Market opens higher – fades into the close

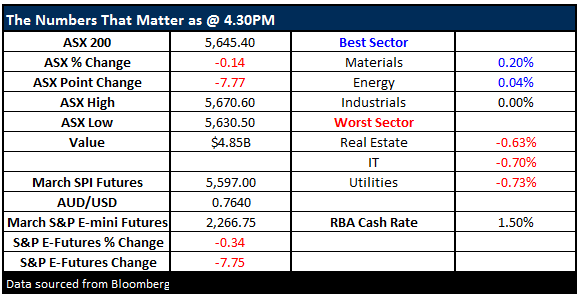

What Mattered Today

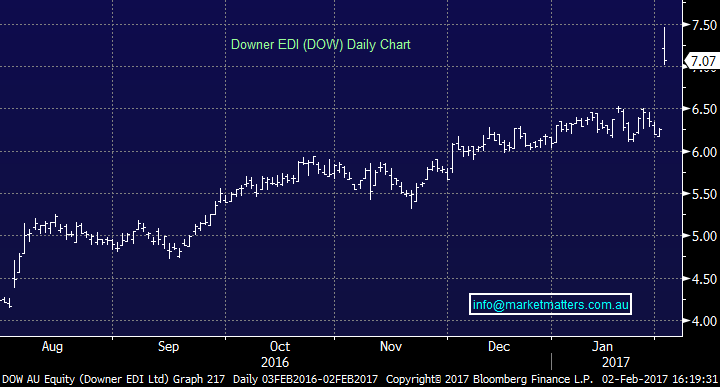

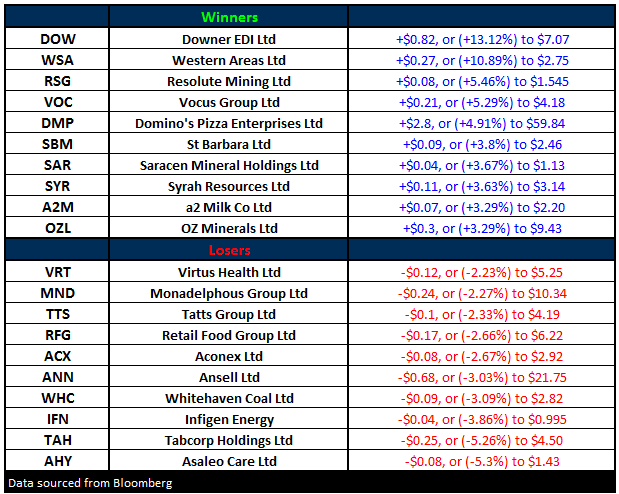

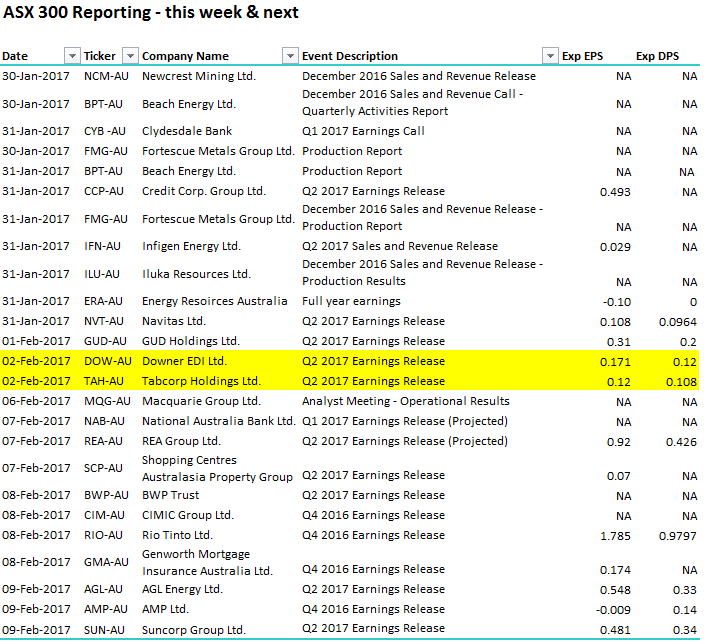

Another mixed bag today with the market peaking early on (10.20am) before drifting lower throughout the day. Some buying coming into those stocks that have been under pressure of late with Domino’s up nearly 5%, Vocus put on ~5% and Western Areas traded up more than 10%. Downer Edi reported a good set of half yearly numbers, topping expectations by around +8.5% for earnings while the dividend was in line with consensus at 12cps. The stock was trading up ~12% but it was up more earlier on – a high of $7.46 versus a $7.07 close. Looks like buyers got a little optimistic this morning.

Downer (DOW) Daily Chart

On the flipside, OceanaGold was hit hard following news that the Philippine Govt had suspended one of their projects – and a number from other companies as well. This has wider ramifications given the other mines are largely Nickel, hence the reason for WSA’s share price rally + Independence Group also put on ~3%. OGC say it’s unjustified and unlawful but just another example of political risk in overseas countries. The US firming in these stakes!

Other gold stocks did well today, with Newcrest up +2.17% and Evolution put on +1.84%.

Newcrest Mining (NCM) Daily Chart

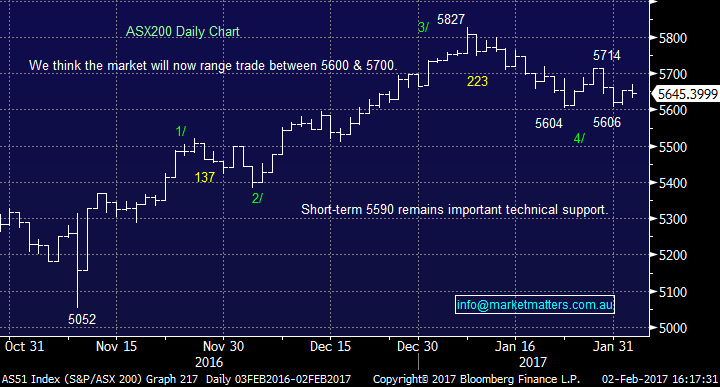

In this type of market and given our view that the market will have one more meaningful rally higher, we think it makes sense to be accumulating stocks on the back foot. We’ve certainly done that with Henderson Group (HGG) of late, while there are a number of other stocks currently on the radar. Its near impossible to pick lows in stocks, and when it does happen, its more luck than good management – but managing cash levels, sector allocations then finally specific stocks will deliver results over time. Our cash levels remain high ~27% and we are continuing to look for opportunities to buy weakness.

We had a range today of +/- 40 points, a high of 5670, a low of 5630 and a close of 5645, up off -7pts or -0.14%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

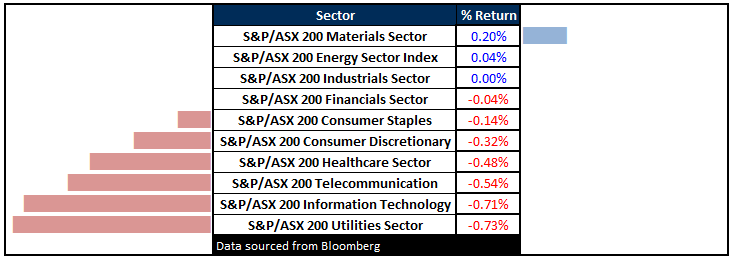

Sectors

ASX 200 Movers

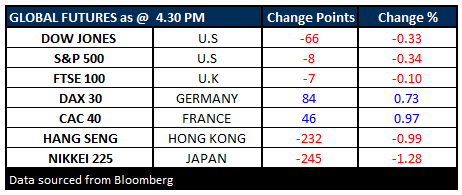

What Matters Overseas

DOW beat by around +8.5% while Tabcorp was hit by costs associated with the Tatts deal

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here