ASX 200 back up above 5700 – ends week on a high

What Mattered Today

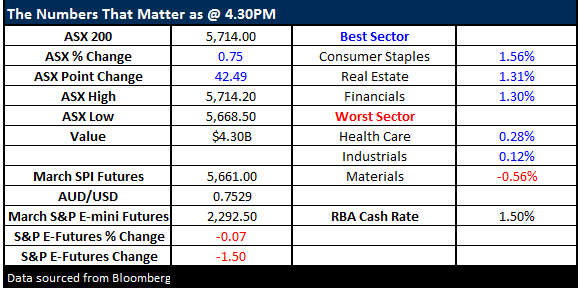

Another reasonable session for Aussie stocks with the market cracking up through 5700 on the back of strong buying in the sectors exposed to a higher $US and higher global interest rates following a move up in both overnight. The likes of QBE did well adding +1.9% to close at $12.33, Macquarie (MQG) was up +1.93% while the Banks were also well supported – the BIG 4 adding 16 index points. Golds lost ground – Newcrest (NCM) down -2.67% to close at $21.18 while the mid cap plays fell more in aggregate. The commodity names were mixed today with BHP down -1.33% while RIO continued to rally, up another 0.92% to close at $67.85. Momentum here seems strong however we continue to think that we’ll get a better entry opportunity into weakness.

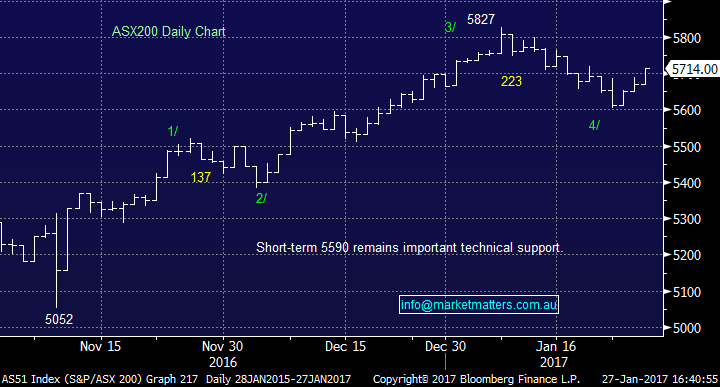

Not a bad week for the ASX 200 after a very soft session Monday that saw the index close at 5610 - we then clawed back +104pts or +1.85%. In terms of the Market Matters portfolio, we’re looking to average into existing positions and / or take one of two more reducing our ~30% cash weighting which we’ve increased into recent strength. A couple of stocks came back to good levels today, namely PTM below $5.00, Newcrest which was down ~5% at one stage today, and Macquarie which was up, but has pulled back in recent sessions. We didn’t act to increase our exposure given our current view for US stocks…tonight’s trade will be interesting and ideally we want to see the strength that has pushed the DOW through 20,000 fail and that sets up the high chance for a decline back into the range that we could then use as a buying opportunity – our clear preference over and above chasing new highs at this point.

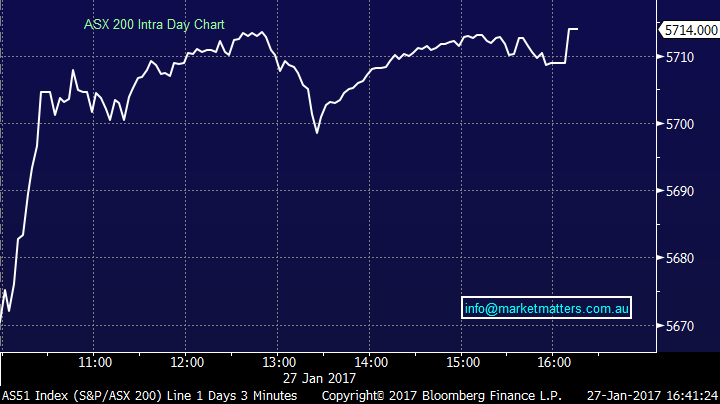

We had a range today of +/- 46 points, a high of 5714, a low of 5668 and a close of 5714, up +42pts or +0.75%. Volume was actually OK with $4bn through equities.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

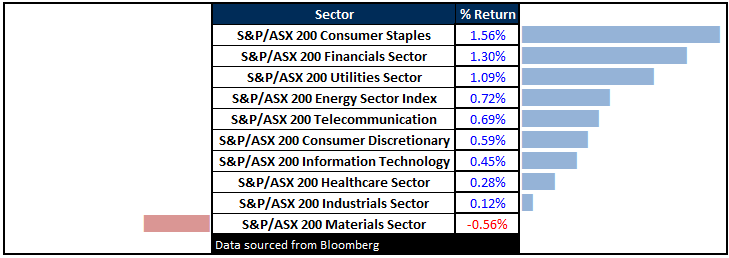

Sectors

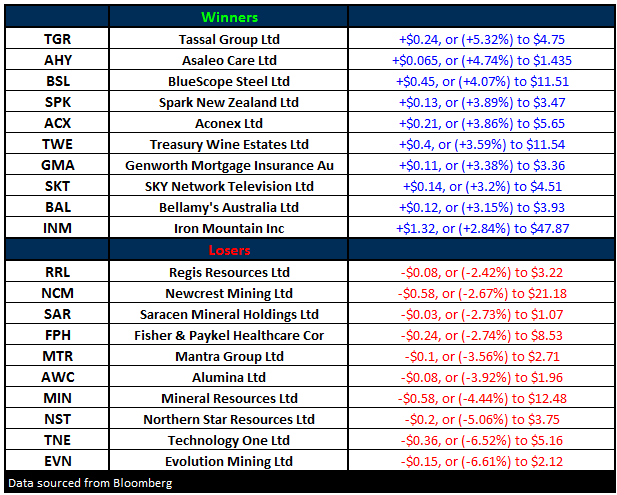

ASX 200 Movers

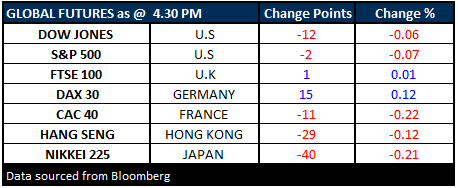

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/01/2017. 4.45PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here