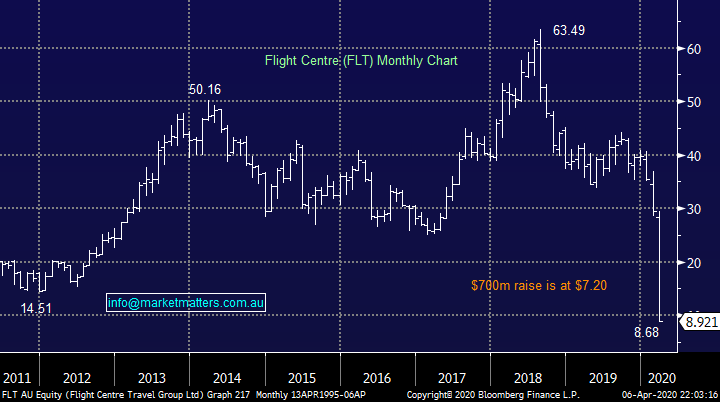

From Capital Raisings to potential switches, it’s all happening! (FLT, REH, SXL, AIA, SYD, SGM, RHC, WSA, JBH, CGC)

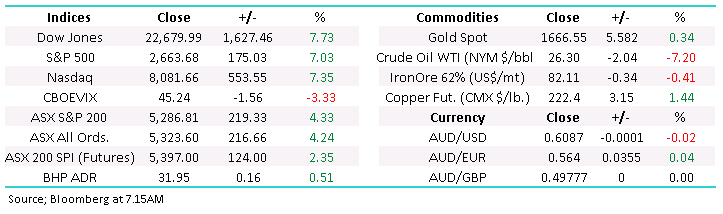

Local equities have kicked off this week with a huge bang, rallying +219-points / 4.3% making a fresh 3-week high in the process, while we’re not out of the woods by any means things certainly felt significantly better yesterday at 4pm when compared to last Friday. Buying was broad based with almost 90% of the ASX200 closing in the green while 15 stocks rallied by over +10% compared to zero falling by the same margin. On the sector front Energy stood on top of the podium but from a points perspective the Banks, heavyweight Resources & Healthcare stocks dominated the gains, it’s starting to feel like buyers are suffering from FOMO (Fear of missing out) as they consider the bargains which were on offer in late March – yesterday we closed exactly 20% above the low formed less than 2-weeks ago.

The news on the COVID-19 front was encouraging both over the weekend and throughout our day session driving up the ASX and global markets – Japan +4.2%, Hong Kong +2.2% and US futures over +3.5%:

1 – While the reported number of coronavirus cases locally edges towards 6,000 we recorded our lowest daily increase in new cases since the outbreak started in Australia, claims are already starting to gather momentum that we’ve flattened the curve – I would say we’re winning the game but we’ve only just entered the 3rd quarter.

2 – Over the weekend major European trouble spots Italy, Spain and France all reported a decline in COVID-19 death rates, as did US hotspot New York.

3 – Highly respected Bill Gates said “the virus death toll may not reach experts worst case scenario” if correct social distancing is adhered to.

What a difference a weekend makes when it comes to news flow, last night the headline in the Daily Mail was “What the end of lockdown will look like when Australia starts to gradually lift the coronavirus restrictions” – recently we’ve seen some huge swings in both pessimism and optimism around the coronavirus which has of course translated to “Fear & Greed” when it comes to stocks.

MM continues to believe the ASX has found or is looking for a major low.

ASX200 Index Chart

Yesterday we saw a crescendo of action on the capital raising front with the underlying theme being solid buying was emerging at the correct price - Flight Centre (FLT) has raised $700m at a 27.3% discount to its last trade plus $200m in extra debt, Reece Ltd (REH) raised $600m at a 12.5% discount to its last closing price, Southern Cross Media (SWM) raised $169m at a 17% discount and in NZ Auckland International Airport (AIA) raised $NZ1.2Bn at only a 7% discount to Fridays close. Also, Oil Search (OSH) is now looking for around $1bn which should give another indication of the markets appetite for discounted Australian stocks.

Remember MM has been banging the drum of “when the number of capital raisings surges the market is close / at a low” – that feels like now and the last 24-hours aggressive buying supports this view. Of the 4 finalised deals above a huge $2.7bn was raised with an average discount for the placement of less than 16%, not bear market numbers – I feel that fund managers who have been sitting on cash expecting more capital raisings at deeper discounts are suddenly feeling unsatisfied and too cashed up.

Remember only a few months ago MM was warning investors that company buybacks were driving both share prices and respective valuations up to unsustainable levels. While we never anticipated the severe decline which COVID-19 created we did feel that directors were chasing stocks too hard and wouldn’t be flexible enough to buy weakness when it ultimately eventuated, ironically we’ve now gone 360 degrees with some boards being forced to raise capital after their stocks have plunged significantly lower.

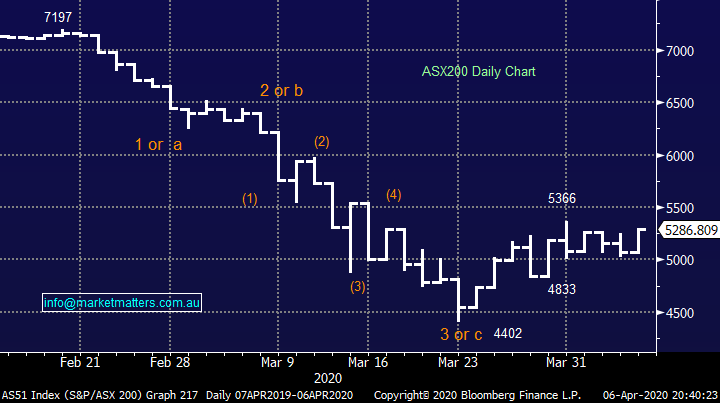

To put things in perspective almost 10% of companies in the US S&P500 have suspended buybacks just when their stocks have become relatively cheap, that already represents a quarter of last year’s buybacks, or more than $A300bn. A huge tailwind has at least been temporarily removed from US stocks although my “Gut Feel” tells me in around 6-months after equities have bounced say another 20% some will again start buying.

US S&P500 Index Chart

Yesterday we wrote: We have 2 scenarios evolving for US stocks, we’ve used the small cap Russell 2000 chart below to illustrate both:

1 – US stocks decline another ~10% to fresh 2020 lows providing an excellent buying opportunity.

2 – Last week’s consolidation of the recent bounce will create a platform for stocks to extend their 10-day recovery. In the case of the Russell 2000 a close above Fridays high will generate an excellent risk / reward buying opportunity i.e. just 3% higher.”

Overnight US stocks have surged higher triggering number 2 above hence generating an excellent risk / reward buy signals at least for a further 8-10% upside.

MM is bullish US stocks with an initial upside target 8-10% higher.

US Russell 2000 Index Chart

1 Does MM have interest in the 4 capital raisings mentioned above?

As we touched on earlier the market has been set alight by successful capital raisings in recent days, below I have quickly looked at the 4 which appear to have been finalised as we question whether it presents a buying opportunity.

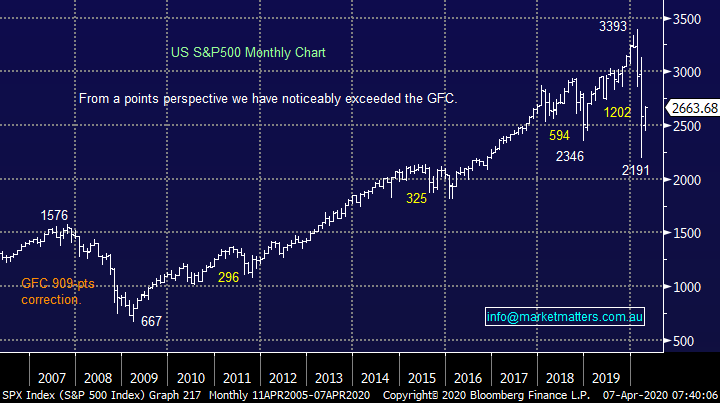

1 Flight Centre (FLT) $8.92.

Flight Centre (FLT) has finally completed a $700m equity raise at $7.20, a 27.3% discount to its last trade and a 16.3% discount to its theoretical diluted price, plus they’ve tacked on an additional $200m debt raise. It’s taken the struggling travel agent a fortnight to finalise the raise which MM feels shows a combination of its average / poor quality plus improving underlying market sentiment which enabled them to finally get something done – remember Cochlear (COHJ) took just a few hours.

The business has committed to close more than 50% of its global leisure shops in an effort to reduce its annualised operating expenses by ~$1.9bn but the obvious question is what will be the impact on the business. The company has seen revenue fall by 70-80% in these troubled times which is understandable and we can see a pop higher when things improve on the virus front but we want to see the business operate in its new form for at least a few months before considering the stock for our portfolios.

MM has no interest in FLT at this stage.

Flight Centre (FLT) Chart

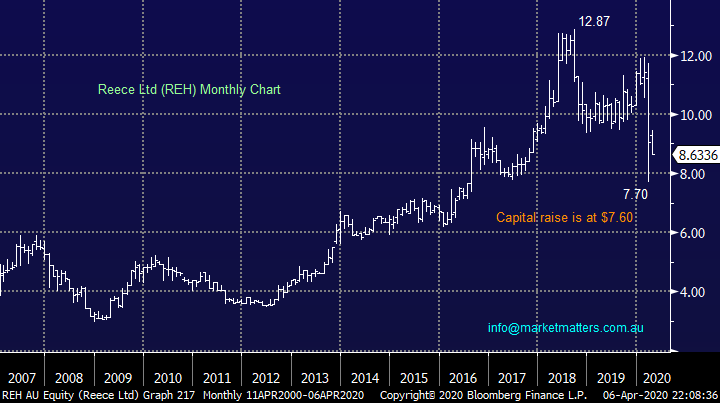

2 Reece Ltd (REH) $8.63.

Plumbing and bathroom business REH have raised $600m to strengthen its balance sheet after a strong March quarter, the Wilson family (family owners & operators) took up $170m of the offer, an strong vote of confidence in our opinion. This is a quality business which we like after its 30% pullback.

MM likes REH at current levels.

Reece Ltd (REH) Chart

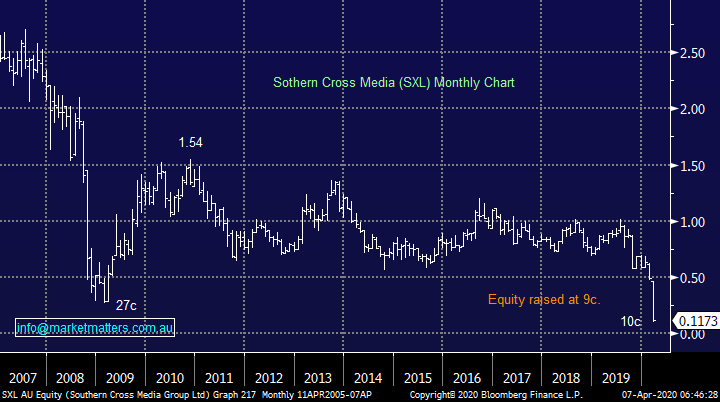

3 Southern Cross Media (SXL) 11.73c

Southern Cross Media (SXL) has raised $169m at a 17% discount to its last traded price. The radiobroadcaster has raised the money in an attempt to survive COVID-19, they are reducing debt and suspending 2020 and 2021 dividends, plus implementing pay and bonus cuts. This is not an investment grade business to MM but it may bounce for the traders.

MM has no interest in SXL.

Southern Cross Media (SXL) Chart

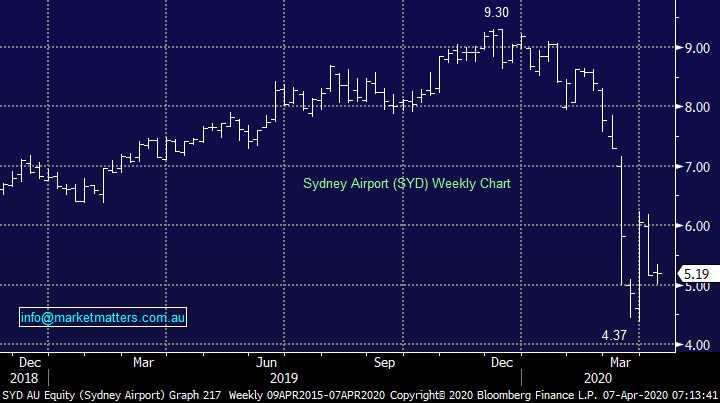

4 Auckland International Airport (ASX AIA) $4.87.

AIA has raised $NZ1.2bn at a 7% discount to its last price which is still almost 50% below its 2019 high. The board have cancelled dividends until 2022 and put on hold ~$2bn worth of projects plus they are implementing executive pay cuts as they aim to reduce operating costs this year by 35%.

This raise yesterday appeared to suck some buying from Sydney Airports (SYD) which struggled to close positive when markets were surging. Credit Suisse sees SYD suffering a similar fate as AIA with no dividends this year and only 17.5c in 2021 as international numbers look set to fall by ~70% - clearly 2 companies that will benefit from a quick economic pick-up post COVID-19.

MM prefers TCL over SYD and AIA.

Auckland International Airport (ASX AIA) Chart

Sydney Airport (SYD) Chart

Conclusion :

Of the 4 capital raisings confirmed yesterday REH is MM’s clear favourite.

2 & ½ Switches MM are considering

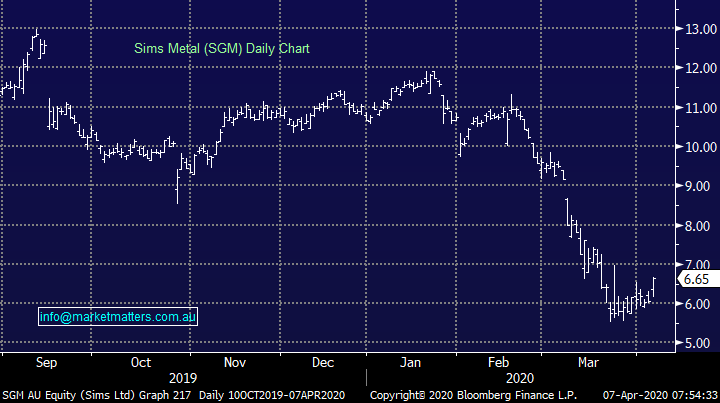

Over the last few weeks we feel MM has improved the quality of our portfolios and the next 24-48 hours looks set to offer more opportunities on this front as the aggressive relief rally courtesy of improvements in the coronavirus data has led to outperformance by some stocks that were being priced to fail, or for potential deep discounted capital raisings e.g. on Monday Sims Metals (SGM) rallied almost 10%.

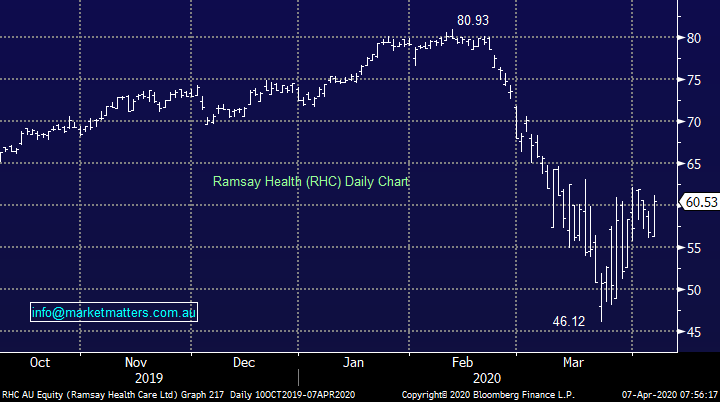

1 Sims Metals (SGM) to Ramsay Healthcare (RHC)

Definitely not a like for like switch but in our opinion an ideal time to switch to the far higher quality Ramsay Healthcare (RHC) which we have discussed a number of times over recent weeks.

MM is considering switching SGM to RHC.

Sims Metals (SGM) Chart

Ramsay Healthcare (RHC) Chart

2 Western Areas (WSA) to JBH Hi-Fi (JBH)

Another switch that is not like for like but it’s up the quality curve which has been lauded by MM over recent weeks. WSA has managed to bounce over23% recently even while the nickel price struggles whereas JBH has recovered further, a relative performance which we believe is likely to continue. We are fans of JBH as subscribers know and the improvement of the COVID-19 numbers should support retail medium-term.

MM is considering switching from WSA to JBH.

Western Areas (WSA) Chart

JB Hi-Fi (JBH) Chart

3 Costa Group (CGC) to Reece (REH)

Fruit and vegetable grower CGC has endured an extremely tough 18-months but in 2020 its actually up 15%, from a pure money management perspective MM is considering switching part of our holding in CGC to REH.

MM is considering switching part of our CGC position to REH.

Costa Group (CGC) Chart

Conclusion:

MM is looking to switch from WSA / SGM / CGC to JBH / RHC / REH as we focus on improving the net quality of the MM Growth Portfolio.

NB Just because the numbers are improving for COVID-19 doesn’t mean an economic turnaround will be instantaneous, some lower quality companies are likely to recover slowly and after a relief “bounce” the market will want some convincing that all is ok under the hood.

Overnight Market Matters Wrap

- US Markets rallied to start the month and second quarter of 2020 following reported death tolls in some of the most hard-hit coronavirus areas. It is projected however, the US is yet to hit its peak death toll.

- On the commodities front, crude oil fell following the reported shortage in storage capacity, while Dr. Copper gained 1.44% however global growth signs are still on the downside at present.

- BHP is expected to outperform the broader market after ending its US session by an equivalent of 0.51% from Australia’s previous close.

- This afternoon at 2.30PM the RBA meets with a 56% chance of a rate cut, according to Bloomberg – this has increased from 48% a week ago!

- The June SPI Futures is indicating the ASX 200 to gain 136 points higher this morning, towards the 5425 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.