Round 1: Retailers v Landlords (JBH, HVN, LOV, SCG, SGP)

Another solid performance by the ASX200 yesterday, the local market has now rallied 16% from Monday mornings low making it the best 3-days for the Australian market since the GFC, shame about the few weeks beforehand! Thursday’s advance was dominated by a number of stocks who enjoyed solid fund manager attention while decent selling was conspicuous by its absence leading to a pop of over +10% by 24 members of the index, clearly lots of love around in certain areas. It wasn’t a classic “risk on” session, more a case of a number of situations playing out but the market is clearly regaining some confidence.

The healthcare sector embraced the major appetite for the Cochlear (COH) capital raise sending the stock soaring 30% above the $140 placement price plus heavyweight CSL Ltd(CSL) surged over 6% after being a quasi-funding vehicle for the capital raise on Wednesday – so much for our hope to buy COH sub $150! The IT sector was also a standout for me rallying over 7% even while its US equivalent the NASDAQ fell 1% in the previous session.

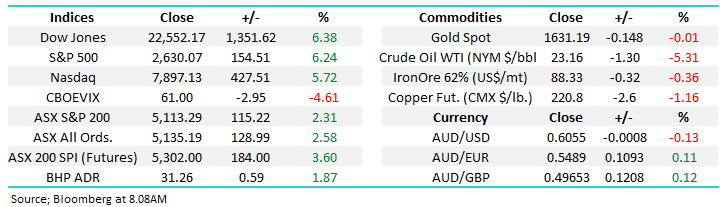

We picked this bounce at the start of the week but now we’re going to test 5300 this morning things feel a touch more 50-50 in the short-term but it does feel like we’re migrating back to a stock pickers market as opposed to a COVID-19 panic driven state of affairs. Time will tell but one of the most reliable market indicators for equities is how they react to news, last night the US announced a mammoth increase in jobless claims to 3.28 million, if stocks can continue to shrug off bad news it will be an excellent signal that we may have already seen a major coronavirus panic low.

US Initial Jobless Claims Chart

The chart below published by Tom McClellan this morning illustrates the Feds impact (stimulus) on stocks post the GFC hence remember the phrase “don’t fight the Fed” – we wrote a few days ago that MM can see equities back to new all-time highs in the next 1-2 years and assuming that central banks keep the taps turned on for the foreseeable future history tells us it’s not an unrealistic outlook hence MM believes subscribers should be in “buy mode”, not panicking out of stocks.

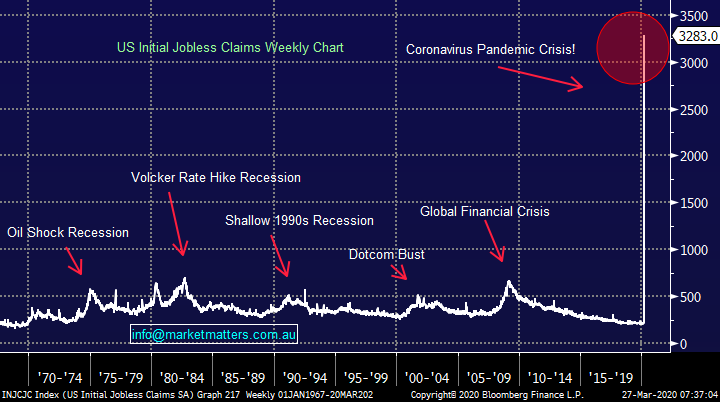

We love our stats at MM and the below table looks at the expected returns 1 year forward after different quantum’s of market drawdowns. For example, we’ve highlighted a 35% drawdown (as we’ve had) which has occurred 64 times since 1936 implying that each year, there is a 6.45% probability of such a move playing out. The average return over the next 12 months is ~20%. While the below stats paint a positive picture of the market bouncing back, it does take time.

One thing which caught my eye overnight as many countries go into lockdown was Sweden, home of climate activist Greta Thunberg who featured on a few You Tube episodes of Sailing La Vagabonde - an interesting channel if you’re into sailing / entertainment. Anyway, most of us regard the country as a very safe and clean place but they’re keeping schools, cafes & bars open while actually encouraging people to go out! It appears they are comfortable to lose a reasonable number of the old and sick, I wonder if they are following Trump or vice versa?

MM believes investors should be in “buy mode” but we wouldn’t chase strength above 5100 – just yet.

NB Technically we can still see another test lower which is easy to comprehend as the domestic and US COVID-19 news looks set to get far worse before it improves but the next pullback will be a great buying opportunity in our opinion whether the ASX200 reaches 4200, or only tests 5000, we believe it’s going to be the time to be fully exposed to stocks.

ASX200 Chart

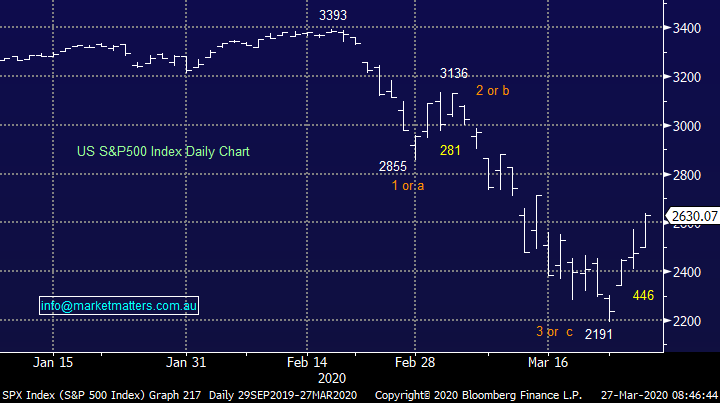

US stocks have roared back to life this week again largely as we had been expecting, the bounce so far is an impressive 20%. We have labelled the chart below to illustrate how we see the market unfolding in the coming weeks and months, there’s no change in our assessment from a risk / reward perspective as the surprises from COVID-19 appear to be largely behind us:

1 – We have already seen a major multi-year low which was certainly accompanied by enough panic and hysteria for this to be the case. If this scenario unfolds we are likely to see another test lower on another chapter of bad virus news which encounters unsatisfied buying before we commence a journey back to all-time highs – hard to comprehend but don’t underestimate the impact on asset prices of almost zero interest rates and huge stimulus washing through the system.

2 – This current bounce will run out of stream fairly soon and new 2020 lows will be plumbed in the coming weeks, this would represent an excellent buying opportunity in our opinion.

NB At this stage MM has a 60-40 preference for the first scenario BUT either way we’re buyers of the next pullback.

US S&P500 Index Chart

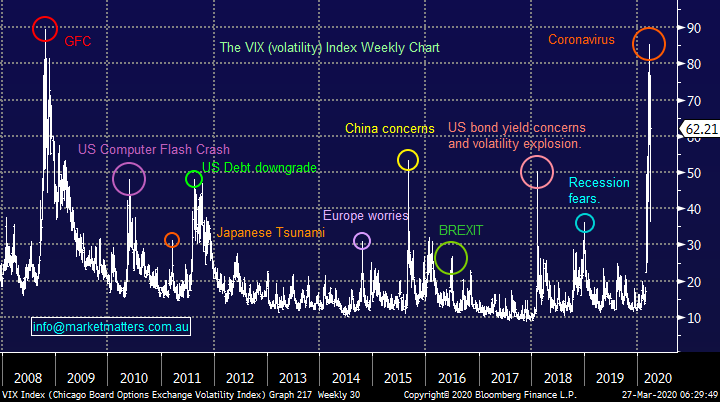

The Fear Index has almost perfectly copied the panic we saw by equities back in the GFC if we assume stocks continue to tread a similar path markets are set to see a steady decline in volatility through 2020 – just when many have become too scarred & / or scared to sell options and the like, now is the best time in the last few years to sell volatility.

MM believes the VIX has topped out for 2020 and things will slowly but surely stabilise.

Fear Index (VIX) Chart

As we mentioned yesterday the Australian Dollar has been a leading indicator for risk over the last few weeks, if this relationship which has been in play since COVID-19 has caused global hysteria remains in force we need to see the $A back above 65c before we get technical buy signals but in today’s volatile market that could be only days away.

The current position of the $A currently gives us no clear short-term signs for stocks.

Australian Dollar ($A) Chart

Do we like either Retail or Landlords as the battle commences?

Unfortunately, whether it be public hoarding, mass sackings or the lack of a clear message from the Australian government the coronavirus pandemic has not brought out the best “Digger Spirit” in our great country, here’s hoping. Yesterday Australian retail icon Solomon Lew moved aggressively against local landlords and unfortunately his staff implementing 2 painful, potentially illegal and confrontational steps which will take place at 6pm this evening:

1 – He has stood down 9000 staff from his stores e.g. Just Jeans, French Connection and Portman’s.

2 – He intends to stop paying his landlords rent - another win for the lawyers in time I expect.

This dramatic step has shaken many commercial and retail landlords to their core, even if he eventually gets forced to pay the rent it will be a long painful and expensive journey through the courts, as we said the lawyers will be cheering! I feel closing shopping centres in Australia will be inevitable, probably by the end of the weekend, foot traffic has already almost plunged to zero. The banks are being flexible in these times of need, will the countries major landlords?

Lew has a reputation as a strong adversary so we fear there will be no winners from this stoush, it’s easy to argue that Mr Lew is breaking his contract and is wrong BUT as the country is supposed to be pulling together on an almost war like footing shouldn’t the landlords be cutting the rent to help their customers? It’s a potential battle of public opinion v the law, our question today is whether its creating any good risk / reward opportunities?

ASX200 Retail & Real Estate Indices Chart

Retail Stocks.

The retail sector has been struggling as Australia moves towards a full lockdown but as investors we must look beyond the today and remember like China “we will be going back to work” in a few months’ time. While none of us know exactly when the more important question we need to ask is which stocks are best positioned to flourish post-COVID-19 and of course which of these are trading at attractive levels for the investor – especially as the consumer is likely to be strapped for cash for most / all of 2020.

Probably the most important point for MM is whether we have the awful coronavirus or not we believe a significant on-line footprint is a must for the years ahead, not having to be dependent on landlords is a clear positive for retailers’, we only have to consider the success of Amazon to acknowledge this.

Today I have looked at 3 prominent retailers to see if value is emerging in these uncertain times.

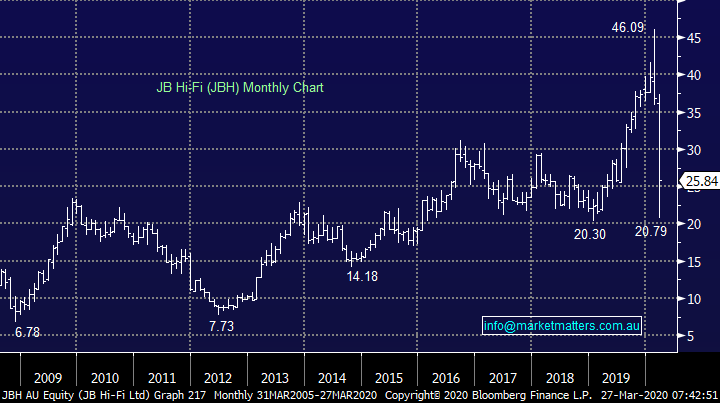

1 JB HIFI (JBH) $25.84

Music and electronic goods retailer have more than halved due to the virus and we believe things are overdone for this top quality retailer. While we acknowledge they technically sell discretionary items, I think their technology offerings in this day and age are becoming less discretionary and more non-discretionary, particularly in the current environment - simply I can see much of their inventory being regarded as a necessity by much of our population, especially as technology is continually evolving.

JBH shares are trading at more than a 40% valuation discount to the average of the last decade while the company was carrying little debt compared to earnings before things dried up, although the business does have an excellent on-line presence.

MM likes JBH into current weakness.

JB HIFI (JBH) Chart

2 Harvey Norman (HVN) $2.90

HVN has basically halved in a similar manner to JBH, retails clearly and understandably underperformed since the economy moved towards a full lockdown. This homewares and electrical goods retailer has a different product mix to JBH and one we feel will take longer to turnaround akin to an oil tanker as the consumer is likely to hold back on bigger ticket purchases for the home until both the countries and their personal finances have stabilised – I know that I will.

I was in Harvey Norman yesterday buying some tech and while this area was busy, the rest of the store certainly wasn’t (other than the chest freezer salesman up the back!)

MM prefers JBH to HVN.

Harvey Norman (HVN) Chart

3 Lovisa Holdings (LOV) $4.95

LOV is a $530m fashion jewellery retailer who was flying high before COVID-19, however supply out of China has been a struggle and now containment measure in Australia, New Zealand and South Africa have forced them to temporarily close stores. Yesterday they announced the deferral of their last dividend for 6 months while they also increased access to debt funding and extended the term for a further 3 years. These guys have a strong balance sheet and when things return to “normal” we believe the stock will again flourish, especially if they can get some rental relief.

MM likes LOV as a more aggressive play.

Lovisa Holdings (LOV) Chart

Real Estate stocks

The Real Estate Sector has grown to 6.4% of the ASX200 as a huge post GFC recovery has taken place but the sector is facing some clear headwinds at present from COVID-19 including the inability of tenants to pay rent while bond yields have also been rallying applying pressure in terms of funding.

Today I have considered 2 prominent real estate stocks, both of which is very affected by Mr Lew’s actions over the last 24-hours – we are cognisant that lows are often formed when things look the worst.

1 Scentre Group (SCG) $1.72

MM has been bearish shopping centre operator SCG for the last year which has clearly proved on the money at this point in time but after the recent plunge we have moved to a neutral stance, but it still doesn’t feel like the time to buy.

MM is now neutral on SCG.

Scentre Group (SCG) Chart

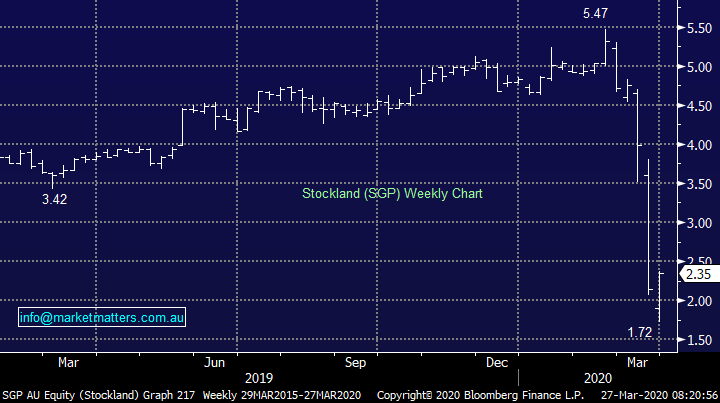

2 Stockland (SGP) $2.35

MM has a 3% exposure to SGP in our Income Portfolio which we are now reconsidering as / if the stock bounces – I question if the retail landscape of the future is going to see rents fall or at least fail to keep pace with inflation, you can only squeeze an orange so much.

38% of SGP’s earnings are exposed to retail which is under significant pressure.

MM is short term bullish on SGP, however we will likely sell into any strength above $3

Stockland (SGP) Chart

Conclusion

MM likes JBH & LOV in the retail sector

We are short term bullish on SGP, but would become a seller ~$3

We see no reason to increase exposure to those real-estate stocks exposed to the retail sector.

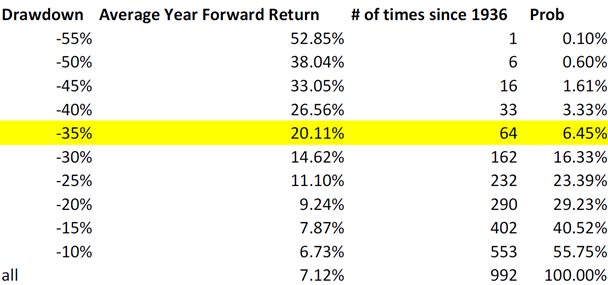

Overnight Market Matters Wrap

- The US equity markets ignored the 1,064% jump in weekly jobless claims and helped the S&P 500 to its best 3-day rally since 1933 as investors start to welcome stimulus packages coming through.

- The commodities side however was weak, with crude oil losing 5.31% overnight to US$23.16/bbl. as an oversupply concern remain amongst traders.

- The coronavirus toll continues to grow with total reported worldwide cases now reaching over the 500,000 mark.

- The June SPI Futures is indicating the ASX 200 to rally 221 points higher this morning, testing the 5335 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.