The coronavirus tsunami is approaching our shores – where to hide? (S32, NHF, FLT, WTC, CWN)

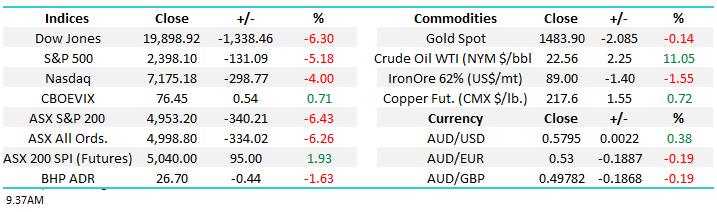

“Another day another dollar” is not an apt phrase for the vast majority of March as we contemplate what’s slowly unfolding before our very eyes. Australia saw an almost 25% increase in confirmed cases yesterday as we slowly gather momentum in a comparable manner to Italy in late February. It’s a surreal feeling in Sydney at present, I’m still in the office in Chifley Tower (Sydney CBD), about half the firm is in however a lot of fund managers / groups we deal with are not, my wife Alice works for a large multinational and they’re all working from home, and I suspect that will be a theme that gains momentum.

A lot of testing happening internally here to ensure operations continue as they should when the majority are working remotely, in the US all trading is finally moving electronically (i.e. no floor trading). This pandemic will have longer term implications on how we all work for here, businesses that hadn’t contemplated remote working have now done so, and that canary is now out of the coup. If more flexible work arrangements are successful during this period, then more flexibility will be a positive consequence of this outbreak.

Bill Ackman is a well-known US hedge fund manager that I enjoy listening to, he’s passionate about his views and backs them, they’re not always right but he thinks independently and has a highly concentrated portfolio of his ‘bets’. He spoke on CNBC overnight (click here) calling for some very dramatic action which I tend to agree with. He believes that we should just ‘shut up shop’ for a month, stay home and go hard and fast on isolation. The government should direct their efforts into supporting the population / and business for a month and that will dramatically curtail the spread.

If we skirt around the issue it will last longer, and cost more both from a humanitarian and economic perspective, capitalisation doesn’t work if things stall for 18 months, but it can handle a shorter, sharper more aggressive shutdown. Well worth a listen – he’s negative on the virus and the current approach from Trump, but is a buyer of stocks given extreme weakness in prices. As an aside, if you’re looking for something to watch on Netflix, there is a documentary about his failed short position on Herbalite, it cost him around $1bn over 5 years, however it’s a really interesting take on having a sound investment thesis, but ultimately getting it wrong, anyway – I watched it a few years ago and enjoyed, something to do while we’re all huddled up in isolation.

Remember most of our grandparents went through a war where millions died, things have been much worse in the past. Italy has now recorded almost 3,000 deaths due to the virus, amazingly soon to eclipse China, but the rate of new infections appears to be in decline hopefully suggesting the worst is behind them.

That said, the health impact of the virus might be totally overshadowed by its economic impact, I read a headline in a prominent UK newspaper recently which sums up my current feeling “Coronavirus will bankrupt more people than it kills and that’s the real global emergency”. This is the issue for markets which is obviously our focus at MM.

We will continue to monitor the pandemic statistics closely but as we’ve said over recent weeks “it feels like it’s going to get worse before it gets better”. One clear area of hope is never in human history have so many intelligent men & women been working towards one common goal, a vaccine, this is one area where records might be broken on the positive front as comparing the current effort to previous efforts in history on the medical front is irrelevant.

Coronavirus in Italy & Australia Chart

Australia and most of the developed world is rapidly going into a “lockdown”, a recession is clearly going to occur and suddenly many are fearing for their livelihoods – more than 2 million Australians are casual employees with the majority of these in tourism, hospitality and retail, these people look likely to lose their jobs or at the very least receive massive pay cuts. The knock on effects are going to surge through the domestic economy bringing many small businesses to their knees but from a stock market perspective the major point is we all knew this a week ago, how much of the bad news is priced into the markets 32% decline – we think a lot in some stocks / sectors.

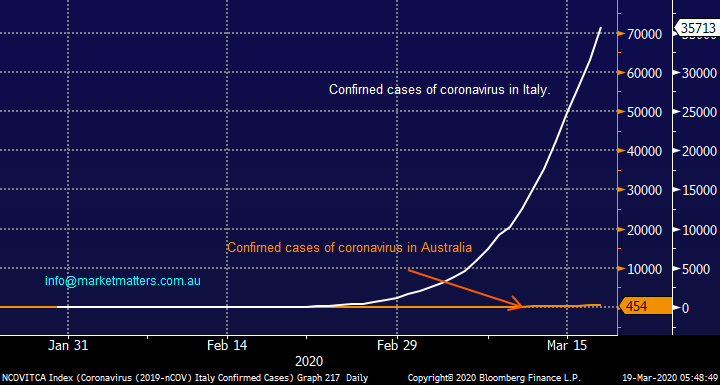

Technically we’ve been calling the 4800 area as the ideal area for a major bounce and view government stimulus as the reason, we look set to test this level on open today with the Dow closing down ~1300-points this morning – note we are looking / hoping for a bounce back towards 5500 not a change in trend.

ASX200 Chart

Stocks that look cheap with ok debt levels (for now).

Today we’ve looked at 5 stocks which MM believes the market may be undervaluing when we consider the current Price to Book (PB) Ratio compared to the stocks historical level i.e. what the market is usually prepared to pay for the company’s underlying assets. If we combine this indicator of how oversold a stock is with the important filter of low debt to EBITDA (Earnings before interest, taxes, depreciation, and amortization), which looks at how many year’s cashflow (based on a one-year forward estimated basis) are needed to pay off all the company’s debt, we get a group of stocks worth closer scrutiny.

In simple terms MM is looking for the following:

1 – Stocks where the panic selling has significantly undervalued a company’s assets compared to their average over the last 10-years.

2 – Stocks that have low debt compared to their earnings - obviously income levels will be under pressure for most businesses in the months to come.

3 - Stocks that pass the ‘sniff test’ as simple fundamental scans always require an overlay of common sense

In our opinion these are the sort of stocks which will recover the best when we eventually exit the COVID-19 lockdown plus their risks are arguably lower. As a point of reference, the top 100 stocks in the ASX are trading at a 15% discount to their historical Book Value while carrying an almost 2x Net Debt / EBITDA.

1 South32 Ltd (S32) $1.76

Diversified metals and mining company S32 – its trading at more than 45% discount to its historical book value while carrying no net debt.

Obviously, the prices of resources are falling as the world slips into an inevitable recession but we feel this company is well positioned for a recovery, plus they have the balance sheet to be able to take advantage of distressed opportunities as they arise.

MM likes S32 into current weakness.

South32 Ltd (S32) Chart

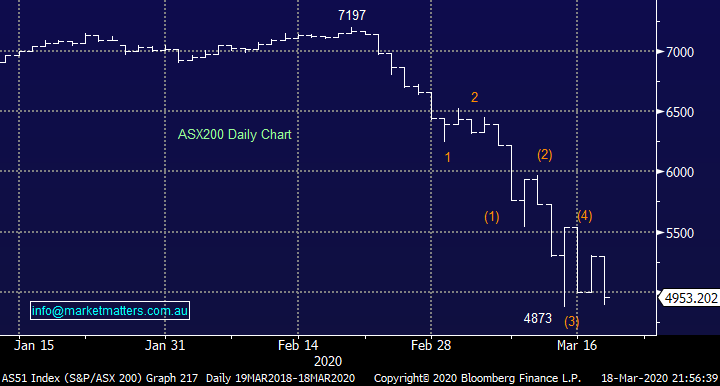

2 NIB Holdings (NHF) $4.38

Private health insurer NIB Holdings (NHF) is now trading at more than a 33% discount to its historical book value while retaining a solid balance sheet.

This stock has been under significant pressure since mid-2019 as people have been moving away from expensive private health cover but we now speculate that once the coronavirus pandemic comes under control the Australian Govt. Is going to be extremely keen / need to arrest this trend as the health system looks likely to be tested beyond its means.

MM thinks NHF is interesting below $4.

NIB Holdings (NHF) Chart

3 Flight Centre (FLT) $14.80

Retail travel agency Flight Centre is at the centre of lifestyle disruption but its trading at an almost 65% discount to its historical book value while carrying net cash on its balance sheet. Since the GFC, FLT have prepared for downturns like this by carrying a large cash balance and this is proving to be a good move.

Obviously, FLT is going to struggle for income in the months ahead but this business should be well positioned for a rebound if the shutdown does not continue for an extended period of time. The main concern here is the potential liability of closing stores, they’ve already announced the closure of 100 underperforming stores, with more likely.

In the longer term, this shock will put FLT in a better position for the future, however in the short term, more pain is likely.

MM is negative FLT short term however there will be a time to step up and buy this, just not yet

Flight Centre (FLT) Chart

4 Wisetech (WTC) $11.88

Cloud based logistics software company WTC screens well on the metrics outlined above, however there are a few things that need to be taken into consideration here, the main one being do we believe the ‘book value’ of their assets?

The value of these assets will ultimately be determined by the earnings they generate and after many of them were bought in better times through an aggressive expansion program, we have little faith in using this measure in a business-like WTC.

My favourite Buffet quote is the one about only being able to tell who’s swimming naked when the tide goes out, and I fear the use of aggressive accounting policies through a period of expansion via acquisition may just come home to roost for WTC.

MM has no interest in WTC

Wisetech (WTC) Chart

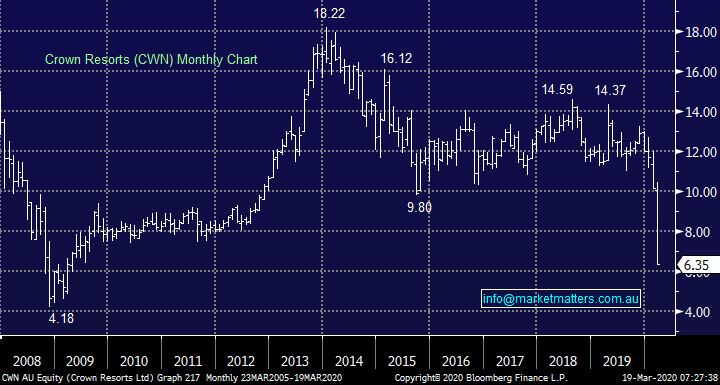

5 Crown Resorts (CWN) $6.35

Casino and resorts operator Crown are front and centre in the fallout from COVID-19 but again in a years’ time this is a business that may look very cheap. I ride the Triumph over the Harbour Bridge each morning and look across at Barangaroo and can’t help but think this will be strategic asset, that can’t be replicated in a market that will grow over the long term.

Obviously CWN’s income has been slashed by the virus but the stock is trading at an almost 50% discount to its historical book value while apartment sales (75% under contract) will deleverage its balance sheets fairly aggressively from 2021, although defaults will be a concern in the near term.

If I look forward 6 months, I believe this is a stock we’ll own, but at lower levels.

MM likes CWN into further weakness.

Crown Resorts (CWN) Chart

….and one final word on the banks following a discussion in our morning meeting today about what is currently factored in for bad debts. The table below looks at the level of peak bad debts during the GFC for each bank along with current estimates of where the market is currently forecasting. As can be seen, the market is currently forecasting / pricing in a big uptick in bad debts to levels seen during the GFC.

From Brett LeMesurier…. The following table shows the peak bad debts for the major banks in the GFC (being FY09) and my estimate of the market’s current expectation for annual bad debts based on the today’s closing share prices.

| Bank ($B) | FY09 | current estimate |

| ANZ | 3 | 3.0 |

| CBA | 2.6 | 2.9 |

| NAB | 3.9 | 3.8 |

| WBC | 3.4 | 3.2 |

Source: Shaw Research

Conclusion

MM is keen / interested in the following 5 stocks considered today on different levels.

1 – Avoiding – Wisetech (WTC)

2 – Interesting medium-term prospects from current levels – NIB Holdings (NHF)

3 – Excellent long-term prospects from current levels - South32 (S32)

4 – Excellent long-term prospects but at lower levels – Crown (CWN) & Flight Centre (FLT)

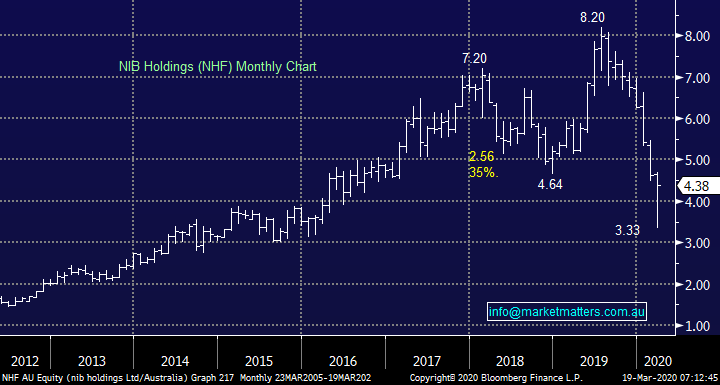

An updated snapshot of Global Markets

US stocks were again sold off last night, but it surprises many to be told that the downside momentum is actually waning, we like US stocks for a good bounce from last night’s low.

At MM we have refrained from aggressively pushing the buy button for our International Portfolio, it just “felt wrong” previously but we are likely start again tonight.

*watch for additional alerts.

US S&P500 Index Chart

US bonds continue to fall, or yields rise as investors effectively flock to cash, some of this money we feel may find itself into stocks in the weeks ahead i.e. smart people buy when things look their worst.

MM believes US bond yields have bottomed in 2020.

US 10-year Bond yield Chart

Overnight Market Matters Wrap

- The game of snakes and ladders continue across the globe, with the US equity markets plunging overnight, prior to a late rally that still doesn’t touch the sides of the current damage that has been done.

- It was the fourth time in many days where the circuit breaker was triggered, temporarily halting trade, while ‘defensive’ assets were also being sold off and investors switching to cash until signs of stability holds ground.

- On the commodities front, crude oil is tested its 20-year low before managing to settle back to US$22.5 /bbl. While on the metals front, Dr. Copper was off 6% - further signs of the inevitable recession to come to fruition.

- RIO will be closely looked at following its suspension of one of its copper mine in the US after being impacted by an earthquake.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.