The reflation play roars ahead, what stocks can play “catch-up” (OZL, RIO, ILU, S32, IGO, NCM)

The ASX200 surged over 110-points higher yesterday with the large cap miners dancing to the MM bullish tune – OZ Minerals (OZL) +3.8%, RIO Tinto (RIO) +3.7% and BHP Group (BHP) +2.5%. However, the buying was encouragingly very broad based with only 8% on the market closing in negative territory, the Energy & Telco Sectors were the worst performers on the day and they both still rallied +0.9%. Considering the domestic COVID-19 news continues to worsen this was a stellar performance which will be more than just frustrating the bears, I’m not reading of many players who are positioned like ourselves i.e. basically fully exposed to equities, our contrarian call certainly felt on the money yesterday with our initial market target ~5% higher.

The press are having a field day with the worsening virus statistics / situation, especially in the US and at home, but while the rhetoric from politicians remains emphatically market friendly it continues to disappoint the numerous market pessimists e.g. yesterday afternoon Prime Minister Scott Morrison ruled out pursuing a strategy to eliminate the virus saying it would cause the unemployment rate to double and ruin the Australian economy. Ironically, many countries appear to be now following Donald Trump’s lead although I’m sure they would never admit to it. Basically, we appear to be adopting the “learn to live with it ethos” as the battle is fought via containing clusters and underlying herd immunity.

The latest Bank of America Fund Manager survey showed fund managers, similar to Hamish Douglass mentioned yesterday, have increased their cash levels to 4.9% above the average of 4.7% - I would point out that the Magellan CEO has been a major tech bull so I fully understand why he took some profits at current levels. Overall, this illustrates to us that being long stocks is not a scary crowded trade although within the tech space it might be a very different story. Just a quick glance at the chart below suggests to me that if we enjoy a strong end to this week the local index will finally breakout of the current 7-week trading range with the 6400 area the target if July were to simply match June’s trading range.

MM still remains bullish equities medium-term.

ASX200 Index Chart

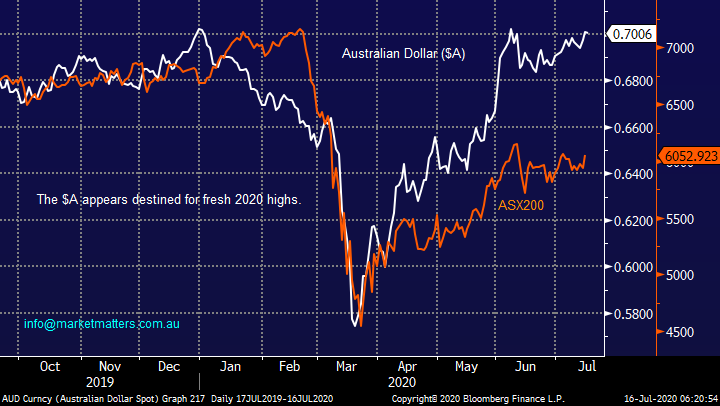

The $A has quietly rallied back above 70c, not bad for a “growth currency” in the middle of a global pandemic. We continue to feel a short-term rally towards 71c and fresh 2020 highs is just a matter of time which is theoretically bullish stocks when we consider the correlation illustrated below which has been in play for well over a year. However we are mindful that the $A in particular has rallied almost 30% from its March low hence a “pop” to new recent highs might not follow through aggressively, especially when we consider how comfortable the Aussie was around these levels before the coronavirus raised its painful head. Overall while MM is bullish we remain mindful of the zig-zag style advance by risk assets since March and we still like the “buy weakness & sell strength” mantra for 2020.

MM remains bullish the $A and ASX200.

The ASX200 v $A Chart

Iron ore was back in the spotlight yesterday for all the right reasons as the local sector soared higher with Fortescue (FMG) the obvious star as it closed at an all-time high, above $16 for a 50% gain in 2020. The appreciation in iron ore is another classic example of investors underestimating how far / long a trend can last, especially where the Chinese consumer is concerned. However MM has significant exposure to this bulk commodity through both RIO Tinto (RIO) and BHP Group (BHP) hence today’s report will focus on whether we should be taking a little cream off the top from one of these key holdings looking for both diversification and improved performance elsewhere in the resources complex – it might be time for some “catch up” by the sector laggards.

MM remains bullish the reflation trade.

Iron Ore (CNY/MT) Chart

Global Markets.

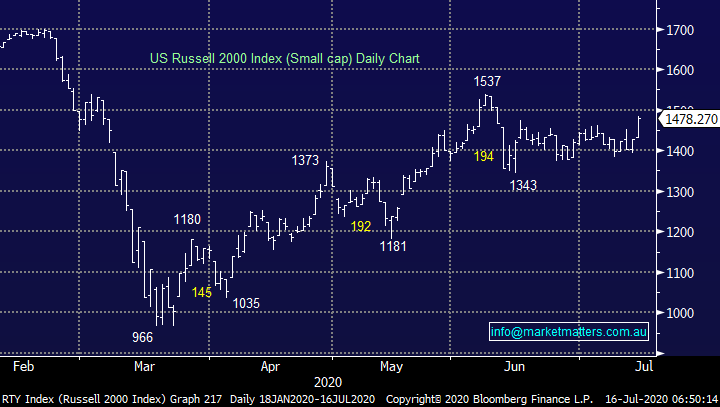

The global tech stocks appear to be finally taking a well-earned rest, overnight we saw the NASDAQ only rally +0.1% while US small caps surged +3.5% - fortunately the ASX is far more correlated to the later as we don’t benefit from the likes of Apple (AAPL US) and Microsoft (MSFT US). Our target for the often-ignored Russell 2000 index is ~8% higher which bodes extremely well for local stocks short-term and especially the high Beta (volatile) end of the curve.

MM is particularly bullish US small caps at today levels.

US Russell 2000 Index Chart

Looking for value in the Resources Sector.

The Materials / Resources Sector has enjoyed the significant tailwind of a 20% rally in the Bloomberg Base Metals Index but while are bullish the complex similar to the $A we can see below that prices are returning to the levels of equilibrium during 2019 – the question is will the huge economic stimulus from China and the rest of the word drive up demand enough to push prices up still further. We believe the answer is yes at MM but chasing the sector in general at current levels doesn’t feel prudent, similar to what we are seeing today in the Tech space some profit taking could easily roll through the sector hence we believe it’s time for careful stock selection as opposed to aggressive blanket buying.

Importantly to remember we remain very bullish the commodities space over the next 12-18 months especially as we believe they may become the new go to space for retail investors looking for income e.g. even heavyweight BHP looks well positioned to yield over 4% fully franked, very attractive if the price of the underlying commodities continue to rise. In our Growth Portfolio we hold BHP Group (BHP), RIO Tinto (RIO), OZ Minerals (OZL), Alumina (AWC) and Western Areas (WSA) for a combined healthy 28% exposure, the question we’re posing today is our portfolio mix correct, as opposed to should we be holding such are large exposure to the sector e.g. over the last 3-months alone the appreciation in some of our stocks has been exciting OZL +39%, RIO +18.6% and BHP +23.4% - but will they offer the best alpha in H2 of 2020?

MM remains bullish the Resources in H2 of 2020.

Bloomberg Base Metals Index Chart

A quick glance at the ASX200 Materials index below illustrates how strongly its performed in 2020, we are bullish medium-term and believe its actually 50-50 whether we are about to see acceleration to fresh multi-year highs in the coming weeks hence we have no intention of losing our position, the question is do we have the optimal mix moving forward, can we tweak things to improve the underlying alpha – by definition we will be adopting the attitude of “if in doubt do nought”.

MM expects the ASX200 Materials index to breakout to fresh multi-year highs.

NB The ASX200 Materials Index includes the Building, Gold & Resources stocks.

ASX200 Materials Index Chart

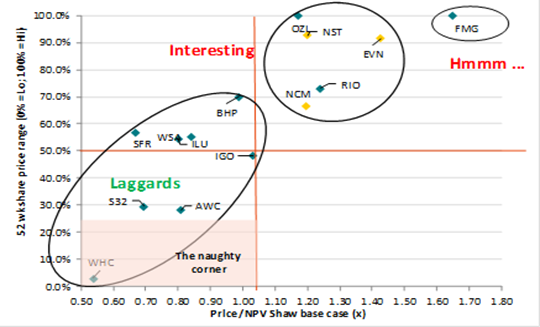

Firstly, we have scanned our existing holdings looking for stocks that we feel may have run too hard, not a particularly easy exercise when we’re bullish the sector. Below was an easy place to start, the table from our analyst in the sector, Peter O’Connor – Rocky, the performance / valuation chart which produced the following standouts:

1 – Gold and iron ore have run hard and will probably need further tailwinds to maintain current levels – on a macro level we can see both of these unfolding, but we prefer gold over iron ore.

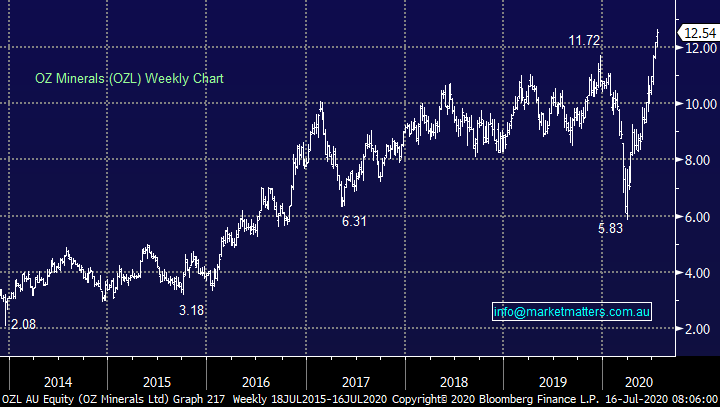

2 - OZ Minerals has enjoyed a period of strong outperformance and may be due for a rest after making fresh 9-year highs.

3 – BHP has actually been lagging RIO on this matrix.

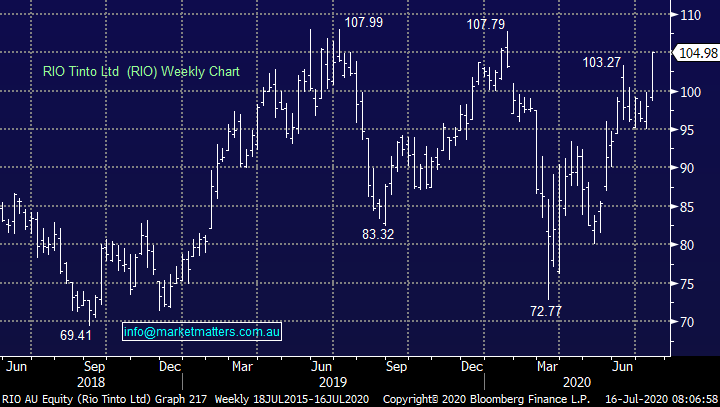

On balance this gave me the answer I was looking for and one we have alluded to in the past – if we were to trim our existing resources exposure the potential funding vehicles would be RIO or OZL but it would need to be a compelling story and risk / reward profile for us to be reducing either of these 2 holdings hence lets simply look at 3 of the laggards plus our old favourite Newcrest Mining (NCM).

NB we left obvious candidate Whitehaven Coal (WHC) off the list for now, as I suggested earlier in the week, it all seems a bit hard in this area however never say never, especially if we see the Farallon share overhang gone.

OZ Minerals (OZL) Chart

RIO Tinto (RIO) Chart

1 Iluka (ILU) $9.04

Mineral sands operator was downgraded by JP Morgan last month around concerns for next month’s profit report, we like the stock but believe its going to struggle to rally significantly short-term negating any logic to switch current holdings. A small cap Mineral Sands stocks we have looked at recently is Strandline (STA), which for those looking at the smaller end of the market looks good.

MM likes initially for a test of $9.50.

Iluka (ILU) Chart

2 South32 (S32) $2.14

Diversified miner South32 (S32) has been out of favour over the last 12-months leading to speculation of a merger with Fortescue (FMG), while we feel this is unlikely, we never say never. Until S32 can regain is relative mojo from a performance perspective we would rather by observers.

MM is neutral S32.

South32 (S32) Chart

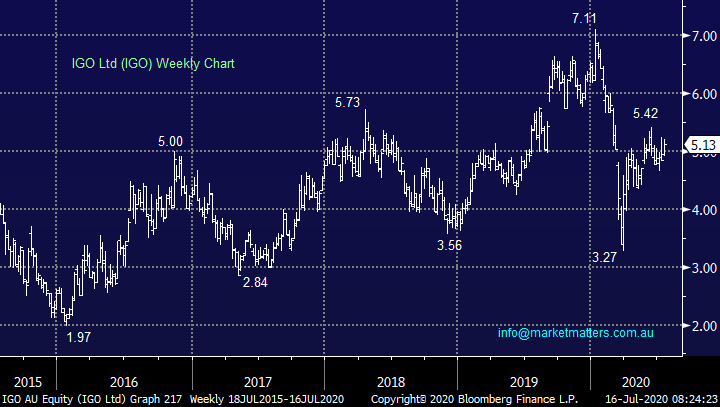

3 IGO Ltd (IGO) $5.130

Nickel and gold miner IGO has performed well since March but we expected a little more enthusiasm after a recent production update from its flagship Nova project – we would rather play nickel through Western Areas (WSA) and gold via Newcrest Mining (NCM).

MM is neutral / bullish IGO.

IGO Ltd (IGO) Chart

4 Newcrest Mining (NCM) $33.26

Australian heavyweight gold producer NCM screens very well on a valuation basis compared to other gold names, we are keen on NCM seeing at least 20% upside over the next 12-months

MM is bullish NCM moving forward.

Newcrest Mining (NCM) Chart

Conclusion

The only move we are considering at current levels is reducing either OZ Minerals (OZL) or RIO Tinto (RIO) and buying Newcrest Mining (NCM).

Overnight Market Matters Wrap

· The Australian market is set to build on this week’s gains today in the wake of strong leads from both Wall St and European markets overnight, following this week’s successful trials for potential COVID-19 vaccines, with strong gains in economic sensitive stocks, in particular the airline and cruise line companies.

· The Dow and S&P 500 both rallied about 0.9% and the Nasdaq 0.6%, while the three leading European markets surged around 2% in the wake of pharmaceutical company Moderna’s positive news on Tuesday of the results of its latest virus drug trials. Investors were also heartened by the latest quarterly earnings form Goldman Sachs which easily beat expectations, driven by strong investment banking earnings.

· On the commodity markets, oil prices rallied about 1.8% following a sharper than expected drawdown in US inventories. Other commodities were mixed, with gold holding around US$1810/Oz and base metals slightly weaker. The A$ is back above US70c and the ASX futures are pointing to a 0.4% gain on the local market. The latest COVID-19 data showed the global virus infection rates now stand at over 13.1m of which the US accounts for about 3.3m

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.