further stimulus to support its economy from COVID-9, which is now a hopeful short-term issue.

- Metals on the LME were relatively flat overnight, while Crude oil rallied more than 2% as tensions in Libya escalated enough for traders to be concerned about supply. Gold eked out another small gain to trade at a multi-year high.

- Another busy day of corporate earnings today with the following - Accent Group (AX1), Austal (ASB), Beacon Lighting (BLX), Bingo (BIN), Boral (BLD), Charter Hall Retail REIT (CQR), City Chic Collective (CCX), Coca-Cola Amatil (CCL), Domain (DHG), Ebos (EBO), Iluka (ILU), Integral Diagnostics (IDX), IRESS (IRE), LendLease (LLC), MedibankPrivate (MPL). Origin (ORG), Perpetual (PPT), Polynovo (PNV), Qantas (QAN), Santos (STO), Smartgroup Corporation (SIQ), Super Retail (SUL), Sydney Airports (SYD), The Star Group (SGR), Whitehaven Coal (WHC)

- The March SPI Futures is indicating the ASX 200 to test the 7150 level this volatile morning as February index options expires.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.