3 stocks of interest as we learn from March (NCM, RMS, ALL, TCL)

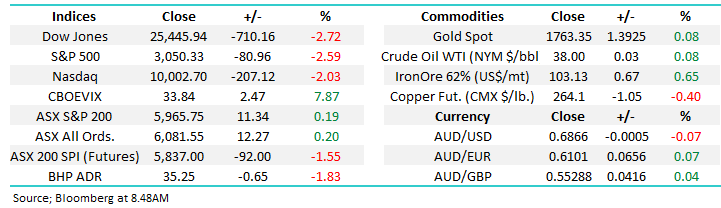

In an almost stealth like manner this markets almost turned boring on us, the ASX200 has now spent the last 6-trading days in a tight 125-point / 2% trading range, strangely it doesn’t feel like it but the numbers don’t lie. Yesterday saw another slightly higher close with 53% of the index closing in positive territory, with the exception of another strong performance by the Gold Sector nothing particularly caught my attention although there was definitely an undertone of “risk off” permeating through the market.

Considering the papers are full of headlines like “Victoria calls in the army to combat second wave” we regard stocks treading water as a stellar effort, as we continue to point out with investors / traders short or underweight equities there are likely to be plenty of buyers into weakness. Although it’s not all bad news, I was very encouraged to see Scott Morrison appoint Pru Bennet to start addressing Australia – China relations, in our opinion anybody who doesn’t believe we need the Asian goliath to help maintain our fortuitous standard of living simply hasn’t read the reality script.

Unfortunately, virus cases continue to rise globally with over 160,000 new cases in the last 24-hours, were rapidly approaching 10 million infections & 500k deaths as the risk of a second wave intensifies. From a markets perspective the US continues to look the most concerning, 4 states have just recorded their highest single day of new cases illustrating that much of the country is still in the eye of the storm, forget a 2nd wave the 1st one isn’t finished yet! Stocks are currently wobbling as the pandemic is not allowing things to return to normal as fast as stock markets were factoring in, today we’ve looked back at March for any stocks that might again sell-off too hard and produce buying opportunities – overnight the Dow plunged over 700-points / 2.7% as cash again emerged as a very attractive asset class.

With no major change to the index for much of June it should come as no surprise that our flagged further tweaks to the Growth Portfolio haven’t waivered – we are looking to increase risk around 6% lower and / or take some money off the table about 5% higher.

MM still remains overall bullish equities short & medium-term.

ASX200 Index Chart

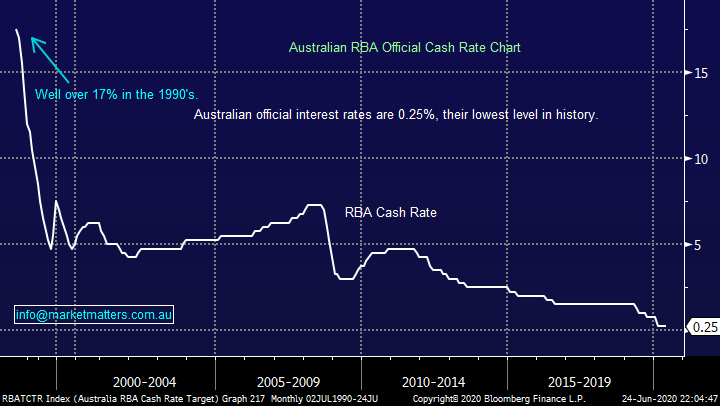

US Election.

The US Presidential Election is looming fast, its only 131 days until November 3rd, will it be Trump again or can Joe Biden sweep the Democrats back to power. Prior to the coronavirus Trump was so far ahead I probably wouldn’t be addressing the issue so far out but things have changed as even his hard core supporters appear to be doubting how efficiently he has coped with the virus plus the recent “Black Lives Matter” protests. Suddenly the bookies have Biden as favourite, overnight Betfair had Biden at $1.66 with Trump blowing out to $2.82, there’s a lot of water to go under the bridge yet as Donald Trump starts to crank up his campaign trail and we should remember it’s how he finishes that matters, not how he starts.

My “Gut Feel” is its more of a 50-50 punt at this stage, not my game, but Trump has been a market friendly President and you cannot blame him for the virus outbreak. In terms of how Trumps dealt with the pandemic he’s got the country back to work as fast as many, it’s just unfortunately resulted in a lot more deaths than was probably necessary. The stock markets telling the story that they expect much of the same i.e. relatively high human casualties, but the economic engine will keep firing. The economy will probably be one of Trumps big cards come November hence he’s likely to remain keen on as much stimulus as possible over the coming 4-months.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

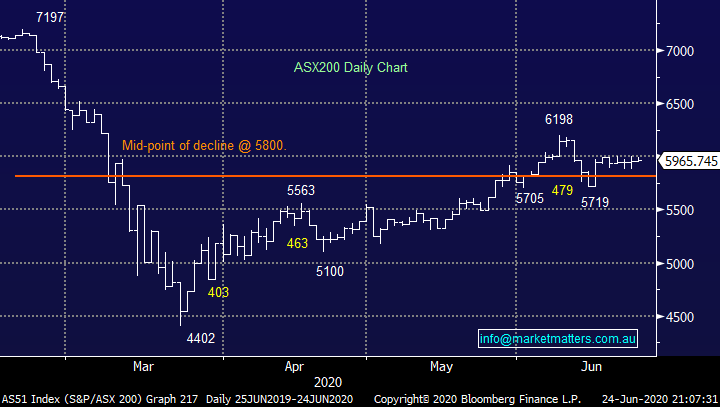

Interest Rates.

We’ve all heard about interest rates being at their lowest level in history, I’m sure anybody with a mortgage is getting used to it! Overnight I read a story on Bloomberg that almost defies belief, Austria has successfully issued a 100-year bond with a yield of just +0.88%, it received $A2.3bn which is an awful lot of money prepared to accept less than 1% per annum for a whopping 100-years. History tells us that periods of high inflation come about in the same cyclical manner as recessions but there’s clearly a lot of folk putting safety way ahead of returns –we believe investors are wearing blinkers on rates at the moment.

MM believes interest rates are bottoming but any meaningful rally may take some time to unfold.

Australia’s RBA Official Cash Rate Chart

Global Markets.

Whether its rising cases of coronavirus or Trumps potential demise in November’s election there’s plenty of uncertainty returning to US equities and as its often said “somethings got to give” and perhaps last night it did. We still have the same 2 scenarios in play with the S&P500 but the first scenario below is now looking more likely after last night’s fall across global stocks:

1 – we are indeed correcting the whole advance from the March 23rd low with our ideal target ~5% lower i.e. the time to again commence accumulating stocks.

2 – stocks will again shrug off coronavirus fears and were heading ~10% higher before MM will consider reducing risk / market exposure.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

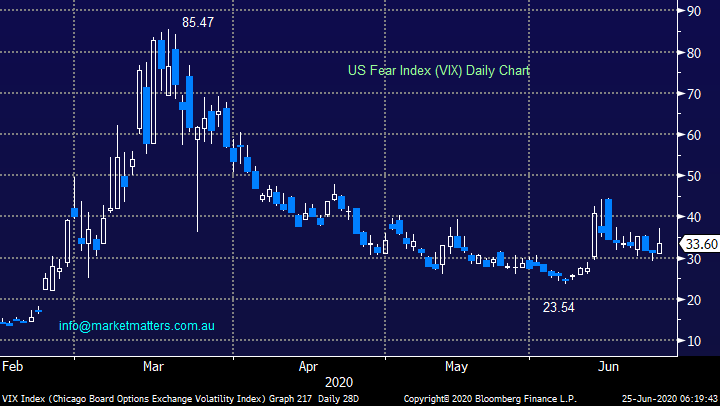

As would be expected on a night when stocks take a battering the US volatility index (VIX) rallied but what caught my eye was its inability to remain close to its highs implying sophisticated traders are still fading this move believing that the panic moves of March will not be repeated, or in other words stocks are indeed a buy into any sharp pullbacks. I was out with a couple of institutional traders last night and they talked about the huge blow up’s in the US hedge fund space, a fund they deal for lost $4bn in 8 days and went out the back door. As one of the guys rightly said, we won’t see capitulation / liquidation driven moves like that for another 5-10 years.

MM remains bullish volatility but from lower levels.

US Fear Index (VIX) Index Chart

3 stocks to target if we get another leg lower.

The coronavirus is again scarring investors as it should when many stock market sectors are potentially priced for perfection, or at the very least a quick and successful rebound from COVID-19. Today we’ve given consideration to what stocks we want to buy if indeed equities are going to take another leg lower with obvious regard to risk / reward, remembering of course we may be wrong and another very painful economic lockdown might be around the corner. Markets evolve and move like an amoeba and it’s our belief that not all stocks / sectors will be thrown into the proverbial sin bin this time around but if we do see aggressive selling in the SPI futures even the strongest of stocks are likely to correct courtesy of arbitrage.

We are considering 2 very different styles of companies into a potential leg lower:

1 – stocks that have shown their hand in 2020 and look great but decent entry has proved tricky, hence a reasonable pullback will attract MM.

2 – stocks very sensitive to economic growth and the coronavirus, another sharp drop may yield good risk / reward buying levels.

MSCI World Index Chart

1 - Gold Sector.

MM has been looking for an ideal time to buy into the precious metal sector which has enjoyed a strong post March recovery, but we’ve probably been cautious to a fault due to the markets record long position. However we note that during the worst of the COVID-19 panic it was cash / bonds where investors flocked as opposed to gold, and overnight as the Dow fell over 700-points the precious metal did indeed retreat ~$US25/oz from its high taking gold ETF’s down ~2% in the process. We currently have 2 stocks firmly in our sights:

1 – Newcrest Mining (NCM) $31.56: we like the largest player in the Australian market, ideally under $30.

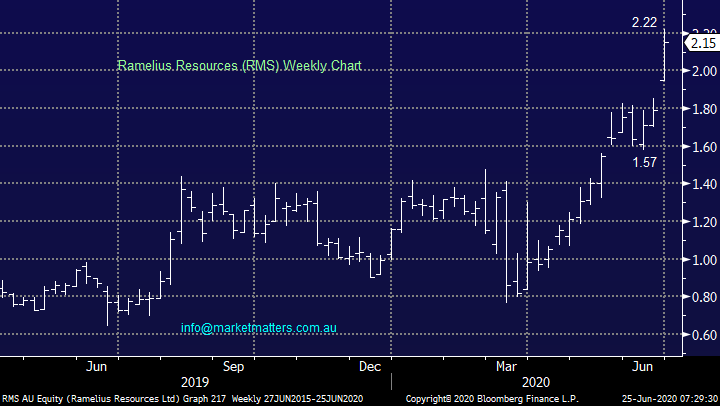

2 - Ramelius Resources (RMS) $2.15: this $1.7bn WA player is rapidly evolving into a major Australian gold company and with an all-in cost of ~$A1200/oz its thoroughly enjoying the precious metal trading ~$A2575/oz. We currently like RMS back under $2.

MM likes NCM and RMS ~5% lower.

Newcrest Mining (NCM) Chart

Ramelius Resources (RMS) Chart

2 Aristocrat Leisure (ALL) $26.19

Any degree of meaningful secondary lockdown is likely to weigh heavily on the Travel and Tourism Sector and this has already been unfolding to a certain degree over the last week but we don’t yet see any signs of “panic selling”. One of our preferred plays to this eventuality is through gaming business ALL, primarily because although it will indeed see a significant drop in revenue it doesn’t carry the huge overheads of some in the sector like the casinos and travel businesses.

MM likes ALL under $24.

Aristocrat Leisure (ALL) Chart

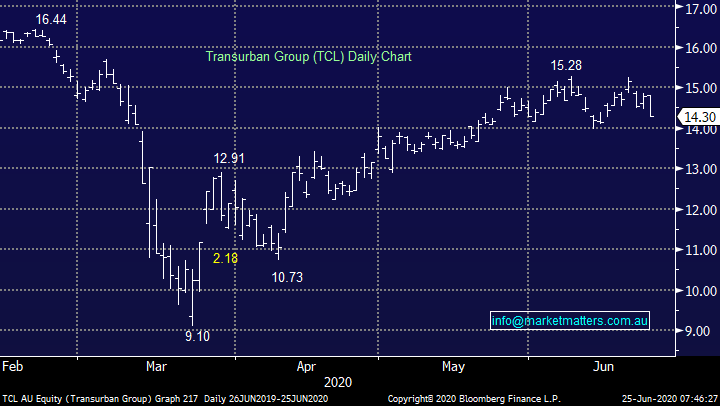

3 Transurban Group (TCL) $14.30.

Toll operator Transurban (TCL) should come under pressure if markets decide another period of lockdown is possible / likely as traffic on the roads will again dry up. This week they cut their dividend for the full year with a 16c payment for the final dividend of FY20, nearly half they paid at the half year – not unexpected but clearly not a positive. They also flagged that dividends for FY21 will be paid out of free cash flow (FCF) and won’t be topped up with any capital return that has helped bolster the yield for the stock over recent years. Capital will instead be used to strengthen the balance sheet and fund further developments as they come up.

In terms of the trading update they said traffic volumes had been improving but this may now be short-lived, some roads have been enjoying around 90% of the pre-COVID use. Across the network traffic for the week of the 14th of June was around 20% below last year, continuing the improvement from the circa 60% hit seen in April. We still believe TCL will just manage to sneak through the COVID-19 period without the need to raise capital given they are still compliant with debt covenants, but investors will feel it in falling yield as a result. We like TCL though and it will continue to improve as we return to the road. MM remains a holder in our Income Portfolio.

MM likes TCL ~6% lower.

Transurban Group (TCL) Chart

Conclusion

MM remains a keen buyer of stocks into weakness with the above 3 on our potential shopping list.

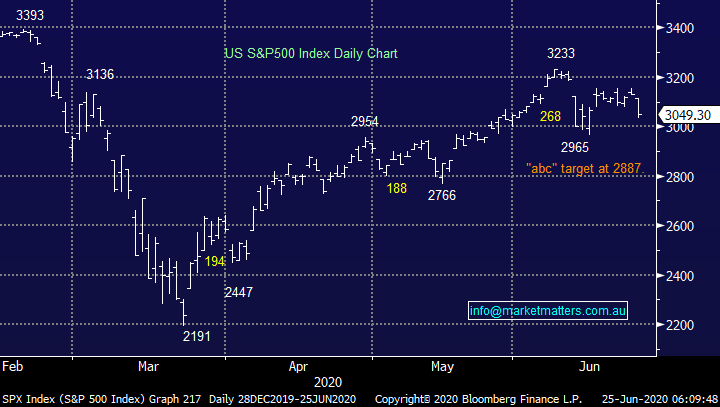

Overnight Market Matters Wrap

- Concerns over the resurgence of the coronavirus flared overnight which saw US stocks trade lower

- The yield on US 10-year treasuries fell as investors flocked to the 'safe haven' assets.

- On the energy front, crude oil lost 5.5% on the growing concerns of the second wave of coronavirus, while gold too weakened marginally, off 0.2%.

- The September SPI Futures is indicating the ASX 200 to open lower, testing the 5900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.