Four stocks we believe can rally strongly – Part 2 (QAN, COH, REA, GMG, TNE)

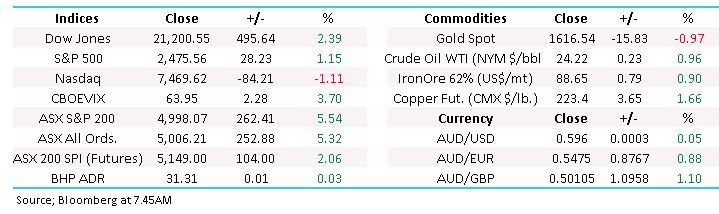

The ASX200 exploded higher yesterday largely assisted by the previous night’s 2112-point / 11.4% gain on Wall Street, while we only managed to reflect 50% of the gains by the US in the current market environment I’m sure we’ll all take a 262-point / 5.5% gain every time! In quick fashion Australian stocks have bounced 13% from Mondays low, pretty much as we expected but we must maintain some perspective, it’s only a 21% retracement of the last few weeks decline, as the chart below shows we may have broken the downtrend but its no lay down misere to chase stocks at current levels.

However history tells us events like the coronavirus pandemic do often cause major market lows and excellent buying opportunities.

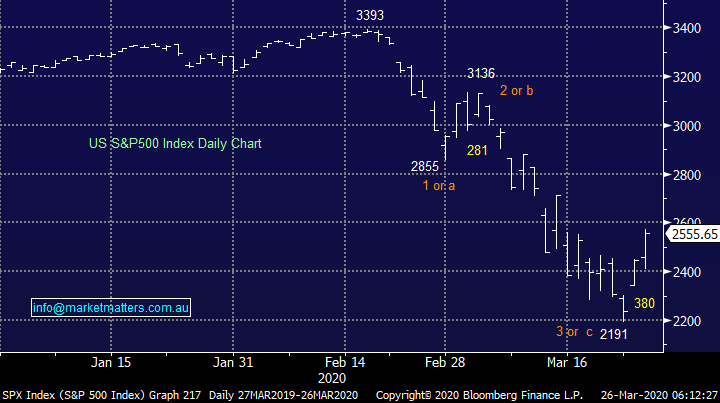

Under the hood of yesterday’s strong recovery by the local bourse the theme was very much “risk on” as we saw stellar performances by the Consumer Discretionary, Energy, Financials, Resources and Industrial stocks while the perceived safe havens of Healthcare, Telcos and Utilities struggled with a number actually falling on the day. Arguably the best illustration of the change in market sentiment was by the Aussie Dollar ($A) which soared back above 60c after testing 55c late last week – interestingly both the ASX200 and $A have bounced well over 10% but the currency has been leading by around 48-hours, worth watching over the coming weeks.

We’ve now seen 2 significant economic policy boosts to confidence out of the US, it will be fascinating to see how resilient stocks are over the coming weeks as COVID-19 threatens to make the US the new global focal point of the pandemic, a strong likelihood according to the World Health Organisation (WHO).

1 – The Fed has gone “all in” with its bond buying to support their economy, its committed to basically buy any financial asset except equities to avoid a liquidity driven extended recession.

2 – Today the US senate finally, and inevitably, approved a $US2trillion dollar stimulus to effectively work in parallel with the above Feds measures towards the same cause.

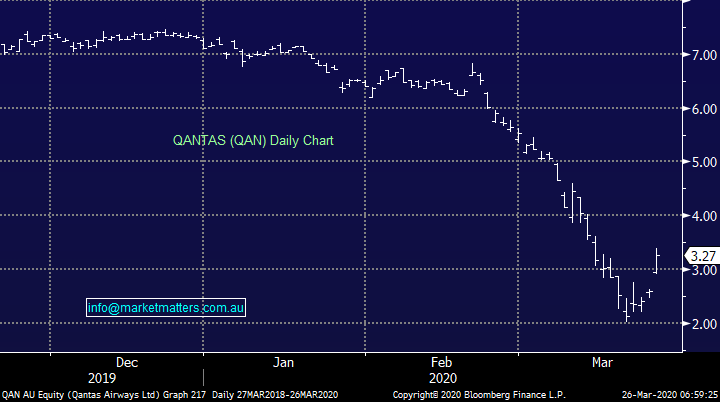

We also saw some positive domestic news on the stock level with QANTAS managing to secure a little over $1b in liquidity at an interest rate of just 2.75% while a $800bn capital raise by Cochlear was increased by 10% after-market - I’m sure the word was out that demand was high for this quality stock at a 44% discount to its late February high – there’s clearly demand for quality at the right price.

MM believes investors should be in “buy mode” but we wouldn’t chase strength above 5000 – yet.

NB Technically we can still see another test / break of recent lows which is easy to comprehend as the domestic and US COVID-19 news looks set to get far worse before it improves.

ASX200 Chart

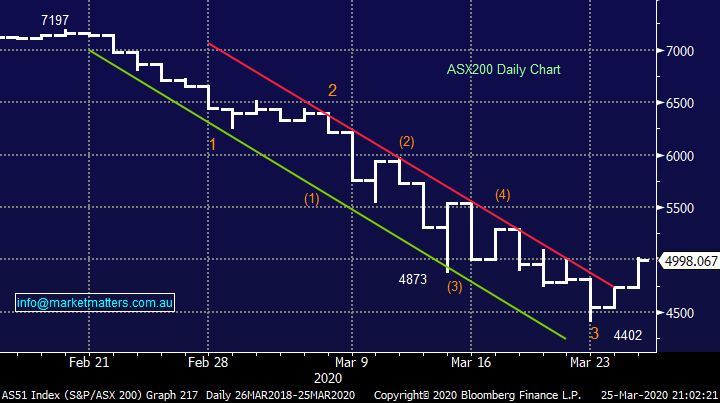

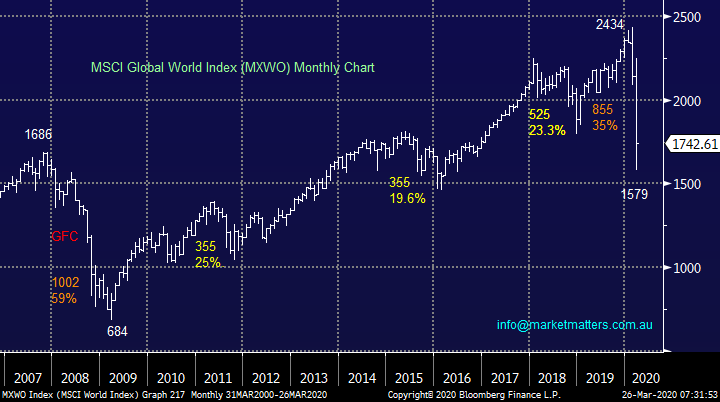

US stocks roared back to life this week largely as we had been expecting at MM, we have labelled the chart below to illustrate how we see the market unfolding in the coming weeks and months, fortunately we are now in a solid position from a risk / reward perspective as the surprises from COVID-19 appear to be largely behind us:

1 – We have already seen a major multi-year low which was certainly accompanied by enough panic and hysteria for this to be the case. If this scenario unfolds we are likely to see another test lower on another chapter of bad news which encounters unsatisfied buying before we commence a journey back to all-time highs – hard to comprehend but don’t underestimate the impact on asset prices of almost zero interest rates and huge stimulus washing through the system.

2 – This current bounce will run out of stream fairly soon and new 2020 lows will be plumbed in the coming weeks, this would represent an excellent buying opportunity in our opinion.

US S&P500 Index Chart

We mentioned earlier that the Australian Dollar has been a leading indicator for risk over the last few weeks, if this relationship which has been in play since COVID-19 has caused global hysteria remains in play the outlook is favouring the 2nd scenario outlined above i.e. one final look to the downside still appears likely for risk assets i.e. shares.

The pullback by the $A overnight suggests equities will run out of steam in the next 24-48 hours.

Australian Dollar ($A) Chart

We mentioned QAN earlier, Australia’s flagship airline enjoyed one of its best ever days on Wednesday rallying over 26% after the company secured just over $1bn of liquidity at an interest rate of just 2.75%, this was secured against a few unencumbered aircraft - its deals like this that enables MM to have a positive outlook for stocks into 2021. This deal takes the cash balance to nearly $3b, with another $1b in undrawn facilities, while the net debt position remains around $5b. Qantas is in a strong position despite the issues in the industry and today's announcement shows the amount of balance sheet flexibility they have.

MM wouldn’t be chasing QAN above $3 but we are confident the iconic airline will be running smoothly in a years’ time hence it will be an interesting stock if we see another test of the $2 area.

We like QAN if we see renewed weakness back towards $2.

Conversely Webjet (WEB) on the other hand remain stuck in a trading halt, now going for a 5th session as they struggle to complete a capital raise

QANTAS (QAN) Chart

Four stocks MM can see rallying ~50% from current levels – Part 2.

The recent global stock market sell-off has been both aggressive and largely indiscriminate in nature although debt has been the clear common denominator for underperformance. The sell-off in these stocks which are likely to require cash injections will in many cases be overdone by those companies who can raise funds relatively easily like QANTAS (QAN) and Cochlear (COH) but potentially underdone if a business fails to find willing parties to support them in these unprecedented tough times.

However it’s the mass selling of stocks that interests us the most at MM as quality businesses that look soundly positioned to thrive in the years ahead have been dragged lower by the tsunami of selling that’s cascaded through markets, this literal dumping of financial risk assets has often unfolded via the liquid futures market which leads to the arbitrage selling of stocks on a weighted basis where basically no consideration is made to the respective quality of the businesses in the sights of sellers = opportunity!! Hence we have scribed a Part 2 of yesterdays strongly requested note of stocks that might rally aggressively into 2021.

NB We have focused on oversold quality businesses as opposed to those who might surge if they can follow COH and QAN and raise money comfortably in today’s tough environment.

MSCI Global World Index Chart

1 Cochlear (COH) – $168.00

As we’ve touched on earlier Sydney based hearing implant business COH has raised $880m at $140 plus an additional $50 in a share purchase plan – if your going to raise $$ for the first time in 25-years make sure you do it properly! Only a few weeks ago COH had extremely low debt levels compared to earnings but it wasn’t trading particularly cheaply, that relative valuation is likely to improve nicely once the stock recommences trading after the placement at $140 – our best guess is it opens around $150, a 7% premium to the placement price.

COH now has cash on hand to continue its R&D to maintain its important competitive advantage while of course being able to look after that valuable asset staff.

MM likes COH below $150.

Cochlear (COH) Chart

2 REA Group (REA) $69.00

The vast majority of people have looked at realestate.com.au over the last few year although unfortunately in todays tough times for many its to see if their house has fallen in value. We all know that the housing market is grinding to a halt as open days and auctions are banned but we don’t believe 3-months of inactivity is reason to dump this stock almost 50%!

This is a stock that had cash on its balance sheet compared to debt only a few weeks ago but obviously zero income changes the landscape somewhat but this is a company MM believes will be leading from the front when COVID-19 becomes history. After all this pandemic is unlikely to affect Australia’s obsession with property, it may even strengthen it further as an asset class in these uncertain times.

MM likes REA into weakness.

REA Group (REA) Chart

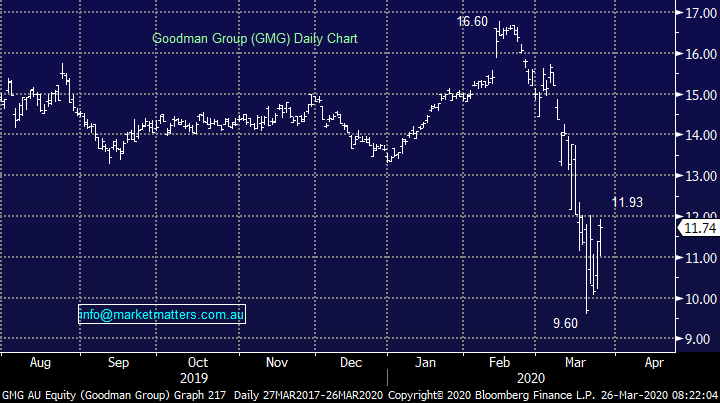

3 Goodman Group (GMG) $11.74

In February the Real Estate Sectors largest player Goodman Group (GMG) delivered for investors with its half yearly results increasing operating profit by over 14% to ~$530m which translated to an upgrade in FY2020 earnings estimates – a great example of a quality company repeatedly delivering. Unfortunately COVID-19 will now adversely impact FY2020 but they still illustrate GMG is a quality operation whose plunging share price has caught our eye.

“From a technical perspective we can still see fresh lows in 2020 BUT this would be a screaming buy in our opinion” – hence GMG is one for the radar as opposed to buy finger today.

MM likes GMG into fresh 2020 lows.

Goodman Group (GMG) Chart

4 Technology One (TNE) $7.11

TNE is an IT company that we haven’t talked about at length this year as we focussed our attention on the better known names like Xero (XRO) but this Brisbane based enterprise software company is excellently positioned for today’s environment. This $2.2bn company has quality re-occurring revenue with the vast majority of this coming from the likes of government and healthcare plus the big kicker the companies sitting on over$100m net cash when stocks are cheap.

MM likes TNE into weakness.

Technology One (TNE) Chart

Conclusion

MM likes COH below $150 and REA / & TNE into weakness plus GMG if we see fresh 2020 panic lows.

Overnight Market Matters Wrap

- The US equity markets continues to slowly win the economic battle against the coronavirus overnight, with the Dow & S&P 500 ending their session in positive territory following its stimulus plan.

- ‘Safe haven’ asset, gold lost 0.97% of its lustre to US$1,616.54/oz., while crude oil gained little however fears of an over supply remains with stockpiles seem to run out of storage space.

- The June SPI Futures is indicating the ASX 200 to rally 184 points higher this morning, testing the 5180 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.