Quiet session while the Victorians are on Holidays

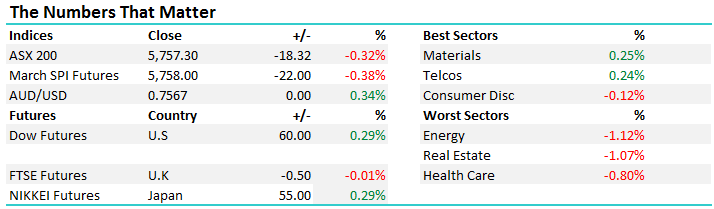

The ASX200 was very quiet today, with most Victorians on holiday for Labour Day. The ASX200 drifted lower, especially in the first hour, once traders realised that the recent buying in our bank stocks was absent. By the day's end the ASX200 closed -0.32% led by the Energy -1.2%, Real Estate -1.07% and Healthcare -0.8%. A range today of 47, a high of 5792, a low of 5745 and a close of 5757, off -18 points or -0.32%

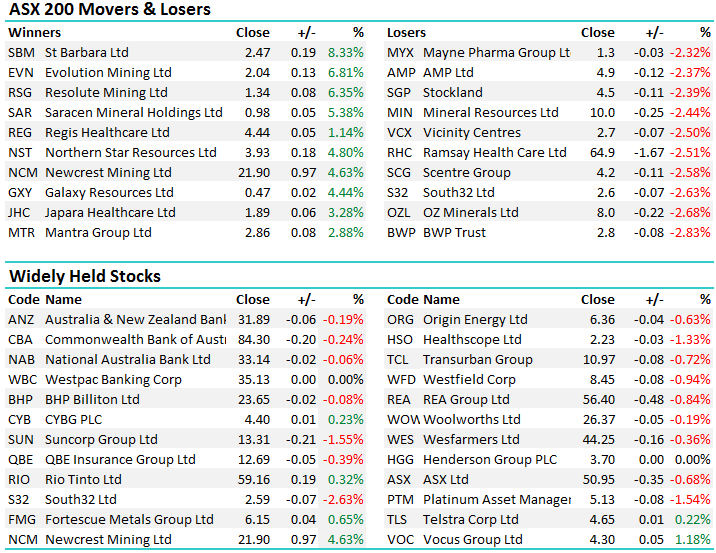

The notable exception in the Financial Sector was Macquarie Bank (MQG) which closed up 47c at $89.42. We are long MQG, looking to take profit ~$90,50 which is rapidly coming into sight.

However, the resources recovered from early losses to close in the black with the Materials Index closing up 0.1%.

ASX 200 intra-day chart

ASX 200 daily chart

We were again active in the market today, buying an additional 2% RIO ~$58.40, it was pleasing to see the stock recover 95c from its lows to close positive on the day at $59.16 - this takes our holding in RIO to 5% of our portfolio. We would not be surprised to see RIO end the week over the psychological $60 level.

Fortescue Metals (FMG) was a standout today, showing how quickly it can turn, temporarily breaking under $6 before rallying hard and eventually closing at $6.15 - at one stage the stock rallied 4.3% from its low. We always are happy to take our trading money early in this volatile beast!

RIO Tinto (RIO) Weekly chart

Last but not least, the gold sector had an excellent lift with RRL +5%, EVN +6.8% and NCM +4.6%.

While today's rally does not prove our recent foray into the precious metal sector, via EVN and RRL, will eventually prove fruitful today's reaction after the last 2 weeks aggressive sell-off does feel like a classic low.

Regis Resources (RRL) Weekly Chart

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here