Is now the time for Iron Ore, Oil, Copper or Gold? (WBC, OSH, OZL)

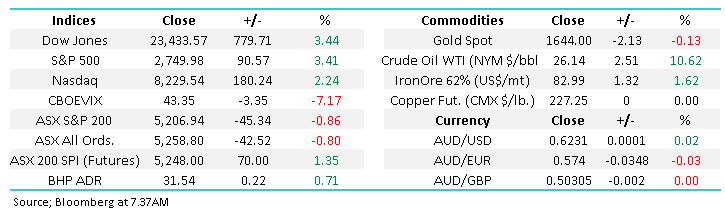

The ASX200 tried to rally yesterday after finding itself down 130-points before 10.30am, solid broad based buying dragged the market higher throughout the day and we were actually up +70-points with an hour to go but alas some decent late sell orders were enough to leave us down 45-points come the closing bell – its very hard for the Australian market to rally when the “Big 4 Banks’ fall on average -4.6%, remember they still make up a whopping 20% of the ASX200.

We discussed the banks in yesterday’s Income Report but just when the country needs them to do the right thing for us to struggle through and then recover from the COVID-19 recession they received a Fitch downgrade which coupled with APRA continually telling them how to operate put renewed pressure on the sector; I’m not convinced APRA should be quite so instrumental in telling our privately owned banking sector what dividends they should or shouldn’t be paying. The below sentence was the core of yesterday’s Income Report:

“APRA are going to intervene in the level of dividends paid by the banks, and it seems to MM from yesterday’s rhetoric, they’ll err on the side of caution, which means substantially lower dividends for investors, most likely this year and next. This is not going to be a total shock to the market with dividend estimates already having been revised down”.

Yesterday the Bank of Queensland (BOQ) followed APRA’s “suggestion” and deferred its dividend, a lot of Australian investors rely on income from bank dividends to meet their daily needs, potentially we might be about to see a mass retail bail out of a sector, just when the medium-term valuations are arguably becoming compelling. MM reduced its Westpac (WBC) holding at the end of March above $17, while CBA remains our no 1 pick in the sector. For those not exposed to the sector, we see a strong risk/reward buy if the sector falls another ~10% to fresh 2020 lows.

MM likes the Australian “Big 4 Banks” into fresh 2020 lows.

Westpac Bank (WBC) Chart

From an index perspective if it wasn’t for the major headwind from the banks the ASX200 would more than likely be well above the psychological 5500 area but their current position adds weight to our view that the local index is poised to rotate between 4950 & 5450 for a few weeks – tweaked 50-points lower due to the “heavy” banking sector. Australia appears to be “flattening the COVID-19 curve” which if it can be maintained over Easter & for a few more weeks feels likely to see a potential return to normality sooner than many were predicting just a few weeks ago.

MM continues to believe the ASX has found or is looking for a major low.

ASX200 Index Chart

Yesterday morning we heard that Oil Search (OSH) had managed to comfortably raise $1.16bn, the discount was a theoretical 18% to its last trade which again illustrated market appetite for stock at a discounted price. The local market has already seen 8 capital raisings this month (it’s only the 8th) for ~$4bn, when the dust settles we’re going to need a “V-shaped recovery” in these particular businesses to produce exciting returns because dividends are likely to be off the table until at least 2021, we caution that a large discount doesn’t always represent a long-term bargain.

We remain comfortable to be moving the MM Portfolios up the quality curve as the post COVID-19 economic uncertainty arguably matches the previous humanitarian ones.

Oil Search (OSH) Chart

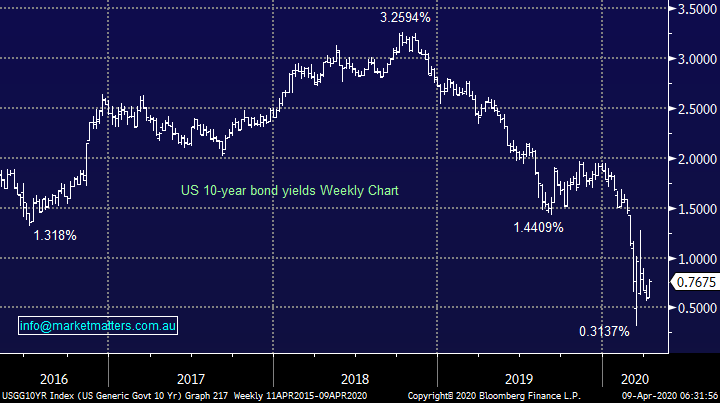

Overseas Market Snapshot

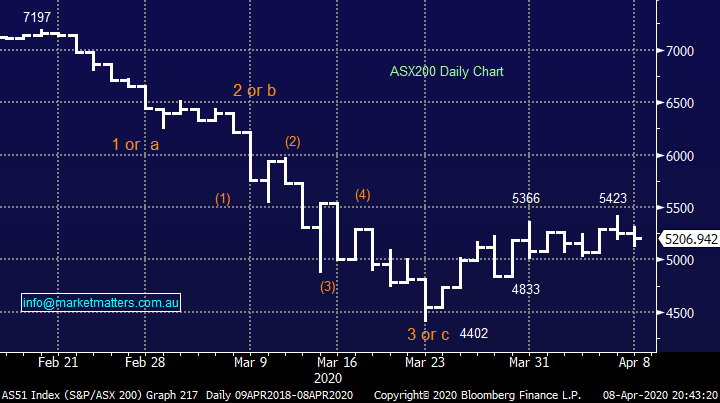

Overnight US stocks enjoyed a solid session with the S&P500 rallying +3.4% with all 11 sectors closing up on the day. Impressively US stocks have now regained 46% of their COVID-19 losses compared to only 28% by the ASX200 again illustrating the importance of our Banking Sector to the underlying index. Unfortunately again this morning the SPI futures are only pointing to a 1.3% initial gain from local stocks, still well under where the ASX was trading at 3pm on Wednesday – again it looks to be a case of “we don’t go up without the banks”.

MM remains buyers of weakness in US stocks but were now 50-50 at current levels.

US S&P500 Index Chart

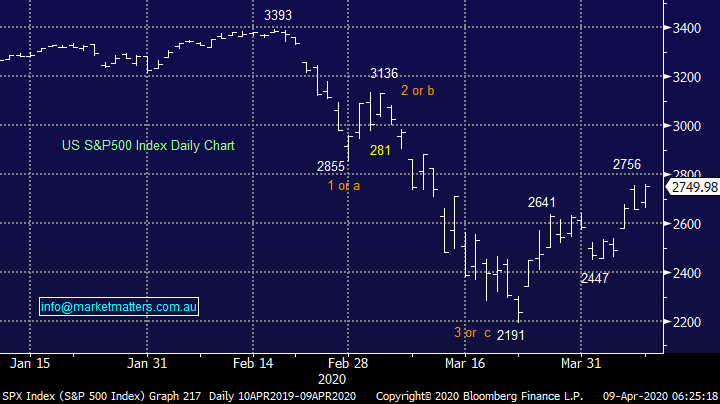

We haven’t mentioned bond yields for a while mainly because they’ve gone pretty quiet as Central Banks (CB) crush short-term interest rates. When we look through COVID-19 MM believes the global economy will experience major reflation as recent enormous stimulus rolls through the respective countries, people just need to regain confidence around their day to day safety. In our opinion CB’s throughout the world would be delighted to see some inflation post the pandemic but once the juggernaut starts rolling it can be extremely hard to slow down without interest rate increases hence we feel bonds are topping, intertest rates bottoming.

MM believes bond yields are ending their multi-year Bear Market.

US 10-year Bond Yields Chart

Australian 3-year Bond Yields Chart

Does MM prefer iron ore, crude oil, copper or gold?

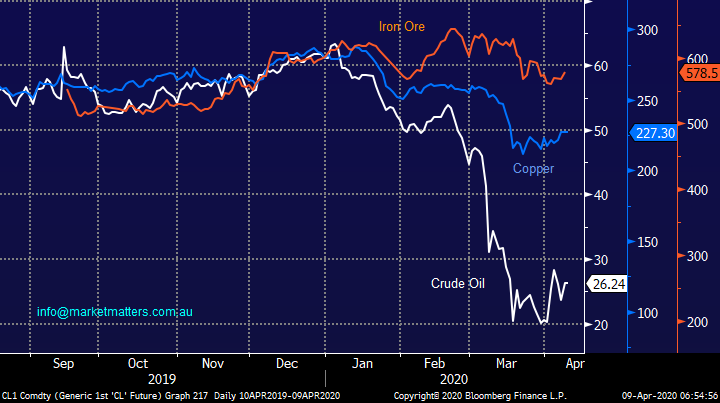

Due to the ongoing bickering between global oil producers we have an enormous divergence between the commodities which usually paint an excellent picture of the health of the world’s economy.

1 – Iron Ore is only a few percent below where it started this year which has aided the major outperformance from the likes of Fortescue Metals (FMG), iron ore should remain buoyant while China’s knocking out steel but it’s not “cheap”.

2 – After a small bounce copper is now 18% below its 2020 starting point putting it somewhere in between iron ore & crude oil, in our opinion this is the truer reflection of global economic strength.

3 – Crude Oil remains 60% below its 2020 high and remains pressured on both the supply and demand fronts, however MM believes a major low is in place for this commodity and sector although we must be cognisant that the oil stocks could easily get ahead of any price recovery.

From a risk / reward perspective MM likes copper, crude oil and then iron ore.

However, our reflation outlook is supportive of all 3 and iron ore certainly is enjoying strong current momentum with China returning to work hence it’s important to note we are not calling iron ore as a sell.

Crude Oil, Iron Ore & Copper Chart

Gold had been a pretty good proxy for US Bonds until March when things went a little haywire. The correlation over recent years was very logical as bonds rallied, rates fell making gold more attractive. Over the weeks / months ahead we can see gold trading between $US1550 and $US1750/oz.

At this stage we are comfortable holding stocks like OZ Minerals which is predominantly a copper stock that also produces gold, but we see no reason to own pure gold plays at this point in time.

MM has a positive bias for gold.

Gold v US 10-year Notes Chart

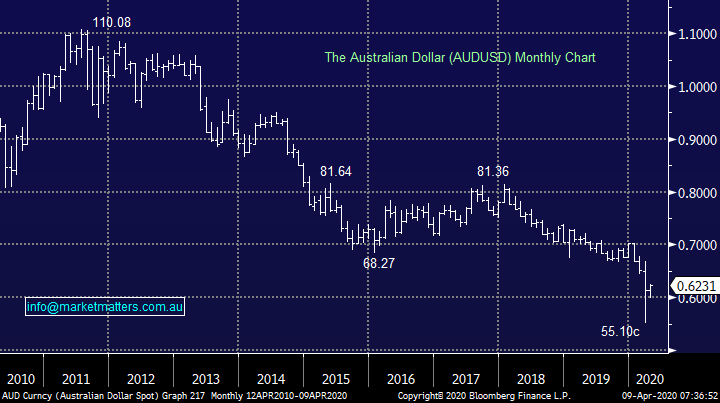

The $A has now bounced 13% from last month’s low showing that appetite for risk assets is gaining momentum. In the medium-term our bullish outlook for the $A implies strength in the resources but potential underperformance from the in vogue $US earners – I imagine a solid close above 70c would be needed to see a potential partial exodus from this multi-year strong group of stocks.

MM is bullish the $A and we still have an 80c target.

The Australian Dollar ($A) Chart

The US Metals & Mining Index has outperformed the broad index since equities started recovering from their mid-March low, we are bullish the index eventually targeting a break of its 2018 high – this coincides with our reflation view.

MM is bullish global miners moving forward.

US S&P500 Metals & Miners Index Chart

MM’s favourite Resources stocks

I’m sorry for the apparent lack of imagination here but from a risk / reward perspective MM likes the larger, higher quality end of town – BHP Group (BHP), RIO Tinto (RIO), OZ Minerals (OZL) Santos (STO) and Beach Petroleum (BPT), all 5 of which currently reside in our Growth Portfolio.

MM will consider increasing these holdings into any pullback this month.

OZ Minerals (OZL) Chart

Conclusion:

MM remains bullish the resources in line with our reflation call.

From today levels our preference in order from a commodity perspective is for Crude Oil, Copper, Iron Ore and then Gold.

Overnight Market Matters Wrap

- The US equity markets rallied overnight, as investors bet on another round of stimulus.

- Crude oil shot up over 10% as traders now believe the expected production cut to be announced after the Emergency OPEC meet tonight will be enough to curb the current shortage of storage – a big shift of change in less than a week!

- Across in the Euro region, the sea of red dominated as France’s first quarter output decreased the most since World War II.

- The June SPI Futures is indicating the ASX 200 to gain 67 points higher, towards the 5275 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.