Almandin wins the cup – RBA holds rates steady – Chinese economy gains momentum

What Mattered Today

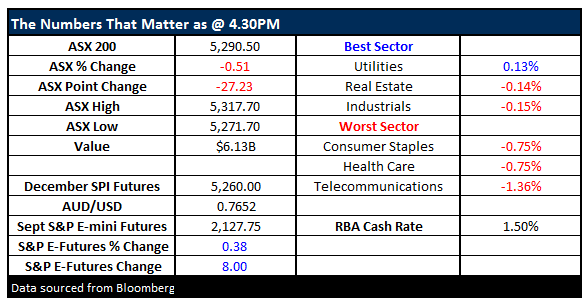

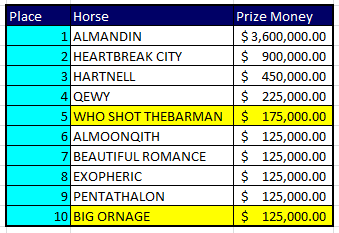

The RBA didn’t cut rates, Chinese manufacturing data was better than expected continuing a good recovery from the Chinese economy and ALMANDIN won the Melbourne cup pocketing cool $3.6m…here’s the rundown of the cup and importantly, the prize money

The RBA was never going to cut rates, with the market pricing just a 4% chance ahead of the decision. The statement pushed more of the same and it seems the RBA is now on hold for the foreseeable future. As we’ve written numerous times, we think the rate cut cycle is now over, the low on rates is now in at 1.50%. The local ‘yield trade’ is telling us that, as are interest rate futures – economists are slowing coming around.

In terms of the Chinese Manufacturing data, today’s PMI readings suggest that the Chinese economy has gained some traction with the Caixin (old HSBC number) manufacturing PMI jumped in October, from 50.1 to a 27-month high of 51.2. The consensus was 50.1 while the official manufacturing PMI also beat expectations, rising from 50.4 to 51.2 v 50.3 expected. Recent data flow + commodity prices are all suggesting that the Chinese economy has bottomed and building momentum.

And finally – in the most important print for the day, we picked BIG ORANGE on the nose, which came 10th and WHO SHOT THE BARMAN for place, which came 5th – no luck from our side, however, we’ll ‘pony up’ again next year.

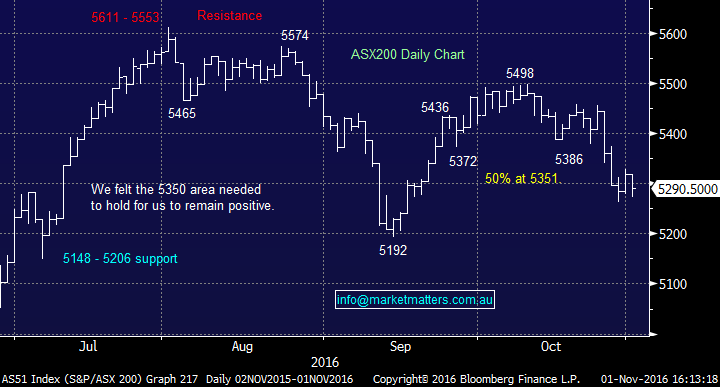

On the market today, we had a range of +/- 42 points, a high of 5313, a low of 5271 and a close of 5286, off 31pts or -0.59%.

ASX Intra-Day Chart

ASX 200 daily chart

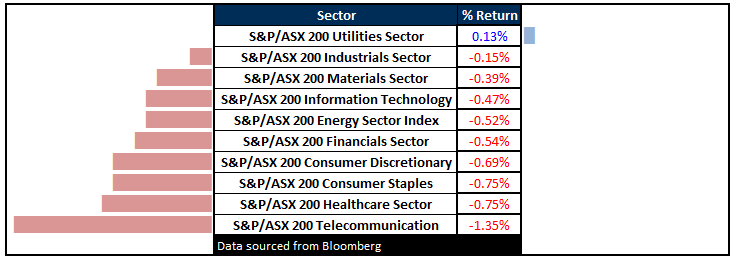

Sectors

ASX 200 Movers

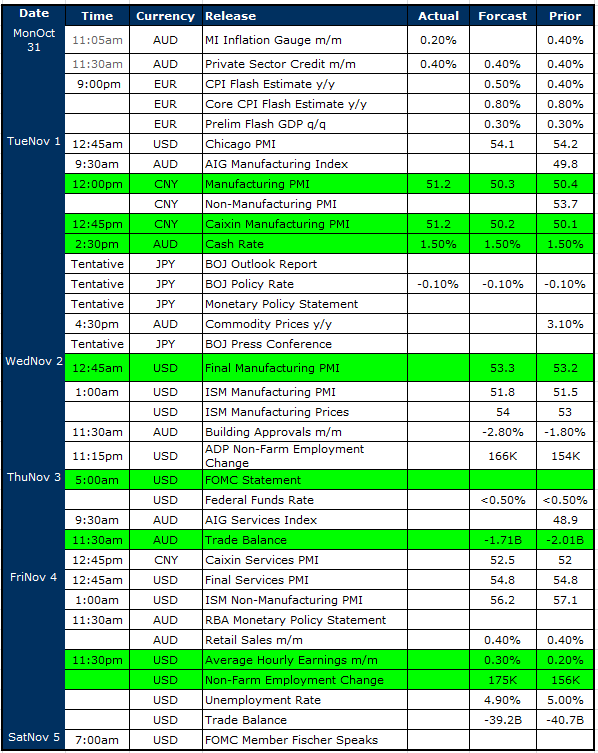

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

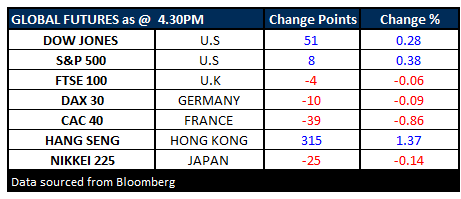

FUTURES – look fairly mixed at this stage.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy.Prices as at 1/11/2016 5.25PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here