Has the “easy money” already been delivered by the Oil stocks? (FMG, NWH, MRNA US, STO, BPT, BHP)

Platinum Portfolio Name Change: A quick note to say the name of this portfolio will be changing to the Market Matters Growth Portfolio, it’s simply a name change for a few reasons. 1 Platinum Asset Management claim to have dibs on all use of the term Platinum, have written numerous legal letters to us en-route to court action. At MM we’re not that precious and would rather focus on the market than spending money fighting a large fund manager, although clearly MM is on their radar, so we’ll take that as a compliment. 2. We were changing the name anyway when we launch the new MM website (coming soon!) given we’ve got another portfolio focussed on the ASX that we’ve been working on over the past 6 months to add to the mix – more on that at a later date. So the portfolio name will change, however the composition / approach stays the same.

The ASX200 again struggled around the 5600 area yesterday with the index finally closing down -0.5%, a very similar result to most of Asia. The sentiment in our time zone was hindered by the US S&P futures slipping lower throughout the day as increasing global tensions with China appeared to weigh on stocks – not surprising considering the US just passed a bill that could ban some Chinese companies listing on US exchanges, plus for good measure President Trump tweeted yet another criticism of Xi Jinping’s leadership. It feels like there’s enough volatility bubbling away beneath the surface to potentially dent the aggressive gains over the last 10-weeks.

We have been highlighting the risks building from a trade war with China who remain by far the largest importer of Australian goods, I still fear we may become a sacrificial pawn in an elaborate game of chess between the US & China. After recent tariffs on barley and beef China has now “imposed inspection procedures” on our iron-ore, our largest export to Beijing et al. While miners are playing it cool on the outside they might just be quacking in their boots, share prices in the sector are surprisingly quiet at present but considering the aggressive recovery which has been largely enjoyed post March it’s a situation worth monitoring carefully – Fortescue (FMG) has pulled back less than 4% from this week’s new all-time high.

MM is a keen buyer of any sharp sell-offs in the Australian Resources Sector.

Fortescue Metals (FMG) Chart

While it’s important to understand that MM is not calling a major top we do feel there’s a very good chance that the next say 6-8% move for stocks is down hence we have started to increase our cash position after carrying an aggressively long stance over recent months. If we are correct this will give us a great opportunity to add some alpha / value to portfolios as we look to “leg’ a couple of switches we have been monitoring of late. The ASX200 has now been testing ~5600 for over a month which is classic topping “rolling over” price action e.g. even before this year’s sudden drop at the end of February the ASX200 had been testing the 7150-7200 area for 5-weeks i.e. tops tend to rollover whereas bottoms reverse sharply – a function of human psychology.

MM remains bullish equities medium-term but we’re now adopting a more neutral / negative stance short-term.

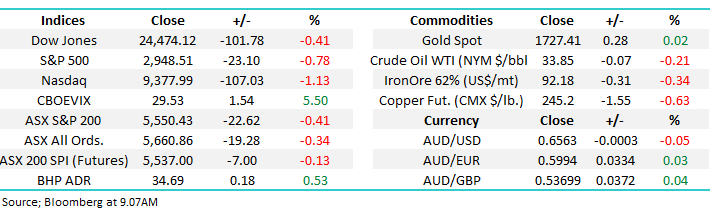

ASX200 Index Chart

NRW Holdings (NWH) surged over 30% yesterday which was great for MM but not the reason I’ve mentioned the stock again this morning. As we outlined in yesterday’s Afternoon Report the mining and construction services business provided a business update which surprised many with a reinstatement of their dividend as they flagged a record 10-months putting them on track to meet full year guidance. Suddenly we have a stock trading on only 10x earnings with a very strong order book plus they are extremely well positioned for the likely acceleration in public infrastructure projects.

The simple read through is both interesting and encouraging for the mining & services sector which ties in with our major overweight exposure to the sector e.g. Emeco Holdings (EHL) also rallied over +13% on Thursday. We believe the repricing of the sector is just getting going and have no plans to reduce our position.

MM remains bullish NWH and related stocks.

NRW Holdings (NWH) Chart

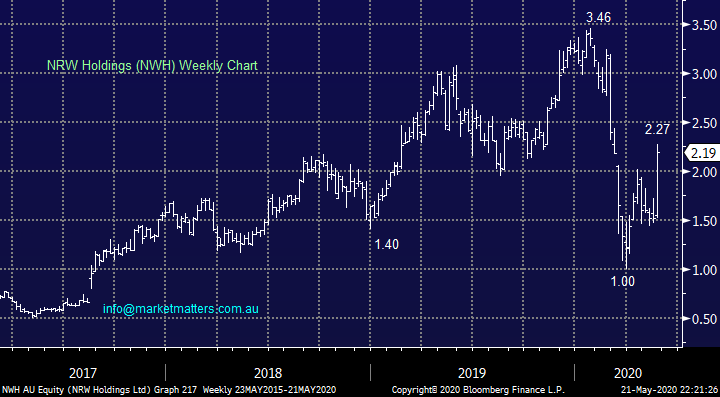

We have been banging the “buy on weakness / sell on strength” drum for many weeks with the important caveat that we have been far keener buyers than sellers, this last part of the equation has now reversed albeit only slightly i.e. we are happy to take some $$ from the table around current levels. One of the best places to see the swings of optimism / pessimism is with US biotech company Moderna (MRNA US) which surged on Monday around hope of COVID-19 test results but the positive rhetoric has not been backed up with cold hard data – the Dow punched 1000-points higher at one stage on the news.

We have already seen a number of these “glimmers of hope” around reducing the impact of the pandemic on the global economy but the strong likelihood is its going to be 2021 until some medical relief is actually enjoyed throughout the broad community. However we really should put things into perspective, remember it’s been over 60-years since we started looking for a vaccine for Malaria and yet the best we have is still only 40% effective – Malaria still killed over 400,000 people in 2018 while COVID-19 currently sits at 332,000.

We believe that the world and equities is going to need to live with COVID-19 for many months to come, at the very best - on the stock level MM is neutral MRNA.

Moderna Inc (MRNA US) Chart

Overseas markets

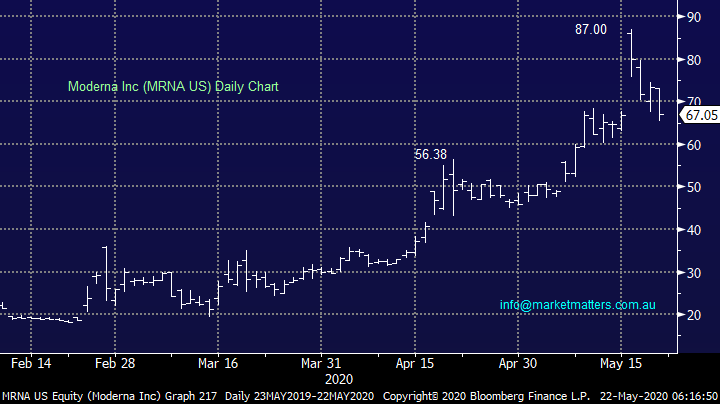

Overnight US stocks were noticeably mixed with the high flying tech based NASDAQ falling over -1.1% while the lagging small cap Russell 2000 edged higher – this degree of divergence is a classic characteristic of a market top but not a definite stand-alone reason to sell. While we ideally will see a few more percent on the upside for US equities our preferred scenario is the next 5-10% meaningful swing is now down.

Investors sentiment overnight by another set of poor economic data, the latest jobs report showed another 2.4m Americans filed for unemployment benefits, taking the total unemployment filings to over 38m since early March – huge social financial pain.

MM remains bullish global stocks medium-term but short-term they are starting to feel “rich”.

US Russell 2000 (Small Cap) Index Chart

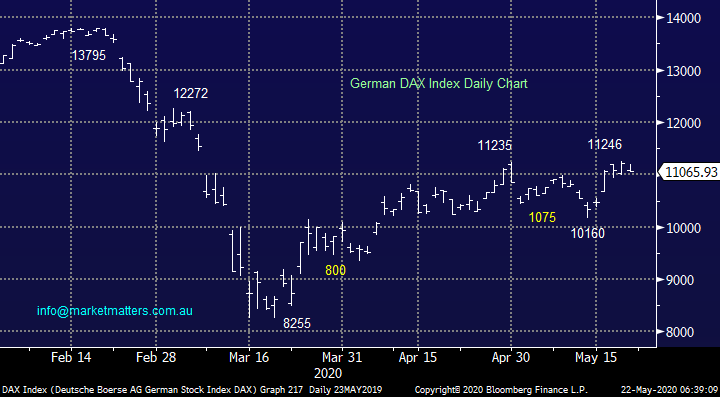

European Indices like our own have been lagging the likes of the tech based NASDAQ and S&P500 but they finally reached our minimum upside target area yesterday, following an impressive 36% recovery we feel the risk / reward now favours the downside – ideally investors will have some money on the sidelines to be a buyer if such a move unfolds.

MM now believes the German DAX is vulnerable to a 10% correction.

German DAX Index Chart

Is it time to take some $$ off the table from the Energy Sector?

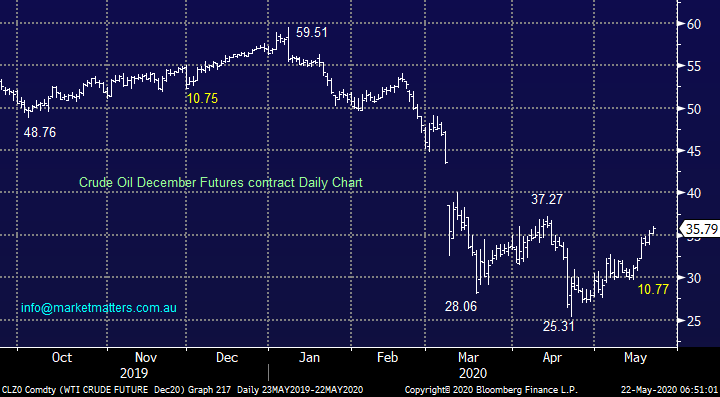

Crude oil, basis Decembers Futures contract, has surged well over 40% since that memorable morning in April when we woke to see spot crude oil (the futures price crude oil for actual delivery) had plummeted to minus -$US40/barrel, in recent years we’ve now seen previously unimaginable negative interest rates and crude oil, who could possibly have forecast that at the end of the millennium. MM went long Santos (STO) as a short-term play during this period of panic and mayhem hence we pose the question today of whether it’s time to take some $$ off the table as crude hits our initial target area.

There are a couple of important points for us to consider with regard to this thought process:

1 – Crude Oil has already rallied 40% to hit our initial target area.

2 – MM is significantly overweight crude oil in our Growth Portfolio holding a combined 6% in Santos & Beach Petroleum (BPT) plus 9% in diversified player BHP Group (BHP) while the Energy Sector is only 4.6% of the ASX200.

3 – Medium-term MM believes the Value Sector will outperform Growth which has positive read through on Crude Oil / Energy.

4 – Conversely the almost exponential growth of Ethical Funds is not supportive of longer-term elevated valuations within the energy sector, although this point is not that relevant here and now in our opinion.

When I put the above 4 points in my morning juicer my initial thought is at these levels MM should be carrying a market weight exposure to Energy, not an extremely long / aggressive position.

Crude Oil December Futures Chart

The Australian Energy Sector halved under the combined weight of a Russia-OPEC price war and COVID-91 but it’s now bounced around 45%, almost in step with the underlying commodity price. Saudi Arabia and Russia have finally ended their price war and subsequently slashed production while US oil companies are decommissioning rigs and shutting wells but this combination of good news, we feel is already largely built into the 40% rally.

However we cannot see oil in the short-term regaining its pre-crisis levels because of the huge oil stock overhang which needs to be simply depleted before prices can again look towards $US50/barrel oil, or the $US60/ barrel which markets challenged in January. The major unknown is on the demand side today, a secondary wave of COVID-19 infections in the developed world is likely to see another dip in prices.

Hence MM is now neutral crude oil and the Energy Sector short-term.

ASX200 Energy Sector Chart

Our initial conclusion is we should in fact take some $$ off the table in this sector which leads us to consider which our 3 holdings is the most suitable, or individually do they still look cheap.

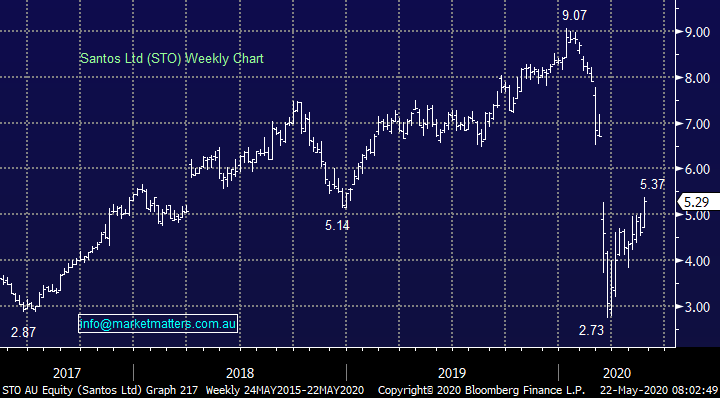

1 Santos (STO) $5.29

Our STO position implemented in late March is already showing a nice 50% paper profit but this doesn’t make it the ideal candidate to reduce our sector exposure although we are mindful the position was taken for the very move which has unfolded. STO is tracking crude pretty well, currently it looks solid and I’m reticent to relinquish a winning position.

MM is currently neutral STO short-term.

Santos (STO) Chart

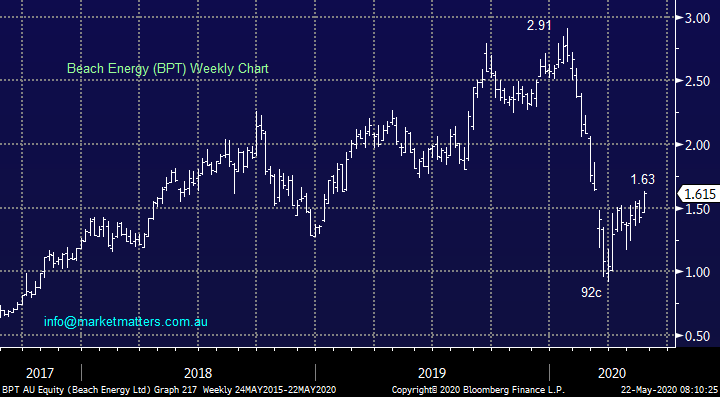

2 Beach Energy (BPT) $1.61

BPT has been in our MM Growth Portfolio since late 2019 hence is unfortunately down courtesy of the reasons discussed in today’s report. BPT has tracked oil in a more magnified / exaggerated manner than STO, in both directions. Although it may pullback short-term like STO it feels good medium-term.

MM is neutral BPT at current levels.

Beach Energy (BPT) Chart

3 BHP Group (BHP) $34.51

BHP looks great and a break up towards the $40 area looks a strong possibility, especially considering our core bullish view towards Value Stocks. There are 2 reasons we are contemplating reducing our BHP holding from 9% to 6% but at this stage we are keen to give the “big Australian” the benefit of the doubt:

1 – BHP is at risk of China imposing tariffs on Australian iron ore.

2 – MM holds 9% in BHP which is on the “heavy side” considering our other positions in the Resources Sector.

However due to our core underlying views towards the market we are keen to remain overweight BHP.

MM remains bullish BHP.

BHP Group (BHP) Chart

Conclusion

The “easy trade” is probably to take profit on Santos (STO) or reduce BHP Group (BHP) but at this stage we are only considering STO as its satisfied all of our reason when we initially went long.

MM is considering taking profit on Santos (STO).

Overnight Market Matters Wrap

- A fairly volatile night overseas as investors took risk off the table - tensions between US and China to blame.

- Crude oil held steady, while gold lost some ground (-1.4%) from its recent highs as did copper.

- As global economies continue to slowly reopen, the number of global coronavirus infections continues to climb, exceeding 5m overnight, with the death rate close to 330,000. The US accounts for more than 1.5m infected and 93,400 deaths so far.

- The June SPI Futures is indicating the ASX 200 to open marginally lower testing the 5540 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.