6 stocks MM are happy to buy (JBH, LLC, SKI, SYD, PDN, AMZN US)

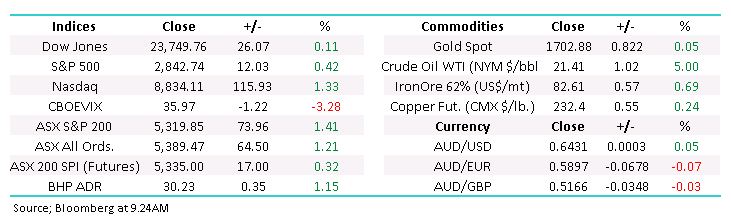

The ASX200 put in a stellar performance yesterday managing to rally +74-points / 1.4%, ignoring a very bad Friday night on Wall Street plus US S&P500 futures falling an additional -1.5% in our time zone but as so often been the case we appear to be the leaders, not the followers – yet again Australia proved correct overnight as the Dow reversed a 36-point early decline to close positive. “Under the hood” the banks led the recovery with the “Big 4” rallying an average of +2.3% following Westpac’s (WBC) result which showed a 70% drop in profits and no dividend this time around but it feels like a classic case of “sell on rumour buy on fact” as the market embraced the underlying sentiment that the sector is in a solid position to deal with the negative fallout from COVID-19.

Unfortunately 40% of the ASX200 still closed in the red otherwise the gains might have been far more emphatic with the losses that caught my eye primarily in the Consumer Services Sector agreeing with our view that tourism may struggle for years to come. Flight Centre (FLT) may have surprised some when they announced that their business was still managing to run at 5-10% of normal levels and to paraphrase what we said yesterday “travel will be one of the last areas of the global economy to recover, and potentially it may never return to the activity levels enjoyed before COVID-19” -basically the sectors too hard in our opinion and supposedly cheap stocks might just get cheaper, or fail to embrace market strength if / when the ASX makes a serious assault on Februarys all-time high.

The other underlying message from yesterday’s solid recovery was until further notice “buy weakness and sell strength” is proving to be the perfect modus operandi for active investors looking to add some alpha / performance around the edges to a portfolio. Surprisingly since Marchs explosive decline the ASX has now traded in a relatively tight band between 5100 and 5563 for almost a month, unfortunately it’s not as easy as picking the markets trading range to add value unless were trading index based ETF’s because stocks / sectors have often been dancing to their own very different tunes almost day to day.

MM remains bullish equities medium-term, hence we are in net “buy mode”.

ASX200 Index Chart

Yesterday we sent out 2 alerts to subscribers:

1 – Growth Portfolio – we switched from JB Hi-Fi (JBH) to Lend Lease (LLC), we prefer exposure to government construction stimulus as opposed to the Australian consumer at this stage of the economic recovery cycle – hopefully, that is! We see more relative upside / catch up by LLC as illustrated by the chart below. Their equity raise has them in a good position to take advantage of opportunities here – I discuss this stock further in the below video.

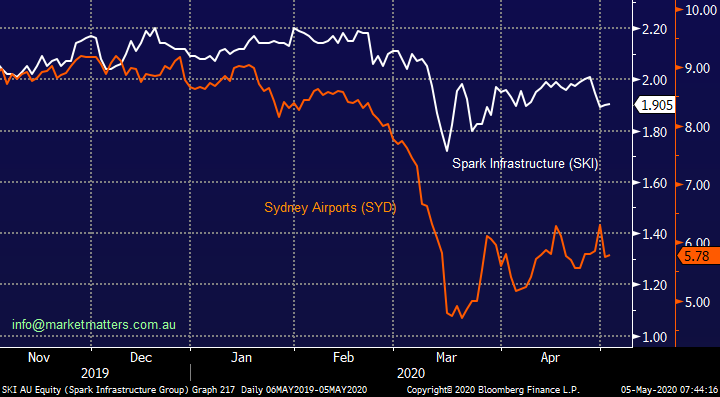

2 – Income Portfolio – we switched from Spark Infrastructure (SKI) to Sydney Airports (SYD) yesterday, taking a longer term view on SYD which we considered after the recent significant outperformance from SKI. Infrastructure stocks provide a degree of stability in income portfolios and Sydney Airports is a stock we’ve been targeting for a number of years (as was Transurban). While we believe travel stocks will take longer to recover, Sydney Airports is now priced accordingly.

JB Hi-Fi (JBH) and Lend Lease (LLC) Chart

Spark Infrastructure (SKI) and Sydney Airports (SYD) Chart

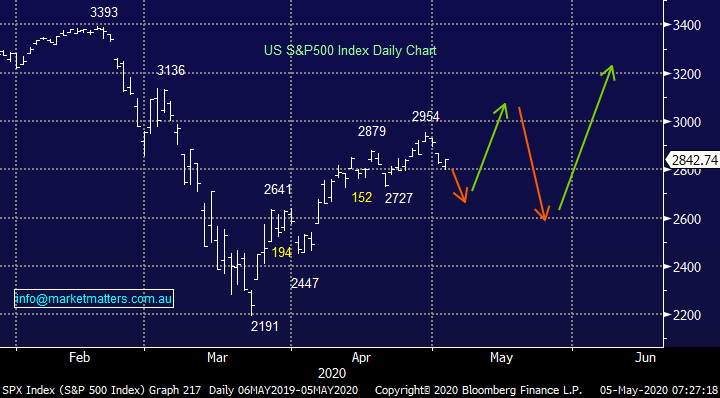

Overnight US stocks closed marginally higher as the 2800 area continues to act like a magnet for the S&P500. Ideally for our forecasted path below the market will chop around here a bit longer, try another leg down which will fail then try and rally which will also fail etc Basically MM believes stocks are oscillating around the equilibrium levels until we see a meaningful indication of how the global economy will recover from COVID-19 i.e. “V-shaped, U-shape, W-shaped or L-shaped. Personally I believe the “shape” of the recovery will depend on the individual stock / sector as not all parts of the economy will resume normal operation together.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

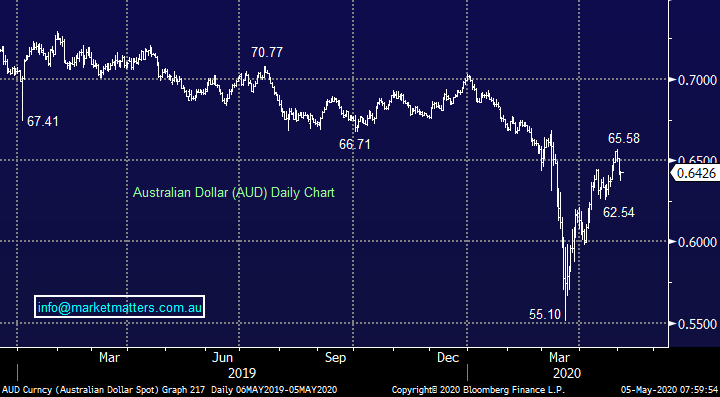

In a similar manner to equities the $A is hovering around the 64c area as risk assets move in tandem, there should be no surprise with this correlation although it’s a shame that the $A is not currently providing a nice leading indicator. However what matters to MM is we add value to portfolios through 2020 and beyond and at this stage subscribers should anticipate the following general moves across our investments:

1 – Rotation between positions if appropriate when we feel the index is around fair value i.e. current levels at this point in time.

2 – Increase risk exposure ~3% lower and decrease exposure to risk ~5% higher, it may feel a touch micro but remember were only talking about a few potential “tweaks”.

Medium-term MM remains bullish both equities and the $A.

Australian Dollar ($A) Chart

Lastly a quick look at a stock that has figured prominently in our Mondays questions Report over the last year – Uranium miner Paladin Energy (PDN). Our answer has generally been the same, let the stock tell us when it’s time to jump aboard this serial underperformer which was trading above $5 prior to the Fukushima disaster. We believe that time has now arrived, and investors can consider PDN with stops below 7c – NB still a large % risk at this stage.

MM is bullish PDN initially looking for ~50% upside.

Paladin (PDN) Chart

Today I’ve taken a different tack, recording a 14min video on 6 stocks we’re happy to buy now. Stocks covered include: Amazon (AMZN US), The Trade Desk (TTD US), Lend Lease (LLC), Appen (APX), Transurban (TCL) & Smart Group (SIQ). The majority we own, however 2 we don’t but want to. Click here or below

Conclusion

We are bullish the 6 stocks covered

Overnight Market Matters Wrap

- The US equity markets rallied overnight, on the back of crude oil on a 4-day winning streak, while the airline sector dragged, following comments from Warren Buffet exiting his investments completely away from the airlines on behalf of Berkshire Hathaway Inc.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 1.15% from Australia’s previous close.

- The RBA meets this afternoon at 2.30pm with a 57% chance of a rate cut.

- The June SPI Futures is indicating the ASX 200 to open 20 points higher, testing the 5340 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.