Is it now time to take our money from the iron ore names? (BIN, BHP, RIO, FMG)

The ASX200 rebounded strongly from early loses yesterday to finish the session up over +1%, the buying was not as broad-based as we’ve been accustomed to with over 35% of the market closing lower. However when the big miners are surging higher plus heavyweight CSL finally finds some love and bounces over 3% we inevitably get a strong day for the index. The Materials Index ended the day up over 3% with building stocks surprisingly occupying 3 of the top 4 spots although it was iron ore which dominated the headlines aided by Chinese manufacturing data coming in better than expected - we will revisit the topical bulk commodity sector again today as MM holds a substantial exposure to 2 of the 3 major names across 3 of our portfolios.

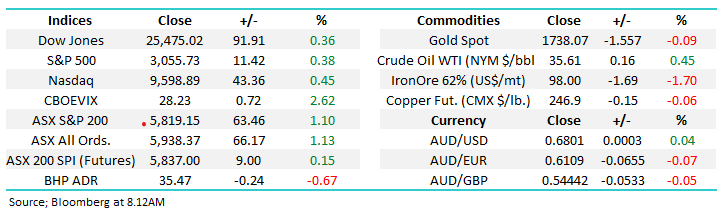

Another noticeable benefactor of the strong Chinese PMI data was the Australian Dollar which had already soared above 68c overnight reaching its highest level since early February, interestingly before stocks plunged due to the COVID-19 pandemic. As we’ve witnessed since the stock market lows in March the $A has a knack of leading pullbacks by local stocks, this makes sense because it’s regarded as a quasi-barometer of economic strength both at home and abroad. A couple of important conclusions we take from the latest bout of $A strength which aligns with a core MM macro view:

1 – There are no sell signals in play for the ASX200 while the $A makes fresh multi-week highs, if anything we should eventually see some catch up by stocks which have been lagging of late – see chart below.

2 – MM remains bullish the $A targeting the 80c region which by correlation is very positive for local stocks medium-term.

3 – More directly a strong $A reinforces our preference for resource stocks over the heavily owned $US earners who have been outperforming for years.

MM remains bullish both the ASX200 and $A.

ASX200 v Australian Dollar ($A) Chart

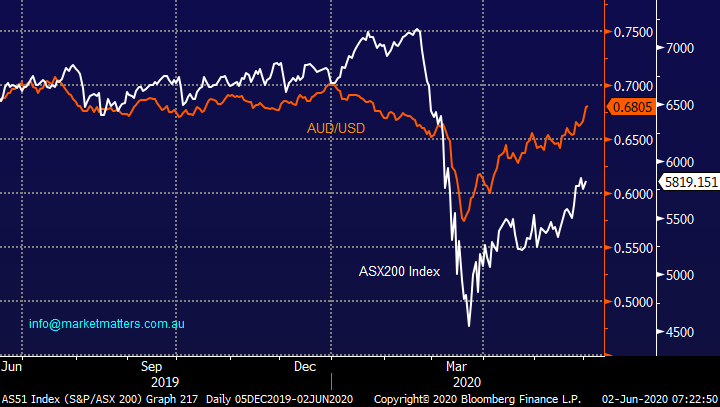

The last 4 trading days has seen the local index rotate in a 220-point range, we feel the longer it can hold around 5800 area the more likely an attempt at 6000 is just around the corner – not rocket science. While the banks and resources are taking it in turns to carry the markets torch all feels solid on the stock / sector level.

MM remains bullish equities medium-term but were still adopting a more neutral stance short-term, just!

ASX200 Index Chart

Yesterday MM enjoyed waste management / recycling business Bingo (BIN) surging more than 7% to fresh multi-week highs, the stock still looks great which implies the building sector can add to its recent gains – we will be watching for opportunities as discussions unfold around the best ways to stimulate the Australian economy e.g. in the AFR yesterday was an article along the lines of “money for home renovations would have a great impact on jobs”.

MM remains bullish BIN with an initial target above $3.

Bingo (BIN) Chart

Overseas markets

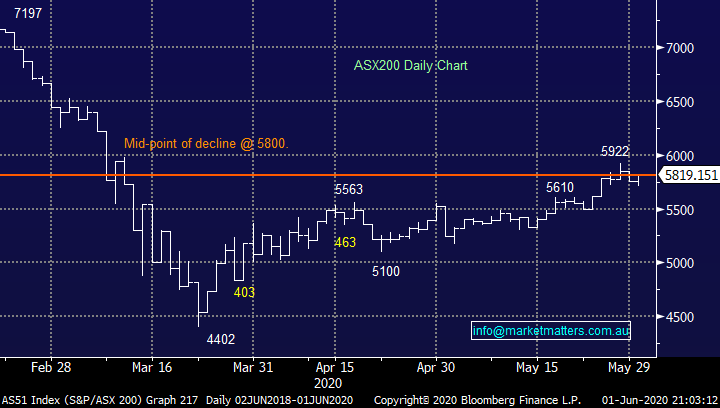

US stocks had a relatively quiet night considering the turmoil unfolding in the country but again they did illustrate they need more than a little bad news to send them lower i.e. there’s still plenty of buying into any weakness.

MM remains bullish global stocks medium-term but short-term they still feel “rich” or vulnerable to a pullback.

US Russell 3000 Index Chart

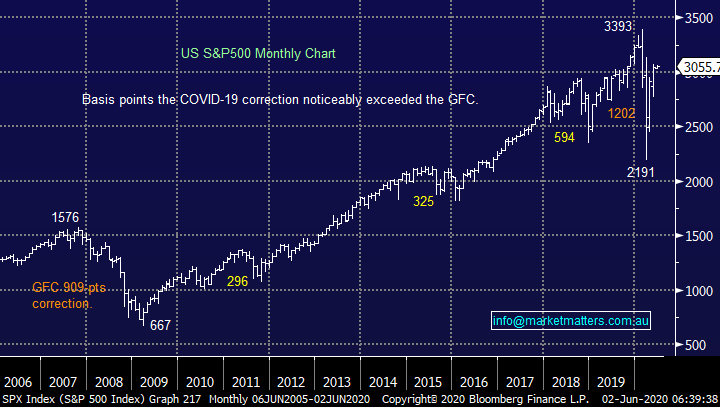

Remember, medium-term we remain bullish US stocks targeting a break out to fresh all-time highs above 3500 for the S&P500.

US S&P500 Index Chart

Is time to take some money from iron ore names?

While grabbing profits can often be the easiest trade its not always the best for long term portfolio performance, trends have a habit of running for longer than many expect, both bullish and bearish. As we often discuss the price of an asset is determined by supply & demand, in the case of iron ore both have been bullish of late sending the price of the bulk commodity up 40% in just a few months:

1 – Demand: as we saw yesterday the Chinese economy is much stronger than many had forecast and they are the world’s major consumer of iron ore for steel production / usage.

2 - Supply: questions are being asked of Brazil’s ability to deliver iron ore due to rising pressures from COVID-19, the Latin American country is responsible for ~25% of global supply.

With both of these 2 factors being bullish the result is higher prices, just as we’ve witnessed. The break of the psychological $US100/t has caught the attention of many in the press but as the chart below illustrates its been rising for weeks – note the chart below is in Chinese Yuan. Not surprisingly just for good measure we’ve also been seeing China’s stock piles heading south but even as prices rally they will also need to restock moving forward. We are not calling iron ore to rally further but we do feel it will stay higher for longer which will flow through to more upgrades for the sector. - analysts’ consensus for iron ore is currently closer to $US60/tonne!

Undoubtedly like the rest of the world Brazil will recover from the virus and aggressively kick start its production but we don’t believe the subsequent drop in price will be too dramatic as China stimulates its economy following COVID-19. Our best guess at this stage is iron ore in the chart below will rotate between 700 and 775, this will make the Australian producers cash cows for many, many months to come.

Iron Ore September Futures (CNY/MT) Chart

1 – BHP Group (BHP) $35.71

Diversified miner BHP has become a wonderful cash cow for investors, especially with iron ore soaring higher, estimates are for its next dividend to be ~60c fully franked putting the stock on a very healthy yield compared alternatives in todays “zero interest rate” environment. At MM we believe crude oil has bottomed, iron ore will stay higher for longer and inflation / global growth is on the rise – what’s not to like for BHP.

MM remains bullish BHP medium-term with a target ~$45.

BHP Group (BHP) Chart

2 – RIO Tinto (RIO) $97.23

RIO has been the laggard of the big 3 names but as we’ve seen recently stocks have been snapping back into line with aggressive moves, my guess is RIO will do the same and play some much needed catch up.

MM remains bullish RIO with an initial target 8-10% higher.

RIO Tinto (RIO) Chart

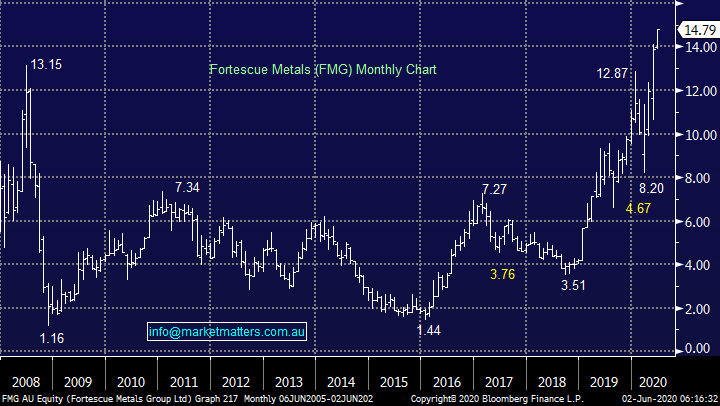

3 – Fortescue Metals (FMG) $14.79

FMG has been the clear winner from the dynamic rally by iron ore, Twiggy Forests company is now 30% larger than RIO in the S&P index which is likely to be causing some of the current squeeze higher. However if we are correct and prices do remain higher for longer FMG is a huge beneficiary and the dividends will keep on flowing making this a great yield play just when some of the banks have turned off the tap and some of the more traditional “yield plays” are facing headwinds. However, I will keep my ear to the ground because if I hear too many investors are buying FMG purely for yield it will be a concern.

Fortescue Metals (FMG) Chart

As we have illustrated below FMG has clearly tracked the iron ore price fairly closely over the last 18-months although it’s got a little ahead of itself at present. Considering a lot of the bullish news is already factored into the ores price I’m reticent to chase FMG at current levels but it would be very interesting back towards $13.

MM likes FMG but the risk / reward is not compelling as we approach $15.

Fortescue Metals (FMG) v iron ore (CNY/MT) Chart

Conclusion (s)

1 -MM remains bullish our holdings in BHP and RIO although short-term a pullback would not surprise as the press gets a hold of the $100/tonne story classic timing for at least a short-term top i.e. “buy on rumour, sell on fact”. We would currently consider FMG ~$13.

2 - We are bullish the resources sector medium-term, but we are looking towards the “cheaper” names to increase our already overweight stance i.e. South32 (S32), Iluka (ILU) and Alumina (AWC) which we have already started accumulating.

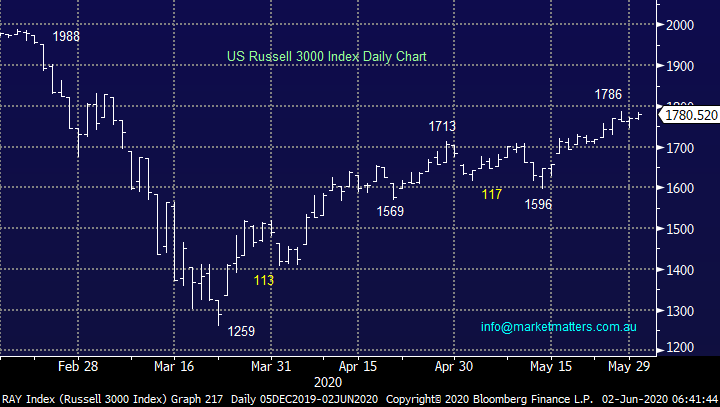

Overnight Market Matters Wrap

· The SPI is pointing to a slightly positive day for Australian equities, last up 9 points to 5837. This comes after the Dow and S&P 500 rallied 0.4% and the NASDAQ closed 0.7% in the black.

· ISM Manufacturing in the US remains in contraction, but the reading rose to 43.1 from 41.5 last month, which was the lowest level in 11 years. Investors seemed to shrug off the protests over the death of George Floyd however some were concerned they could lead to an increase in coronavirus cases.

· The RBA meets today where its widely believed the policy will be unchanged despite the economic impact of the coronavirus perhaps not being as severe as initially thought. The $A rallied and is currently trading at US68c.

· Copper and nickel were strong on the LME while aluminium was the only negative amongst the complex. Iron ore fell 2% but is still holding above $US100/t while gold is at $US1750/oz.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.