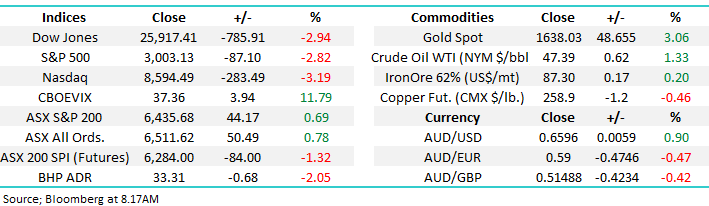

Overseas Wednesday – The US Fed slashes rates but stocks tumble (MSFT US, UBS US, MCD US)

The ASX200 put in a very lacklustre performance yesterday as solid selling hit the market after the RBA cut rates by 0.25%, down to 0.5%, yet again their lowest level in history. The market finally closed up a relatively meagre +0.7% compared to the Dows 5.1% surge on Monday night – again the ASX has picked the following session in the US perfectly. Many subscribers may have been very confused by the market’s reaction yesterday afternoon so we’ll kick off this mornings missive with our interpretation of the various markets / reactions to the RBA’s move:

1 – The Australian Dollar rallied steadily after the rate cut – markets had basically fully built in a 0.25% move but the futures market was also pricing in a 50-50 chance of a larger 0.50% cut hence it was likely in part a “relief rally” by the $A following 2.30pm’s decision. However the rhetoric from the RBA’s boss Phillip Lowe made it clear that the Reserve Bank stands ready to cut interest rates further if needed, although their ammunition is rapidly running dry.

2 – Australian 3 & 10-year bond yields nudged higher over the day - a combination of the above reasoning for the $A plus bonds look into the future and we feel fund manages might be starting to feel the bull market party for bonds maybe reaching a euphoric, blow-off top style end – we do.

3 – The ASX200 steadily slipped lower all afternoon with the banks the standout weight on the index – typical. In the morning note we wrote that banks were value here, and we still believe that’s the case. The banks succumbed to political pressure and immediately started passing on the full 0.25% cut to mortgage holders hence eating into their margins i.e. in simple terms the gap between their borrowing costs and mortgage rates.

In real terms, this one cut is not a major issue. In terms of CBA for instance, by passing on the full cut rather than 20bp which they would have liked, this hurts their net interest margin by 2bp or more widely, impacts their earnings by 1% - not a huge issue now but it becomes one if more cuts happen and the Government continues to put pressure on them to pass on in full. Interestingly, reports this morning emerging that the Government would have increased the bank levy had the cut not been passed on in full – seems extraordinary.

As we’ve touched on recently the “Big 4” banks currently make up 19.2% of the ASX200 making it hard for the index to get particularly excited when all four are down by over 1% - we like CBA into fresh recent lows around $78. The futures market is currently having an enormous impact on both stocks & the index at present as daily turnover remains very elevated, this makes sense as it’s the easiest way for fund managers / investors to increase or decrease net market exposure e.g. yesterday the SPI futures turned over $11.3bn, exceeding that of the underlying stock market. The futures often lead stocks with arbitrage eventually dragging things back into line when they get too skewed i.e. if the futures get smacked traders buy “cheap” futures and sell stocks of the same $$ value looking to reverse in the future.

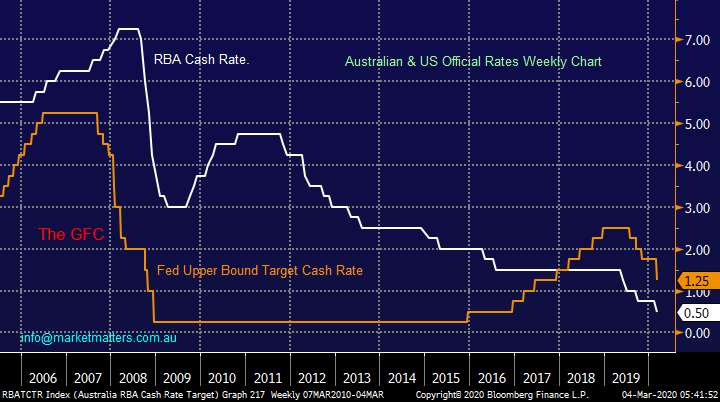

Australian & US Official interest rates Chart

Scott Morrison has also thrown his hat into the ring suggesting looming stimulus will be “targeted, measured and scalable”, only a week ago he was bantering around the word modest, sounds to me like its going to be big – MM has been banging the fiscal stimulus drum in 2020 and the government now looks likely to deliver. The massive concerted stimulus effort that MM has been anticipating is clearly unfolding, the Fed slashed rates 0.5% last night in an emergency mid-cycle cut although Jerome Powel’s accompanying comments have sent stocks tumbling early on including the obvious “The ultimate solutions to this challenge will come from others, particularly health professionals," – is this an acknowledgement that Financial Engineering will have limitations in the foreseeable future?

MM is neutral stocks at this point in time but volatility remains a constant.

Moving forward MM is keen to increase its exposure to equities further across our 4 portfolios as we remain firm believers in stocks as the best asset class over the medium to long-term but CONVID-19 is an unprecedented style event leading to us exerting a larger degree of caution than would be our usual style following a 13.2% correction. Once the world follows China out the other side of the COVID-19 outbreak, stocks will again look cheap but the million dollar question is when & where, picking market extremes can be extremely tricky and its why MM often scale our way in and out of positions, our likely path in 2020.

Our “best Guess” is the ASX200 is approaching a period of consolidation between the 6200 and 6500 regions, a fairly chunky 5% band that can be used to add value to portfolios if we are correct. Interestingly this morning as the Dow fell, it did remain above last week’s lows, the SPI felt a lot more reticent to retreat which implies some investors are starting to look for value into current weakness.

ASX200 Chart

Overnight US stocks were smacked after an initial spike higher after the Fed’s interest rate cut, we are now planning on selling weakness at these levels following recent comments / price action from the US. All signs are the US “Plunge Protection Team” has been dusting off its buy trigger – here is a quick look at what this is the https://www.investopedia.com/terms/p/plunge-protection-team.asp

The US markets tech based NASDAQ Index has corrected over 16.5% in rapid fashion, its undoubtedly been an unsettling COVID-19 led ride for investors, we’re looking for buying opportunities and some further clarity on how indices look likely to unfold moving forward.

MM has now transitioned to neutral / bullish stance on US equities.

US NASDAQ Index Chart

No change, MM has been calling a low for bond yields into the current drop and as MM pointed out previously we probably needed a panic event like the coronavirus to create this potentially blow-off move. Time will tell if we are correct but we’ve certainly got Part A of the equation, a panic flight to bonds sending bond yields down towards all-time lows has unfolded perfectly with last night’s rate cut by the Fed increasing the downside momentum.

MM believes the flight to the safety of US bonds is causing an almost panic style top in price / bottom in yield.

US 10-year bond yield Chart

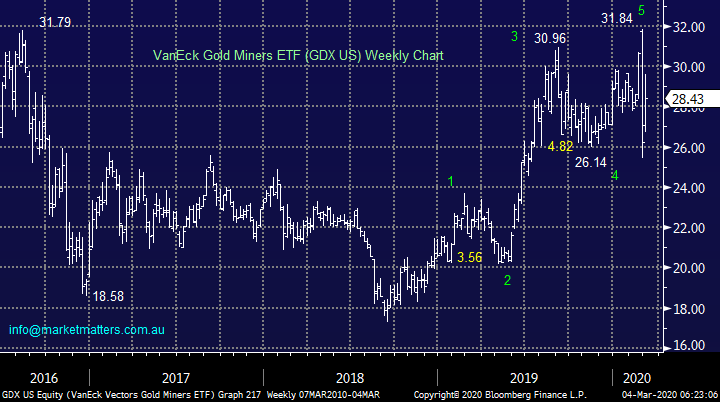

Interestingly some perceived “safe havens” like gold are not enjoying the strength many would associate with panic events like the COVID-19; global gold ETF’s reached our target area perfectly last week before plunging around 20%, hence we now have no interest in the precious metal.

MM is now neutral / bearish gold stocks.

VanEck Gold Miners ETF (GDX US) Chart

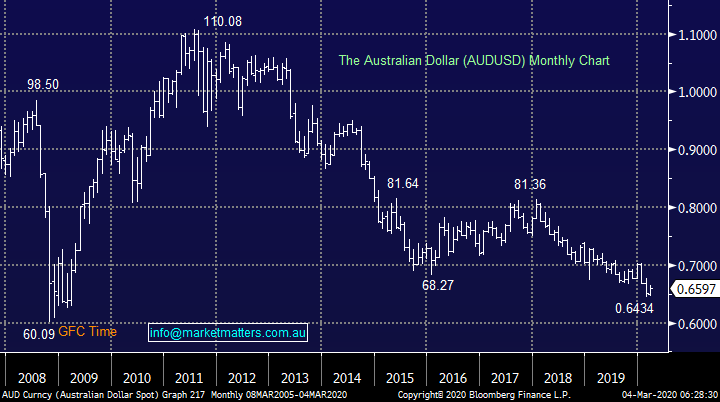

The Australian dollar is reasonably well positioned to benefit from central banks pressing the stimulus button in a major way plus the US cutting interest rates by more than we did. The $US has already started falling and we still expect the $A to surprise many and start to improve although I do feel like a bit of a broken record saying this….

MM is looking for a low for the $A as downside momentum continues to wane.

Australian Dollar ($A) Chart

MM International Equites Portfolio

MM is holding 21% of our International Portfolio in cash “looking to go shopping” into the current weakness in equities: https://www.marketmatters.com.au/new-international-portfolio/

Buy:

In times of extreme volatility and panic we believe its very much the quality end of town where investors should be looking to build positions, as such MM has 2 quality household names in our sights at present, plus a turnaround story:

1 - Microsoft (MSFT US): we are looking to average our position around current levels leaving us the ammunition / flexibility to increase our holding further around the $US140 region.

2 – UBS Group AG (UBS US): we are looking to increase our relatively small holding in UBS if we see a spike under $US10 in the coming weeks / months.

3 – McDonalds Corp (MCD US): we like MCD at current levels, this our favourite play in case stocks have finished their correction.

MM is looking to slowly deploy our 21% cash position.

Microsoft (MSFT US) Chart

UBS Group AG (UBS US) Chart

McDonalds Corp (MCD US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at a healthy 39% in our Global Macro ETF Portfolio as we sit poised to act into current volatility: https://www.marketmatters.com.au/new-global-portfolio/

At this stage we have 2 plays in our sights:

1 – Switch our iShares Silver ETF (SLVP US) position into the Invesco DB Agricultural Fund (DBA US) i.e. increase the position size of the later.

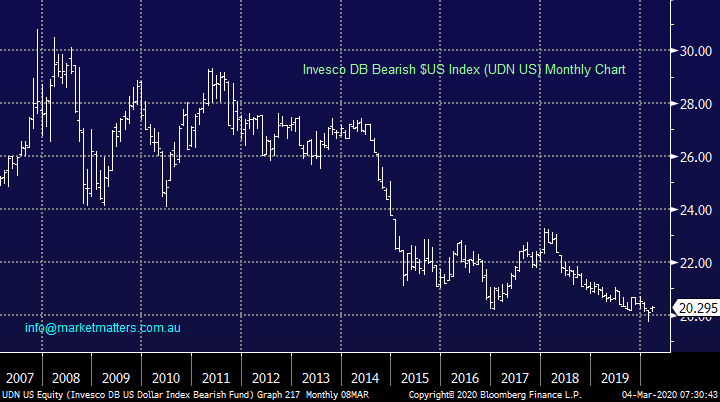

2 – Buy Invesco Bearish $US Index ETF (UDN US), we are looking for at least a 15% appreciation in this ETF.

Invesco DB Bearish $US Index (UDN US) Chart

In todays income note we’ll look at bond markets in more depth, specifically around the movements in listed income securities locally following the decision yesterday from NBI to pull their recent rights issue.

Overnight Market Matters Wrap

- The DOW couldn’t continue with its recovery closing down 789 points or 3%, the NASDAQ (3%) and S&P 500 (2.8%) also both coming under pressure. This in spite of the fact that the Fed enacted an emergency cut of 50bps, making it the first time since 2008 that they have cut out of cycle. The markets are pricing in another 50bp cut before years end. Bonds were slightly weaker with the 10-year treasury yield falling to 1.01%, though it did hit an intraday low of 0.9043%.

- Oil was approximately 1% higher, base metals were a mixed bag last night, though Cooper and Nickel were both higher. Gold rallied almost 3% US$1640/oz. The AUD had a good night on the back of the Fed cut and is trading almost 1% higher at 0.6595. Iron Ore was down 0.4% at $88.55. The ASX futures currently down 84 points

- The March SPI Futures is indicating the ASX 200 to resume its year’s descent and open 126 points lower, testing the 6300 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.