NAB takes hit ahead of reporting (NAB, S32)

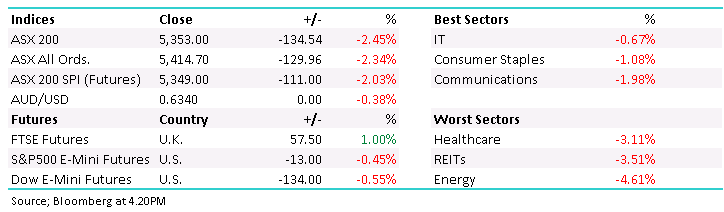

WHAT MATTERED TODAY

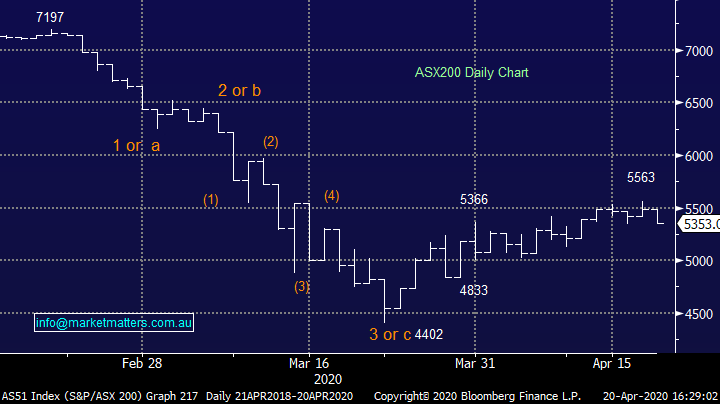

A soft start the week as the market opened down and tracked lower throughout the day. A few attempts to rally were overcome with sellers and the index finally finished on the lows. The weakness is not that surprising given the move we’ve seen from the 4400 level to peak recently at 5563 – we’re expecting some weakness to creep in short term and today could have been the start of it. That said, we remain of the view that the low has been seen and any weakness will not be an escalation of the panic like selling we saw in March i.e. markets pullback, however volatility index makes lower high, bond yields fail to makes news lows etc.

Energy the weakest link today as Crude came under pressure during our time zone. The May contract which expires on Thursday was down around 19% today, June was down around 6% as many speculators roll out a month i.e. sell May and buy June. Only those that want to take physical delivery will hold to expiry. IT was at the other end of the spectrum down only 0.67% in a weak market.

Today the ASX 200 fell -134pts /-2.45% to close at 5353 - Dow Futures are trading down -134pts/-0.55%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

NAB -2.38%: it was NAB’s turn today to confess ahead of reporting season. The bank increased remediation provisions for the half to $288m pre-tax while changes to software capitalization will have a $742m impact on earnings and the carry value of the investment in MLC Life will be reduced by 20% for a $214m hit to after tax earnings. The confession was largely expected by the market as the new CEO looks to rebase earnings. Key to note that software capitalization balances and the value of the Life investments are both deducted from Group CET1 capital so there is little change in the bank’s capital position. NAB traded in line with the rest of the Big 4 despite the news.

NAB Chart

South 32 (S32) -3.4%: the Aussie diversified miner was out with their 3rd quarter production report today and the numbers seemed reasonable despite the weakness seen in the shares. Record aluminium production out of South Africa & alumina production in Brazil were the highlights, while Coal in the Illawarra is expected to return to normal levels in the coming months. There were some hits to guidance for production on the full year however these, along with the suspension of the buy-back, were all flagged in an update to the market in late March. The weakness today was mostly seen as a result of falls in the base metals. We have S32 on our radar if it re-tests the recent lows.

South 32 (S32) Chart

BROKER MOVES:

- Beach Energy Raised to Hold at Canaccord; PT A$1.59

- Integral Diagnostics Rated New Buy at Blue Ocean; PT A$3.95

- Orica Raised to Buy at UBS; PT A$21.38

- Mineral Resources Cut to Hold at Morningstar

- Sandfire Resources Cut to Hold at Jefferies; PT A$4.36

- Whitehaven Cut to Hold at Shaw and Partners; PT A$2.50

- Sandfire Resources Raised to Accumulate at Hartleys Ltd

- Flight Centre Cut to Lighten at Ord Minnett; PT A$8.96

OUR CALLS

Growth Portfolio: We sold Magellan Financial Group (MFG) today for a nice profit

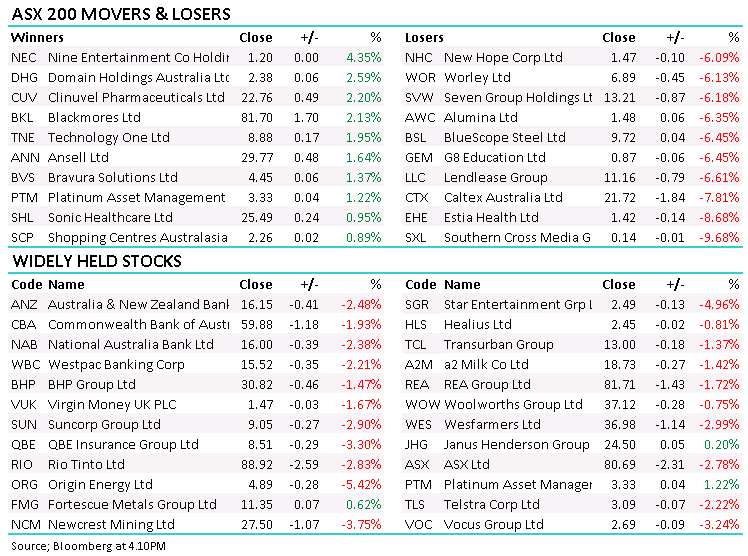

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.