Buying the Under Pressure Resource Stocks Today

The ASX200 was strong today, but internally it was again a game of two halves, a phrase that's getting a touch repetitive - Banks / Financials were again strong with the banking Index rising ~1%, but resources were again weak with BHP -1.21%, RIO -1.95% and FMG -2.24%.

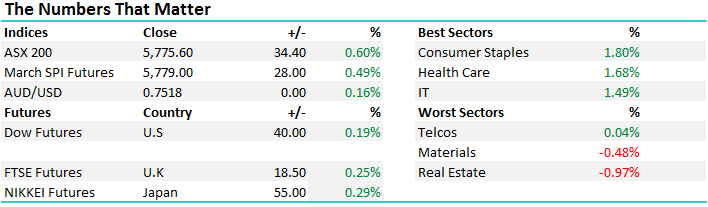

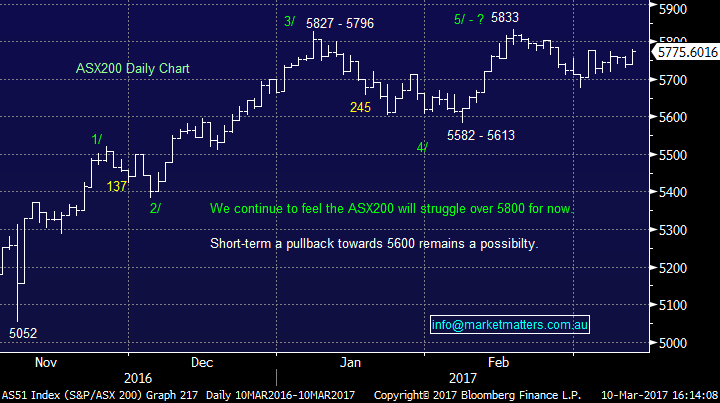

The ASX200 made a fresh monthly high today reaching 5781, before closing 34 points higher (+0.6%) at 5,775, with its range for March only 106-points. Statistically a squeeze towards 5900 feels likely in coming weeks, hence we remain bullish for the March and April period.

ASX 200 intra-day chart

ASX 200 daily chart

We were active in the market today, initiating two fresh investments and taking profit on one trade:

1. We bought RIO Tinto (RIO) at around ~$59.70, allocating only 3% of our portfolio into the diversified miner, leaving room to add an additional 2% if the stock falls closer to $58.

2. We allocated 2.5% of our portfolio into the gold play Regis Resources (RRL) around $3.05. Leaving room to average at lower levels.

3. We took a ~20% profit on our FMG May option position - trading position.

RIO Tinto (RIO) Weekly chart

Alerts

Lastly, a quick update on our thought process behind the alerts that have been sent out to subscribers over recent days. Alerts are very important to the MM service, but it's obviously very tricky to design a perfect offering for all subscribers. Our recent thought process:

1. If we intend to transact in a particular stock at a particular level we distribute the alert prior to the market opening, usually after discussing the view in previous reports. Hence allowing subscribers to decide if / how they follow the alert.

2. Obviously sometimes like yesterday when we were intending to buy RRL under $3 these alerts are unfilled. However, if we do not inform subscribers beforehand opportunities can be easily missed in fast moving markets.

3. If we decide to "tweak" any buying / selling levels and / or volume in stock we send out a fresh alert like today. For example we purchased RIO above the sub-$59 level that was first intended this morning but we reduced the volume from 5% to 3%.

We hope his helps explain our thought process, we decided to purchase some stock today at slightly higher levels than first planned because the US Employment data often produces dramatic swings in global stock markets.

We are glued to our Bloomberg's daily and our aim is to be your "eyes and ears" in the market looking to add value on many levels from stock selection to day to day entry / exit levels.

Have a great weekend and watch out for the weekend report!

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/03/2017. 5.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here