What to buy & avoid as coronavirus fear intensify (AAPL US, FMG, BLD)

Just when you think you’ve got the market on a string it delivers a rapid fire “left-right combination” with a big reality check attached! At MM we had been forecasting the market to fail around the 7200 area, it reversed from 7197 and things looked as per programmed. We increased our cash position back up to 12% in our Growth Portfolio simply because we felt the risk /reward was unattractive, especially with the coronavirus being shrugged off like the common cold. However, we only expected a quick ~5% correction to provide another buying opportunity into weakness, the story of the post GFC bull market, the pullback is now 7% with no obvious end in sight.

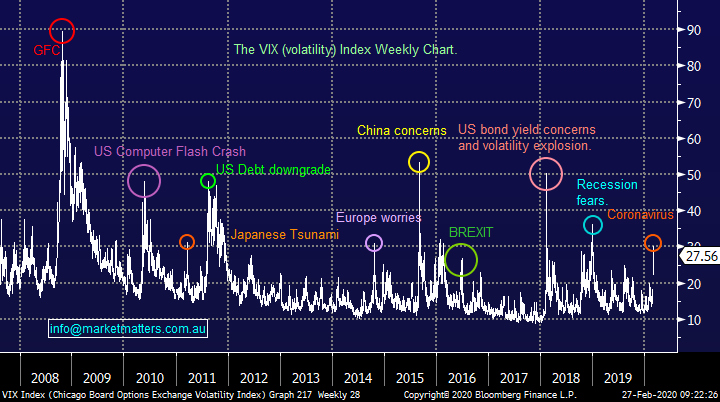

The ASX200 has tumbled 200-points through our 6900-target area like a hot knife through butter as the coronavirus is starting to panic investors in a very unnerving manner – there’s no doubt investors fear the unknown. Yesterday I was discussing previous tumultuous periods for stocks with a few very seasoned traders, people who had previously thought they had seen it all from the 1987 crash to the GFC but the common phrase was something along the lines of “I’ve never seen a pandemic hit stocks, who knows how far they can fall”.

The conversation actually reminded me of a poignant excerpt from Nick Leeson’s book (the trader who broke Barring’s Bank), for those that don’t know the story the Rouge Trader was ultimately undone by an earthquake in Kobe, Japan which led to the throwaway line which went something like – “analysis cannot pick an earthquake”. During the current panic we need to hold our nerve and maintain focus on the bigger picture, we believe the markets gone from one extreme to the other and when we put things in perspective, MM believes another about face is likely in the coming week (s):

1 - The CDC (The Centre for Disease Control and Prevention) estimates that in the US up to 42.9 million people got sick during the 2018-2019 flu season, 647,000 people were hospitalized and 61,200 died.

2- To date the coronavirus has ‘only’ infected ~82,000 people globally with the death toll sitting below 3,000 i.e. there remains a lot of room for last year’s flu season in the US alone to trump the coronavirus globally. We’re not saying it’s not a major issue but with some of the world’s greatest brains searching for a vaccine I ponder if we’ve now become far too pessimistic.

3 – Ten days ago China's central bank lowered a key interest rate and injected more money into markets and yesterday Hong Kong announced it was going to follow in Kevin Rudd’s footsteps and give all permanent residents over 18 years old a HK$10,00 handout as part of a HK$120m relief package – as we’ve been discussing over the last fortnight, MM believes global central banks will launch stimulus, it may not work in years to come but we believe it will again reignite equites, the million dollar question being when.

However, its critical to deliver a balanced view on this evolving crisis and the coronavirus does have a mortality rate around 100x that of flu hence if we cannot contain this deadly outbreak on the global scale the impact could ultimately be significant. The issue for stocks is containment comes at a cost with growth plummeting as cities / countries go into lockdown and with stocks last week priced for perfection the current sharp correction should be no surprises – the question being how far / long will it fall.

At this stage we believe stocks are likely to fall for at least a few more weeks, but some sharp bounces are overdue which may give investors the opportunity to reduce market exposure if they are scarred plus of course increasing flexibility to buy at lower levels. Flexibility becomes key in an environment such as this.

MM is now in “Buy Mode” looking to cautiously increase our exposure to equities into weakness.

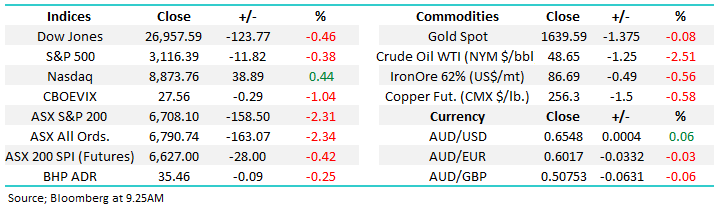

Overnight US stocks were very choppy with the Dow closing down -0.46% while the tech-based NASDAQ rallied +0.44%, it smells like a base is forming. The SPI is calling the ASX200 to fall -0.5% early on but I feel on the day it may rally from here, BHP closed down less than 10c in the US, while we have a barrage of results coming out this morning.

Today we’ve attempted to help keep our subscriber’s fingers on the pulse in these volatile times. Plus importantly we have considered what sectors we believe will recover the best from the current virus fuelled pullback and those which may drag their heels for longer, in other words how we want to be strategically positioned through the rest of 2020.

ASX200 Chart

A huge day on the reporting front today including results from: Adelaide Brighton (ABC), Atlas Arteria (ALX), AfterPay Touch (APT), Bega Cheese (BGA), Costa Group (CGC), Flight Centre (FLT), Freedom Foods (FNP), Link Administration (LNK), National Storage REIT (NSR), Ramsay Health Care (RHC) & Zip Co (Z1P)

For a reporting season calendar courtesy of Shaw & Partners Research – Click here

Costa (CGC) FY19 Result: out this morning and looks decent v low expectations. Revenue was slightly above at $1.048bn versus $1.025bn expected, with revenue growth coming in at 5.8% versus 2.33% expected = good. While profit was low relative to sales coming in at $28.4m, it was above expectations of $27m, with analysts range being $24-28m. Net debt was also lower than prior forecasts, while they spoke of improving conditions thanks to sustained rain and better pricing for most of their lines. In terms of pricing, they actually said pricing levels improved ‘considerably’, while declaring a token 2cps dividend as expected.

In terms of coronavirus, they say no impact as yet, although they’re monitoring the situation carefully – global supply chains the main potential issue here. In terms of outlook, Citrus the only area that looks weaker with downside potential. All in all, a good result from CGC after a tough year.

Flight Centre (FLT) has just downgraded, now expecting underlying profit before tax to be 240-300m for the year (big range) versus current expectations which were sitting at $313m. If we’re generous and use the midpoint, it’s a~14% downgrade. Ouch.

More out later…

Global Markets

US equities experienced a classic choppy style consolidation night as the tech-based NASDAQ approaches its 10% correction level, remember nothing unusual here as we get one most years. We must remain open-minded to how the current pullback will unfold but the previous correction of similar magnitude back in 2018 lasted over a month and unfolded in a classic “abc” style pullback, the coronavirus led decline has yet to show its hand in terms of structure / appearance but a bottom in March is our “Gut Feel” at this stage but probably not significantly lower.

MM is looking for buying opportunities into current weakness.

US NASDAQ Index Chart

We often turn to the world’s largest stock to get a handle on where indices are in the bigger picture and after correcting over 12% in the last few weeks, we believe any forays lower represent solid risk / reward buying opportunities for Apple. The rate of fresh coronavirus cases in China is declining and the government is slowly encouraging people back to work, this will undoubtedly create a spike up in new cases but assuming it remains within estimated boundaries we should see a recovery in Apples supply chain with just the consumer required to get excited for the ship to become fully stabilised, a few more cash handouts (stimulus) like in Hong Kong yesterday and iPhone sales might surprise many to the upside.

MM likes Apple in the $US280-285 region.

Apple Inc (AAPL) Chart

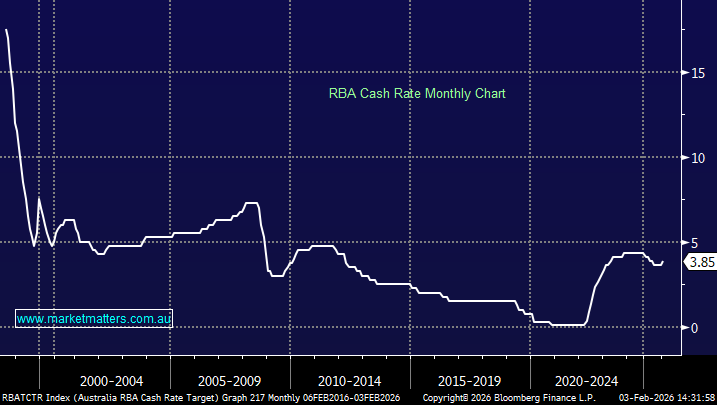

US bond yields have made fresh all-time lows this week, a move we have been forecasting throughout 2020. Importantly we have been calling the current spike lower in bond yields to represent a major swing low, obviously time will tell here but Part A of the outlook is on track, we believe the following is likely to unfold on the ground:

1 – We can see the Fed cutting interest rates by up to 0.5%, starting next month, I’m sure President Trump will be pushing this band wagon aggressively into November’s election.

2 – The government will be adding any fiscal stimulus it can to kick start an economy which is almost inevitably going to stall in the coming months – again don’t forget Novembers election, if Trump can shine through this crisis he might get to keep the keys to the Whitehouse without a big fight.

MM is still expecting bond yields to bottom during this crisis.

If this opinion proves correct the “yield play” might ultimately underperform in later 2020 although it will still enjoy lower official interest rates.

US 10-year bond yields Chart

Interestingly the flight away from risk assets (shares) into safe havens such as gold, bonds and the $US is not unfolding in a uniform manner. While bonds continue to rally gold and the $US have encountered some selling, this is easily explained for the $US because investors are already very bullish and hence long the Greenback. This is another market where MM sees inversion in the coming months and its already started to fail at recent highs.

MM has a contrarian bearish view on the $US at current levels.

The $US Index Chart

Overnight the VIX was stable at ~27

Volatility Index Chart

Sectors MM likes as the virus panic unfolds

We believe this a simple scenario as MM looks to be correctly positioned from a strategic perspective for the next chapter in what is clearly unfolding as a volatile 2020. The crux of our view is we expect significant stimulus to be thrown at the global economy in an attempt to avoid a global recession, central banks have limited room to cut interest rates, with the US arguably having the most room, hence we see different forms of QE to again be rolled out to increase liquidity while the respective governments are likely to announce huge levels of fiscal stimulus, Hong Kong has already come to the party.

Hence MM is looking to largely have exposure to stocks and sectors who will benefit from fiscal stimulus e.g. government spending on infrastructure. Also, as a side note we prefer a mix of stocks that are providing a decent sustainable yield, this is likely to help portfolios net returns over the rest of 2020.

If we see the world and especially China launch significant fiscal stimulus the 3 sectors, we believe will outperform in 2020 are as follows:

1 – The resources as demand will increase for commodities to implement much of the government spending – interestingly the iron price remains above the average price of the last 6-months making the likes of Fortescue attractive, especially into a dip towards $10. The Australian resources are largely paying great dividends at present, although they are cycling off a peak seen in 2019.

Iron Ore Chart

Fortescue Metals (FMG) Chart

2 – Building stocks should benefit in a similar manner to the resources as companies enjoy an increase in volume of public works. Whether it’s the actual construction companies themselves or suppliers of materials there is likely to be more $$ to go around.

We remain long Boral (BLD) in our Growth Portfolio with a target ~20% higher – while its forecasted 4.2%-part franked yield remains attractive in today’s interest rate environment.

Boral (BLD) Chart

3 – Banks, this is a slightly convoluted addition, but we like them through 2020 hence they deserve a mention. The Australian banks have endured a tough 4-years due to the Banking Royal Commission and declining bond yields but at MM we believe both of these headwinds are moving into the rear-view mirror.

As we’ve said MM believes central banks and governments will strike hard with stimulus without great concern towards inflation, after all they’ve failed to wake this sleeping giant over the last decade. We wouldn’t be surprised to see a pick-up in inflation but more importantly bond yields should reverse as the global economy shows signs of a recovery, this should help the banks – their large fully franked dividends remain very attractive to investors.

ASX200 Banking Index Chart

Sectors MM doesn’t like as the virus panic unfolds

I have simply listed the sectors we are largely avoiding moving towards Q2 of 2020 and the simple reasons why:

1 – The high valuation stocks like the IT sector : Historically these stocks underperform when markets wobble and if we are wrong on what comes next this is the last place we want major exposure, sure they may bounce well when the market ultimately turns but they will receive no major benefit from government spending.

2 – Tourism & travel: it could easily take a while before people start considering large overseas holidays, both inbound and outbound, I know a few of my friends have already switched their attention to domestic destinations with Asia the major loser. The Asian tourist into Australia might become a distant memory through the remainder of 2020. Flight Centre’s downgrade this morning an example

3 – Retail: people are worried which is not good news for businesses trying to open our wallets, especially those with traditional bricks and mortar business models

4 – Yield Play: we went too early with our call here previously but if we are correct and bond yields turn this group should underperform, after benefitting from the initial safe haven demand.

Conclusion

MM wants our portfolio’s to be skewed towards increased stimulus in 2020.

Market Matters Overnight Wrap

· Concerns over the global spread of the coronavirus continued to hang over markets overnight with Wall St failing to hang onto early gains on a volatile night’s trading. The Dow traded in a 600-point range having traded +450 pts in early trading, a low of -150pts before closing near its lows. (-120pts), as did the S&P 500 and Nasdaq. Investor nerves were tested by reports the virus was on the cusp of becoming a global pandemic. This brings the Dow’s total losses in 3 trading days to over 2000 pts (7%).

· Commodities fared little better with the oil price in particular about 2.5% weaker with the Brent benchmark back around US$53.50/bbl. Iron ore likewise dropped 3% to US$88 tonne. Bonds once again rallied, with the 10-year benchmark at one stage hitting record low levels of 1.3% (currently 1.31%) on growing global growth concerns.

· The local reporting season is drawing to a close with companies reporting today including A2M, FLT, BGA, RHC. Overnight RIO reported its CY19 earnings in line with expectations at US$10.37bn and a record dividend of US$4.43, its best result since 2011. The A$ has slumped to a post GFC low of US65.6c while the futures are showing small losses of about 0.3% on the ASX.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.