1 up, 1 down….

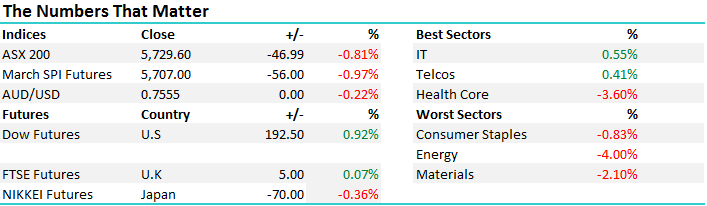

Yesterday’s Trump fuelled the rally seems a distant memory, with the market being clobbered by ~50pts today. This is very typical of a mature bull market which has been running since 2009 – a stat we’ve often quoted and one that continues to guide our investment decisions for the MM portfolio. There is little doubt that the Trump factor is real, fiscal stimulus in the world’s largest economy will improve global growth and that will ultimately lead to higher inflation and higher interest rates.

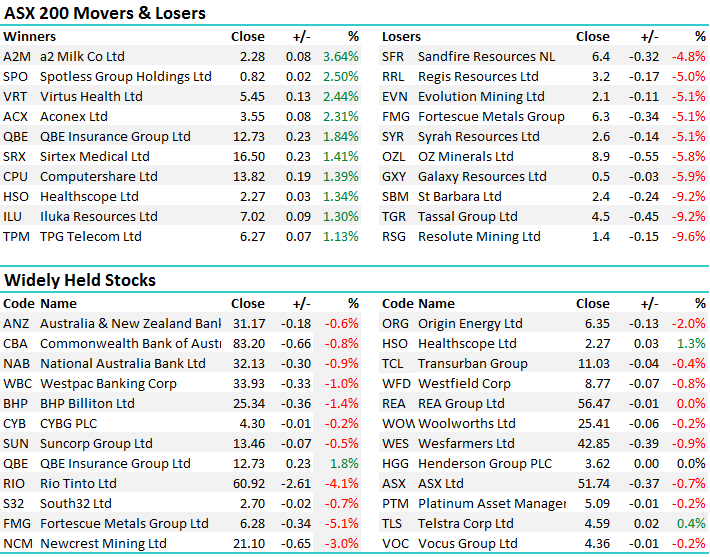

However, as with anything, getting exposure to a particular theme when it’s a known known has been, and will always be difficult – today is an example of that. If we cast our minds back to the start of February, the optimism around resources was extremely high ahead of a reporting season, that confirmed that resource stocks were printing exceptional numbers. Production was up because they thought prices would be low for an extended period, so they produced more to lower the cost per unit. However as it turns out, prices rallied at a time when production was strong = a huge uplift for earnings, so why in the month of February when all this played out, were resources the worst performing sector on the ASX?

Sectors last month….(February 2017)

Source Bloomberg

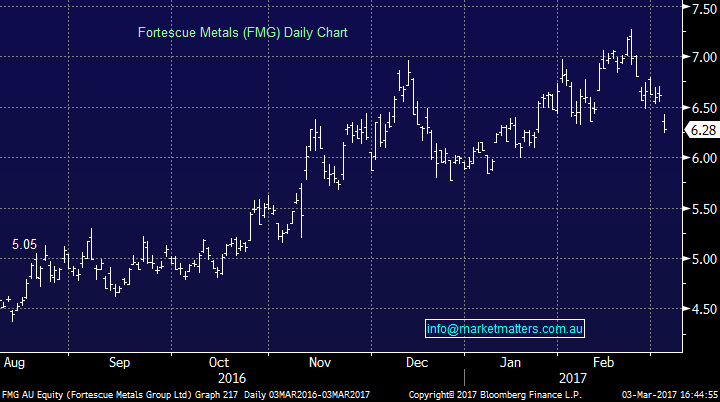

The answer is clearly around expectations. They were high, the companies delivered, but the holders of those companies expected it and there was a clear void of new buyers. The resources stocks have now pulled back – we’re short Fortescue (FMG) when the majority love it, but we have remained firm with our views / levels to step up and buy these names. We agree that resources are a big part of the reflationary trade, however with all types of investment, whether it property, shares, exotic fish or anything else that appeals, the total return is dictated by the price you pay. We will buy resources soon, but today is a clear lesson not the follow the crowd. We don’t follow the crowd and hope our subscribers have found us, because they don’t want to do that either.

Fortescue Metals (FMG) Daily Chart

To that end, we bought a Gold stock today after selling one last week, Newcrest Mining (NCM) when it was trading significantly higher. This is not about being traders, it’s about being active in our allocations and adding value. So many managed funds in this day and age more or less track an index. If you want to track an index, MM is not for you. If you want to try to outperform, then stick around, that’s what we’re about.

Stay tuned for the Weekend Report on Sunday – we’ll detail our views on all major markets globally.

On the market today, we had range today of +/- 40 points, a high of 5465, a low of 5712 and a close of 5729, off-47pts or -0.81%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here