Assessing Bell Potter’s top tech picks for FY21 (NST, BIN, XRO, UWL, IFM, PWH)

It was a clear ‘risk off’ session yesterday with 84% of the ASX 200 closing in the red, Gold stocks and the Supermarkets were the only real consistent sector winners implying a degree of safe haven buying, however while the market closed down ~1.5% the selling wasn’t panic like with the market remaining in its 5700 – 6200 trading range for the last month, yesterdays close was around the midpoint of that range. While the bearish rhetoric is high, and I’m hearing a lot of talk about overvalued markets given the news cycle, the fact stocks are remaining resilient as the US tops ~3m coronavirus cases and many parts of Victoria go into lockdown is no mean feat.

Overall, I felt the COVID-19 news was poor yesterday and that’s why our markets tapered off into the close:

1 – Victoria now has 860 active COVID-19 cases, the highest amount since the pandemic began with 777 occurring in the past 7 days. 134 new cases were recorded yesterday.

2 – Australia has now recorded 106 deaths from 8,886 cases implying a fatality rate of 1.19% (and falling), not an high as originally expected

3 – However to put this into perspective, nearly 2.9m tests have been conducted nationally with just 0.3% of those being positive.

Despite this recent set back, Australia is still doing a very good job containing / managing this virus, 106 deaths while clearly unfortunate is not a big number considering we lost ~160,000 people for various reasons in 2019.

Markets tend to react to the unknown left field stuff, they get shocked and then move on, digesting whatever the issue is and look forward. Right now at least it seems markets are looking ahead to the prospect of better earnings from companies in the US as quarterly earning season kicks off next week. Economists have been way too negative on their forecasts around economic data, it seems to me that markets believe analysts might have also fallen into that trap. Working with both ‘types’ over the years though, they’re very different. Analysts drink more of the positive ‘coolaid’ than economists so I’m not so sure the link being made is a valid one, not long to find out with a number of the US banks reporting next week.

It was one of those frustrating days yesterday for MM, we’ve been looking to buy Gold for a while and it kicked higher while a few of the stocks we own had a tough day at the office. Banks provided a decent drag from an index perspective which is not a real surprise when lockdowns are being reimposed, however we continue to believe that impairments banks have already taken are large, and given the stimulus, the extension of loan holidays for another 4 months then 2H20 will be better than feared for the banks (September yearend).

MM retains its bullish stance towards equities medium-term

ASX200 Index Chart

We touched on the Northern Stars (NST) quarterly update in our PM Report yesterday with a definite conclusion that we were happy, as was the market which sent the stock up almost 6.56%. The company has originally pulled guidance during COVID-19 due to vagaries around additional safety measures hurting production levels, however they managed to come in pretty close to their original guidance which was a relief to the market. While NST is knocking on the $15.00 handle after a solid session yesterday, one trend caught my eye in Golds yesterday as money flowed into NST, the other Gold stocks pared gains implying that it was more about rotation rather than outright new money hitting the sector. We’ve held off on gold for a while and we’re not going to chase here.

MM remains bullish gold, but we’re not chasing here

Northern Star (NST) Chart

Overseas

Overnight US stocks edged higher with large cap technology shares once again leading the way. Alibaba (BABA US) which resides in the MM International Equities Portfolio put on more than 8% following reports of an IPO of their Financial division in Hong Kong – the division muted to be worth north of $200b. Tencent (700 HK) added 5% yesterday in Hong Kong, apparently they put in a ‘big bid’ into Afterpays (APT) $800m capital raise which completed at $66.00. Between March and May of this year, Tencent bought 4.98% of APT stock .

MM remains bullish the US S&P500 targeting new highs

US S&P500 Index Chart

Underlying strength in Iron Ore continued overnight with the September contract in China now up more than 7% on the week as optimism around Chinese growth coupled with supply concerns from South America continue to drive prices. At MM we’ve been advocating selling strength in Iron Ore to fade into Gold however we’ve not yet pulled the trigger.

We hold RIO Tinto (RIO) in the MM Growth Portfolio targeting a move above $100.

Iron Ore Chart

Copper is also playing to our jig and its now threatening to break its longer term downtrend. This has propelled our holding in Oz Minerals (OZL) to new 8 year highs however momentum remains strong, and we remain bullish.

MM remains bullish base metals like Copper

Copper Futures Chart

Assessing Bell Potter’s top tech picks for FY21

Each year Bell Potter releases their top picks in each sector for the year ahead. They can be hit and miss like any long list of stocks presented at the start of the year, some years have been good, some years haven’t and there’s a lot of water that goes under the bridge during a 12 month period. Also important to note that I’m naturally a sceptic and lists like this can be more of a marketing piece than anything. That said, Technology is the place of growth and in an environment of low interest rates and a sluggish overall economy it makes sense to look at companies that are not as exposed to underlying economic trends – and Bells tech picks have actually been pretty good.

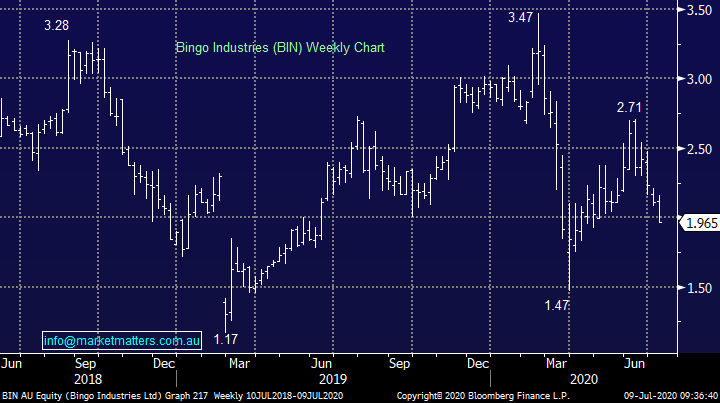

As a simple example, using two stocks in the MM Growth Portfolio, Bingo Industries (BIN) and Xero (XRO). The first picks up commercial waste and either puts it in landfill or recycles it. The amount of rubbish picked up depends on the level of construction activity which is reliant upon a lot of different factors, but ultimately more construction = more waste and more work for Bingo – its heavily exposed to the economy.

Bingo (BIN) Chart

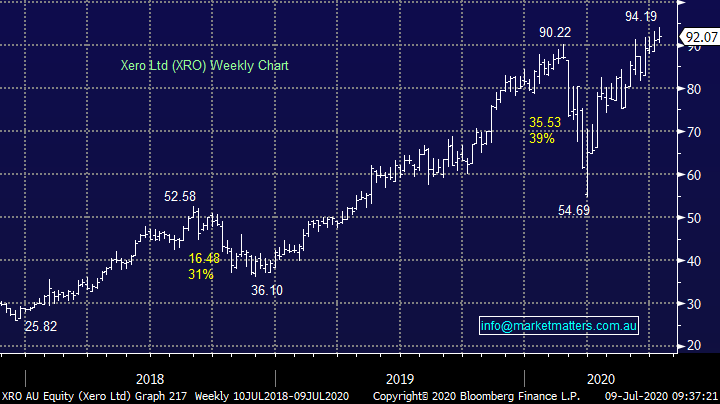

Xero on the other hand has a cloud based accounting platform, expensive to develop however incredibly scalable and importantly, their pool of customers is global. The growth profile is far superior and sales are not as heavily reliant upon on the ebbs and flows of economic activity.

Xero (XRO) Chart

While there’s a place for each sort of company in a portfolio, the drivers for their performance are very different, and quiet clearly, in an environment where economies are struggling, technology that improves processes, improves efficiencies, reduces staff costs, helps flexible work arrangements, aids in making better decisions can be more resilient. For that reason, we should embrace technology in portfolios.

In 2018, Bells picked Citadel (CGL), Technology One (TNE) & Appen (APX) as their preferred picks.

In 2019, they retained CGL and TNE adding in Integrated Research (IRI)

In 2020, they again retained CGL adding in Uniti Group (UWL) & Adacel Technologies (ADA)

In 2021, they retained Uniti Group (UWL) adding in Infomedia (IFM) and PWR Holdings (PWH)

The consistent theme across the stocks they’ve highlighted this year are they’re profitable and they’re creating solutions to disrupt / improve more traditional industries.

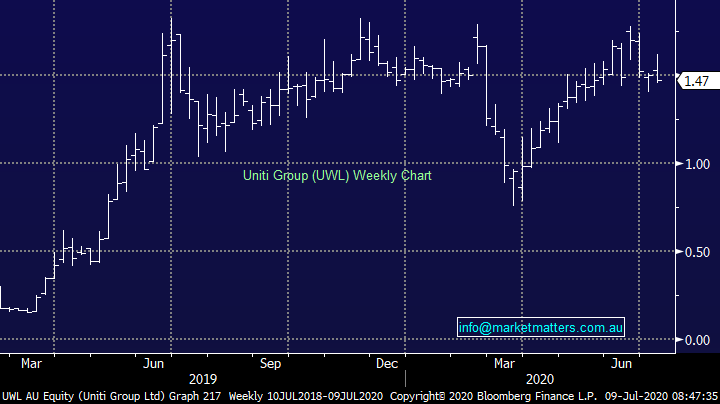

1 Uniti Group (UWL) $1.47

This ~$640m company operates in the telecommunications space and is all about offering an alternative solution to the NBN. They’ve grown through acquisition recently and unlike many technology companies, they are profitable.

As is the case with any small stock it’s success is very reliant on management and it’s important to understand the shareholder register. The CEO Michael Simmons used to run Vocus (VOC) and holds 5.3m shares, Vaughan Bowen was the founder of M2 Telecom which long term MM subscribers will remember fondly as we held into the takeover, Vaughan is a director and the 5th largest shareholder (7.2m shares), while James Spenceley who originally founded VOC is also on the register with 1.6m shares. This is clearly being backed by the right people.

MM likes UWL nearer ~$1.20

Uniti Group (UWL) Chart

2 Infomedia (IFM) $1.785

This is a quality business and one I’ve reviewed a number of times in the past, Similar to UWL, it’s market capitalisation is around ~$660m. They provide software solutions to the car parts industry and are key cogs in the aftermarket car parts sector. Bapcor (BAP) and ARB Corp (ARB) are the two ‘go to’ stocks in this space listed on the ASX however IFM is a smaller exposure with higher growth potential exposed to this theme.

Unfortunately the price action does not excite for now with a recent capital raise weighing on the stock.

MM is neutral IFM

Infomedia (IFM) Chart

3 PWR Holdings (PWH) $4.35

A smaller ~$400m company that seems to be more a manufacturing play than a tech business. PWH develops cooling systems for race cars and the wider automotive sector. The technology aspect is around the intellectual property (IP) they have in the space, however with the hit to global motor racing and the strong run in the share price from the Match lows, its hard to get excited about PWH here.

We would only be interested in PWH into weakness

MM is neutral/negative PWH

PWR Holdings (PWH) Chart

Conclusions (s)

Of the 3 stocks covered above, our preference is UWL, IFM, PWH in that order, however none of them immidiatly excite.

Overnight Market Matters Wrap

- A choppy session in the US overnight, eventually ending in positive territory led once again by the tech. heavy Nasdaq 100 continually hitting new highs.

- On the Covid-19 front, the US cases surpassed the 3 million level, just over 25% of the reported global cases.

- Investors have slowly switched their risk caps on, as an expected global stimulus move by governments were being witnessed – UK Chancellor, Sunak announced a package of ~£30 billion while the Canadian finance minister had a bigger than expected fiscal plan.

- On the commodities front, gold hit new highs, while crude oil rallied despite US inventory build was high while demand remains low.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 2.34% from Australia’s previous close.

- The September SPI Futures is indicating the ASX 200 open 83 points higher, testing the 6000 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.