Overseas Note (on Thursday!) – International Equities & Global Macro ETF Portfolios (TCL, SBUX US, FB US, OOO)

The ASX200 kicked off April and Q2 of 2020 with a strong performance rallying +182-points / 3.6%, totally ignoring a weak US session on Tuesday night and further declines by the US S&P500 futures during our time zone, there’s no doubt individual indices, sectors and stocks are dancing their own jigs in these unprecedented times. Not only were US futures slipping lower all day, but the Japanese Nikkei tumbled -4.5% and Hong Kong -2%, it appears our government & the Australian people are getting the thumbs up for our current response to COVID-19, at least from a relative perspective.

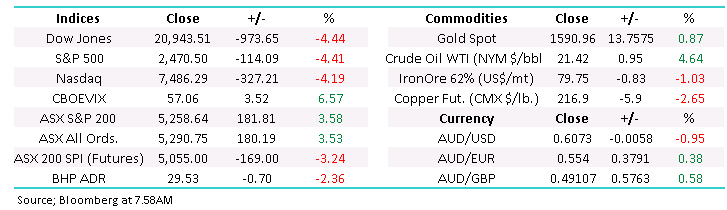

When I study the graphical illustration below the numbers suggest to me this may have some foundation, especially when we consider the vast majority of confirmed cases in Australia acquired their infections overseas i.e. our preventive precautions appear to be having a positive impact. Undoubtedly things are going to get much worse, but it appears we might “flatten the curve” to enable the health system to have its greatest impact. The statistics suggest the 20-30-year old’s who are the largest portion of the infected need to get on board and we can beat this invisible enemy.

Most people I know are now following the governments guidelines including working from home and keeping kids out of school – it’s certainly a harder approach on a day to day basis however seems to be working - my “Gut Feel” is we aren’t going to follow the disastrous social path of Italy and Spain, I certainly prey that’s the case let’s all take a deep breath, suck it up and make a big difference! South Korea who has a population of double ourselves have kept their number of confirmed cases under 10,000, arguably we had a few weeks more to prepare plus the clear paths to fail or succeed had been clearly mapped out - I’m quietly optimistic on that front, although its worth acknowledging that the post lockdown divorce rate in China has soared 25%!!

Moving onto business and stocks, the economic impact of this pandemic is clearly going to be immense on individuals, companies and the government alike, predicting what comes next moving through 2020 and beyond is an equation with a lot of moving parts. Our job at MM is to evaluate the equity market and its individual members to evaluate the areas where we want to invest for optimum returns in the years ahead, at this stage we believe the risk / reward favours being buyers into weakness, even yesterday when the index finished up 182-points there were 3 intra-day corrections of around 100-points illustrating perfectly there are still plenty of “nervous nellies” around.

MM is in ‘buy mode” looking to accumulate stocks and risk assts into the current market volatility.

Confirmed cases of COVID-19 in Australia & South Korea Chart

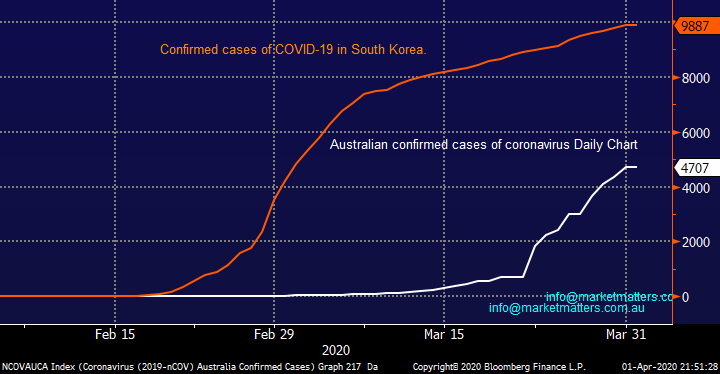

The short-term picture we painted yesterday hasn’t changed in the last 24-hours, a definite rarity through March! Our preferred scenario following the recent 1000-point bounce from last Monday is we see a few days consolidation, normally after that size of rally it would be weeks, but things are happening much faster in 2020. We feel that on balance global equities have likely seen their low, while it’s a fluid situation and we need to be measured in our approach, a lot of panic was being priced in at 4400.

Ideally, we will see a 4-5% pullback from yesterdays close before stocks move higher.

ASX200 June SPI Futures 60-mins Chart

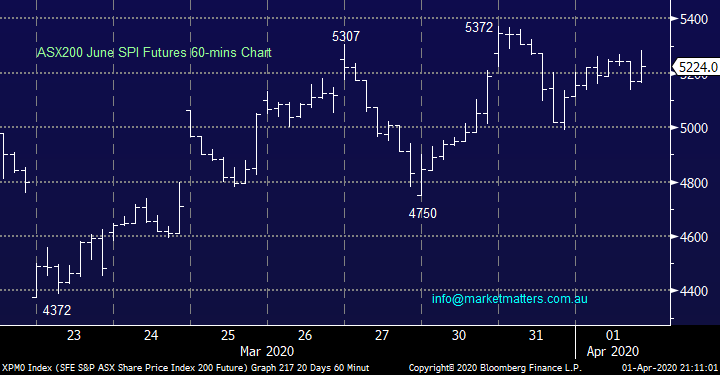

In our Weekend Report published on Sunday 22nd of March, the day before the major 4402 low, we wrote:

“MM still believes the ASX200 will bounce towards 5500 sooner rather than later, for the sceptic that’s only a 30% correction of the last few weeks decline.”

We now feel the ASX200 has provided what MM felt was the “easy money” for the buyers and chasing strength now feels a dangerous course of action e.g. overnight the Dow has closed down almost 1000-points and the SPI futures are implying the local index will open down around 200-points.

ASX200 Chart

“Quality” Capital Raisings & Downgrades are being bought

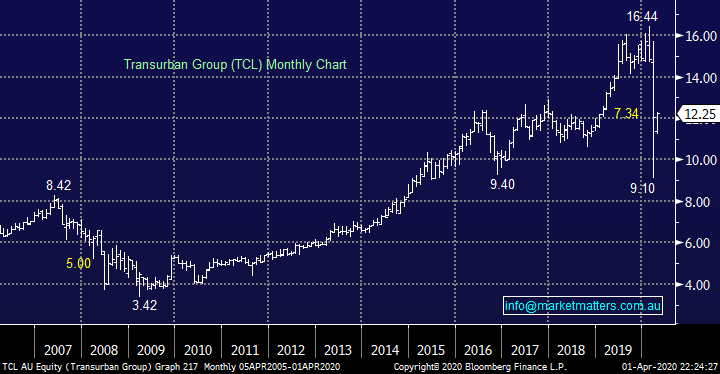

Yesterday we saw Transurban (TCL) withdraw its earnings guidance while pulling back expectations on the dividend front, these will now be paid in line with free cash flow, not from reserves – no real surprise in my opinion but the stock initially fell 6% before seeing sense and gradually erasing all of the losses to close up +1.7% on the day. Across its book, the 4th week of March saw a 36% hit to traffic for TCL, and 14% down for the month of March against last year.

Importantly despite the hit to cash flow, Transurban says it has enough flexibility in the balance sheet to meet its requirements for the next 15-months and continues to push on with the West Gate tunnel project, covering themselves through FY21. Despite all of the negativity, these issues will pass, and traffic will return. TCL is down around 25% from its highs and it’s a stock squarely on our radar.

MM believes TCL is a quality company that will be well positioned in 2021 and beyond.

TCL was another example of a quality stock being bought following a degree of bad news, yesterday Cochlear (COH) closed almost 40% above its recent capital raise i.e. there’s plenty of money on the sidelines looking for solid businesses that offer news driven opportune entry levels. A reminder for COH shareholders, the retail offer is now open with shareholders able to bid for up to $30,000 worth of new shares at $140

Transurban (TCL) Chart

Overseas markets

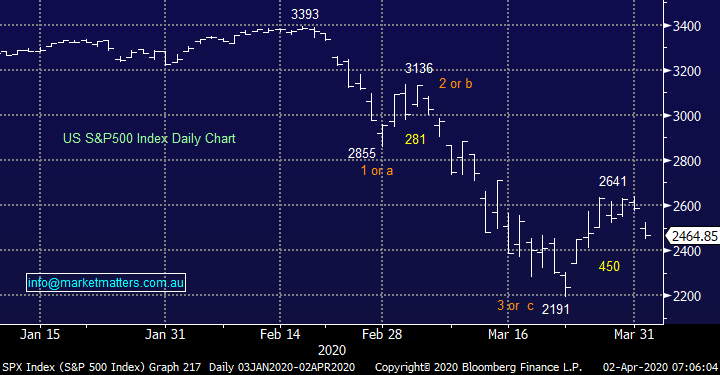

Overnight US stocks tumbled ~1000-points, they have already given up almost 40% of their aggressive bounce from last week’s lows compared to the ASX200 which is closer to half of this. It appears unfortunately that the US is following Italy’s path in regard to COVID-19 with the number of confirmed cases soaring through 200,000 hence the relative indexes performance makes sense but we mustn’t become too blinkered and assume that local stocks will always ignore bad days on Wall Street.

MM believes the US remains way behind the curve on virtually all fronts with COVID-19 and President Trumps optimistic rhetoric looks more like a pipedream by the day.

After the last couple of days pullback MM now sees reason to slowly increase exposure to some global & US equities.

US S&P500 Index Chart

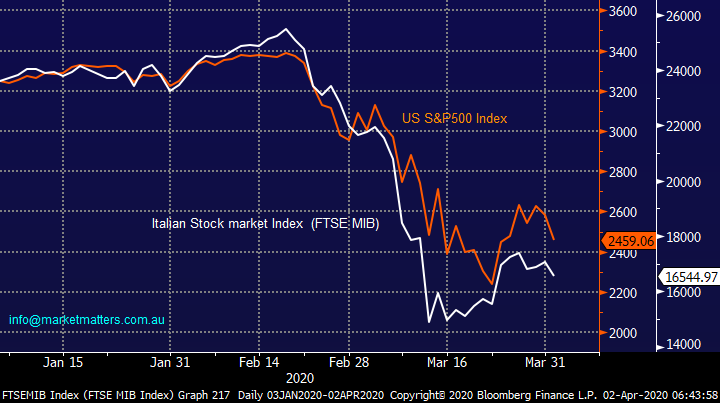

Below is an illustration of both the US and Italian indices showing the European Index bottoming (so far) well before its American peer. Italian stocks bottomed on the 16th of March again showing that markets look ahead, not in the current state of play, but their recovery has been muted which is understandable as the country reels under the impact of COVID-19.

MM continues to feel the market is in a “choppy phase” hence we like the concept of fading aggressive market moves. This view was reflected by our actions earlier in the week when MM trimmed our net market exposure into strength, conversely buying on aggressive down legs appears the prudent course of action to add value / alpha to portfolios.

US S&P500 and Italian FTSE MIB Indices Chart

MM International Equities Portfolio

MM currently holds 18% cash in our International Portfolio and are still “looking to go shopping” into the general market weakness in equities: CLICK HERE

It’s very important for us to consider how consumers will change post-COVID-19 a degree of which will undoubtedly be determined by the manner in which we evolve from the current crisis e.g. Cruise liners look unlikely to recover anytime soon while a number of technology businesses should prove resilient in the new economy. We do not believe this is a time to be a hero, keeping things simple by buying companies with solid balance sheets who look well positioned moving forward is our favoured way to go:

MM has 4 stocks we are strongly considering buying in the next few days as we feel value again presents itself to investors but note our concern for how the US is dealing with COVID-19 will refrain us from adopting an “all-in” approach:

1 - LVMH Moet Hennessey (MC FP): Louis Vuitton has a solid balance sheet and strong exposure to China which is already “going back to work”. MM continues to like this quality retailer that’s trading ~30% below its January high, we are considering increasing our exposure from 4 to 6%.

2 – Visa (V US) : Visa is another company enjoying a strong financial position which should enable it to whether the current economic downturn, MM continues to like this quality retailer that’s also trading ~30% below its January high, similarly we are considering increasing our exposure from 5 to 6%.

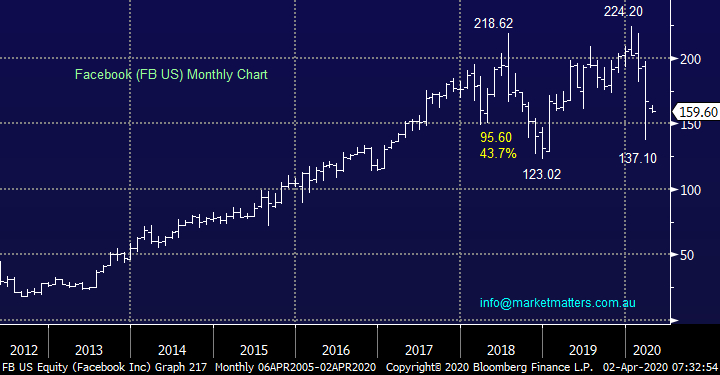

3 – Facebook (FB US): Facebook has experienced an enormous increase in traffic through the virus outbreak although revenue hasn’t yet followed suit. We like this social media giant ~30% below its January high.

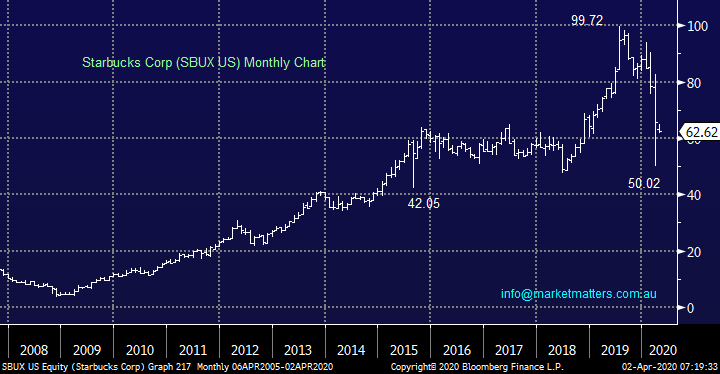

4 – Starbucks (SBUX US): this Seattle based coffee household name is undoubtedly going to struggle short-term but we believe it’s well positioned to recover in 2021, again we like the stock 30% below its 2019 high.

MM is looking to slowly deploy our 18% cash position into further weakness.

Starbucks (SBUX US) Chart

Facebook (FB US) Chart

MM Global Macro ETF Portfolio

MM’s cash position remains at a very healthy 39% in our Global Macro ETF Portfolio as we sit poised to act into the current market volatility: CLICK HERE

Similarly to the International Portfolio patience has paid off with this portfolio reasonably well, MM have 3 “tweaked” plays in our sights as we continually asses how we see financial markets evolving post COVID-19, undoubtedly a very fluid situation at present:

1 – increasing our position in the Invesco DB Agricultural Fund (DBA US) from 6% to 10%.

2 – Buy Invesco Bearish $US Index ETF (UDN US), we are looking for at least a 15% appreciation in this ETF.

3 – Buy the BetaShares crude oil ETF (OOO) around current levels for the underlying commodity.

We are also assessing ways to best ‘sell volatility’ via a global ETF, more to come on this soon.

BetaShares Crude Oil ETF (OOO) Chart

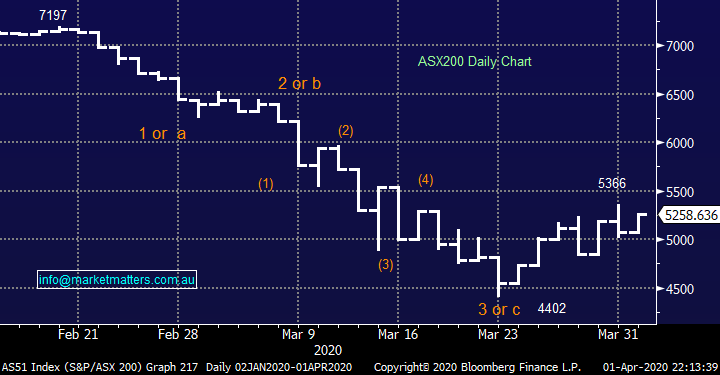

Overnight Market Matters Wrap

- A rocky start to Q2 in the US overnight with all indices down more than 4%

- The estimated number of deaths in the US from the Coronavirus had investors lightening their risk positions as the domino effect on the economy is assumed larger.

- The financials were hit hard on speculation that they will follow suit of HSBC’s and Standard Chartered’ s cancellation in dividend payouts. A similar scenario playing out locally with analyst’s forecasting a decline of 24% in Bank of Queensland (BOQ) and a fall of 18% in Fortescue Metals (FMG). Bloomberg

- Crude oil gained overnight, while Dr. Copper continues to slide with BHP expected to underperform the broader market after ending its US session off an equivalent of -2.36% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to lose most of yesterday’s gain and open 170 points lower towards the 5085 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.