How to play Australia’s rapid deceleration in Housing construction (BLD, JHX, BKW, ABC, LLC)

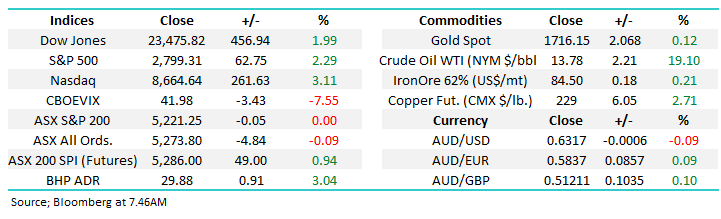

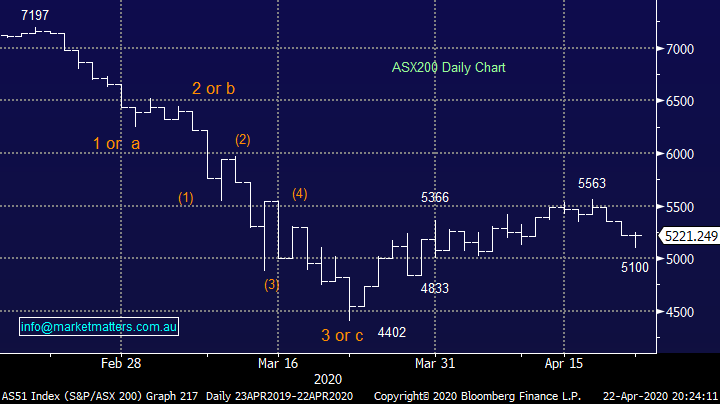

The ASX200 put in an excellent performance yesterday finally closing unchanged following a painful 3% drop by US equities but as we keep repeating our market’s looking forward, not at today’s news – with the day to day swings it’s more like 24-48 hours as opposed to the 6-months for the underlying macro themes. This morning we’ve again seen how well the ASX has “called” overseas stocks as the Dow bounced 2% but don’t assume, we’ll rally strongly today! On the stock level yesterday only 42% of the ASX200 closed positive but when the “Big Four Banks” and CSL Ltd (CSL) are in the winner’s circle the ASX is unlikely to fall far.

Private hospital operator Ramsay Healthcare (RHC) joined the capital raising bandwagon prior to the market opening on Wednesday and I can only assume that part of the Australian markets aggressive rally at 10.30am was due to some positive feedback on the $1.4bn raise which was executed at an almost 13% discount to the last trade. I hear bids were very strong into the book, it was very well covered and many in the institutional placement received zero allocations. A poor outcome when bidding into the book but a positive outcome if you are an existing holder as we are. A Share Purchase Plan opens shortly for retail investors and we’ll provide our views on this at the time.

The Healthcare Sector was one of the best on ground yesterday rallying +1.3% again implying buyers are keen on a number of these names into weakness.

We believe the ASX has bounced from its panic March lows primarily on liquidity as opposed to underlying improving economics, if we’re correct it’s unlikely that any market appreciation will be particularly dynamic and uninterrupted until the 2 move in tandem. I was listening to podcast last night, a macro guy in the US and his guest had a cracking quote which is worth remembering – it’s both correct and incredibly well put. ” Capitalism doesn’t work without bankruptcies just as Christianity doesn’t work without hell”.

With a COVID-19 vaccine likely to be 12 months away we expect that Virgin will not be the last Australian company to call in the administrators and overall market sentiment will continue to ebb and flow. However, on balance we feel fighting the central banks at this stage of the cycle is a dangerous game and we prefer buying pullbacks i.e. buy weakness and sell strength.

I actually had a frustrating night’s sleep as the markets recovery yesterday had me pondering whether we’d missed a good buying opportunity, especially as CSL Ltd (CSL), Appen (APX) and Cochlear (COH) which we’re considering for our Growth Portfolio, all reversed up on the day, “never say never” to buying on an up day, after all we did still close 6% below last week’s high.

MM remains bullish equities medium-term and hence in net “buy mode”.

ASX200 Index Chart

The following thoughts are only relevant if the initial stages of “Phase 2 - going back to work” post COVID-19 prove tough:

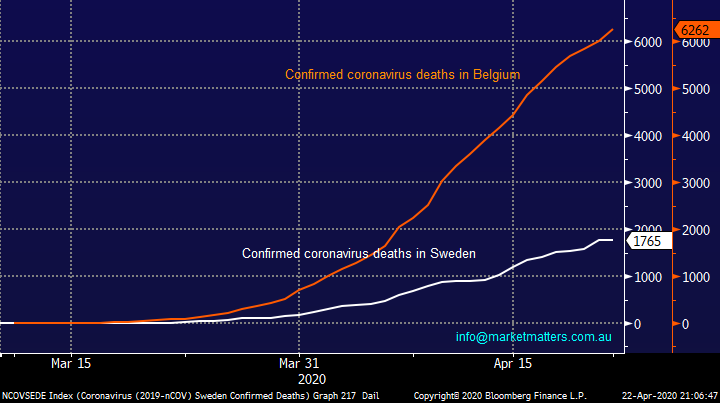

Sweden is showing the world what happens if you largely ignore COVID-19, considering their bars and cafes remain open it’s not too bad, especially when compared to some similar sized European countries in lockdown. Belgium only has a population 10% larger than Sweden and it’s been in lockdown since mid-March yet it has more than triple the number of deaths, while Sweden feels likely to play some catch up we ponder what the final tally will be when the dust settles. However, on a comparative bases their mortality rate is poor compared to Finland and Norway, this virus has been one large mathematics equation!

Undoubtedly Sweden’s more flexible “herd immunity” controls will allow this Scandinavian economy to bounce back faster than most of the developed world as interestingly they still regard their death rate as merely a failure to protect the elderly. Importantly the country is far less likely to suffer from any secondary increase in infections and personally I feel if we experience further major breakouts as the world “goes back to work” Plan B for many countries will be far more akin to this “herd immunity” which Australia actually considered in March i.e. try and protect / isolate the elderly in an effort to save the economy. Remember it’s a very long and difficult journey to mass produce an effective vaccine, from a markets perspective this suggests further periods of uncertainty are highly likely in 2020 /21.

MM feels the world will avoid secondary lockdowns at all costs.

Sweden & Belgium Coronavirus Deaths Chart

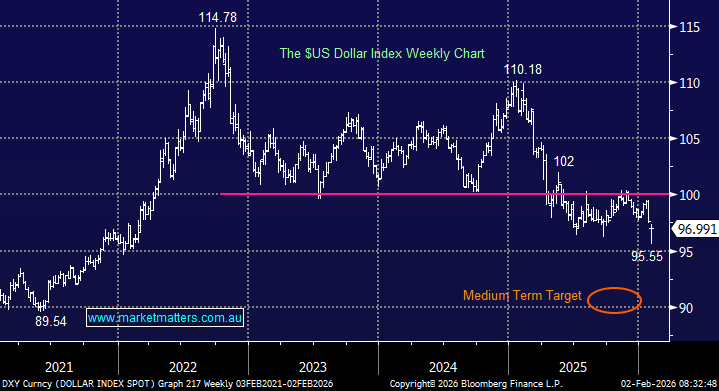

The $A is showing distinct signs of recovering from 62.5c support which adds weight to the possibility that stocks may have already finished their 8% correction from last week’s high, after all things are happening much faster in today’s environment and the pullback was / is of decent magnitude. At this stage the highly correlated indicator copper supports this bullish feel as the industrial metal looks well positioned for a break of its April high following last night’s +2.1% rally.

MM remains bullish both the $A and ASX200 medium-term.

The Australian $A and ASX200 Index Chart

Also last night crude oil showed a degree of normality in the more distant months where delivery / storage is not yet an issue. Production simply must be cut from its current 90 million barrels per day when demand sits at 75 million barrels and storage facilities are full, Brent crude made fresh 20-year lows yesterday for a reason – a little US – Iran “spice” may help short-term but it’s not the solution, oil needs a world “returning to work” combined with OPEC, Russia etc showing a united front to lower output.

MM is bullish crude oil targeting 20% upside from current levels.

Crude Oil December Futures ($US/barrel) Chart

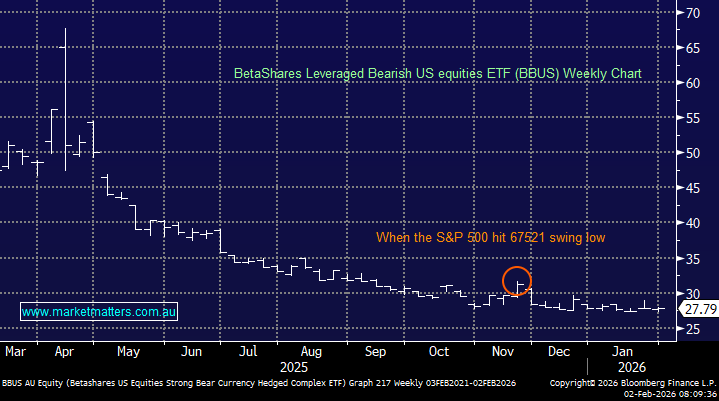

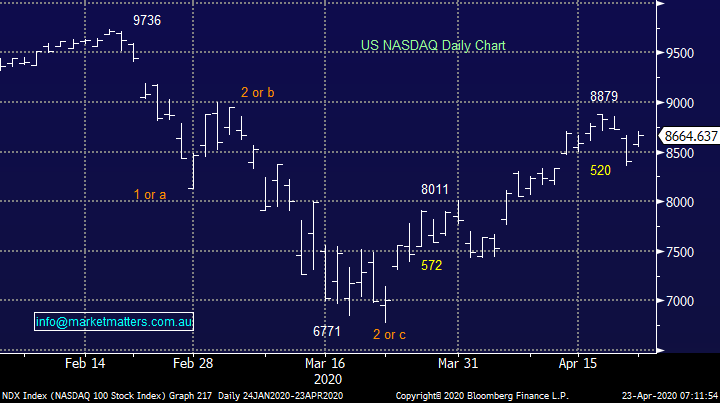

Overnight US stocks recovered most of Tuesdays losses with the NASDAQ again outperforming on an up day. A couple of important points of note with regard to our outlook for the US IT stocks:

1 - We remain bullish the NASDAQ which has already corrected over 70% of its March decline, short-term some rotation between 9000 and 8400 would not surprise.

2 – We expect the NASDAQ to continue outperforming the more broad based S&P500 with the quality Australian peers likely to perform strongly.

MM remains bullish the NASDAQ targeting fresh all-time highs.

US NASDAQ Index Chart

A “Tradies” nightmare.

The average Australian “tradie” has enjoyed a construction boom since I can remember but that’s all stopped now courtesy of COVID-19, importantly it was actually struggling beforehand. The virus has simply sent a declining market into full “Bear like” hibernation. Before we consider a number of the affected stocks in the ASX just consider some of the scary statistics looming over the head of many brickies, plumbers, chippies etc. – salary cuts are already becoming the norm:

1 – Free standing home construction is already at a 6-year low, its clearly about to get a whole lot worse with many touting levels not seen for 60-years.

2 – New home sales fell well over 20% in March with April likely to be significantly worse.

3 – Timber orders look set to fall by ~50% into Q4 of 2020 which bodes very badly for other products like bricks and cement.

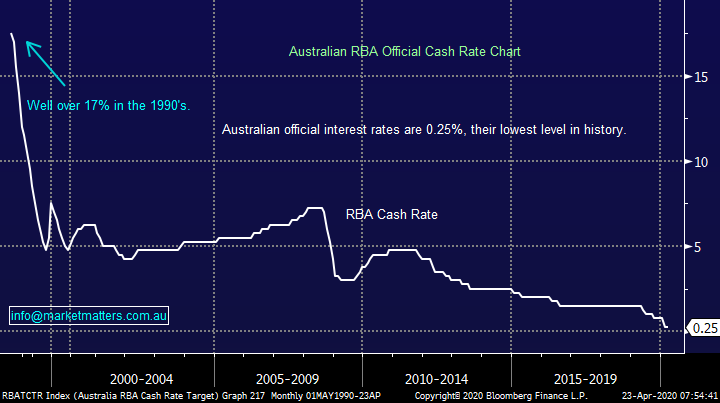

This is one industry MM believes might stay on the canvas for years without specific government support which by definition is a worry for investors as Scott Morrison has already spent up big time. Official Australian interest rates are already basically at zero in an effort to support the economy through COVID-19, nobody is talking recovery at this stage that feels something for 2021.

However, my concern with regard to residential construction is its position in the pecking order of concern for the government.

1 – A relatively firm existing housing market is a must for the Australian economy to recover as it determines so much of our consumer confidence.

2 – Fiscal stimulus is likely to be immense but building new country infrastructure doesn’t help home builders.

3 – The government’s main concern in my opinion with regard to housing construction is around employment but this was already struggling before the virus.

MM believes there will be some support for housing, but it might not be the silver bullet many are hoping / expecting. Hence, we feel it’s imperative with any “bottom picking” in the construction sector to look at stocks more orientated towards infrastructure.

RBA Cash Rate Chart

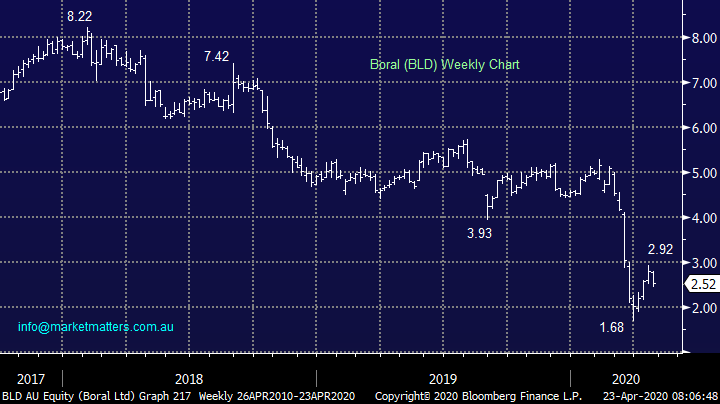

1 Boral (BLD) $2.52

Like many stocks Boral’s liquidity buffers have come under pressure by COVID-19 but the company have stated there are no imminent risks – hard to believe that. Unfortunately, this is a business that was already under pressure before the pandemic due to its accounting shenanigans in its windows business while it’s also been struggling in its concrete and building products area, although asphalt has helped. We’d expect an incoming CEO to clear the desk after long standing helmsman Mike Kane departs after handing down FY20 results. Any reduction in forecasts could lead to a capital raise.

As with a number of underperforming shares BLD has bounced strongly from its March low but the risk / reward at current levels is not exciting to us at this point. If we were to see new lows in 2020 it will be interesting as a potential corporate play post a recapitalisation of their balance sheet.

MM can see BLD making fresh 2020 lows.

Boral (BLD) Chart

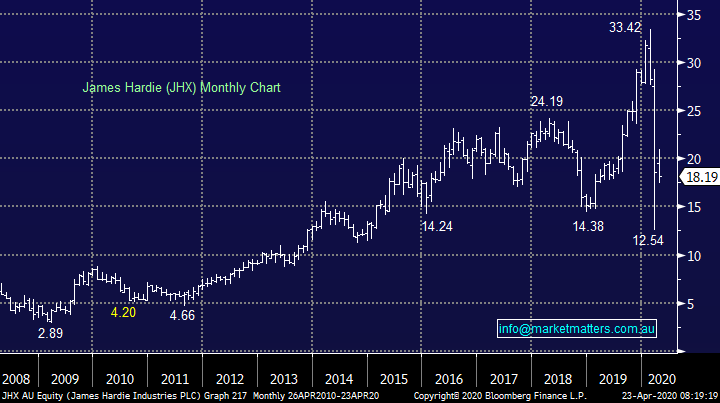

2 James Hardie (JHX) $18.19

JHX is one building company that was booming before COVID-19 but like so many its given back all of its recent gains. The trouble is the company manufactures products for new home construction and upgrades, the very areas that have ground to a halt. We like this business when we see glimmers of hope for housing, but this may be further away than many anticipate.

Importantly JHX is far more exposed to the US housing market than our own and as such may recover sooner if President Trump gets his way.

MM is neutral-positive JHX around $18.

James Hardie (JHX) Chart

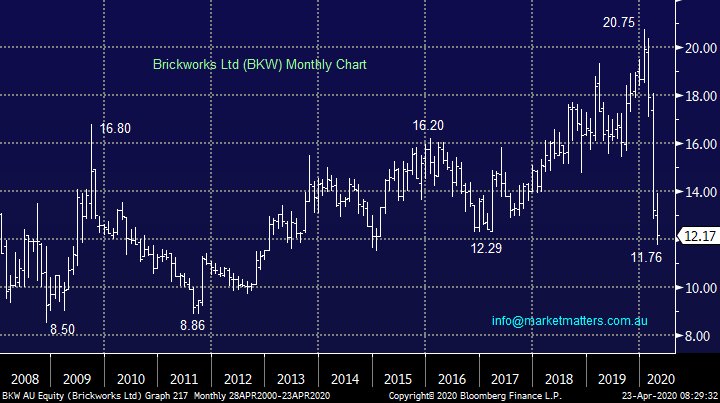

3 Brickworks (BKW) $12.17

BKW made fresh 2020 lows yesterday having ignored the strong recovery by local stocks since March’s panic sell off. This brick and paver manufacturer is simply in the wrong place at the wrong time and while it will undoubtedly produce solid long-term value at some stage, it might not be until under $10, its simply too hard to us.

MM has no interest in BKW.

Brickworks (BKW) Chart

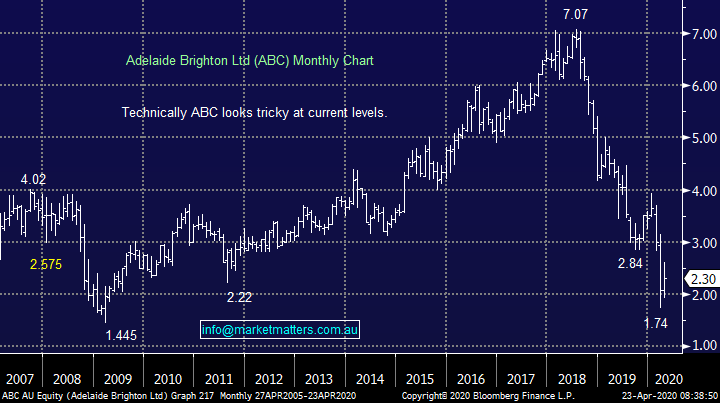

4 Adelaide Brighton (ABC) $2.30

Cement supplier ABC is in a very similar boat to BKW although its been struggling since 2018, again just too hard at this point.

MM has no interest in ABC.

Adelaide Brighton (ABC) Chart

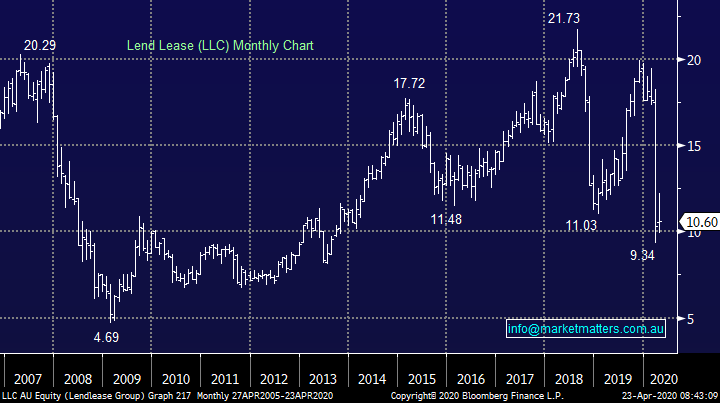

5 Lend Lease (LLC) $10.60

Property and Infrastructure group LLC was soaring only in February following an excellent half-year earnings, but it’s been “virused” like so many stocks. Aggressive government spending will help LLC recover strongly hence we are watching developments closely.

MM has no interest in LLC just yet but is watching it carefully.

Lend Lease (LLC) Chart

Conclusion:

MM is not keen on the building stocks but JHX is our favourite when the environment does recover, especially in the US.

With regard to infrastructure LLC is on our watchlist but its showing no signs of a pick up yet.

Other stocks to benefit from an infrastructure build will be Bingo (BIN) and Cleanaway (CWY), Downer (DOW), Cimic (CIM) & Monadelphous (MND) to name a few

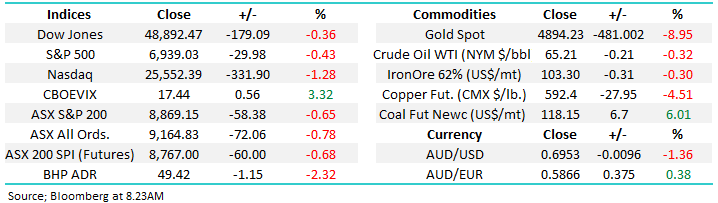

Overnight Market Matters Wrap

- The US equity markets rallied overnight as investors digested recnet reports and improvements signs around the virus.

- Crude oil stabalized for now and rose on the back of renewed geopolitical tensions with President Trump instructing the US Navy "to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea."

- BHp is expected to outperform the broader market after ending its US session up an equivalent of 3.04% from Australia's previous close

- The June SPI Futures is indicating the ASX 200 to open 90 points higher, towards the 5310 level this morning with April equity options expiry today.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.