“The Banks are back in town”, what now after NAB? (NAB, REH, JBH, CBA, WBC, JBH, BEN, VUK, MQG)

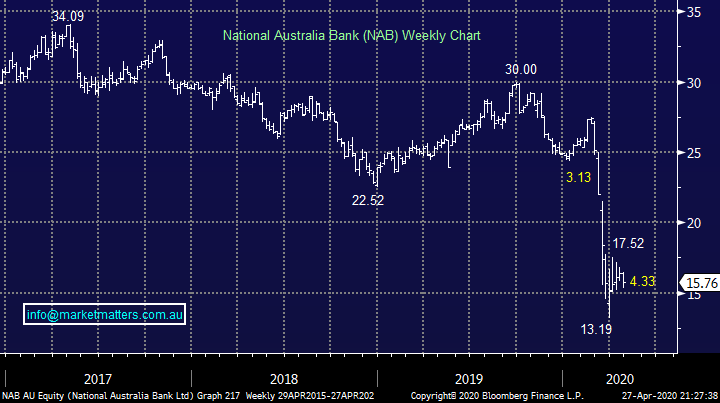

The ASX200 is fighting hard to end April on a high note although one hugely influential sector is creating an enormous headwind - The Banks. When our market closed yesterday the ASX had managed to recover 20% from its March low compared to the US tech-based NASDAQ whose futures at the same time were up over 30% from the depths of despair in late March. The “Big Four” banks are the primary difference in performance as they threaten to make fresh 2020 lows following NAB’s $3.5bn capital raising – ouch.

NAB announced the capital raise and significant dividend cut prior to the market opening on Monday – the dividend will decline 63% for the half while the $3.5bn raise is at $14.15, an 8.5% discount to the stocks last trade taking into account shares bought in the placement will not receive the 30c fully franked dividend on May 1st. The timing of the announcement surprised the market as NAB weren’t due to report for 10-days, in the process they leapfrogged both Westpac (WBC) and ANZ Bank (ANZ), sneaky or smart depending on your perspective – the scorecard at the top line showed a 51% drop in first-half earnings and a 33% drop in cash profit, including a $807m coronavirus provision. A few points from this decision which impacts so many retail investors:

1 – If we assume NAB opens around $15, a similar decline to Westpac (WBC) yesterday its yield over the next 12-months is forecast to be only 3% fully franked i.e. the announced 30c in May and a potential 20c in November. Clear pain for the retail investors who hold almost half of the bank’s shares.

2 – NAB have raised capital and cut their dividend in anticipation of rising loan losses courtesy of COVID-19. The defaults are undoubtedly going to be painful to NAB from the small businesses they have courted over recent years i.e. “Australia’s biggest business lender”.

3 – The $3bn capital raise from institutions was well supported, an ongoing strong trend in today’s market. The timing clearly implied they believe ANZ and Westpac might be forced to follow suit.

4 – The heat’s now on ANZ and Westpac who are due to make similar announcements in the near future – I would love to have heard the conversations in those board rooms yesterday.

Please excuse the title of today’s report but it reminded me of an old 1976 rock ballad by Irish band Thin Lizzy, I’m probably talking a foreign language to the younger subscribers but to those familiar with the song obviously the banks were replacing the boys in my mind yesterday morning – today’s report not surprisingly will be about how MM believes investors should “play” the banks in today’s uncertain times.

I have also included a quick video this morning which goes further into NAB’s result and associated capital call. CLICK HERE

National Australia Bank (NAB) Chart

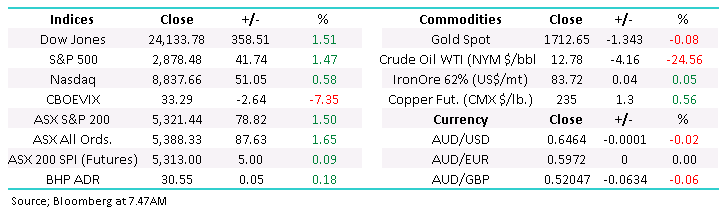

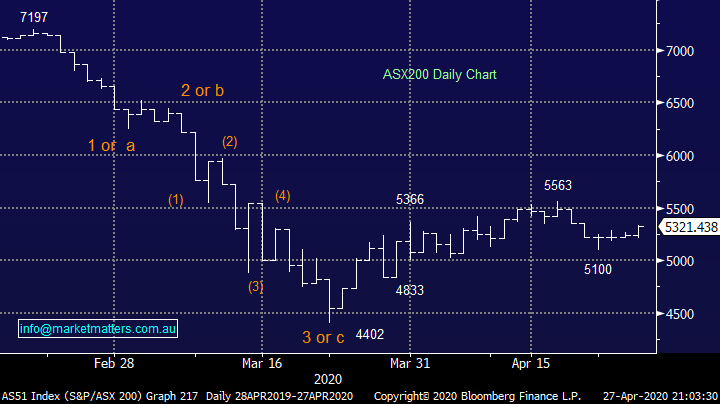

However before we unravel the apparent doom and gloom of the banking sector firstly I wanted to look at the overall AX200 which put in a stellar performance yesterday rising +1.5% as the banks plunged, well over 80% of the index rallied including 31 names which soared by over 5% i.e. we saw strong broad based buying outside of the Banking Sector. Two very bullish factors were again evident to investors yesterday and they should definitely not be ignored in our opinion.

1 – The ASX rallied strongly in the face of adversity, the “Big Four” banks make up around 20% of the index but the index shrugged off their issues, not common over the last decade – the market feels underweight stocks in my opinion.

2 – Capital raisings remain largely very well supported implying there’s still plenty of cash on the sidelines which again implies to MM the markets underweight risk.

An anticipated steady global “return to work” by many developed countries appears to be the main catalyst that’s exciting stocks, no great surprise following the huge uncertainty and panic about a month ago. Of course, the huge amount of central bank liquidity is also helping.

MM remains bullish equities medium-term and hence are in net “buy mode”.

ASX200 Index Chart

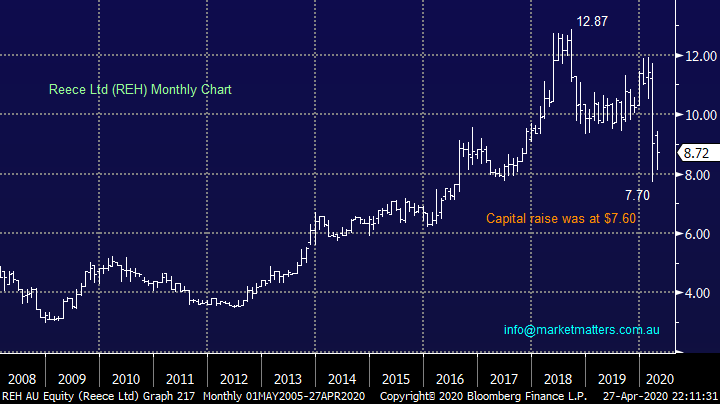

Yesterday MM followed through on our previously discussed plan to buy plumbing and bathroom supply business Reece Ltd (REH). The company recently raised capital to hedge itself against what they described as it’s worst-case scenario where all its markets have a protracted lockdown. This seems unlikely (although possible) however REH now has the balance sheet to withstand such a shock while importantly being extremely well positioned to benefit from a post COVID-19 pick-up in economic activity.

MM remains bullish REH medium-term.

Reece Ltd (REH) Chart

MM mentioned potentially selling JB Hi-Fi in the Weekend Report and its likely to again threaten our targeted $35 area this morning. If we stand back and simply consider that JBH is now only down 8% from its 2019 close I wonder if optimism is getting ahead of reality with this music and electronics retailer which by definition needs a cashed up /positive consumer to thrive. While JBH is undoubtedly a quality business its price is going to be determined by how quickly the average Australian reopens their wallets yet we’re a damaged beast, hence we feel the risk / reward is diminishing slowly but surely.

MM is considering taking profit on our JBH position at higher levels

JB Hi-Fi (JBH) Chart

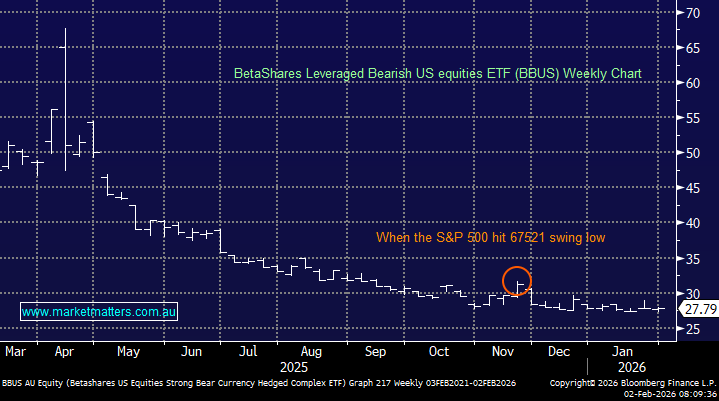

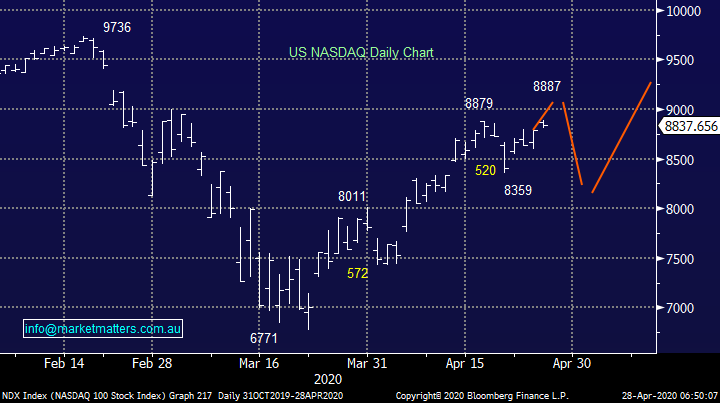

Overnight US stocks followed through on the strength shown by their futures in our time zone although interestingly the tech based NASDAQ which generally leads opened strongly only to close near its lows, Microsoft (MSFT US) actually closed down even while the Dow rallied over 350-points. I have again shown the chart of the NASDAQ from the Weekend Report, at the time we were 50-50 around what came next, our view has now evolved and although we are bullish medium-term another pullback of over 5% is our preferred scenario short-term.

MM is bullish US stocks medium-term but net bearish short-term.

NB This is pretty micro stuff but still useful if we’re correct for the active investor looking to tweak portfolios.

US NASDAQ Index Chart

Where to now with the banks?

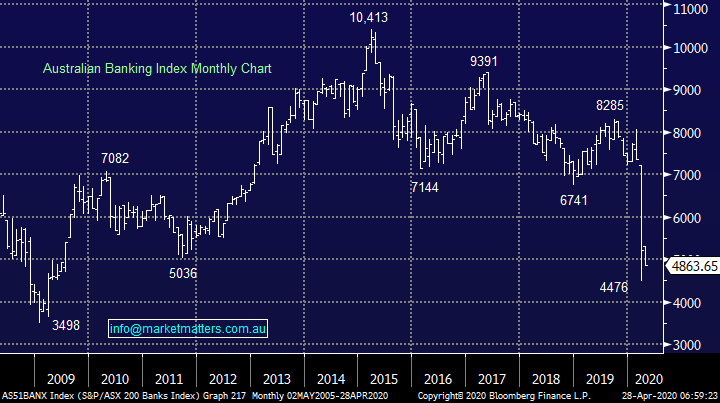

The Australian Banking Sector has endured a torrid few years basically halving in price while most stocks have soared post the GFC, that’s even after we take into account the markets ructions during the virus pandemic. We all know the history of the Banking Royal Commission, an increased regulatory environment etc but looking forward is what matters and Australia needs a strong Banking Sector to recover from COVID-19, we thought some comments yesterday by Australian Super were very purposeful and should not be ignored, the $180 billion industry fund giant, said “it would back the NAB raising and would be "happy to assist" if more capital is needed.”

So NAB has raised cash for a buffer to the fallout from COVID-19 yet they believe there’s an 85% probability of a “V-shaped recover”, in other words like REH earlier they are preparing for a potential worst case scenario which makes sense to us during the current uncertainty. There’s obviously no historical back drop to the coronavirus breakout but we did see the banks come to market and raise capital to shore up their balance sheets during the GFC, this proved great medium-term buying for investors in hindsight. Back in 2008/9 the Big Four raised between $1.9 and $2.3bn at around a 10% discount to the last traded price making this NAB raise noticeably larger.

1 – During the GFC in July 2009 NAB raised capital at $21.50, a great investment at the time as the stock proceeded to rally almost 80% while paying healthy dividends along the way.

2 – However as is so often the case the music did stop playing and for investors who didn’t “take the money and run” the stock is now underwater although some healthy dividends have been collected along the way.

ASX200 Banking Index Chart

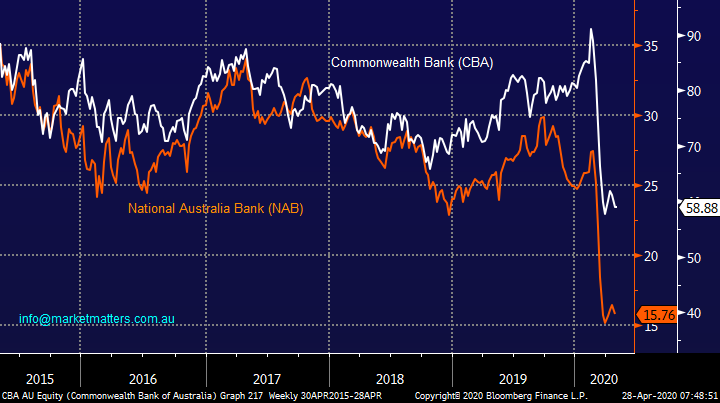

The obvious question is do MM believe the banks are a buy today and if so which ones? Earlier in 2020 we switched our NAB holding to CBA in anticipation of this current issue with NAB, the chart below illustrates the subsequent underperformance by NAB compared to CBA.

NAB have made plenty of provision for credit risks but issues may still arise especially if we see a significant fall in housing, continued deterioration in business conditions &/or higher unemployment. If the elastic band stretches further, we may well switch CBA back into NAB.

MM would consider switching CBA back into NAB if this gap widens

Commonwealth Bank v National Australia Bank (NAB) Chart

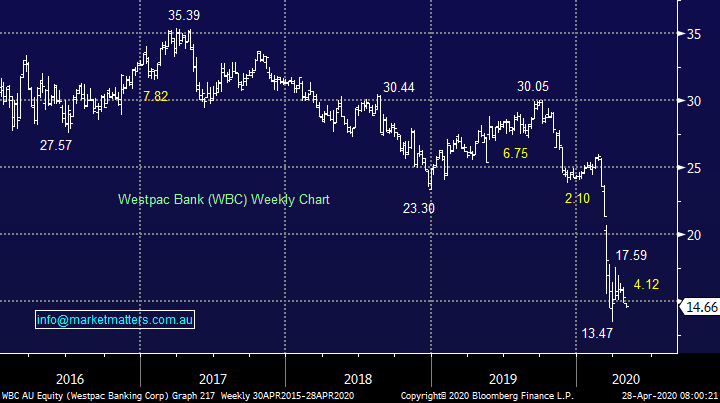

Also about a month ago MM reduced our Westpac (WBC) position above $17, obviously in hindsight I wish we had been more aggressive but it still allows us some flexibility within our Growth Portfolio whether it be towards buying back into WBC, or another bank, or just not panicking as their prices decline. At this stage we will remain very fussy on price but all things being equal in WBC’s looming report we are considering averaging our WBC position into fresh 2020 lows, which may correspond with a capital raise.

MM is considering increasing our WBC into fresh 2020 lows.

Westpac (WBC) Chart

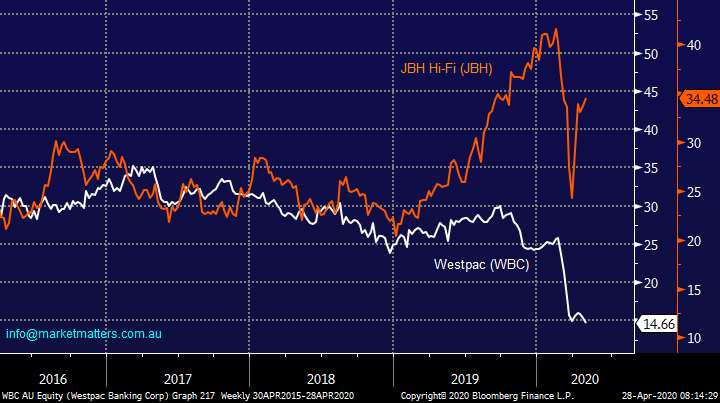

Interestingly the health of our economy, Australian consumer and general business conditions have a huge impact on the health of both our banks and Australian retailers yet the chart below shows where investors’ confidence lies and it’s not with the banks. The elastic band between JB Hi-Fi (JBH) and Westpac (WBC) does look extremely stretched and moving forward I can see the later outperforming – that puts me on an island!

While I’m not saying its vaguely time to go “all in” on the banks I do believe its time to consider “nibbling away, the Banks are about as unpopular today as they were revered back in 2015 – I remember going into my old accountants office back in the heyday when Commonwealth Bank (CBA) was threatening $100 and he said “your jobs easy, just buy the banks”….I wish I’d had my contrarian light flashing loudly that day!

MM believes this is an ideal time to be nibbling away at the Banking Sector – things will improve

Westpac (WBC) v JB Hi-Fi (JBH) Chart

Alternative Banks

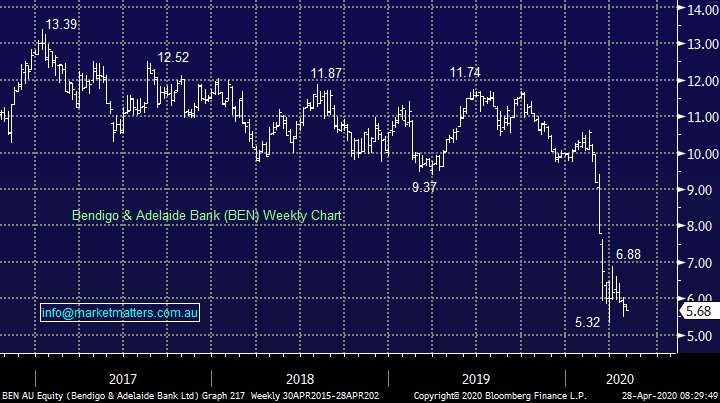

Both the Bank of Queensland (BOQ) and Bendigo Bank (BEN) have struggled within the embattled sector, both are down almost 50% over the last 6-months whereas CBA has fallen -26%. In the Weekend Report we wrote: “If BEN makes fresh 20-year lows to around the psychological $5 area technically another bounce towards $7 feels likely i.e. a 40% bounce” we still like this thesis.

MM likes BEN into fresh 2020 lows.

Bendigo Bank (BEN) Chart

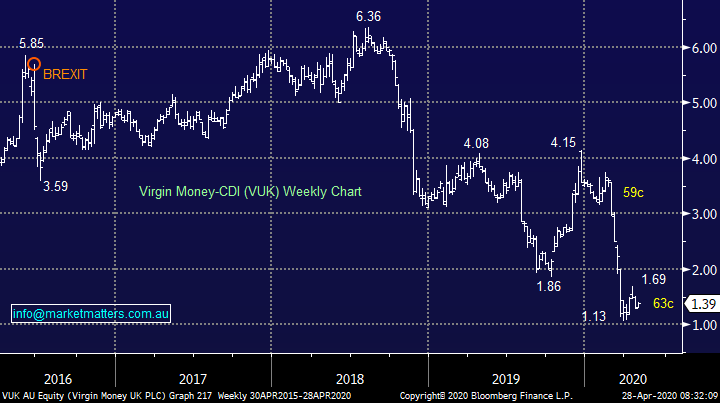

Similarly we wrote over the weekend about Virgin Money (VUK) – “Virgin Money (VUK) looks capable of bouncing over 60% from fresh 2020 lows, unlike Virgin Airways, VUK has a far more domestic facing list of shareholders starting with Perpetual & Investors Mutual who both hold close to 4%.”

We like VUK as an aggressive, shorter term play into fresh 2020 lows.

Virgin Money (VUK) Chart

Lastly, Investment bank Macquarie Bank (MQG) has a history of rising from the ashes like a phoenix during a crisis, its 30% plunge as COVID-19 has shaken financial markets feels overdone if / when we see an economic recovery.

MM likes MQG below $100.

Macquarie Group (MQG) Chart

Conclusion:

MM continues to like the banks into new 2020 lows, but we are pedantic buyers.

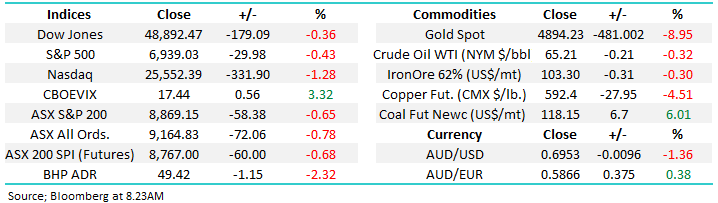

Overnight Market Matters Wrap

- The US equity markets continued its slow path to recovery as investors begin to see the glass half full at present, as the growth rate of the coronavirus continues to fall, meaning an expected opening of its economy at a faster rate.

- Crude oil sank as a large chunk of selling was witnessed by the largest oil ETF, down 24.56% to settle at US$12.78/bbl. for the session.

- Treasury yields crept up, following reports that the European Central bank will provide further stimulus measures after it was seeing from the Bank of Japan yesterday.

- The June SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5340 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.