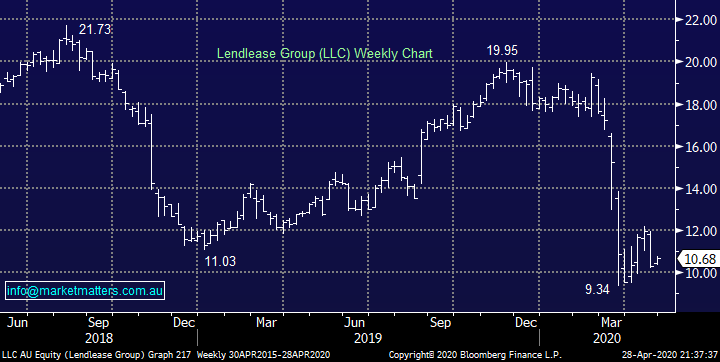

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (LLC, AMZN US, BP LN, FUEL, QQQ US)

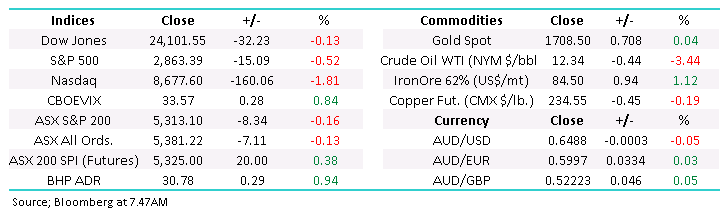

Slowly but surely normality is returning to stocks, the ASX200 has basically traded between 5000 and 5500 for the whole month of April, amazingly we experienced that range twice in a single day back in mid-March. Underlying sector and stock fundamentals have taken over from pure panic as investors attempt to look through todays awful economic data in an effort to comprehend how a post COVID-19 lifestyle will impact companies in the years ahead. MM’s outlook for April has played out as “selling strength & buy weakness” has been the ideal approach for the last few weeks, importantly we feel the trend is your friend with this one until further notice but we remain net buyers.

The banks have been dominating the news this week, but we would argue the main takeaway has been the ongoing strong appetite for discounted stock i.e. there is still plenty of cash in those hills! It was also pleasing to see Cochlear (COH) belatedly look after most of its retail shareholders as the company significantly increased its SPP from $50m to $220m, either they felt very guilty when the reality was explained to them or they just fancied some extra cash. Conversely NAB who has owned 50% by retail shareholders is currently only giving 15% of its raise to existing retail shareholders via a SPP, perhaps in this case they were concerned over demand. Either way I believe the trend is improving with regard to retail investor allocations in capital raisings.

While the index has been relatively quiet of late it does appear investors are selectively moving up the risk curve as we discussed in the Weekend Report, it can be illustrated by a couple of sectors / indices which caught my eye yesterday & overnight:

1 – Consumer Discretionary stocks rallied +1.7% yesterday yet they are down over 15% in the last 12-months.

2 – Healthcare fell -0.2% yesterday yet they are up over 40% in the last 12-months.

3 – Overnight the high performing tech-based NASDAQ fell -1.8% while the underperforming small cap Russell 2000 rallied over 1%, a clear night of “risk on” in the US.

Overall MM is bullish risk and equities but after the strong bounce since Mid-March we are only interested in selective pockets of the market as we feel another pullback is a strong possibility in early May.

MM remains bullish equities medium-term and hence in “buy mode”.

ASX200 Index Chart

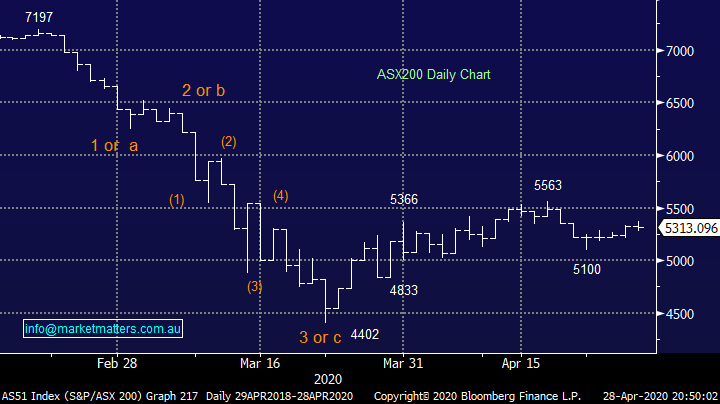

The Fear Gauge / Volatility Index (VIX) has continued to drift lower as global equity markets slowly calm after the panic in March. However, memories of a savage ~30% decline don’t vanish overnight and it’s still trading over double of the majority of 2019.

Volatility Index (VIX) Chart

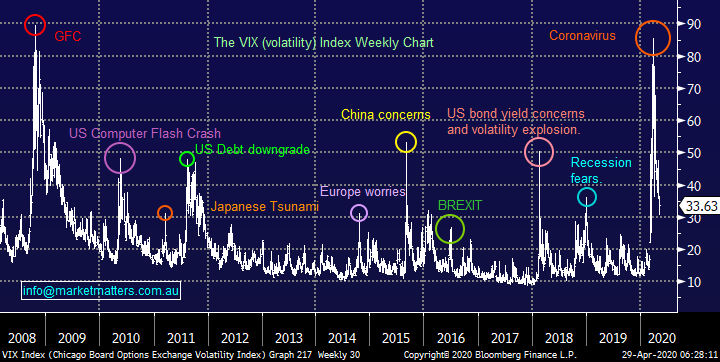

Yesterday saw lend Lease (LCC) follow many companies into the equity raising arena as they sought $1.15bn to shore up its balance sheet through these unprecedented times. We like the companies view that property is a cyclical market and this is a time to be proactive as opposed to defensive. The combination of the equity raising and a $900m leap in borrowing capacity takes LLC’s available liquidity to within a cappuccino of $4bn.

The capital raise is at $9.80, similarly to the banks at an 8.2% discount to its last traded price. Although not specifically mentioned in our Weekend Report LLC was one of the “dog stocks” we looked at with an ideal entry level around $9, definitely not out of the question if stocks take another leg lower. A couple of points to consider from the 35 equity raisings to-date which has lined company coffers with more than $15bn – around 75% of the stocks are up after the raise with an average appreciation of ~17% but stocks often open around here making entry in the raise required to benefit. Also, when the raise is increased due to large demand it’s a not surprisingly a strong sign, worth watching with LLC.

MM is bullish LLC into weakness.

Lend Lease (LLC) Chart

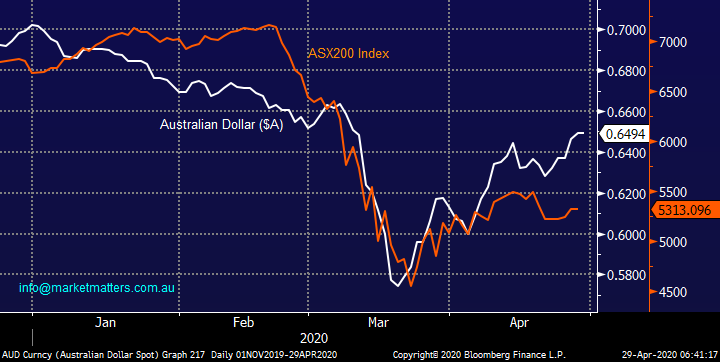

Assuming the little ”Aussie Battler” continues to lead local equities then more upside appears on the menu which is certainly our view medium-term – the $A has now rallied +18% from its March low when the market was pricing in massive prolonged global contraction and uncertainty.

Medium-term MM remains bullish both equities and the $A.

Australian Dollar ($A) & ASX200 Chart

Overseas equities

Overnight US stocks largely reversed lower lead by the NASDAQ which was clobbered -1.8%, a meaningful decline after making fresh April highs early in the session. No change to our view from the Weekend Report, MM is looking for a reasonable pullback to buy with the 8300 area our initial target for the NASDAQ.

MM remains bullish quality US stocks in the medium-term.

US Nasdaq Index Chart

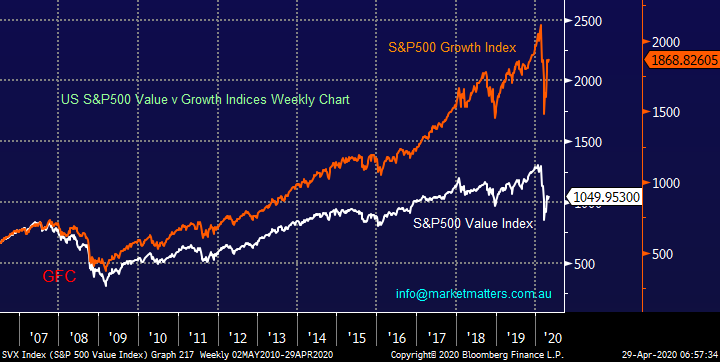

Overnight we saw the S&P500 Value Index benefit on a relative basis as the Growth stocks encountered strong selling / profit taking after midnight our time. Our takeout from this and how we see stocks short-term is twofold:

1 – We remain bullish quality tech-based companies, but we can be patient with buying short-term e.g. Amazon (AMZN US) has already corrected 5%, a touch lower would be our ideal time to start buying – see International Portfolio section.

2 – We believe cyclical stocks are about to garner some of the cash on the sidelines as investors hunt for value i.e. Resources, Energy and believe it or not perhaps even Banks – UBS rallied more than 5% overnight!

MM remains in “accumulation mode” for global equities.

US S&P500 Value & Growth Indices Chart

MM International Equites Portfolio

MM now only holds 8% in cash following our purchase of Exxon (XOM US) and Trade Desk (TTD US) , we are looking to increase our equity market exposure a little more through any May weakness in stocks but we will be fussy as we’re close to fully invested : https://www.marketmatters.com.au/new-international-portfolio/

Our thoughts have evolved over the last week as we touched on earlier, we remain happy with our exposure to the quality Tech and Healthcare names like Apple, United Health and Google but with the exception of Amazon fresh buying is likely to be more focused in cyclical / value names as the market starts looking for bargains. However, there’s no change with our view that stocks will rally into Christmas in a staircase like manner as we see ongoing swings of sentiment hence in general, we will continue to look to buy weakness & sell strength. This rally in stocks is not so much about earnings (yet), its more focused on liquidity, a topic we cover in today’s income note.

We have updated our 3 most likely purchases moving forward, the purchase of Exxon (XOM) from last week looks good with a 10% paper profit always a nice start, In our opinion the commencement of a strong recovery in the Energy Sector:

1 – Amazon (AMZN US) : AMZN the largest global cloud & e-commerce company surged to fresh all-time highs earlier in the month, we continue to believe the stocks represent value for the years ahead with our current ideal entry around $US2,250.

1 – BP Plc (BP LN): UK based oil goliath BP looks excellently positioned to recover at least 30%.

3 - UBS Group (UBS US) : MM is considering increasing this holdings up from 4% to 6%.

4 – LVMH (MC FP): MM is considering taking a ~7% loss on this luxury retailer as flagged in the Weekend Report.

*Watch for alerts.

Amazon (AMZN US) Chart

BP Plc (BP LN) Chart

MM Global Macro ETF Portfolio

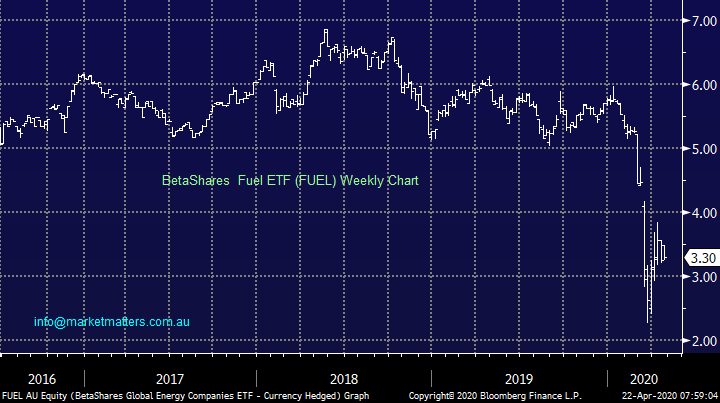

MM’s cash position now sits at 14% in the Global Macro ETF Portfolio and we’re happy with the portfolios purchases over the last week in ProShares Short VIX ETF (SVXY US) & BetaShares Global Energy ETF (FUEL US) : https://www.marketmatters.com.au/new-global-portfolio/

Moving forward we now only have 3 positions on our radar following recent moves:

1 – Buy / Sell Invesco Geared Bullish NASDAQ ETF (QQQ US): In line with our choppy bullish stance towards US equities we will consider averaging this 5% position under $US200 and selling around $US220.

3 – Buy Invesco Bearish $US Index ETF (UDN US): we like the UDN where it is now, sub $US20, MM is looking for at least a 15% appreciation in this ETF.

4 – iShares MSCI Global Silver & Metals Miners (SLVP US): MM is considering basically “scratching” this position around $US11 where it closed last night.

*Watch for alerts.

BetaShares Fuel ETF (FUEL) Chart

Invesco QQQ Trust (QQQ US) Chart

Overnight Market Matters Wrap

- The US equity markets had a breather overnight from its recent run with the major key indices ending in negative territory, led by the tech. Sector.

- The energy sector continues to be on the front page, with crude oil falling 3.44% to US$12.34/bbl. overnight.

- BHP is expected to outperform the broader market after ending its US session up nearly 1% overnight.

- The June SPI Futures is indicating the ASX 200 to open 37 points higher towards the 5350 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.