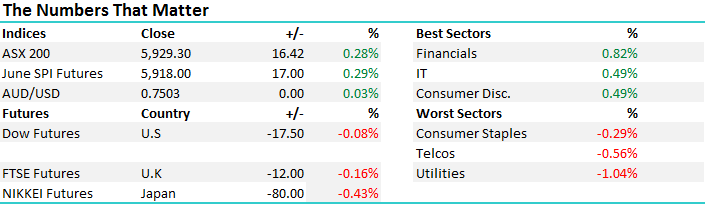

Financials lead the ASX to 5950!

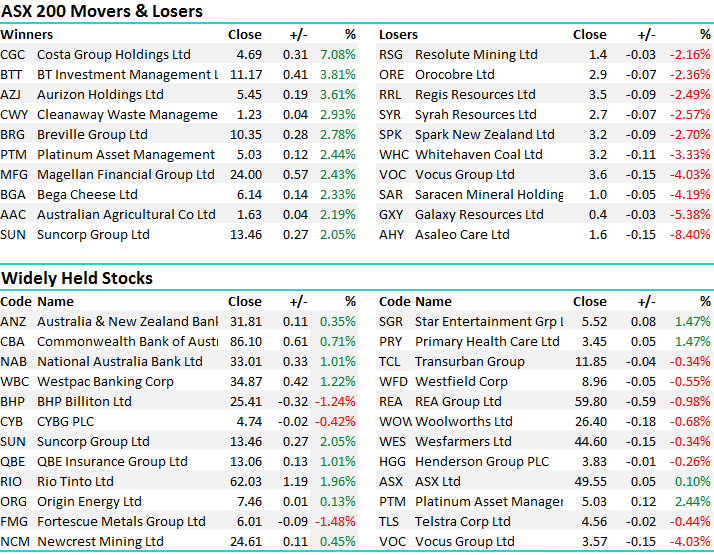

Another decent session for the ASX today with financials once again dominating the gains, although after hitting an intra-day high of 5950, some profit taking became obvious on the index. We had a range today of +/- 52 points, a high of 5950, a low of 5898 and a close of 5929, up +16pts or +0.28%.

Banks accounted for +12pts of the index gains, however the most love was felt in the diversified financial space with Platinum Asset (PTM) up +2.44%, Magellan put on +2.43% while BT (BTT) was the standout adding +3.81%. A space we continue to like.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

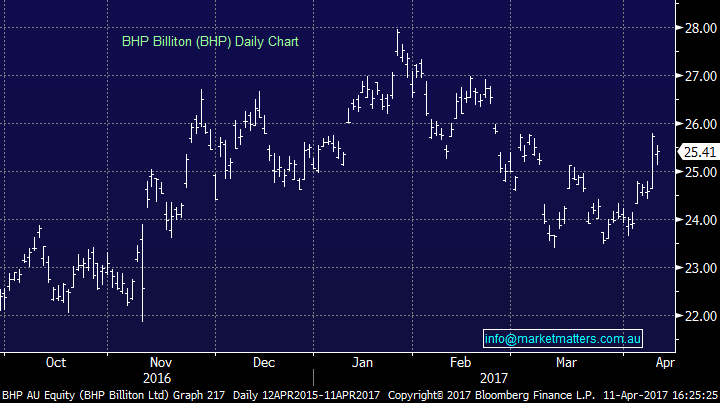

BHP continues to be the talk of the town after the proposal from Elliot Partners doing the rounds, with three clear recommendations. On contemplation, the proposal is sound but it’s unlikely to get up.

Dissolving dual listing; This is expensive and complicated and something BHP have considered on a number of occasions in the past. It’s unlikely to happen

Spinning off the Petroleum Division; A possibility and BHP do have form here after spinning off Onesteel, BlueScope, S32 in recent history, however BHP are big on their 4 pillars of future growth, being Iron Ore, Coal, Copper and Petroleum

Franking Credit Release; Obviously this is something that will add value, but a discussion BHP must have with the Aussie Govt. It’s not alone in having a high franking balance and other companies (HVN and TAH examples) are grappling with the same issue. HVN used an interesting way to address this last year by raising equity while at the same time issuing a fully franked dividend, however it appears the ATO was not a fan!

Anyway, it’s food for thought and BHP have appointed Goldman’s to help prepare a response. BHP shares closed down -1.24% today to $25.41, however we think the simple discussion around this proposal is a win win for shareholders. We remain bullish BHP

BHP Daily Chart

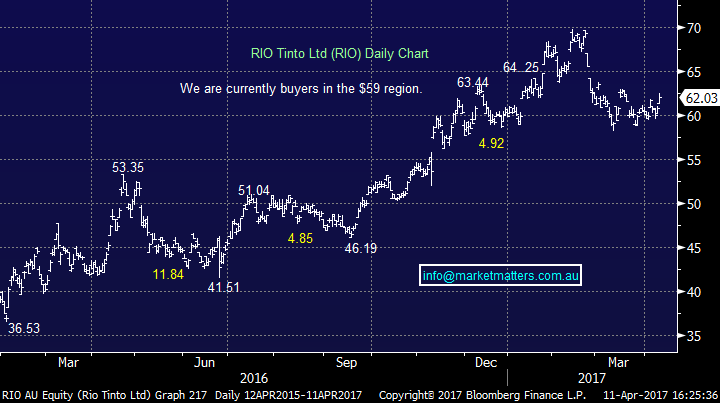

The interesting aspect to consider is around, RIO, given it satisfies 2 of the three ideas outlined above, yet didn’t rally yesterday. RIO played catch up today rallying +1.96% to $62.03. We own both BHP and RIO from lower levels.

RIO Tinto (RIO) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here