COVID-19 now deemed Pandemic, policy response arrives

Wednesday brought investors yet another day of significant volatility with the local market tumbling -4% from its initial positive open, the ASX basically followed US S&P futures lower all-day as Joe Biden firmed as the likely Democratic candidate – markets are already forecasting Donald Trump’s got a real battle on his hands come November with his odds of re-election now out at $1.75 compared to Biden at $2.25 according to the TAB. An uncertain run in to the Presidential campaign and election is the last thing equities need at present, it’s a bit like “putting fire out with gasoline”.

**Trump is due to address the nation from the Whitehouse, around midday AEST today while Prime Minister Scott Morrison is set to announce an ~$18bn domestic stimulus package **

The 2 important points to remember:

1 – Equities love Republicans and especially Donald Trump as can be seen from the chart below hence a real possibility of a Democratic victory, albeit from a relatively market friendly candidate is unsettling for stocks.

2 – Donald Trump depends heavily on Trump “rallies” on his campaign trail but with COVID-19 slowly rolling through the US, identified infections have surpassed 1000, this might be heavily curtailed – bring on the social media!

Italy has already gone into total lockdown and other Western countries look destined to follow; Trumps still favourite to remain as US President, but the goalposts are clearly moving around the looming November election. Trying to second guess events day to day is madness at present, we feel comfortable looking 6-12 months out but closer than that is clouded in uncertainty and this obviously covers the bulk of the US election campaign.

US S&P500 Futures Chart

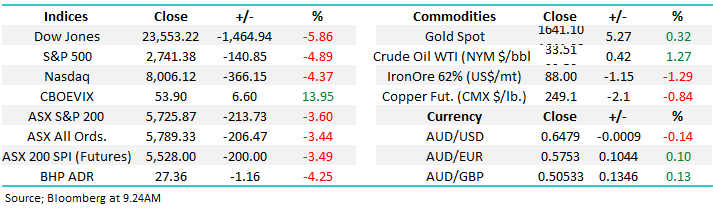

I usually think about / start writing the morning report the night before but in the current environment its nigh on impossible, things are out of date an hour later, let alone half a day! As seen below we are currently tracking the ASX via the SPI Futures 60-mins chart, normally we refer to daily / weekly timeframes.

As we touched on yesterday, we are drawing our lines in the sand to add / reduce risk, in between these 2 areas is choppy unpredictable mess that’s only good for elevating stress levels.

We currently are buyers ~4/5% lower and sellers ~8% higher.

With the Dow down -1,464 points / 5.86% overnight SPI futures are suggesting a 200-points gap lower towards 5550 – If I was short, I’d be taking profits here coinciding with the WHO labelling COVID-19 as a pandemic, and a coordinated policy response now upon us.

We have a high number of medical professionals as subscribers to Market Matters and I’ve spoken to around half a dozen of them over the past week. The clear consensus from a medical perspective is this get worse, before it gets better. The solution to the problem has stark economic consequences that need to be managed through aggressive fiscal measures. We are now at the point where this intervention is taking place, and the outcomes / reactions will be telling from here.

While we think government initiatives combined with central bank intervention will be important right now, we need to remember that the more important issue in this market is the growth rate of the virus, and specifically how quickly it will spread, and how bad it will get. That, more than any policies from Canberra, Washington or interest rate cuts, will decide whether we fall further or whether this entire correction ends up being one enormous buying opportunity.

Clearly there’s a mosaic of bad news circulating at present, however we believe the below 4 salient points are the catalyst for the most recent plunge:

1 – The World Health Organisation (WHO) has fallen on its optimistic sword and called COVID-19 a pandemic.

2 – Deaths in Italy have surged over 30% as the spread and impact of the virus comes very close to home for Western countries – US & Australian stocks were merrily making all-time highs while COVID-19 was contained in China.

3 – The US has failed to announce any concrete stimulus plans yet (Trump to speak at 9pm US time from the Oval Office – midday AEST today)

4 – Just for some cream on the cake Saudi Arabia and the UAE have announced they have both promised to flood the crude oil market sending the commodity down over 4%,

ASX200 SPI Futures 60-mins Chart

MM believes that the US and Europe has held back from announcing major stimulus packages and additional rate cuts because it would probably be ineffective right now, and ammunition is low. However, history tells us they will push “the button” sooner rather than later and equities will at least bounce strongly as they did earlier in the week.

China has given global central banks and politicians some huge clues on how to deal with the crisis, but I fear Italy is already illustrating how some countries have / will fail to heed the warnings and act accordingly. The Chinese equity market after their intervention is close to fresh multi-year highs, a pipe dream for Australia and the US, we just want a respite to the downward spiral.

We believe concerted and aggressive stimulus is close at hand by the Western world.

China’s Shenzhen CSI 300 Index Chart

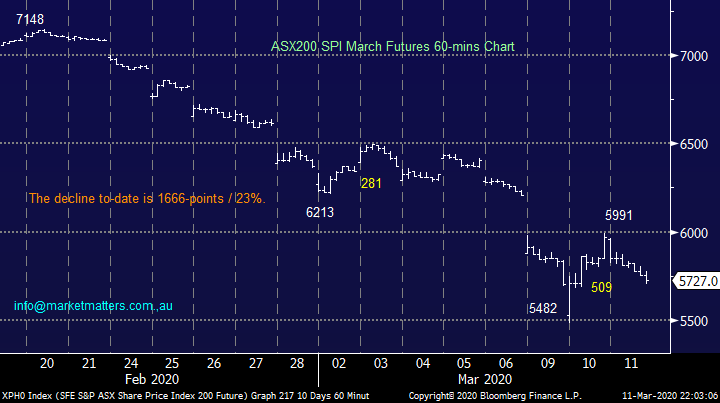

Last night the Bank of England surprised some of the market by slashing interest rates from 0.75% back down to 0.25% while they also made available large amounts of liquidity, however just a few hours later the Pound was higher, the FTSE was up less than 1% and the yield on UK 10-year Gilts had risen to 0.283%, not moves that imply any great recent shocks – one of the current issues for stocks is they are expecting aggressive monetary and fiscal stimulus, they need a real positive or impressive surprise to feel belief.

Official Central Bank interest rates look destined to decline further but the market reaction as mentioned above implies it’s basically all built into the market.

UK Official Bank Rate Chart

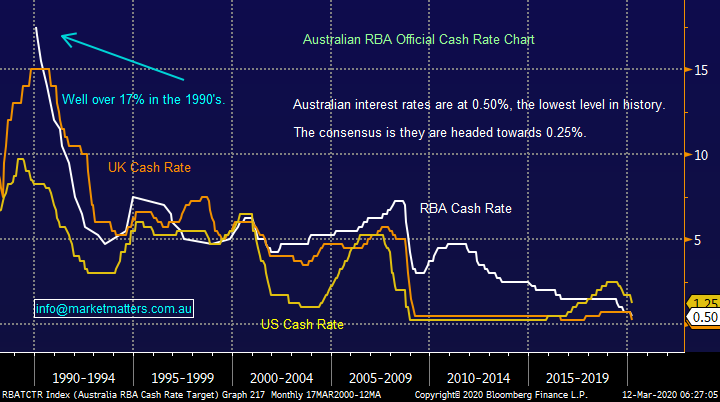

An updated snapshot of Global Markets

US stocks were clobbered overnight, with the Dow trading down over 1600-points at one stage, the chart below illustrates the current correction by the tech based NASDAQ remains very similar to that in 2018, we are now looking to increase our market exposure in the MM International and Global Macro ETF Portfolios into this current leg lower - Visa (V US), McDonalds (MCD US) and Microsoft (MSFT US) remain in our headlights as mentioned in the morning report yesterday.

MM believes accumulating quality US tech names after this 18% correction makes sense.

We’ve been discussing buying / increasing risk into another spike lower in equites and its definitely unfolding as I’m writing this report. Buying over the next 24-hours as the virus gathers momentum through Europe and the developed world feels uncomfortable to say the least but I remind readers that China is going “back to work” as a nation and although things will get much worse before they improve from a headline perspective, both at home and abroad stocks look at least 6-months ahead and we believe as China is illustrating the second half of 2020 will be far better than the present time.

*Watch for overseas alerts in the PM report today post Trump comments*.

US NASDAQ Index Chart

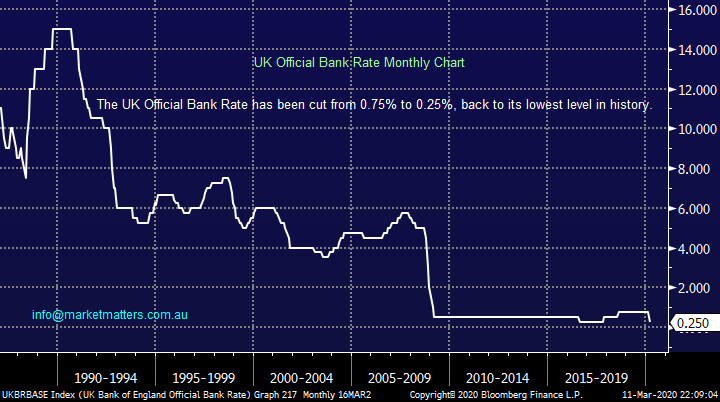

Overnight we saw the UK slash interest rates, the Fed is now expected to follow suit with another 0.5% cut and the RBA will probably deliver another 0.25% cut down to 0.25% sooner rather than later but as we can see very clearly below global interest rates are almost at zero, not much powder left in this keg.

1 – Central banks need to announce aggressive QE (quantitative easing) to placate markets, if its coordinated across the globe we believe the impact could be very positive

2 – Governments also need to announce aggressive fiscal stimulus to stop the global economy from grinding to at best a 2-moth halt, Australia set to announce this today however more importantly, Trump is set to speak at midday.

We believe and hope lessons were learnt from both the GFC and China and the above will arrive in the coming days.

Major Official Central Bank Rates Chart

One very interesting observation from last night was the rally in bond yields (prices down) and gold falling over 1%, safe havens haven’t delivered even when the Dow was down 1600-points! MM has no interest in bonds or gold at current levels.

As with the UK we are seeing US bond yields rally as shown below, this may bode well for risk assets moving forward.

MM is still expecting bond yields to bottom during this current market turmoil.

US 10-year Bond yields Chart

Gold Chart

Stimulus Today

A line in the sand will likely be drawn today. With SPI Futures pricing in a drop of 200pts on open, there are two obvious catalysts that could impact the day’s trade and beyond. Scott Morrison will be discussing an ~$18bn aid package which equities to around 1% of GDP, roughly equivalent to the contribution of the domestic travel and education sectors combined.

Perhaps more importantly, President Trump has ‘made some decisions’ as he put it earlier today and will be speaking at midday.

Both of these developments will have a big bearing on trade today and we’ll cover these this afternoon

Conclusion

Today will likely draw a line in the sand in terms of fiscal measures – politicians have the floor which always concerns me; however we’ve seen monetary policy offer very little in terms of market support.

Overnight Market Matters Wrap

- The US sold off further overnight as we enter ‘Bear’ market territory, snapping an 11-year ‘bull’ run as WHO declared the coronavirus a global pandemic and remains surprised over the inaction of some governments.

- The Bank of England cut its interest rates by 50 bps and the government is proposing a large stimulus package. German Chancellor Merkel said that up to 70% of the country’s residents will catch the virus.

- Metals on the LME were mostly positive, while iron ore closed 2.2% lower but still managed to hold above $US90/t.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 4.25% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to lose 200 points this morning, testing the 5530 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.