Afternoon Report Monday 7 December 2015

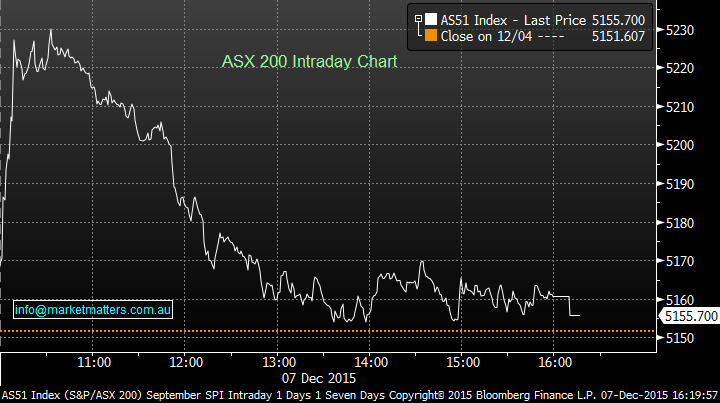

- A frustrating session was experienced today, where a glimmer of hope was witnessed early this morning in the ASX 200, rallying as high as 5,229, only to see some selling in the Futures Market, leaving the broader market to end only 4 points higher (+0.1%) at 5,156.

- The bank sector were the safest bet, with the big 4 banks up an average of 0.4% and Westpac (WBC) the main positive contributor, up 0.7% to $32.52.

- In the Telco sector, a shift to Vocus Communications (VOC) was apparent, ending 1.4% higher to $7.51, while Telstra lost 1.7% to $5.32.

- Not surprisingly, the Gold Sector followed suit from the performance of the physical commodity over the weekend. Newcrest Mining (NCM) rallied 2.9% higher to $11.97 and Regis Resources (RRL) closed 4.6% higher at $2.05.

- On the flipside, with the Energy sector lost ground after comments from OPEC in terms of leaving current production output as is. Santos (STO) closed 9.9% lower at $3.81, while Woodside Petroleum (WPL) ended 3.7% lower to $28.00.

- On the Mergers & Acquisitions front, Broad Spectrum (BRS) rallied 47.75 higher to $1.255 after receiving a takeover offer by Spanish Giant, Ferrovial.

- Dexus Property Group has offered to buy Investa Office Fund in a deal valuing the real estate investment trust at $2.15 billion. The board of IOF intends to unanimously recommend the indicative, non-binding offer, according to a statement.

- Real estate agent McGrath shares debut well below their IPO price of $21.10. They closed 13% below the price at $1.835. Market Matters indicated we had no interest in a real estate business which was listing whilst the residential property market was starting to slow.

- Job ads in newspapers and on the internet grew for the fourth straight month in November, which is another encouraging sign that the labour market in improving.

Best Sector – Consumer Discretionary

Worst Sector – Energy

Winners

Broadspectrum Ltd (BRS) +$0.405, or (+47.6%) to $1.255

Investa Office Fund (IOF) +$0.28, or (+7.3%) to $4.11

Evolution Mining Ltd (EVN) +$0.065, or (+5.4%) to $1.275

Northern Star Resources Ltd (NST) +$0.12, or (+5.1%) to $2.48

Losers

Beach Energy Ltd (BPT) -$0.05, or (-9.7%) to $0.465

Santos Ltd (STO) -$0.42, or (-9.9%) to $3.81

Arrium Ltd (ARI) -$0.008, or (-11.4%) to $0.062

Spotless Group Holdings Ltd (SPO) -$0.17, or (-13.8%) to $1.065