- Despite the ASX 200 ending its day 0.8% lower to 5,018, it was surprising for most to see it recover from the lows of 4,979 after falling below 5000 for the first time since September.

- BHP Billiton (BHP) recovered well from its lows, rallying 1.3% from $19.90 to end the day only 7c lower to $20.16.

- The big four banks were all off with Westpac falling 1.6 per cent, ANZ 1.5 per cent, CBA 1.3 per cent and NAB 1.4 per cent.

- Woolies dropped 1.8 percent and is trading at its lowest in over three years. Wesfarmers dropped 0.9 percent. We are watching these stocks as indicated in previous reports when we have called Woolies a sell.

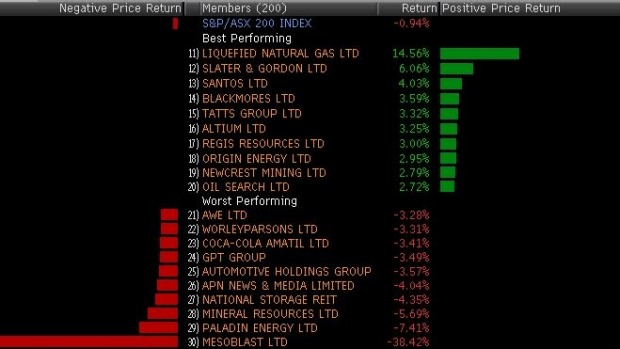

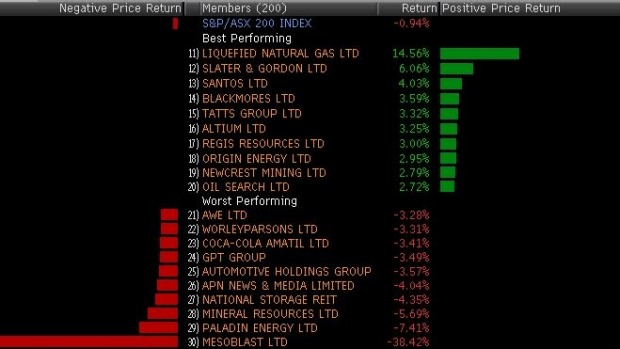

- Telstra managed to buck the trend - around one in five stocks managed a gain - climbing 0.4 percent. Woodside climbed 1.3 percent as the energy sector enjoyed the day's best gains as oil bounced in Asian trade. Santos added 4 percent, Oil Search 2.7 per cent and Origin 3 per cent.

- Gold miners also climbed, with Newcrest closing up 2.8 per cent.

- The day's best was LNG Ltd, up 15 percent after the company announced the major construction contract pricing for its US LNG export venture, another step along the way of the regulatory approvals process.

- Mesoblast plunged close to 40 per cent following its disappointing float in New York's Nasdaq exchange.

- In the gaming sector, Tabcorp (TAH) and Tatts Group (TTS) announced that they failed to agree on its possible merger agreement. This sent TTS to rally 3.1% higher to $4.04 while TAH ended 0.2% to lower $4.41.

- Talks resumed with Asciano (AIO) and Qube Logistics (QUB) as AIO granted QUB to conduct Due Diligence in its books.

Best Sector – Energy

Worst Sector – Industrials

Winners

Liquefied Natural Gas Ltd (LNG) +$0.19, or (+14.6%) to $1.495

Slater & Gordon Ltd (SGH) +$0.16, or (+6.1%) to $2.80

Santos Ltd (STO) +$0.16, or (+4.0%) to $4.13

Blackmores Ltd (BKL) +$5.76, or (+3.6%) to $166.4

Losers

National Storage REIT (NSR) -$0.065, or (-4.3%) to $1.43

Mineral Resources Ltd (MIN) -$0.24, or (-5.7%) to $3.98

Paladin Energy Ltd (PDN) -$0.02, or (-7.4%) to $0.25

Mesoblast Ltd (MSB) -$1.31, or (-38.4%) to $2.10

All figures contained from sources believed to be accurate. MarketMatters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2015. 4.14PM.

Reports and other documents published on this website (‘Reports’) are authored by Market Matters. The MarketMatters Reports are based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distribution without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor.

The Reports are published by MarketMatters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

The author holds an interest in the financial products of ANN, ANZ, BEN, CBA, MQG, OSH, SUN & SEK,.