Looking out from the eye of the storm (QAN, WEB, ENN, VRL, SYD, EHE, ALL)

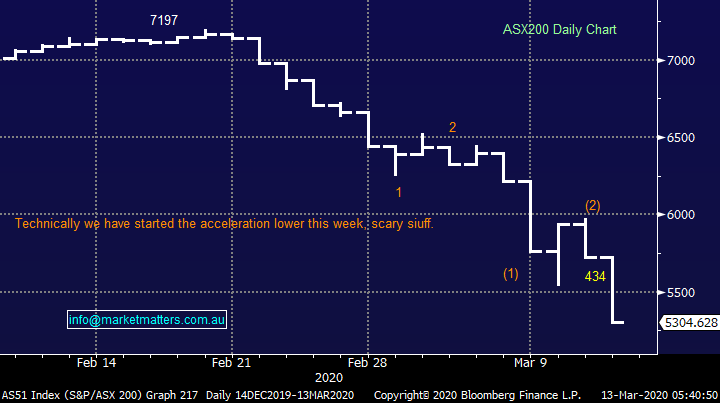

Yesterday felt like a combination of the GFC and the crash of 1987 rolled into one, the ASX200 has now corrected 26% in just over 2-weeks as the uncertainty around the coronavirus intensifies. The fall this morning could be worse as President Trump and the Fed failed to impress investors sending the Dow over 2300-points lower. This is an unprecedented event in modern times, at MM we continue to believe investors should not panic with stocks although in hindsight it would clearly have been the correct course of action once the word coronavirus first hit the news. We love our statistics at MM, the below 2 points are fairly sobering as this pullback has been faster and deeper than many of us imagined, myself included:

1 – US stocks have endured 12 Bear Markets since World War II with an average fall of 33%.

2 – On average bear markets have lasted well over 1-year and have then taken 2-years to recover their respective losses.

Assuming this savage COVID-19 correction is an average correction, and they never feel like it at the time, we might be getting close to the end of the “fire sale” of stocks but any major recovery is a few years away. Hence at MM we feel it’s time to consider what stocks / sectors are presenting the best value medium-term as stock’s literally plunge off the cliff – we all know elastic bands get too stretched in both directions, which presents some excellent opportunities for the patient investor prepared to buy value for the years ahead, as opposed to days.

In times of mass panic MM wants to move further up the quality end of the curve whether it be CBA in the banks or BHP / RIO in the resources.

I was reading a report overnight from another fund manager and the below caught my eye– it’s very apt in today’s panic i.e. Jeremy Grantham's financial crisis advice “Reinvesting when terrified”:

"A market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before".

Whether that shade changes today, tomorrow, or in six months' time, at MM we will do everything possible to leave our portfolios / subscribers best placed to benefit.

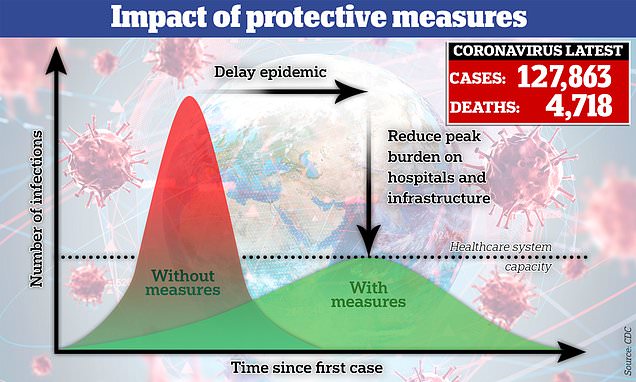

The good news is we all know from China this epidemic can be limited to an extremely tough and painful 1-2 months, but I feel plunging markets are voting with both feet that the US is going struggle badly to cope with COVID-19 - remember this is a country where a huge % of the population slip through the cracks when it comes to getting good healthcare.

On Thursday the already struggling market was simply hammered almost the minute President Trump started talking at midday, investors were hoping for a tsunami of stimulus from the US but all they received was confirmation that the President is very inward looking as he described COVID-19 as a “foreign virus”, stated Europe wasn’t so smart and of course he promised to beat the foreign invade. Basically, he showed as much global teamwork as Saudi Arabia and Russia over their current “oil spat”. Unfortunately, it now looks like the President has shown his hand with at least one eye firmly locked on Novembers US election:

1 – Until he knows how badly the virus will hit the US he will blame everyone else as aggressively as required to look a “strong President”. This is not a traditional war for the US, their military power is useless today hence the drastic, although probably smart, action of banning all flights in / out of Europe – it shouldn’t be too hard for the US to cut itself off from the world, remember almost double the % of Poms have passports compared to Americans.

2 – I’m sure once he believes the virus is under control the market will get its desired massive stimulus package and he will present himself as the great saviour as the campaign trail starts to hot up for November, am I cynical?

Overnight UK prime minister levelled with the people acknowledging we are in the centre of the worst health crisis in a generation with over 10,000 infected in Britain and saying “many of us will lose loved ones. Boris Johnson hasn’t yet banned public gatherings, but he feels far more in touch with reality than President Trump.

Technically the ASX has now broken its post GFC support line with major support at4700 but the current news flow isn’t paying great respect to technical levels – with the current downside momentum it’s a brave trader to be more bullish.

ASX200 Chart

Markets have now decided the world is going into a recession as a base case with forecasters crunching their calculators in an effort to decipher how deep and long it will be. Importantly the second and arguably most important part of the equation is when / how strongly the global recovery can kick back into gear – oh what a difference a fortnight makes.

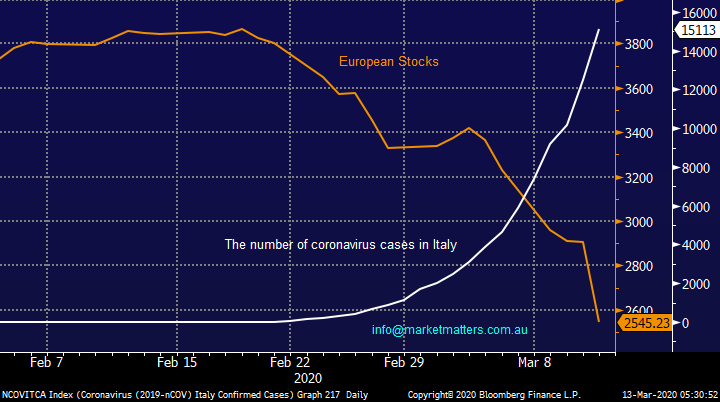

We all know that Italy has moved into a “total shutdown” as their number of confirmed cases spirals above 15,000 and deaths climbs above 1000, the chart below illustrates how quickly things have deteriorated for both equities and people – stocks seemed to roll over 7-10 days ahead of the virus and it probably will be the same on the upside when we do eventually find a bottom. Local equities are clearly concerned that both Australia and the US are where Italy was on February 20th, things are going to get much worse before they improve from at the very least a disruption perspective.

Equities are forecasting that the Western world will not remotely be capable of quelling the coronavirus as efficiently as China.

NB In China yesterday we had less than 10 new infections as the world’s second largest economy gets back to work just when we are looking over our shoulders wondering how things will look on our own shores next week!

Coronavirus in Italy v European equities Chart

I do often get asked how we see things unfolding technically and the pictures clearly looking far more disconcerting than a week ago. Stocks are accelerating to the downside , we are in the proverbial eye of the storm, with a period of consolidation not too far off but probably at lower levels, a few days rotation between 4700 and 5100 is now our best guess but as we said earlier this markets not respecting technical’s as it often does in “usual times” but this is panic, based on a health issue, clearly a lot of variables playing out.

ASX200 Chart

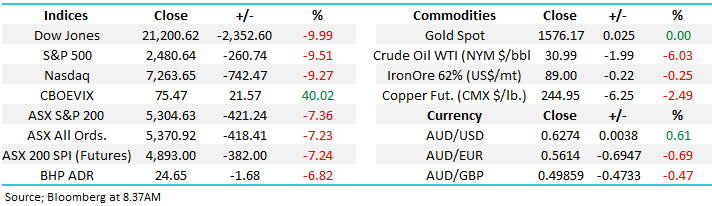

An updated snapshot of Global Markets

US stocks were again smashed overnight, with the Dow closing down over 2300-points /10%, the chart below illustrates the current aggressive correction by the tech-based NASDAQ is rapidly taking on a whole new look as the plunge continues unabated. The pullback clearly looks like a correction to the whole post GFC bull market implying that a test of the 6000 level is not out of the question for the tech-based NASDAQ.

At MM we have refrained from aggressively pushing the buy button for our International Portfolio, it still feels wrong and this course of action now feels likely to continue at least in the short-term.

US NASDAQ Index Chart

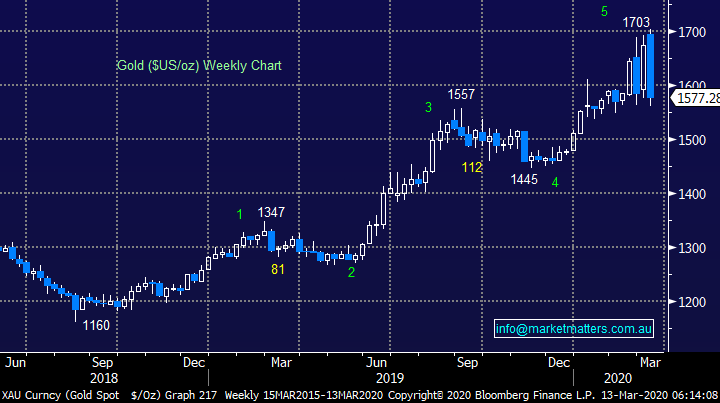

The traditional safe havens have also been struggling over the last few days, overnight gold was smashed ~4% and bonds were basically unchanged as cash was king took on a whole new meaning, it’s certainly hard to find any green on the green this morning.

MM remains bearish gold initially looking for another ~6% downside.

Gold ($US/oz) Chart

What stocks / sectors to invest in medium-term.

At MM we have underestimated the coronaviruses impact on global equities, as investors we must look forward and evaluate what stocks / sectors are offering compelling value as this unforgettable Q1 of 2020 comes to an end. The bloodbath has been all encompassing with only 2% of the ASX200 up over the last month while almost 15% of the members have fallen by over 40%!

Hence the question as the “baby has clearly been thrown out with the bathwater” what stocks / sector do we feel have been too harshly dealt with e.g. sure people are cancelling holidays now but unless the forecasted recession becomes a full blown depression we will still want our few weeks R & R each year, even if we do ratchet down the spend for a while, hence does digital travel business Webjet (WEB) deserve to have fallen over 60% in just a few weeks?

Today’s report is about switching, or re-jigging, our portfolio into the current market panic looking through noise where we see value and a healthy future in the years to come, plus as we said earlier moving up the quality curve.

Many companies will be moving into survival mode as they plan a course of action with potentially plunging revenue, QANTAS stock has almost halved over recent months and a ban on flights between the US and Europe certainly won’t hurt, my wife cancelled Qantas flights last night and waited on hold for over 3 hours to do it!

As investors, we must ponder if value is presenting itself considering that we are likely to be back to “normal” in a few months from a day to day perspective, although of course we will be in a technical recession.

Today I have focussed on the travel & tourism, Aged Care and Gaming sectors which have been simply smashed on coronavirus fears – we are looking to pick the quality businesses that will survive and be well positioned in the years ahead. We need to be cognisant that some of these business might need to raise capital to help with cashflow and in today’s market that means deep discounts but experience tells us from the GFC when large businesses start raising capital it can offer excellent buying opportunities.

QANTAS (QAN) Chart

1 Travel & tourism

Recent events have been extremely damaging to the tourism sector, I’m sure I’m like many out there who have just cancelled trips. Cruise lines are at the pointy end of this, with the likes Carnival down ~70% since the outbreak, Royal Caribbean is down ~77%, Norwegian Cruise Lines ~83% and Trip Adviser is off ~50%.

Despite the carnage, we feel value is emerging in some pockets if we take a longer-term view.

Rather than discuss the trials and tribulations of the likes of Flight Centre (FLT) and Corporate Travel (CTD) we have looked outside of the box and identified 3 stocks we are finding interesting in the sector, 1 or 2 of which may not have crossed some subscribers minds – we have looked at the gaming stocks on separate level as opposed to tourism where they usually reside.

The 3 components we have looked for are relatively low operating costs to mitigate reduced revenue, exposure to domestic tourism to alleviate short-term pain and manageable debt levels.

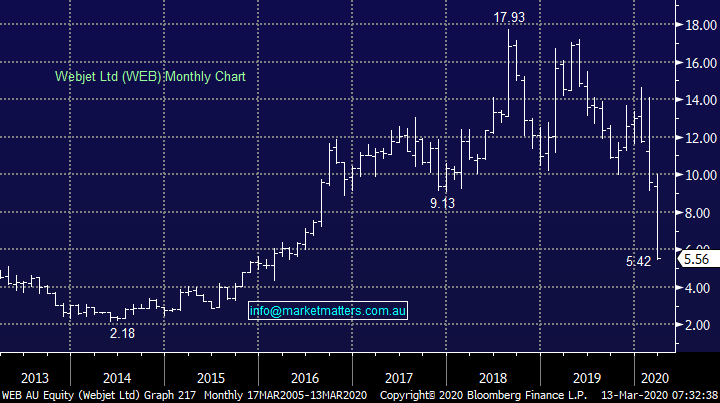

1 Webjet (WEB) $5.56

On-line travel agency WEB will clearly be significantly adversely impacted by recent events around the global pandemic but it ticks some of the above 3 criteria we are looking for in the sector as opposed to the more expensive shop front infrastructure of the likes of Flight Centre (FLT). We feel the recent 60% plunge in the share price is offering some very compelling value to investors.

MM likes WEB down towards $5 as a medium-term play.

Webjet (WEB) Chart

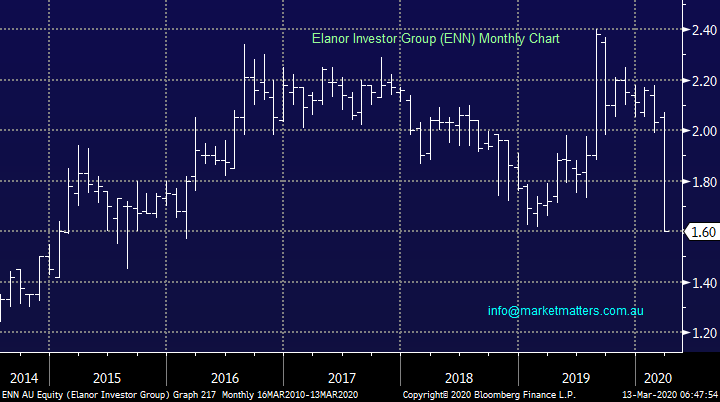

2 Elanor Investor Group (ENN) $1.60

Relatively new business ENN owns shopping centres and hotels including Ibis and Mantra, an interesting mix but we are a little concerned around the transparency of the business’s exposure to the virus.

On the watchlist at present, we want to see how the lack of overseas numbers impacts it first

Elanor Investor Group (ENN) Chart

3 Village Roadshow (VRL) $2.61

Theme park operator and film distributor VRL enjoys domestic attractions such as SeaWorld, Wet & Wild and Movie World, they’re on the agenda of most Australian parents at some stage, potentially now sooner rather than later. Obviously, they will miss the influx of overseas travellers but the locals should plug some of this gap.

Technically it looks set to test sub $2 which adds to our caution.

On the watchlist at present, again we want to see how the lack of overseas numbers impacts the business.

Village Roadshow (VRL) Chart

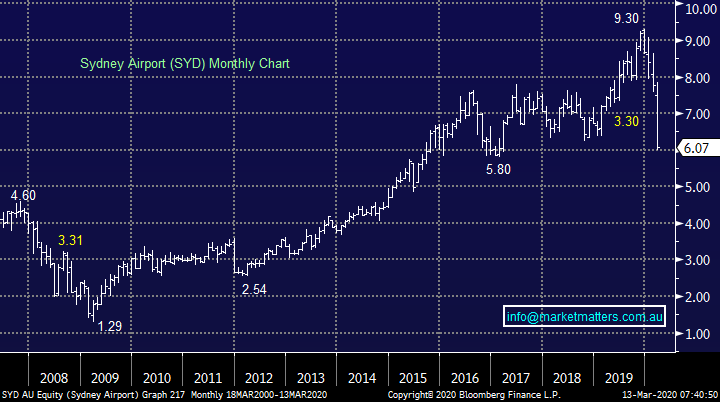

4 Sydney Airports (SYD) $6.07

I know President Trump has slapped a ban on fights between the US and Europe but people will again be flying in a few months’ time as the western world follows a recovery path like China, albeit probably less efficiently. MM believes the almost 40% correction in SYD is offering a great contrarian opportunity.

MM likes SYD below $6 as a medium-term play.

Sydney Airports (SYD) Chart

2 Aged Care Sector

The chance of death from COVID-19 when you’re aged between 70 & 80 is ~8% and it surges to almost 15% for the over 80’s, clearly awful news on the humanitarian front and for business in the aged care sector. Hence aged care stocks have been decimated ~50% over recent weeks

Estia Health (EHE) is down almost 50% from its 2020 highs posing the question is it too much or could these business fail or have to raise money – if we were in a glass half full environment investors might be considering whether they were becoming take-over targets. Both Japara and Regis Healthcare look very similar. We should also remember this is a sector that’s been pressured by a Royal Commission and regulators, a similar story to our banking sector with comparable underperformance in the respective shares.

I believe because of the additional headwinds to the sector this is not a sector for MM at least for now.

Estia Health (EHE) Chart

3 Gaming

With the US suspending NBA games we saw gambling stocks come under the cosh globally but we feel this indiscriminate selling is providing one opportunity, and it’s not with the traditional casinos who have plenty of headwinds – the Chinese “whales” were arriving in lower numbers before the coronavirus plus they are not popular with the growing numbers of ethical investment funds.

1 Aristocrat (ALL) $25.64

ALL is focused on gaming machines and online which we can see recovering faster than the bricks and mortar-based Star and Crown casinos, the large casino’s simply cost more to run on a day to day basis. The ability to make money from “punters” at home is far more appealing to MM.

MM likes ALL in the low $20 region.

Aristocrat (ALL) Chart

Conclusion

MM thinks some great value is emerging in the market for the cashed up and investors like us simply looking to move up the value curve.

1 – MM likes Webjet (WEB) and Sydney Airports (SYD) for tourism exposure, we believe the latter is a “safer” play medium term.

2 – The aged care sector feels too hard at present.

3 – In the gaming and casino sector we prefer ALL over the traditional casinos, but we are mindful of the ever-increasing influence of the Ethical Funds Industry.

Watch for alerts

Overnight Market Matters Wrap

- Global markets continued its descent and sold off into bear market mode as investors believed US President Trump’s speech to the nation didn’t go far enough to fight the spread of coronavirus.

- Nickel fell 2% on the LME, while crude oil fell 6.03% towards US$30.99/bbl. BHP is expected to underperform further after ending its US session off an equivalent of -6.82% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to lose 412 points on the open, testing the 4900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.