What’s next after the banks? (WPL, IFL, NAB, AMP, EHE)

The ASX200 continued the weekly theme of “buy the banks and sell defensives” plus with increasing appetite for construction stocks bets are clearly still being laid for a “V-shaped” recovery. Overall when we consider the ASX is still 23% below Februarys all-time high it’s easy to comprehend how cashed up fund managers can justify chasing pockets of the market higher, although some of the buying is clearly being funded by the years better performers e.g. following on from yesterday’s report Commonwealth Bank (CBA) rallied another +2.2% while CSL Ltd (CSL) slipped another -0.2%.

The markets exploded almost 8% from this week’s low yet interestingly almost 20% of the index is down over the last 5-days, the list of casualties is not surprisingly dominated by the defensive healthcare and gold stocks. Conversely with the “Big 4” banks up an average of +18.8% it’s easy to see what’s driven the index higher, the million-dollar question is what’s next on the menu? Are we going to see healthcare regain its charm or will another theme enter the fray? As we said on Thursday morning while we like some of the Australian Healthcare Sector, they feel complacently owned and further downside is required before MM gets particularly excited.

Earlier in the week MM raised the possibility of gold correcting back towards the $US1450 area, comprehendible with the COVID-19 panic clearly diminishing. When we look at the correlation between gold and the ASX since the swing low in December 2018 it feels like some major reversion is almost inevitable. The implication here is the “risk on trade” has more legs in the months ahead while the allure of gold is set to dull in H2 of this year.

MM believes the ASX200 will outperform gold into 2021.

ASX200 Index v Gold ($US/oz) Chart

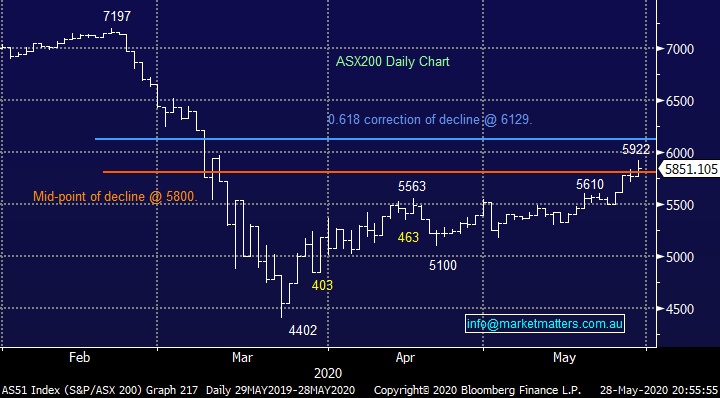

The last 2-days has undoubtedly seen stellar gains by the ASX200 but in both sessions we’ve closed well below the intra-days high, most definitely not a sell signal but potentially the market is at least bracing for a pause – technically we are now bullish while the market holds above 5600. This ties in with our previous picture of stocks versus gold, the “risk-on” play may have much further to evolve although there will inevitably be some bumps along the way.

MM remains bullish equities medium-term but we’re still adopting a more neutral stance short-term.

ASX200 Index Chart

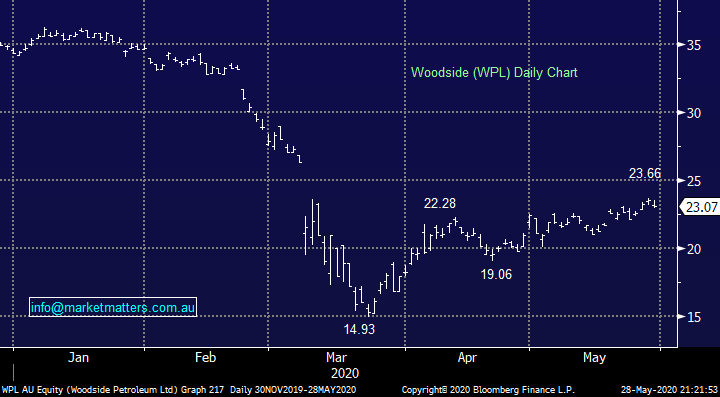

The Oil Sector feels like its slowly cooling after its strong rally from the March panic lows, the December Futures contract has recovered almost 45% while the Australian Oil Sector has surged accordingly, with heavyweight Woodside (WPL) gaining +58% and price leveraged Santos (STO) a whopping +110%. However similar to gold we can see the commodity having a rest, we reduced our sector exposure by taking our money on Santos (STO) last week, a few days early in hindsight but we remain comfortable with the decision at present. The risk / reward is not currently exciting to us within the oil sector short-term.

Our ideal buy zone for WPL is closer to $20.

Woodside Petroleum (WPL) Chart

Overseas markets

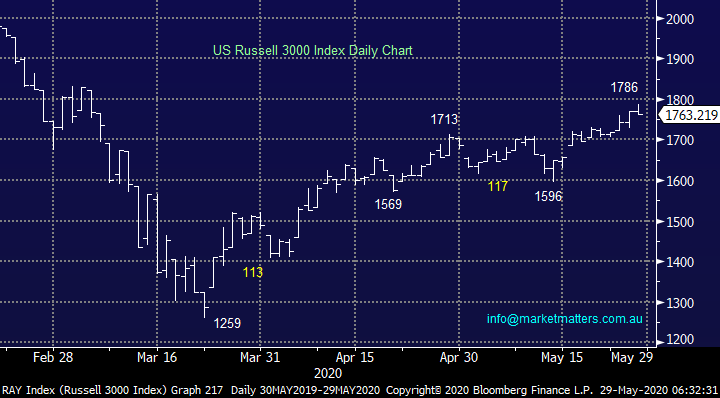

US stocks had a mixed Thursday night reversing down after making fresh recovery highs, our ideal scenario remains a pullback towards the lows of 2-weeks ago for an excellent buying opportunity. The upside momentum is slipping and we took advantage of early strength to take our $$ on United Health (UNH US) for our International Equities Portfolio but it’s important to remember we are primarily focused on looking for stocks to buy into any weakness in the weeks ahead.

MM remains bullish global stocks medium-term but short-term they still feel “rich” or vulnerable to a pullback.

US Russell 3000 Index Chart

What’s the next “hot thing” after the banks?

The RBA has been making some interesting comments over the last few days with the below points catching our attention:

1 – With Australia’s economic downturn appearing better than many feared as we went into lockdown the RBA has all but ruled out negative interest rates & / or extra QE – this huge sugar hit looks to have run its course.

2 – However the RBA does believe stimulus is still required for the tough journey out of COVID-19.

3 - The Reserve Bank governor Philip Lowe is concerned that excess regulation within Australia will stifle our recovery as we attempt to reopen from the virus shutdown. He’s encouraged Scott Morrison to push business & workers to co-operate on reviving productivity growth. "Over the past 20 years whenever a problem has emerged in society we have generally responded with additional regulation. But that process is also limiting the upside and the dynamism in the economy”.

We’ve already seen a range of regulations actually be temporarily paused during the crisis e.g. stopping the night time curfew on trucks enabling better restocking of supermarkets and the relief for company directors on continuous disclosure rules. Just consider the stock broking / advisory industry, ASIC and compliance costs have risen substantially, if these don’t stop rising retail investors will be forced to become totally independent. i.e. the costs do get absorbed by the customer making advice more inaccessible for smaller investors.

If Australia is going to follow the US’s path and reduce our excessive regulation on many industries, we simply have to look at where its created the most pain / costs over the last decade to get a great initial indicator of likely recovery targets. We have focused on the 3 obvious candidates who have made the press over recent times under the cloud of Royal Commission’s but this is a wide subject which we will be considering on a broader level over the week ahead:

1 – The Banks : have been hammered over recent years due to the likes of the Hayne Royal Commission not unwarranted at the time but it’s time to let them breath and function – the market looks to have already embraced this to a degree and when combined with a new belief in a “V-shaped” economic recovery they look attractive after 5-years in the shadows.

2 – Financial Services : like the banks the wealth managers such as AMP and IOOF Holdings (IFL) suffered painfully at the hands of the Hayne Royal Commission.

3 – Aged Care: The royal commission into the Aged Care sent the stocks in the sector plummeting as the market focused on fines and increased operational costs, very logical after the Hayne Royal Banking Commission.

IOOF Holdings (IFL) Chart

1 – The Australian Banks

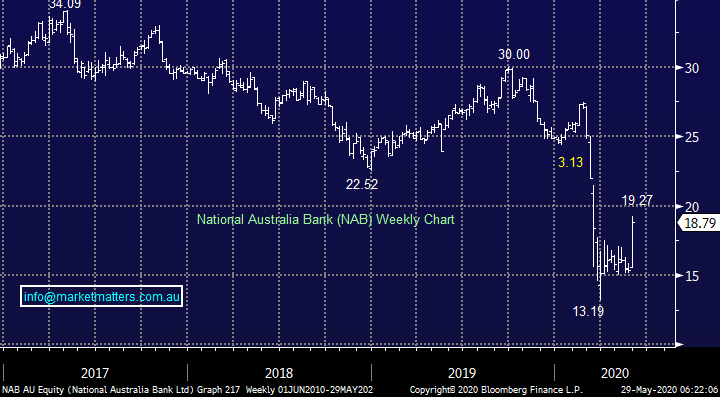

The banks have been dominating the market this week for all the right reasons which makes a pleasant change, NAB shown below has surged 24% this week alone. I feel the banks have primarily been the benefactors of a belief in an economic “V-shaped” recovery – over the last few months we have felt this was highly likely in many industries but not all, this playbook feels on the money but overall things aren’t as bad as many feared.

All of the RBA’s recent rhetoric is supportive of the battered Australian Banking Sector with 3 points standing out:

1 – The local economy is recovering faster than initially feared implying the banks’ bad debts many not be as huge as many feared and importantly a calamitous result was priced into their share prices.

2 – Negative interest rates / additional QE being ruled out is the removal of a potential headwind on margins for the Banking sector.

3 – Any reduction of the hugely expensive regulatory costs for the banks would be welcomed by all.

Overall, the banks are suddenly finding themselves in the eye of the storm of positive news, its been a while! While the risk of a secondary lockdown continues to diminish the banks look good and with fund managers underweight share price appreciation can continue to surprise on the upside.

I’m planning a video with our banking analyst next week (Tuesday) so will publish that on Wednesday morning. He is not as positive the sector, however analysts are sometimes slow at moving when inputs change!! However, he’s a good analyst with a very pragmatic approach. Keep an eye out for that.

MM likes NAB while it can hold above $17.

National Australia Bank (NAB) Chart

2 – Financial Services

The Hayne Royal Commission unearthed some horrendous practices from the likes of AMP and IOOF (IFL) but their share prices have been smashed accordingly, remember AMP was trading above $10 before the GFC. These aren’t necessarily top-quality businesses, but we are at the stage of the stock market recovery where investors are flocking to “cheap” stocks as opposed to ones for the next decade.

As the migration up the risk curve continues there is a definite argument for MM to consider jumping on board the train with a small portion of our MM Growth Portfolio.

MM likes IFL for another 30% upside – stops under $4.50.

MM likes AMP for another 20-25% upside – stops under $1.45.

Hence on a risk / reward basis we prefer IFL.

AMP Ltd (AMP) Chart

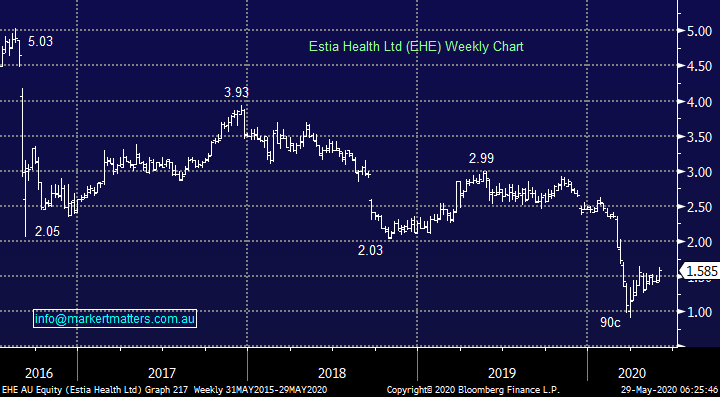

3 – Aged Care

The Australian Aged Care Sector has been smacked over the last 5-years for several reasons including the September 2018 announcement of an undoubtedly expensive Royal Commission into the Sector – Estia Health (EHE) plunged around 30% on the news. In the past the sector was expensive as investors focused on our ageing population now its arguably cheap.

My initial kneejerk thoughts were COVID-19 would diminish the need for Aged Care facilities for all the wrong reasons but now as we see how the pandemic has unfolded in Australia we feel it will be more in demand than ever but costs and quality will need to go up, potentially helping the likes of EHE – its going to get more expensive to live out a long, healthy and happy retirement.

MM likes EHE initially for a further 25% bounce.

Estia Health (EHE) Chart

Conclusion

MM likes the 3 stocks / sectors briefly looked at today as the expensive regulatory landscape diminishes, we will be investigating this in more detail moving forward.

Have a great day!

James & the Market Matters Team

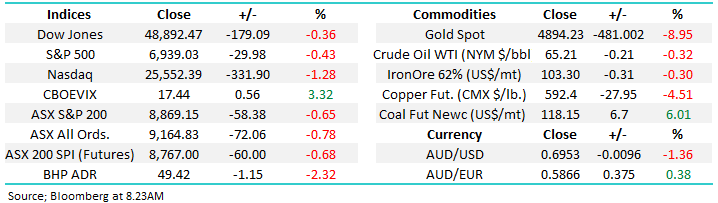

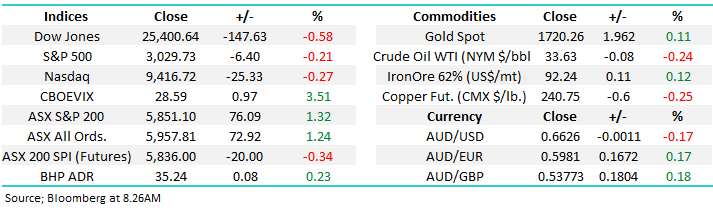

Overnight Market Matters Wrap

- The US equity markets were not able to sustain its gains early in the session as the US-China quarrel reignited and US President Trump to hold a press conference tonight with regards to the issue.

- On the energy and commodities front, crude oil, gold and iron ore all gained, while Dr. Copper underperformed against its peers.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.23% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to open marginally lower, towards the 5835 level this morning with an expected volatile session with the MSCI index rebalance by COB.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.