Can any of the 5 largest losers enjoy a sharp bounce? (BPT, CUV, LNK, WTC, EML)

Yesterday the ASX200 again put in another disappointing performance following a +1000-point rally by the Dow, there’s clearly very little confidence amongst investors that equities can string together a few days of decent consecutive gains. Following the Dows +4.5% advance on Wednesday night AEST a close up just over +1% by local stocks was clearly average at best although all 11 sectors of the ASX200 did close higher on the day - weak performances from both the Banks & Consumer Services stocks limited the gains by the index – the Resources were also a drag but this was primarily because RIO Tinto (RIO) and BHP Group (BHP) traded ex-dividend.

We’ve seen central banks fire their opening stimulus salvo’s with interest rate cuts in Australia, Hong Kong, Canada and the US while Japan and China have acted to increase liquidity into the system, we believe there’s more to come from these big guns plus Europe is due act in some way sooner rather than later. Importantly governments need to step up to the plate with fiscal stimulus, assuming the developed world can deal with COVID-19 as efficiently as China we can see this being enough to reignite the post GFC yield driven bull market. The satellite heat map shows that China is indeed returning to work.

For those who doubt our view that concerted intervention by central banks can ultimately support equities I would counter with look at China! The Shenzhen CSI 300 is testing multi-month highs and at MM we believe Chinese stocks will amazingly make fresh 5-6-year highs in the coming months, forget the Fed, don’t fight the PBOC!

China’s Shenzhen CSI 300 Index Chart

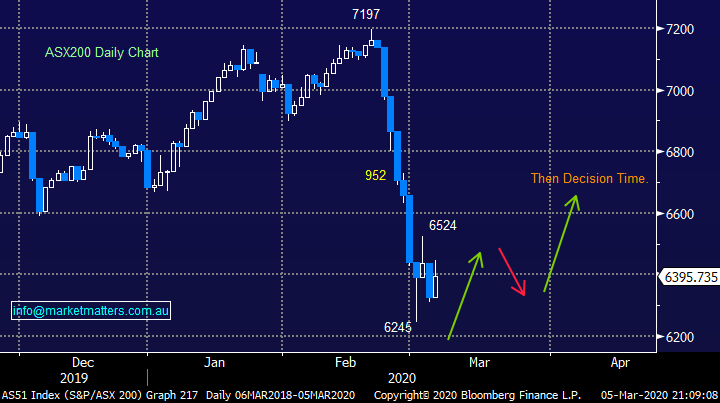

The local market has now managed to spend 4-days in the relatively tight range between 6245 and 6524, under normal circumstances a 279-point / 4.5% range in under a week would be regarded as very large but following the recent -13.2% plunge it feels like a positive slumber. While the range has tightened, volumes have been huge on the ASX this week following last Friday’s epic, biggest value day ever, ~$14bn traded. Usual days are around ~$6bn, this week should average around ~$10bn per day with another big session expected.

We believe stocks are currently “looking for a low” even if it is short-term hence we are considering hitting the buy button if the ASX200 tests the 6200 area - our “Gut Feel” for how the local market is currently unfolding is illustrated below but I’m sure subscribers understand this could be one news flash away from looking wrong. The big swings on Wall Street this week highlight the current level of uncertainty playing out – we’re dealing with a virus and while buying into panic lows usually rewards the patient, it’s not yet clear whether or not last Fridays capitulation style sell-off in the US was the point of most pain.

MM believes investors should be looking to accumulate stocks into the current virus inspired panic.

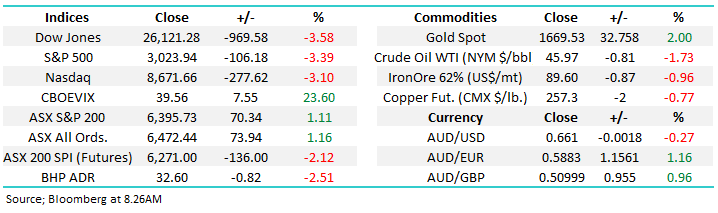

Another bout of weakness in US stocks overnight giving back most of the gains from the prior session, the Dow Jones fell ~970-points while our Futures are pricing a drop of 120pts this morning with the potential to test the 2020 low.

Today we’ve looked at the 5 worst performing stocks in the ASX200 over the last month because they might provide an ideal opportunity to take advantage of a +10% bounce in the index, often stocks that get smacked the hardest will bounce accordingly. However, we are also cognisant of the fact that when we see “panic selling” quality companies are often taken down with the chaff providing some great opportunities medium to longer-term, it’s a risk / reward balancing act like all investing.

ASX200 Chart

A snapshot of Global Markets

As we mentioned earlier US stocks were clobbered again overnight, with the Dow trading down a 970-points, it appears the local market was correct not to embrace the Dows +1000-point rally the previous night – COVID-19 is certainly creating some huge uncertainty in stocks. The US market corrected further than our own but its holding onto the gains from the last few days bounce better than the ASX however we shouldn’t forget that some of the heavyweight local stocks, like BHP and RIO yesterday, are trading ex-dividend around this time.

MM still believes US equities have now found or are close to a low.

US S&P500 Index Chart

MM believes we are approaching a major inflection point for bond yields but while stocks panic and COVID-19 dominates the news the current bear trend for yields could easily have further to unfold i.e. a supportive backdrop for “Value” stocks compared to “Growth”.

MM is still expecting bond yields to bottom during this COVID-19 outbreak.

US 10-year Bond yields Chart

The ASX200’s worst 5 stocks over the last month.

Over the last month 28 members of the ASX200, or 14%, have declined by over 20% with 5 members falling by more than 30%, today we’ve considered whether any of these big 5 losers offer any solid risk / reward as we believe stocks are close to a more sustained bounce of the recent major fall – often in these circumstances the stocks that have been smacked the hardest enjoy the largest bounce.

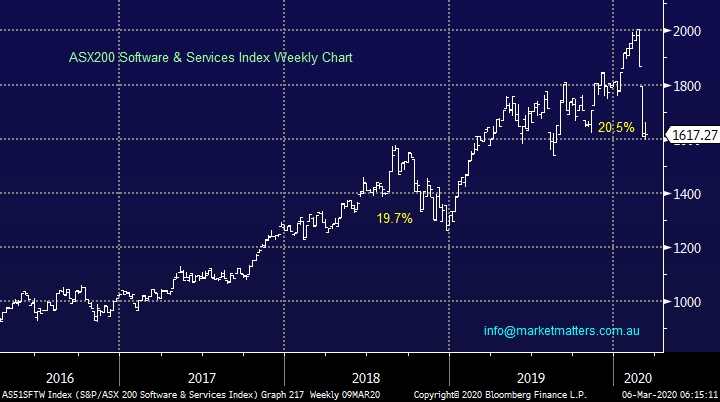

The worst performing 5 stocks over the last month are not surprisingly dominated by the high valuation IT stocks just as was the case in late 2018 but they were also some of the best performers in 2019 justifying our evaluation of these stocks – 3 of the 5 stocks which have dropped by over 30% are from the Software & Services (IT) sector.

Technically the ASX200 IT Sector is approaching significant support after its 20% correction.

ASX200 Software & Services Index Chart

The 5 stocks covered today are interestingly all down between 30 and 40%, we are looking for an opportunity where the company has been oversold on the COVID-19 breakout as opposed to some underlying issues within the business.

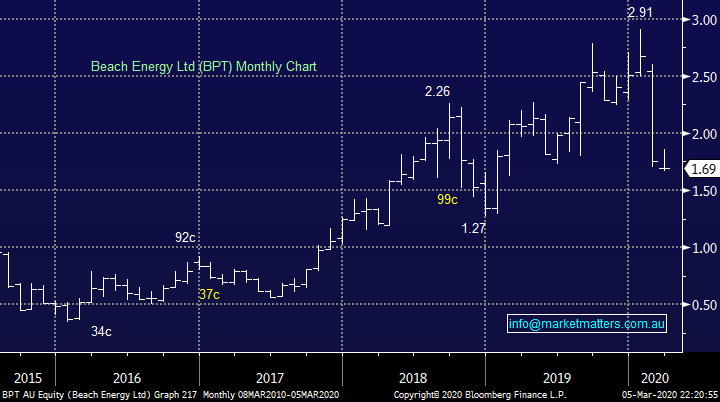

1 Beach Petroleum (BPT) $1.69

BPT has been clobbered -31.8% following the oil price lower, with China being world’s largest importer of crude oi it’s no great surprise that we’ve seen the commodity correct ~22%.

The company delivered a mixed half-year result in February with underlying net profit slightly better than expected at $274m compared to an expected $269m but they increased guidance in terms of exploration spend , this does eventually bode well for future growth but increasing spend in a weak market creates more risk. At the moment moves in the BPT share price are being dictated by the oil price as opposed to underlying company fundamentals - sounds a bit like the whole market.

MM believes BPT and the Energy Sector is approaching a low.

NB: Santos is a lower risk exposure in the energy sector

Beach Petroleum (BPT) Chart

Crude Oil Chart

2 Clinuvel Pharmaceuticals (CUV) $16.92

CUV is an Australian biopharmaceutical company focused on UV-related skin disorders, its corrected a whopping -35.4% over the last month. The stocks been hit especially hard because Italy is the companies 4th largest market and its going into lockdown as I type, also its half year results disappointed investors with revenue increase of under $10m and profitability lower due to a large increase in expenses following the US Food & Drug Administrations (FDA) decision to approve its drug Scenesse in the US.

Following the stocks ~65% correction we do now see interesting risk / reward in this high valuation healthcare stock but this $830m business cannot afford any slips in the road with a P/E of around 65x for 2020.

MM likes CUV as an aggressive play ~$16.

Clinuvel Pharmaceuticals (CUV) Chart

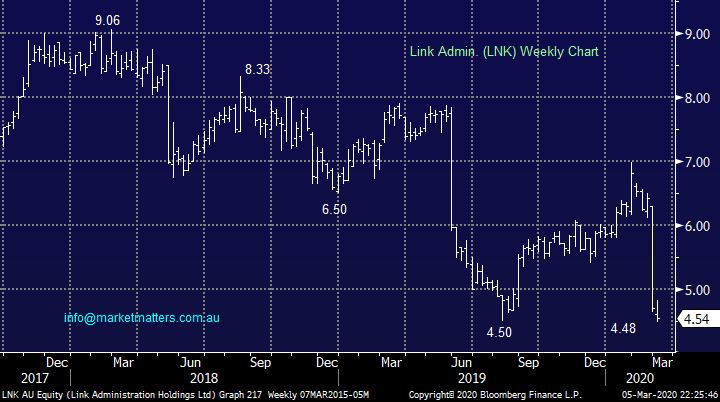

3 Link Administration (LNK) $4.54

LNK has been falling aggressively since it announced a poor half-year update in late February, a 4% decline in revenue and 20% drop in operating earnings plus a warning from the board that FY2020 operating EBITDA looks likely to be 10% lower was hardly reason to celebrate. This fund administrator is estimated to pay a 4.3% fully franked yield in 2020, it’s not catching our attention yet but closer to $4 it may be a “speccy” candidate for our Income Fund.

MM is neutral LNK at current levels.

Link Administration (LNK) Chart

4 Wisetech Global (WTC) $15.48

Logistics solution business WTC has fallen 37.1% over the last month but it’s certainly not all COVID-19 related, this is a company that’s been in strife for almost a year since a prominent global hedge fund accused the company of inflating its profits through accounting smoke and mirrors. Now last month the business announced an awful half year result including a downgrade to its earnings guidance – the 30% increase in revenue to over $200m was not enough to placate nervous investors.

MM still has no interest in WTC but it’s now on watch.

Wisetech Global (WTC) Chart

5 EML Payments (EML) $3.22

Payment car solutions business EML has plunged 39.1% in the last month even though profits have rallied by an impressive 70%, the market reacted negatively to the company reducing the top end of its revenue forecast but it wasn’t a dramatic shift as the price plunge would suggest. – the company has forecast growth around 40% in FY20 which is ok for a business on an estimated P/E for 2020 of 31.5x but not when the stock was priced for perfection up around $5.

MM likes EML as an aggressive play around $3.

EML Payments (EML) Chart

Conclusion

MM likes EML and CUV as potential aggressive plays (punts) for sharp bounces when the market regains some confidence but they’re not for us we prefer Bingo (BIN) and Altium (ALU) touched on in yesterday morning report – click here.

Also, we feel that the Energy Sector and BPT is approaching an inflexion point, but we see no reason to increase our exposure further until we see more clarity

Overnight Market Matters Wrap

· Couldn’t hold on, maybe the ASX200 gave you a clue yesterday with it selling off all day after reaching its highs. The DOW had a very ordinary night closing down 3.6%, with the NASDAQ and the S&P following suit, closing down 3.1% and 3.4% respectively. More coronavirus news spooked the market with the UK and Switzerland reporting their first deaths, with cases in Iran surging. The 10-year treasury yield trading set a new low at 0.92%.

· Oil had an interesting night with OPEC agreeing on a 1.5mil barrel cut, overlooking Russian opposition, which if they do not join could result in a crash of the oil price. Gold had a good night with the metal rising almost 2% to US$1674/oz. The AUD was off slightly trading at 0.6602. Iron Ore had a good night also trading up almost a couple of percent at $92.57. The ASX futures currently down 136 points.

Watch for Alerts

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.