Market Matters Afternoon Report Monday 21st March 2016

WHAT MATTERED TODAY

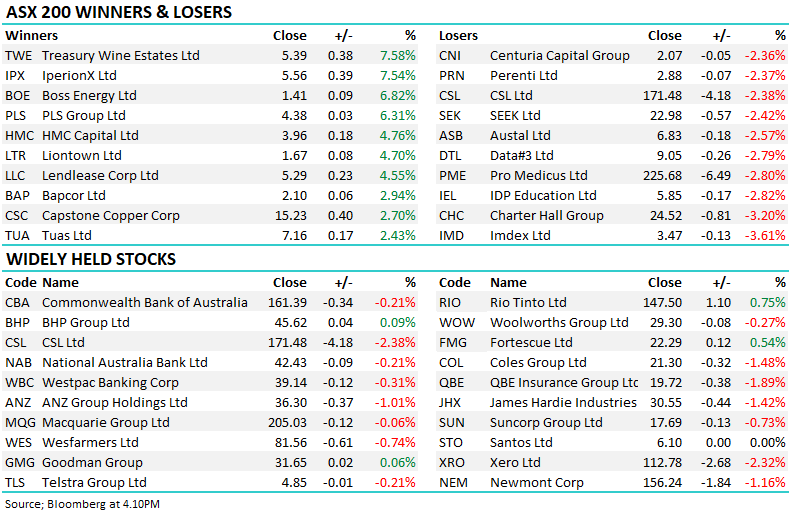

1. 5200 once again provided a cap on the ASX 200 today with the index hitting a high of 5195, before yawning into the close. Defensive industrial stocks the best, Banks weak – as were the energy plays while Resources were generally okay. Gold coy Regis Resources (RRL) which was added to the portfolio last week had a day in the sun up +3.38% to $2.45 v the Gold sector which was down.

2. Not a huge amount of market news today however a lot on the political front with the PM showing some nous by bringing back parliament a few weeks early, moving forward the budget and floating the idea of a double dissolution election. A double dissolution election is different to regular elections, when only half the Senate seats are contested. In a double dissolution, the Governor-General dissolves both the Senate and the House of Representatives at the same time, meaning every seat in both chambers is contested. This is the only time that all senators stand for election at the same time. It’s even more important now given the Govt has recently amended legislation around the power of minority parties and where preferences go.

Anyway, from a markets/business perspective, having a Govt with the ability to make sensible reforms without their fate being determined by a select few in the Senate should be a good thing.

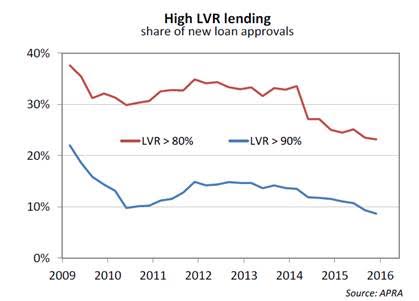

3. Banks were a mixed bag today. Westpac (WBC) the best (-0.49% to $32.52) with CBA the worst (-1.31% to $77.14). There was an interesting presentation from APRA on Fridaytalking about lending standards, Loan to Value Ratios (LVR) and capital positions. In short, lending standards have improved pretty dramatically, LVRs are down, with those on 80% or more off from 35% to 23% over the past 12 months – while serviceability requirements have increased. When you go for a loan, the interest rate used to assess loan servicing is now at least 7.25% (+50bps). The big short seems unlikely.

4. Regarding capital positions, we know 2015 was a year when banks needed to raise a lot and it was tipped that 2016 would be similar. It seems now APRA will review these requirements mid-year, before making recommendations. That means its highly likely banks will not need to raise any meaningful amounts of capital this year – which is positive for earnings. That said, we continue to think that banks will range trade, and we’ve just seen a move from the bottom of the range – but are not yet at the top. Important to buy weakness but more importantly, reduce exposure into strength. We’ve currently got ANZ (ANZ), Bendigo Bank (BEN) & Commonwealth (CBA) in the portfolio – weighting in aggregate of 25%.

5. As suggested in this morning’s report, we think the market has more legs; however some form of consolidation/slight pullback in the very near term is the short term call, before the US market kicks on and re-tests recent highs – somewhere above 2100 on the S&P. On our market we continue to target levels above 5300 – implying upside of +2.6%.

STOCKS ON THE MOVE

6. Macquarie Group (MQG $67.57, –1.05%) – A negative report in the AFR over the weekend prompted some early selling

- Some chatter about MQG’s exposure to ‘Junk Bonds’ by a well regarded commentator in the AFR over the weekend prompted some early selling. The stock was down but recovered more than $1 from its lows

- Junk bonds are non-investment grade credit - anything with a rating of BB of lower by Standard and Poor’s. Fortesque (FMG) is classified as junk. It’s certainly true that MQG play in this area, but they’re an investment bank, and history shows they’re good at it. They’ve also increased their exposure in January, when the world went through a growth scare and credit spreads blew out. They’ve now started to contract which a good thing

- The article also pointed to leverage of MQG’s balance sheet of 19 times. That’s about the same at the big four banks. The real issue with MQG is a rising currency. Anything above 78c starts to eat into earnings, and of course, the market volatility in January put a few corporate deals on ice.

- We’re neutral MQG however for those holding, we’d be using any strength into the high 70’s to reduce.

7. QBE Insurance (QBE $10.85, +1.40%) – up today after bouncing from short term support

- QBE rallied today in an otherwise weak market. It’s a stock on a turnaround path that many investors have held through some turbulent years. A 2007 high around $35 before a fall from grace to $9.50 this February.

- It’s a macro story and will be the cleanest way to play higher interest rates in the US when they finally some. A strong report recently was a welcome change and we need to continue to see that trend play out. If we price QBE on 13x CY16 earnings – which is around its long term average, stock can justify a price around $11.70

- We think QBE is worth keeping on the radar, however look for a price nearer to $9 which could come if US rates are held lower for longer, and the AUD continues to rally

8. Nick Scali (NCK $4.10, 0%) – A good retailer that has traditionally lacked market liquidity

- NCK is a well-known, well regarded retailer that has a very strong record of good growth, sublime margins and they’re genuinely good at what they do. The Scali Family started the business about 50 years ago and still owns 50% of the company.

- For that reason, the stock has been illiquid. That could change with the potential sell down of the Scali family stake. The stock is in a trading halt pending the sell down, and no doubt they’ll be some volatility when it emerges later this week, however a good business that’s worth keeping an eye on

- We’re keen to see trading action post the sell down before making a judgment.