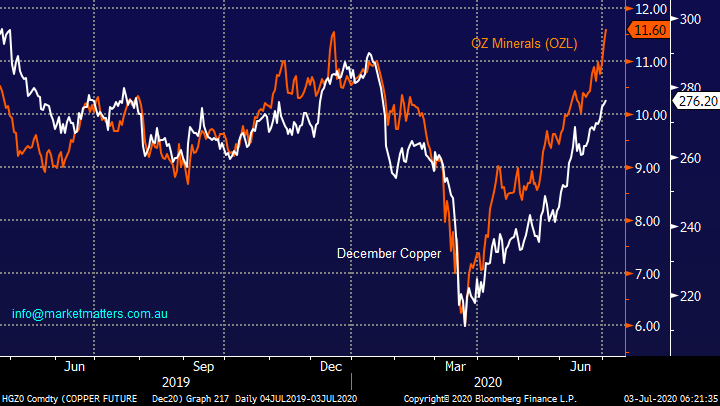

“Shorts are for the beach” – for now at least (OZL, RHC, MQG, BHP, SUL, TCL, SIQ)

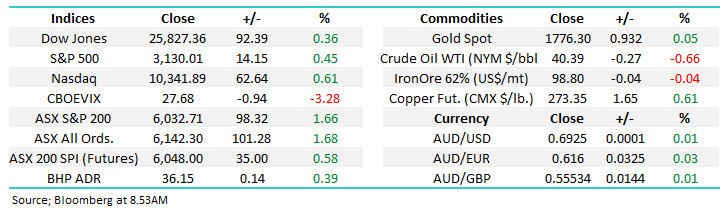

Please excuse todays title but it’s one that’s banded around the office fairly regularly and yesterday’s storming performance by the ASX200 brought it instantly to mind, the local market embraced the strength across Asia advancing almost 100-points for the day & managing to close at its highest level for around 3-weeks. A line from yesterday’s brief report comes to mind “a clear break of 6000 might see some follow through on the upside after the recent consolidation which is shown on the chart below.” Volume was good yesterday which also saw over 80% of the ASX close up on the day, we can easily envisage a short squeeze / panic buying by underweight fund managers propelling this market rapidly up +5-7%.

Its hard to imagine what further “bad news” can be thrown at equities in the short-term and the manner in which they’ve shrugged off the ever increasing likelihood of a second wave of COVID-19 should, in our opinion, be causing great concern to the perma-bears that have been extolling the many reasons that stocks are about to plunge lower basically since March. Undoubtedly later in 2021 markets will experience some patches of volatility as the US election unfolds and although market friendly Donald Trump has fallen well behind in the polls if we do see a decent pick-up in economic activity both globally and in the US over the next quarter you never know, he is still the preferred candidate with regards to the country’s finances and voters have often demonstrated relatively short memories.

The coronavirus numbers remain concerning, but markets look ahead and they’re clearly comfortable with the US registering 30-40,000 fresh cases daily while the total number of global cases is set to breach 11m before the weekend. I continue to read numerous articles on the pandemic with the most optimistic “hoping” for a vaccine in the second quarter of 2021 implying financial markets are ok with at least another 9-months of the virus significantly impacting our day to day lives, assuming of course the global economic engine continues to fire back to life. We’ll look at the reasons why the market has become more comfortable round the virus in the Weekend Note on Sunday. Overnight the US enjoyed an impressive improvement in their unemployment data helping stocks put in another strong performance, about 1/3 of the jobs that were lost as a result COVID-19 have been reclaimed and as we’ve been suggesting for some time, economic data from employment to manufacturing could be described as ‘better than feared’.

MM is by definition in ”sell mode” because we are almost fully invested in both of our Growth & Income Portfolios hence as the ASX is threatening to break to the upside today I’ve updated 3 stocks that we are considering selling into strength – remember MM still believes that the way to add value (alpha) through 2020 / 21 is to buy weakness & sell strength while maintaining a distinctive positive bias overall.

MM still remains overall bullish equities medium-term.

ASX200 Index Chart

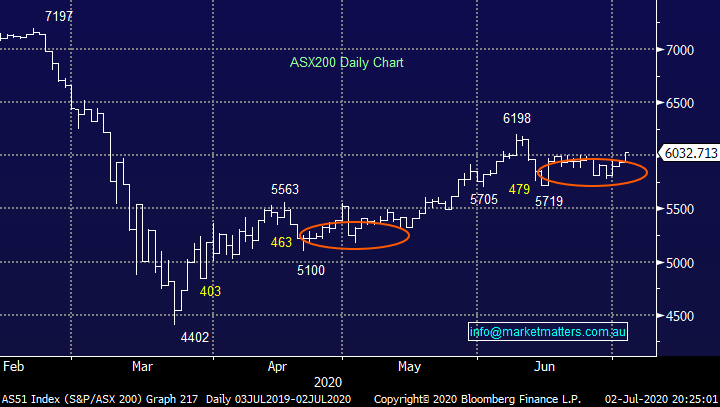

We have been regularly monitoring the $A in 2020 as its led stocks higher while indicating our opinion that an improvement in global growth / reflation is very much on the table for the next 12-18 months. The rhythm of both markets remains in sync with the $A looking set to breach 70c while the ASX200 has a break of 6200 firmly in its sights, now less than 3% away.

MM remains bullish both the ASX200 and $A into 2021.

ASX200 & Australian Dollar ($A) Chart

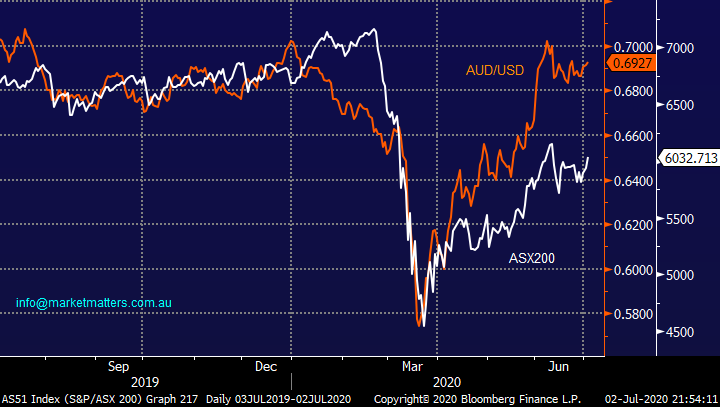

Similarly, “Dr Copper” continues to support the improved growth outlook as it made fresh 5 ½ month highs overnight, noticeably above its level before the coronavirus outbreak. The supply concerns that have helped Iron Ore trade higher are now filtering into the Copper market with COVID-19 related supply concerns coming from Latin America. Our position in OZ Minerals (OZL) still appears on point as the stock looks poised to make fresh decade highs in the near future.

As the chart below illustrates OZL doesn’t appear to be getting too far ahead of itself when compared to the base metal – its primary source of revenue.

MM remains bullish copper into 2021.

Copper December Futures v OZ Minerals (OZL) Chart

Global Markets.

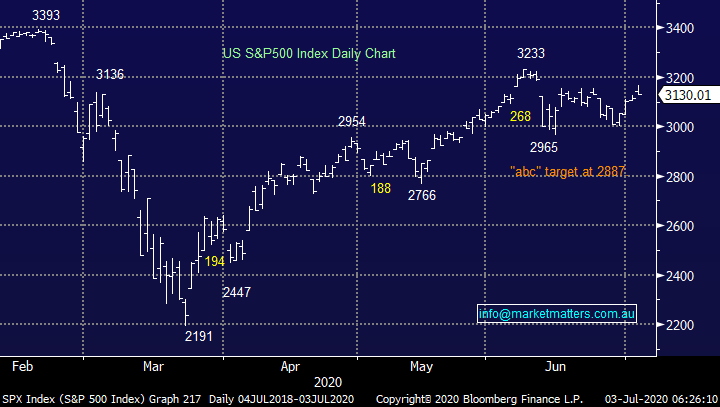

Overnight, US stocks continued to rally following the strong jobs report although they did struggle to hold onto their early exuberance after the data was released, we still see 2 likely scenarios for US equities with the correlated ASX200 implying the latter is now more likely:

1 – Either stocks are poised to correct the whole advance from the March 23rd low with our ideal target ~7% lower for the S&P500.

2 – Or stocks will continue to shrug off coronavirus fears and are heading ~6% higher when MM will consider reducing risk / market exposure.

At this stage if you look at the tech-based NASDAQ it’s hard to be anything except bullish after it again made fresh all-time highs overnight.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

In similar optimistic fashion the VIX Index (Fear Gauge) continues to show investors / traders are rapidly losing confidence in another major market correction, who can blame them as US stocks remain strong in the face of an abundance of adverse news. Our bullish outlook on US equities implies by definition that the VIX is headed down toward the psychological 20 area.

MM will consider taking profit on our short VIX ETF position into fresh recent lows. – a position in our Global Macro ETF Portfolio.

Volatility/ Fear Index (VIX) Chart

MM Growth Portfolio.

The MM Growth Portfolio has basically moved to a fully committed market stance over recent months, were now only holding 2.5% in cash : https://www.marketmatters.com.au/new-portfolio-csv/

Hence as we said earlier by definition we are in “sell mode” but this doesn’t mean we have any interest in losing our position too early, we bought weakness when many investors became scarred and we simply want to get paid for this move up the risk curve. From an index perspective we are considering taking some $$ off the table 5-6% higher but by definition this will be reflected very differently across the various sectors / stocks. Today I have briefly covered 3 of our holdings which MM may sell into strength:

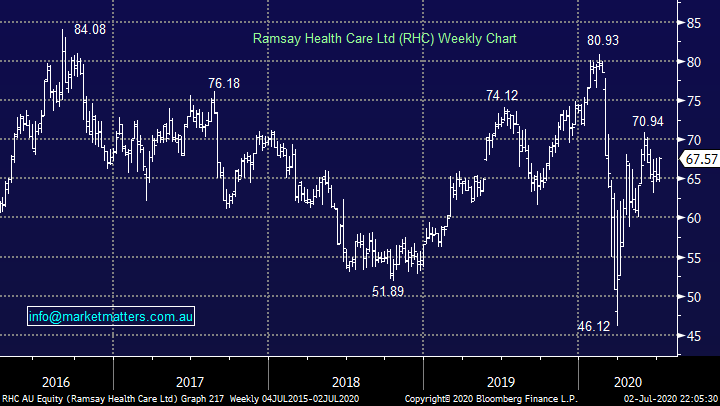

1 Ramsay Healthcare (RHC) $67.57

Private hospital operator RHC has rallied ~10% since we went long in April, but its recent 11% pullback illustrates the stock is not a one direction holding.

MM will consider taking $$ on RHC around $72.50.

Ramsay Healthcare (RHC) Chart

2 Macquarie Group (MQG) $121.90

Investment bank MQG has finally moved back onto the right side of the ledger for MM after coming under significant pressure during the March panic sell-off. This is a position we are considering because of its $US earnings profile and our already overweight exposure to the local banking sector.

MM will consider taking $$ on MQG around $127.

Macquarie Group (MQG) Chart

3 BHP Group (BHP) $36.01

Mining goliath has been looking after us since March but we are very long the resources / oil space hence this is a position we are considering because of our portfolio mix plus iron ore looks a little tired (it could easily have been RIO instead) - a push towards $39-$40 will definitely be tempting.

MM will consider taking $$ on BHP around $40.

BHP Group (BHP) Chart

MM Income Portfolio.

Similarly the MM Income Portfolio has moved to an almost fully committed position, only holding 5% in cash : https://www.marketmatters.com.au/new-income-portfolio-csv/

It’s important to remember that this portfolio has a different objective to the Growth alternative and any sales, move back down the risk curve, needs to have a plan to re-enter in time because cash is yielding basically zero – at least it’s not negative yet!

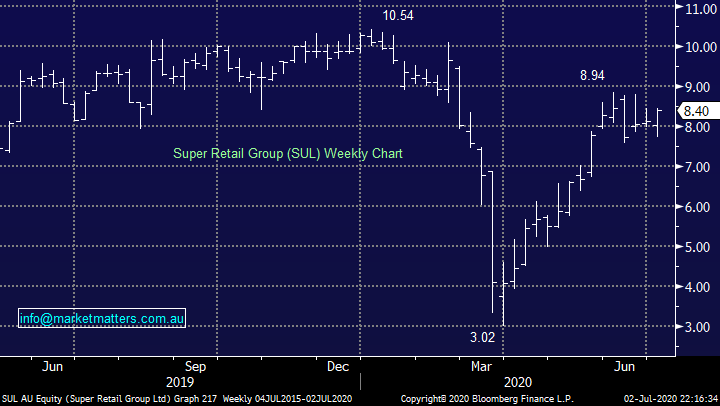

1 Super Retail Group (SUL) $8.40

This QLD based retailer is currently proving an excellent investment for MM showing a paper profit of almost 40% in under 3-months, another 10% higher and the risk / reward will swing towards us taking some $$ off the table.

MM will consider taking $$ on SUL above $9.

Super Retail Group (SUL) Chart

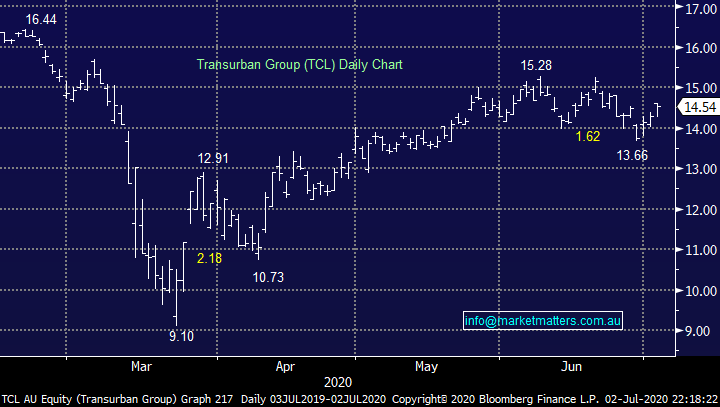

2 Transurban (TCL) $14.54

Toll road operator like so much of the ASX has bounced soundly from its panic March sell-off however we do believe the stocks approaching fair value and around 6% higher MM will consider taking profit.

MM will consider taking $$ on TCL around $15.50.

Transurban (TCL) Chart

3 SmartGroup (SIQ) $6.40

Salary packaging business SIQ hasn’t delivered as we hoped and a pop above $7 is likely to see us grab a small profit and retreat, again looking for better opportunities down the track.

MM will consider taking a small profit on SIQ around $7.25.

SmartGroup (SIQ) Chart

Conclusion

MM is looking to move slightly back down the risk into strength, but not yet.

Overnight Market Matters Wrap

· The SPI is up 35 points after a modest boost to end the week in US equities. The Dow closed 0.4% higher, while the S&P 500 and NASDAQ gained 0.5%. US markets will be closed tonight for the Independence Day holiday.

· Stocks rallied after stronger than expected jobs data in the US. Non-farm payrolls rose by 4.8 million in June, above consensus of 3.2 million. The unemployment rate fell to 11.1% from 13.3% in the previous month. Weekly initial jobless claims were higher than expected which indicates the labour market improvement is moderating.

· New coronavirus cases in the US passed 50k in a day for the first time while Congress passed sanctions that would penalise banks that do business with Chinese officials that implemented the new security laws in Hong Kong.

· Most metals on the LME made small gains including copper which rose for the sixth day in a row over supply concerns in South America. Gold inched higher and oil continues to retake some of the massive losses of the last few months.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.