Afternoon Report Monday 24 August 2015

- An extremely tough day for everyone in the market today.

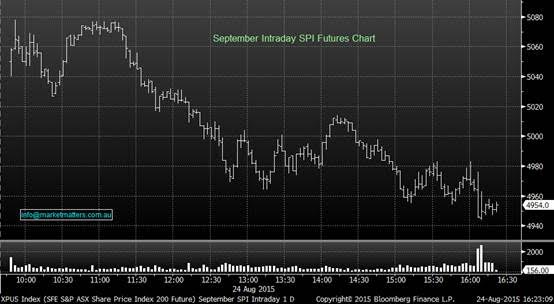

- The market has now fallen lower than our predicted level of 5100, due to concerns around emerging markets.

- We think the market is good value for the longer term now, and stocks like ANZ which we got more of today are good value.

- The ASX200 felt as if it was in a bottomless pit, ending on its lows, down 213 points (-4.1%) at 5,001 and wiping ~$50bn from the market.

- Not a sight of green was seen across the market map, the utilities sector, although in the red, outperformed most, in particular the Energy sector, where Santos (STO) was down 11.3% at $4.97 by close.

- At the start of the day we were considering buying STO but the momentum behind the selling kept us well and truly on the sidelines.

- As discussed in this morning's report our target for the US S&P500 is now about 5% below today's price (chart 1) hence no rush to chase stock today.

- We believe the banks are representing great value at these levels with ANZ paying an anticipated yield of 6.7% / 9.6% grossed up.

- Westpac (WBC) was the weakest link out of the ‘big 4’ banks, ending its day down 6.1% to $29.45.

- Bluescope Steel (BSL) blind-sided investors today, with positive earnings and rallied 8.6% to $3.67.

1 S&P500 Active contract Monthly Chart

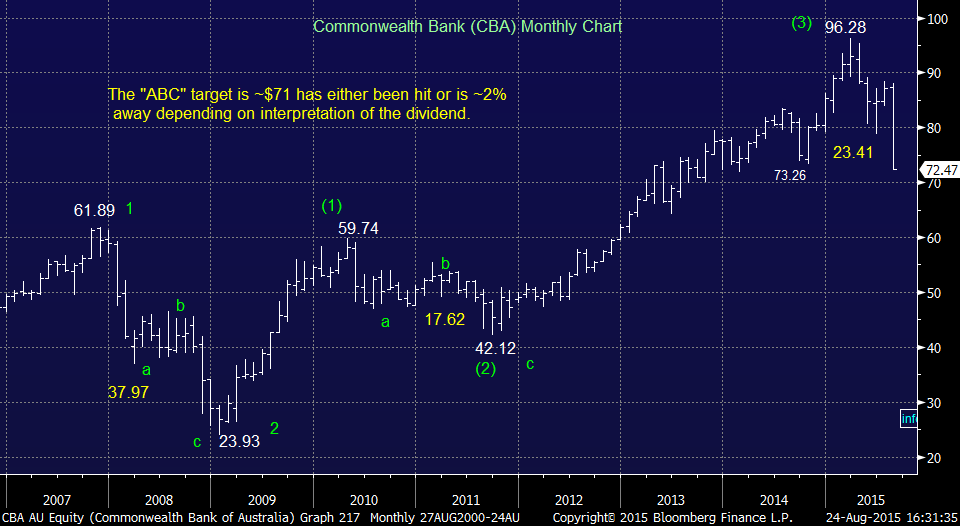

2 Commonwealth Bank (CBA) Monthly Chart

Best Sector – Utilities

Worst Sector – Energy

Winners

BlueScope Steel Ltd (BSL) +$0.29, or (+8.6%) to $3.67

Sigma Pharmaceuticals Ltd (SIP) +$0.035, or (+4.7%) to $0.785

Cochlear Ltd (COH) +$0.18, or (+0.2%) to $84.89

FlexiGroup Ltd/Australia (FXL) +$0., or (+0.0%) to $2.72

Losers

Whitehaven Coal Ltd (WHC) -$0.11, or (-9.3%) to $1.075

Arrium Ltd (ARI) -$0.01, or (-9.5%) to $0.095

Santos Ltd (STO) -$0.63, or (-11.3%) to $4.97

Fortescue Metals Group Ltd (FMG) -$0.28, or (-14.6%) to $1.635

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/08/2015. 4.23PM.

Reports and other documents published on this website (‘Reports’) are authored by Market Matters. The Market Matters Reports are based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distribution without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

The author holds an interest in the financial products of ANN, ANZ, BEN, CBA, NAB, SEK, VOC and WPL.