A brief Thursday Report (CSL, WEB, SUN)

**As I mentioned yesterday today’s report is a brief one as I’m travelling, services will be back to normal this afternoon**

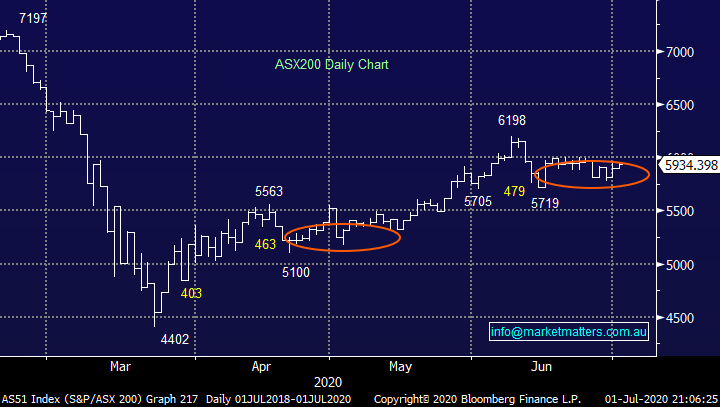

The ASX200 kicked off the new financial year in jittery & fairly lacklustre fashion, but it finally managed to close up +0.6% which in our opinion was another solid performance considering positive news currently feels about as rare as hens teeth - one of the main topics of conversation I’m hearing is focused on whether Australia can contain Victoria’s second-wave of COVID-19. The banks gave the market its backbone on Wednesday with the influential sector firm across the board with NAB & Westpac standouts both rallying almost 2%, conversely the healthcare stocks were the most noticeable laggards slipping -0.8%.

On the economic front Building Approvals came in down -16.4%, twice as bad as forecast, but the data was largely ignored as investors appear to be regarding economists’ forecasts of the underlying damage inflicted COVID-19 as nothing more than glorified guesswork, it’s the forward looking macro picture of the next 12-18 months where the most attention is being focused. In a nutshell on this front MM still believes it’s time for the reflation trade when theoretically the Australian Resources Sector should be one of the star performers, if we are correct with this view MM believes we are likely to see markets start to walk this path through this new quarter.

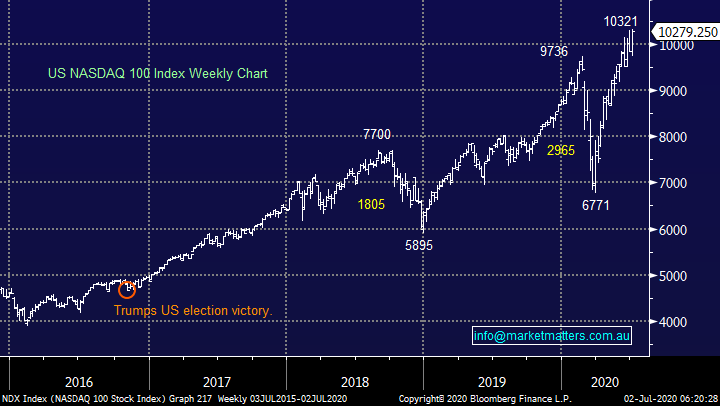

Overnight the broad US market rallied courtesy of another strong performance by the tech based NASDAQ which made fresh all-time highs in the process, I continue to read of too many people trying to pick tops in US stocks and almost nobody’s looking for levels to accumulate / buy, a solid buy signal in our opinion. The SPI Futures are calling the ASX200 to open up around 5975 this morning, a clear break of 6000 might see some follow through on the upside after the recent consolidation which is shown on the chart below.

MM still remains overall bullish equities medium-term.

ASX200 Index Chart

CSL Ltd (CSL) $284.40

Yesterday saw Swiss bank UBS cross a $180m parcel of CSL shares, probably the largest institutional “block trade” of 2020. The early afternoon transaction saw almost 630,000 shares crossed at $283, marginally below the days close. This quality stock remains 17% below its all-time high posted in February, as we’ve mentioned a few times in 2020 MM has no issues with the company, we simply believe it got ahead of itself as complacent investors regarded CSL as sure thing / go-to stock over the last year flagging danger signals to MM – even great companies get too expensive!

MM remains keen on CSL ~10% lower.

CSL Ltd (CSL) Chart

Webjet (WEB) $3.57

Yesterday evening also saw Goldman Sachs looking for bids in a range of a 3.4%- 5.6% discount to the close at $3.57 for 13 million WEB shares - convertible bond investors are reported as the sellers who are said to be looking to hedge their investment. Even if the stock gaps down this morning this is a company that doesn’t excite MM in the uncertain tourism environment.

MM remains neutral WEB.

Webjet (WEB) Chart

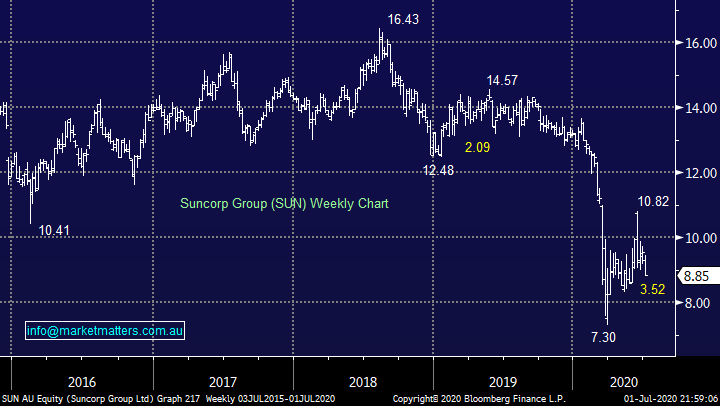

Suncorp (SUN) $8.85

Lastly today a stock which has continued to catch my attention for all the wrong reasons over recent years is Suncorp (SUN) which was MM once longest holding in the MM Growth Portfolio before we exited our position back in 2018. There is now talk in the press that the QLD based business should sell-off its underperforming bank and focus on being an insurer but the rhetoric coming from management is more along the lines of turning it around, either way the report card clearly reads “must do better”, we feel only one to watch at this stage. Technically the stock currently would not look interesting until ~20% lower.

MM remains neutral SUN at best.

Suncorp (SUN) Chart

Global Markets.

Overnight the US stocks rallied at the start of a new month & quarter with the NASDAQ gaining +1.2% touching fresh all-time highs during the session while the Dow actually slipped slightly courtesy of the Banks and Energy Sectors which retreated. We continue to patiently watch 2 potential scenarios:

1 – Either stocks are poised to correct the whole advance from the March 23rd low with our ideal target ~7% lower for the S&P500.

2 – Or stocks will again shrug off coronavirus fears and are heading ~10% higher before MM will consider reducing risk / market exposure.

At this stage if you look at the tech based NASDAQ you might find it hard to be anything except bullish. Also we’ve moved more towards the bullish corner short-term for the ASX which if this proves correct the likelihood is the US will follow suit and cashed up buyers waiting to buy the market cheaper will remain unsatisfied. However July does simply feel like a logical time for a pullback before a strong run into Christmas – let’s wait and see while most importantly remaining patient.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

The VIX Index (Fear Gauge) is starting to show investors / traders are rapidly losing confidence in another major market correction, who can blame them as US stocks remain strong in the face of an abundance of adverse news. Our bullish outlook on US equities implies by definition that the VIX is headed down toward the psychological 20 area.

MM will consider taking profit on our short VIX ETF position into fresh recent lows. – a position in our Global Macro ETF Portfolio.

Volatility/ Fear Index (VIX) Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.