Where are the short-sellers “hanging out” as the market grinds higher? (NWH, MFG, WEB, ING, BOQ, Z1P, JBH)

On Thursday there was again no meaningful change for the ASX200 as it managed to eke out a small gain of +0.3% courtesy of some steady buying across the index which saw over 60% of the stocks manage to close in positive territory. I covered the budget updates in a little more detail in the Afternoon note but I believe the bottom line was summed up perfectly by the Finance Minister – “what was the alternative?” . I feel we should all take on board some of Scott Morrisons interview last night, look ahead, be Australian and make the best from an extremely tough situation.

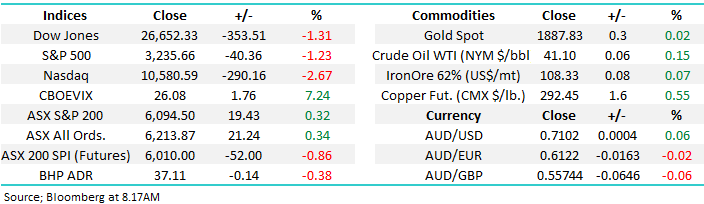

Undoubtedly global equities are doing just that with the MSCI World Index less than 5% below its all-time high. The combination of central bank and government stimulus is clearly managing to offset the huge economic damage being inflicted by COVID-19. While asset prices are being supported by a “shoot now and ask questions later” attitude to stimulus we see no reason not to maintain a medium-term positive outlook for shares, undoubtedly there will be some tough decisions and payback in the years to come but for now markets are revelling in the “free money” world and fighting the trend is a dangerous game - remember black swan events occur when nobodies ready, not when many are anticipating an imminent calamity.

MM remains bullish global equities over the next 12-18 months.

MSCI World Index Chart

The local markets post-March recovery has been fairly muted compared to many of the larger global markets, primarily because of the lagging Banking Sector and relative dearth of IT stocks but we feel this long suffering group can regain their mojo into Christmas which would in all likelihood propel our index to a new higher comfort level – we think patience will ultimately be rewarded for investors who have a significant exposure to the Australian market.

MM still remains bullish the ASX200 medium-term.

ASX200 Index Chart

One of MM’s holding in our Growth portfolio, NRW Holdings (NWH) finally received some love yesterday rallying +8.6% to be best on ground. There was no obvious news to attract the buying, its recent ~25% decline probably just brought the value investors out of their burrows as the mining services business looks very cheap to MM, especially if we’re correct and a reflationary cycle is around the corner.

MM remains bullish NWH initially looking for ~30% upside.

NRW Holdings (NWH) Chart

Conversely the 2nd worst performing stock on the day was fund manager Magellan (MFG), although it only slipped less than 3% following a downgrade by Macquarie (MQG) who now have a price target ~$57 on the stock. Underperformance from MFG would tie in with our view towards the tech-based NASDAQ being stretched with the FANG’s the current focus of their major portfolios, hence we have no interest in this high flying fund manager at current levels.

MM will be interested in MFG ~10% lower.

NB Overnight the IT Sector was again the worst performing in the US, this has been a lot more common in July than I can recall through the rest of 2020.

Magellan (MFG) Chart

Global Markets.

US stocks endured a tough Thursday with mixed earnings and a disappointing jobless claims number creating concern for investors who have propelled the NASDAQ up 63% to fresh all-time highs since March’s panic sell-off. Also not helping equities is the number of daily COVID-19 cases persisting to hold well above 60,000. Although it does feel like its slowly losing its upside momentum, after such a stellar advance by the hugely influential FANG stocks its no surprise that things are at least taking a rest. Short-term things do look tired in the US but at this point a period of consolidation would only be healthy with regard to the continuation of the strong bullish uptrend.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

Looking amongst the most shorted stocks for opportunity.

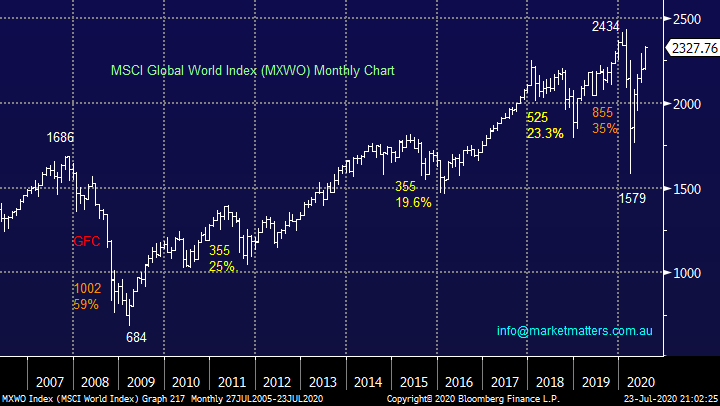

The bears have been getting burnt since March if they’ve been shorting the global indices and especially if they have bought put options which have experienced the double whammy of a strong market and plunging volatility. The VIX which measures volatility has fallen back towards the average of the last 20-years which feels pretty amazing considering the huge uncertainties weighing on stocks e.g. the coronavirus, US / global – China relations and of course Novembers looming US election. Our feeling is the most likely scenario is we’re in for a period of relative stability which may feel almost boring compared to Q1 i.e. The VIX Index looks set to tread water between the 20 and 30 area.

Today we’ve looked at the stock level with regard to shorting to see if any of the currently unpopular stocks might prove to be a mistake by the short-sellers and an ensuing aggressive covering rally may become a real possibility in the months ahead.

MM can see the VIX hovering between 20 & 30 into Christmas.

The VIX (volatility) Index Chart

Today I have briefly looked at 5 well known Australian companies who are carrying large short positions, remember professional traders usually get it correct but when their wrong we often see fireworks on the upside.

1 Webjet (WEB) $3.18

On-line travel business WEB was forced to raise money in April at a huge 84% discount to its high of last June clearly leaving investors licking their wounds. The stocks carrying an almost 10% short position which is understandable when we consider the uncertainty around the future landscape with regards to travel until we have a tried, tested and readily available vaccine for COVID-19, even then things may never fully return to 2019 levels e.g. the likes of South America and Africa may not eradicate the virus for many years which would certainly dissuade many from going there

At this stage I see no reason to be “bottom picking” in WEB, it will undoubtedly have periods where it bounces sharply but picking these will be akin to a game of two-up, not quality value add investing.

MM is neutral WEB.

Webjet (WEB)) Chart

2 Ingham’s Group (ING) $3.39

Poultry business ING has been relatively stable in 2020 but it still hasn’t recovered from its major plunge in August 2019 after announcing their half-year results. The results were ok but the stock was priced for growth and the business didn’t deliver and is only hoping to by next year. The stocks carrying a 9.3% short position which feels a bit rich but the business needs to start performing, the current closure of a Victorian processing plant following a positive COVID-19 test may provide an opportunity for investors who like the stock. For good measure ING does enjoy a reasonable balance sheet which should be relatively immune from the pandemic.

If we see other results driven aggressive spike lower in ING we will be considering it as a candidate for our Growth Portfolio.

MM is neutral / positive ING.

Ingham’s Group (ING) Chart

3 Bank of Queensland (BOQ) $6.43

Queensland based BOQ is carrying a 7.9% short position which I feel could be hurt over the next 6-months but subscribers should understand that this position might for example be paired against a long CBA position hence it may not bother the holders e.g. over the last month CBA is up +6.5% compared to BOQ which has bounced only +0.5%. However, in general BOQ is a higher beta bank meaning it often rallies / falls harder than the “Big 4” and we can see it outperforming moving forward – a candidate for a short squeeze albeit of a relatively pedestrian nature.

MM is bullish BOQ.

Bank of Queensland (BOQ) Chart

4 Zip Co Ltd (Z1P) $6.55

MM is long Z1P as subscribers know and there’s not a great deal I can add to our existing thesis, we are bullish believing the markets is underestimating the size of the evolving global BNPL market. Views are very polarised towards the stock & sector hence there’s no surprise its carrying a 7.7% short position – if we are correct this is a definite candidate for an explosive short covering rally.

Medium-term MM likes Z1P.

Zip Co Ltd (Z1P) Chart

5 JB Hi-Fi (JBH) $44.27

Retailer JB Hi-Fi is a perfect example that highly shorted stocks don’t always go down, JBH is carrying a 6.7% short position yet its only one good day away from a fresh all-time high. We see no reason to be short JBH and would actually be keen to establish a holding if we see a correction below $40.

MM believes JBH will test $50 in 2020.

JB Hi-Fi (JBH) Chart

Conclusion

Of the 5 stocks touched on today we like Z1P and BOQ plus JBH & ING into weakness while we feel there is no reason to punt on WEB.

Overnight Market Matters Wrap

· The “unexpected” rise in US jobless claims sent the equity markets lower overnight

· On the coronavirus front, US has now exceeded 4 million cases, heavily hit in Florida.

· Earnings season continues, with more than 20% of S&P 500 companies having reported with over three-quarters ahead of analyst expectations.

· The September SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.