Seller no buyer for the afternoon (HLS)

WHAT MATTERED TODAY

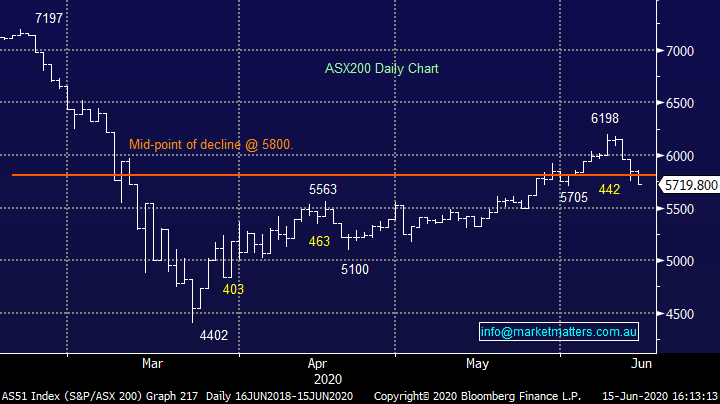

Equities were resilient through the morning in the face of far weaker US futures markets which initially traded -1.4% ahead of our market open. The banks were bid up in the morning before coming off the boil to be one of the more downbeat sectors at the close. Energy was the worst hit on oil markets coming off. An interest week set up there with further OPEC+ cuts to be confirmed –a number of member countries fell short of their promised cuts last time around and look to be backing down on promises that they will make up the difference in the month ahead. The safe havens – and potential winners from the impact COVID has had – in communications and utilities were the best of a bad bunch with all sectors closing more than 1% lower for the day. Overall, the positive morning turned into a weak session and now the third in a row which has seen the index fall more than 100pts, closing -463pts/-7.5% below the recent high last Tuesday.

Soft data out of China was the one of things that weighed on local equities through the afternoon. While unemployment came in slightly ahead of expectations, a miss on Retail sales at -2.8% year on year, and industrial production at +4.4% on a 5% expected print weighed on local risk assets. Reports of further community transmissions of COVID-19 were also a concern – both locally and in China which could be set for a second wave after Beijing had positive cases over the weekend. NSW saw their 3rd community transmission case in 3 days, while a second attendee of protests in Melbourne last week tested positive raised concerns of an explosion in cases as a result of the gatherings. The afternoon saw the market fall 130pts to close on the sessions lows – more so an orderly sell off than panic, but a weak final number concerns short term.

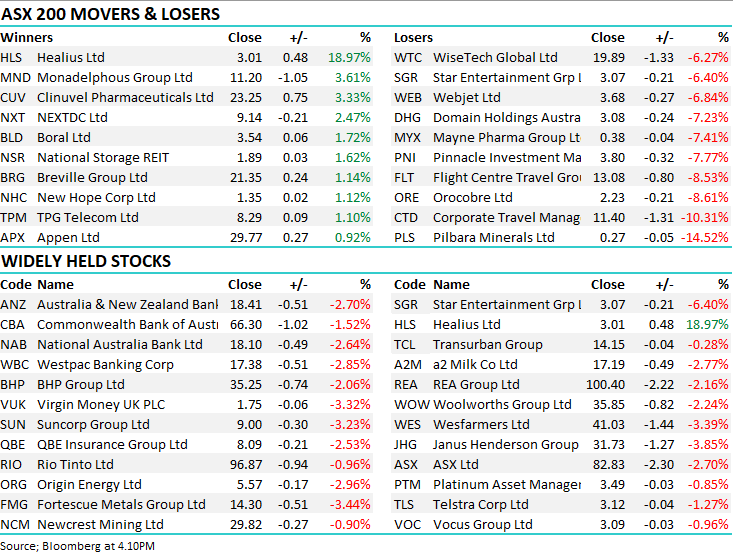

On the stock news side, Boral’s new CEO was announced – the market clearly has high regard for ex-Adelaide Brighton (ABC) chairman Zlatko Todorcevski and bid the stock up against a weak session. Jumbo Interactive (JIN) didn’t trade in the session pending a release on its WA re-seller business. Healius was the big winner though – more on HLS below.

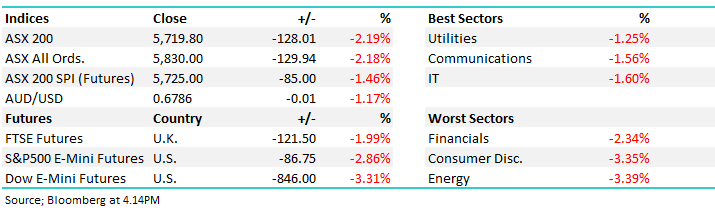

Overall, the ASX 200 fell -128pts / -2.19% today to close at 5719 - Dow Futures are trading up -846pts/-3.31%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Healius (HLS) +18.97%: received a $500m bid from private equity firm BGH for the medical centre portion of the company over the weekend which helped shares pop today. The bid represents around 80c/share with around 18% of the group’s revenue and 22.5% of the group’s EBIT attributable to the sold segment at the FY19 results. Healius will maintain ownership of pathology, IVF clinics, imaging, and day hospitals. HLS has been tussling with suitors consistently for nearly 18 months now – Hong Kong’s Jangho and Swiss PE firm Partners Group had both launched takeover bids. The deal is expected to be completed by year’s end and will simplify the business and sure up the balance sheet. The hope now is that Partners Group will return to the table to collect the rest of the business.

Along with the sale, the company provided further update to the market on how business had tracked since deferring the interim dividend in mid-April. Demand for pathology has been strong on the back of COVID testing while dental, IVF and day hospitals were seeing a recovery, moving back towards pre-COVID utilization levels. The company is confident that it will remain within debt covenants of 3x net debt to EBITDA at the ed of the financial year while it successfully refinanced the facility today, providing an extra $70m worth of liquidity. It’s rally today puts it on the expensive side, though further corporate interest seems likely.

Healius (HLS) Chart

BROKER MOVES:

· Star Entertainment Cut to Underweight at Morgan Stanley

· Crown Resorts Raised to Overweight at Morgan Stanley; PT A$12

· Flight Centre Raised to Buy at Morningstar

· Harvey Norman Raised to Hold at Morningstar

· CSR Raised to Hold at Morningstar

· Super Retail Raised to Hold at Morningstar

· Tabcorp Raised to Buy at Morningstar

· Perpetual Raised to Buy at Morningstar

· Sims Raised to Buy at Morningstar

· Pendal Group Raised to Buy at Morningstar

· Platinum Asset Raised to Hold at Morningstar

· Bingo Industries Raised to Buy at Morningstar

· oOh!media Raised to Buy at Morningstar

· Vicinity Centres Raised to Buy at Morningstar

· Reliance Worldwide Raised to Outperform at Credit Suisse

· ASX Cut to Underweight at JPMorgan; PT A$78

· New Hope Rated New Buy at Goldman; PT A$2

· Fortescue Cut to Hold at Shaw and Partners; PT A$13.80

· Stockland Cut to Neutral at JPMorgan; PT A$3.50

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.