3 Consumer Stocks who may benefit from our “new lifestyles” (XRO, NSR, FLT, EVT, CWN, ALG)

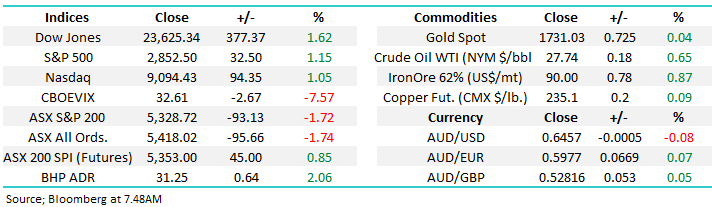

Just when it appeared too easy for traders to buy the ASX when it gapped lower at the open, before selling at the days end, the market gave people a big bad reality slap yesterday. The ASX200 did initially trade down almost 80-points early in the morning before rallying over 40-points to regain half of its losses by around 2pm but just when it again felt rosy unlike the last 3-4 weeks it then proceeded to roll over and close down -1.7%, on the day’s low – it felt like local stocks had become tired and perhaps a touch too comfortable / optimistic. With almost 85% of the local market sinking into the red there were few places to hide yesterday outside of the Gold Sector as “risk off” was the clear tone for the day.

One concern I have is global equities have once again become complacent with regards to COVID-19, strange when you consider that second waves are seriously hindering the recovery through Asia. My major concern is the US, they are striving to recommence work asap yet they’re still seeing 20,000 fresh cases reported on most days with only 26 states seeing the trend decrease, from afar it feels way too early by Trump et al and their ~85,000 deaths looks in danger of soaring through 100,000. Australia might be on top of the pandemic, but we need global trade to undo the financial damage of the last few months, fingers crossed! We will probably get a strong indication of where the worlds at when Germany reopens its European borders in mid-June.

Also just to add to our worries the World Health Organisation (WHO) have now warned that COVID-19 may never go away and we will simply have to live with it, so much for a long, relaxing and fun retirement. Mankind has never found a cure for influenza so potentially we are being too optimistic this time as the WHO said we learned to live with HIV, why not COVID-19. Governments may be in for a very tough few years as they try and balance huge economic contraction against acceptable death rates from the virus – all pretty sombre stuff on the virus front from an international perspective, although today in NSW many will be eating lunch out (with a maximum of 9 others), something we haven’t experienced for the last 6 weeks.

While we remain bullish stocks here, we still anticipate spikes of volatility through 2020 – “buy weakness & sell strength”.

Earlier this morning I outlined our current thinking in a short (8min) video. Click here

Local employment figures were weak yesterday with 575k jobs lost in April, the unemployment rate jumped to a seasonally adjusted 6.2% for April, significantly beating the dire 8.2% forecast however that was because economists got the participation rate wrong. However the hardest call of all is what happens to the number when the JobKeeper payments end in September, we have an astronomical 6 million people from 860,000 businesses on these benefits with many unlikely to be in work come Christmas, the question is will things be very bad or awful, later in the year.

The sugar hit of $1500 a fortnight is undoubtedly helping domestic sentiment and the likes of consumer spending but are people putting some away for later in the year, if not we might be about to see a second economic dip and a tough Christmas. However, despite this potential bad news, we feel the Fiscal and Monetary tailwinds for stocks will remain in place until well into 2021 and that’s the primary reason why we are retaining a more positive stance while the headlines / rhetoric remains so weak.

MM remains bullish equities here, hence we remain in “buy mode”.

ASX200 Index Chart

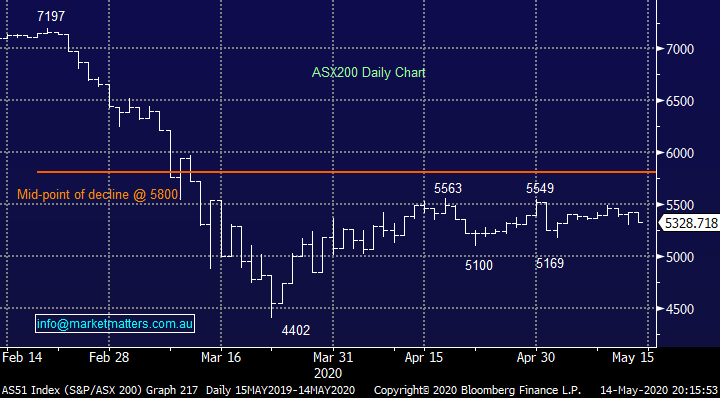

Accounting software provider Xero (XRO) fell close to 5% yesterday following its full year result, the short-term numbers were a touch below market expectations, revenue $718m v $730m exp, EBITDA $137.7m v $150m expected while they booked a small net profit for the year. However as I discussed in the video above and in the Afternoon note yesterday XRO is all about growth and to that end they added 467k subscribers for the year taking total subscribers to 2.285m. Clients are very “sticky” which is a facet of customers loving their product – I certainly do as does my accountant.

MM is considering increasing our XRO position if the stock drops further.

Xero Ltd (XRO) Chart

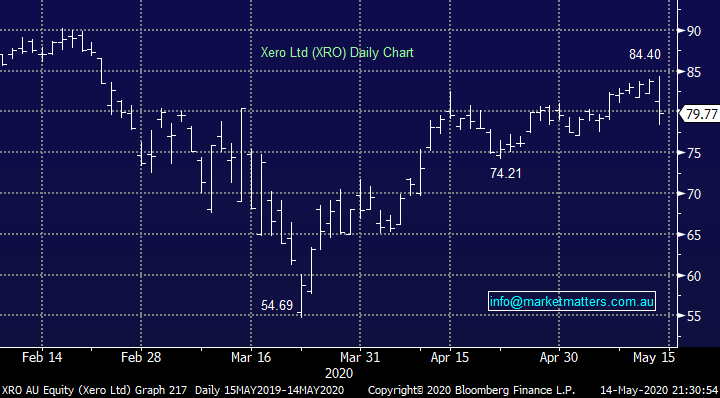

Last week National Storage (NSR) successfully raised $300m at $1.57 with another $30m targeted via a SPP from existing shareholders. The raise does improve their balance sheet with gearing down to ~23% versus the groups target of 25-40%. This implies they have some powder for acquisitions in addition to their already planned $120m of expansion plans, a great time to be able to go shopping in my opinion.

We believe NSR is just at the start of its Australasian expansion, especially when we compare our marketplace to that of the US. American based Public Storage was considering a takeover of NSR at $2.40 before the pandemic, insiders have been buying, the shares which yield over 5.5% pa and the stocks trading below its NTA, although this NTA will be revised down I presume - we still believe there are plenty of reasons to like NSR post raise even if we have been a touch slow out of the blocks.

MM likes NSR at current levels.

National Storage (NSR) Chart

Overseas equities

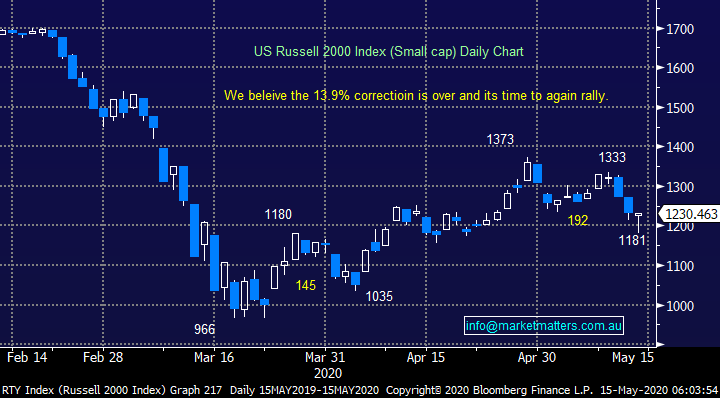

Overnight US stocks impressively shrugged off 2 pieces of potentially damaging news implying to us that the recent correction is complete:

1 – US jobless claims again fell more than expected generating a negative read through on the economy.

2 – Donald Trump said he doesn’t want to talk to his Chinese counterpart Xi Jinping right now continuing to stoke trade tensions.

Our pullback targets have been achieved in both the US and Europe, we are bullish global equities short-term looking for fresh post panic March lows.

Hence after a period of consolidation MM anticipates being active in overseas markets tonight:

Watch for alerts in the Afternoon Report for our International & Global Macro Portfolios.

US Russell 2000 (Small Cap) Index Chart

German DAX Index Chart

3 stocks which may be well positioned for the boost to domestic tourism

As we have discussed previously MM anticipates a boost to domestic tourism with global borders closed which should flow on through into local food, entertainment, and retail growth. Of course businesses who are focused on inbound overseas tourism are stuck between a rock and a hard place – a friend of mine who has a major business importing / selling souvenirs to overseas travellers has suffered unbelievable financial pain from numerous bankruptcies of debtors to a simple grinding halt of day to day activity. Short-term students and migration will undoubtedly fall away but the silver lining from COVID-19 is the reaffirmation of Australia being the lucky country which I feel is likely to increase our attraction over the years ahead.

Australian inbound tourism fell by a record 60% in March, I’m surprised it wasn’t higher although the ~90% plunge in Chinese travellers did feel about right. The Asian money train for local tourism looks likely to be on hold until well into 2021 at the earliest.

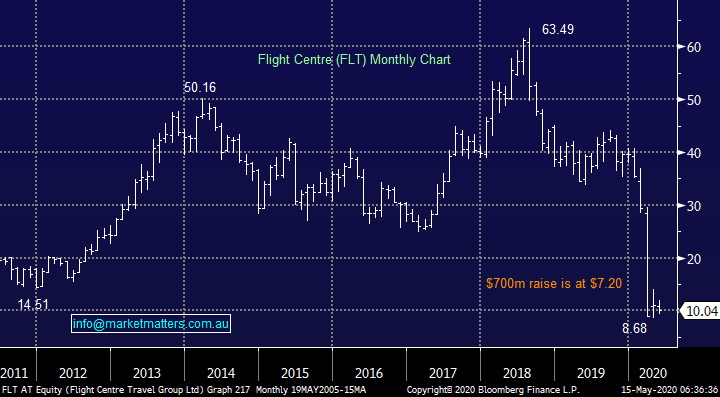

Today I have looked at 3 consumer stocks who may benefit from the dramatic change to our tourism and economic landscape, FLT has been an unfortunate high profile casualty of the pandemic seeing its share price fall ~75% by this unforeseen event illustrating if you’re on the proverbial right side of the fence the likely improvement in business conditions could be very beneficial to correctly positioned or flexible companies.

Flight Centre (FLT) Chart

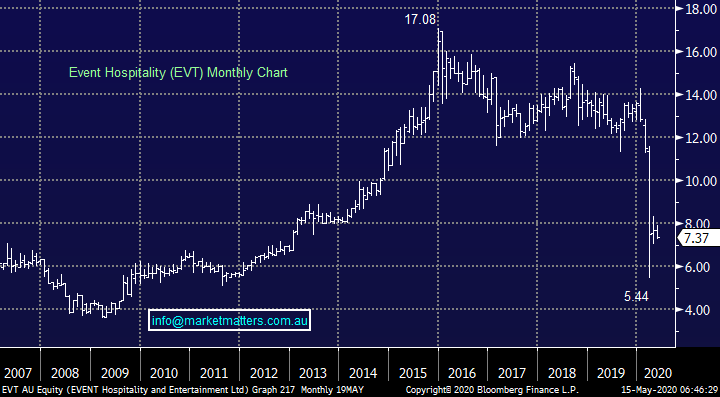

1 Event Hospitality (EVT) $7.37

Cinema operator EVT is a Sydney based $1.2bn based business that has been significantly impacted by COVID-19 and will continue to be so while social distancing remains but having picked up the kids from school this week I feel this is already relaxing in a major way, rightly or wrongly. Scott Morrisons “Step 2” to re-open Australia incudes cinemas although details around how many patrons will be allowed at one time will define potential profitability, or not.

The company was underperforming over the last 5-years which doesn’t excite me, but it is a business that should find switching the lights back on fairly straightforward. We see value in EVT around current levels especially as this has been an excellent reliable dividend payer over the last 5-years, EVT is a potential “outside of the box” yield play moving forward.

MM is neutral / positive EVT.

Event Hospitality (EVT) Chart

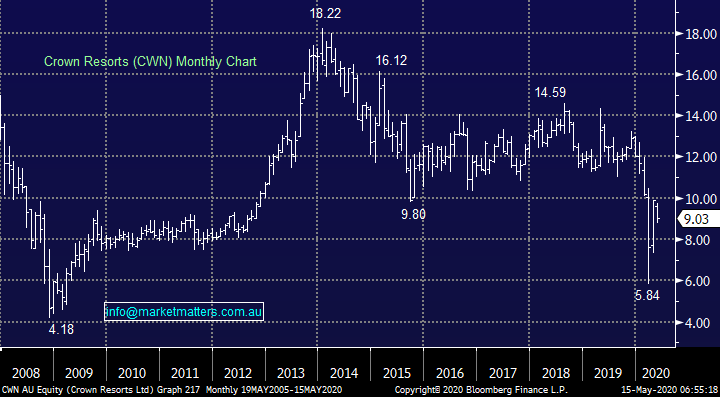

2 Crown Resorts (CWN) $9.03

Obviously CWN is best known for its casinos and looming new build at Barangaroo in Sydney but it also operates hotels, shops, restaurants and even Betfair Australasia although its revenue is really all about gambling on the tables. Revenue from locals will never match those from gambling loving Asia but if they can keep the “lights on” until things return to normal CWN trading sub $10 is likely to look cheap in years to come. It also helps that private equity business Blackstone recently took a 9.99% stake in the business at $8.15, corporate action might well be on the horizon.

The growth of ethical investing funds which we’ve discussed over recent months is a headwind for the stock and should not be underestimated, the likely impact is P/E (valuation) contraction in the years ahead but not necessarily price if the underlying business performs.

MM likes CWN around current levels.

Crown Resorts (CWN) Chart

3 Ardent Leisure (ALG) 35.5c

ALG has been struggling big time since the Dreamworld disaster but the forced change in holiday destinations might just give the amusement park operator a much-needed new lease of life – remember Disney re-opened in China this week. Unfortunately, in February the inquest into the Thunder Rapids ride found the parks systems were “frighteningly unsophisticated” – this sounds very expensive moving forward.

I have friends who have been to both Disneyland and Dreamworld in the last few years and they regard the later as being akin to a local suburb playground from a comparative basis. However, Whitewater World and Sky Point Observation Deck are better assets, it just needs to get Dreamworld sorted once and for all without legal and operational costs dragging the business under.

MM is neutral ALG – all seems a bit hard

Ardent Leisure (ALG) Chart

Conclusion

MM likes EVT and CWN of the 2 stocks looked at today although we are unlikely to buy short-term.

Overnight Market Matters Wrap

- A volatile session overnight in the US, opening sharply low following the renewed tensions with China and the US along with poor unemployment data, only to stage a rally late in the session bringing the major key indices to close in positive territory.

- Crude oil continued to slowly recover, as storage worries decline

- The Airline sector will continue to be a drag, following Singapore airlines reporting an annual loss of ~US$150m.

- The June SPI Futures is indicating the ASX 200 to open 50 points higher testing the 5360 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.