Subscribers questions (LYC, HLS, SLR, NCM, MSB, CL1, VOC, GOLD, GDX, PPH, ISX, ILU, OCL, MQG)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we have results from Altium (ALU), Bendigo (BEN), Bluescope (BSL), IPH Lts (IPH), Invocare (IVC), JB Hi-Fi (JHB), Jumbo Interactive (JIN), Lend Lease (LLC). I cover ALU, BSL, LLC, JBH below

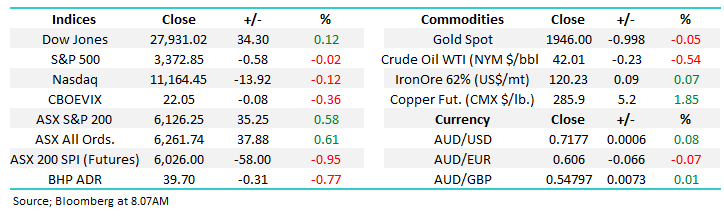

The SPI Futures are calling the ASX to open down almost 1% today following a fairly lacklustre session on Wall Street, it feels a touch overdone on the downside, but we all know about the magnetic pull towards the 6000 area. There’s no major fresh news over the weekend but it continues to feel like investors are discounting any potential worst-case scenarios, or in other words the markets “too cashed up” to fall very far:

1 – Victoria’s COVID-19 numbers are declining slowly while NSW remains reasonably well contained but we still have no idea when and how this unwanted chapter in our lives will finish.

2 – US stocks are ignoring stimulus uncertainty believing like MM that we will get yet another 11th hour resolution (yet again!) but its pricing in zero risk of being disappointed.

MM remains bullish Australian stocks medium-term.

ASX200 Index Chart

Australian rare earths miner Lynas (LYC) has a market cap of almost $1.9bn and now they’re tapping the market for another $425m when it delivers its 2020 earnings this morning – the deal is set to via a placement and rights issue priced between $2.30 & $2.40, or about 10% below Fridays close. The move is being forced on the company because they have been ordered to stop producing low-level radiative waste in Malaysia, the plan is to bring it back to Kalgoorlie, WA.

It will be very interesting to see who takes up the shares, only last year the company rejected a bid by Wesfarmers at $2.25 which looks like a smart move at today’s price.

MM is neutral LYC at this stage.

Lynas Corp Ltd (LYC) Chart

Thanks again for the much appreciated questions, perhaps the pick-up in volume is a signal subscribers are becoming a little more comfortable with the future outcome from COVID-19.

Question 1

“Hi MM 1. Can you give me your latest view on HLS (Healius)- Would you continue to hold as further corporate interest seems likely. Or would you take the 20% I'm up and use the funds elsewhere. Do you have a price target to sell? 2. What are your views on SLR - Silver Lake Resources” - Regards Debra G.

Morning Debbie,

The last actual bid for Healius (HLS) was by Partners Group back in late February at $3.40 per share which was rejected by the board. Since then, HLS have agreed to sell their Medical Centres to BGH Capital which is on track for completion in 1H21 and that was the reason for a strong recovery in the share price in a move that many describe as defensive. We feel the likelihood of a successful takeover of HLS as a whole has now diminished, the stocks rotating around looking good buying around $3 and a sell at $3.50, hence we’re neutral today.

At an operational level, its latest trading update delivered in July was weak, however the expected numbers were wide given the material accounting adjustments related to the sale of the Medical Centres. The focus now is all about sustainable growth in their imaging and pathology units and it seems for now at least momentum is strong.

MM is neutral to positive HLS.

Healius (HLS) Chart

We like gold producer Silver Lake Resources (SLR) after its ~18% correction but it’s clearly a volatile play which needs careful evaluation with regards to risk / reward. Hence, we would leave some flexibility to average if the stock fell back under $1.90.

MM is net positive SLR.

Silver Lake Resources (SLR) Chart

Question 2

“Hi James, is buying a currency-hedged ETF for gold miners MNRS less risky than buying a single gold miner, NCM especially when you consider the $A is on the way up. Is there an ETF for silver miners in the ASX as I can't think of any?” - Thanks Sidney H.

Morning Sidney,

Our opinion is currency hedged ETF’s are indeed less “risky” than individual miners as we witnessed last week when Newcrest (NCM) which we own disappointed the market when it reported leading to subsequent underperformance as the sector recovered. Effectively a position in the ETF is following a view on the gold price / sector as opposed to a single stock being a more focused outlook.

Hence at MM we advocate using a mixture of ETF’s and individual stocks when we deem appropriate. To play a view on silver miners I believe you are best suited going to the US market e.g. iShares MSCI Silver Miners ETF (SLVP US) – there’s not one listed on the ASX as there are no pure play silver companies listed in Australia.

MM remains bullish NCM, but we are looking for the $33 area to hold further weakness.

Newcrest Mining (NCM) Chart

Question 3

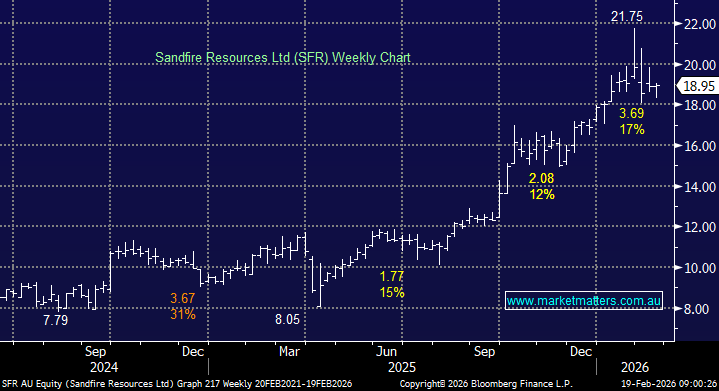

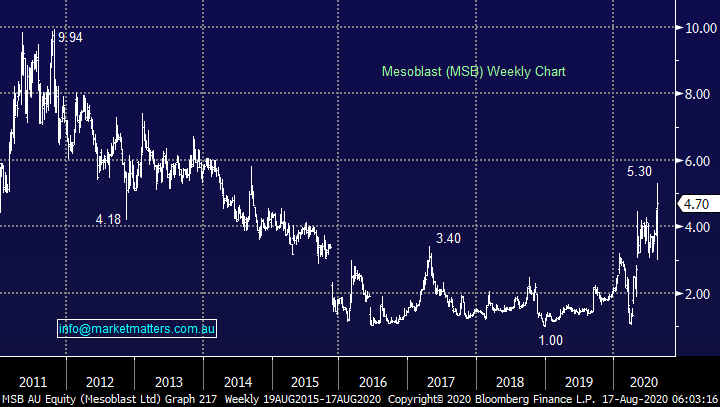

“Hi Guys, was hoping you can comment on Mesoblast, got hammered. Is it worth looking at or buying now?” - thanks Peter B.

Morning Peter,

Alas Monday has come around too late for this question as following its positive FDA oncological drug ruling Mesoblast (MSB) rallied dramatically on Friday. The stocks now soared ~500% from the depths of this year as the market clearly became more confident of a positive outcome for its new drug, at this stage it feels like a classic case of “buy the rumour sell the fact” i.e. we feel the risk / reward is unattractive much above $5.

MM is now neutral MSB

Mesoblast (MSB) Chart

Question 4

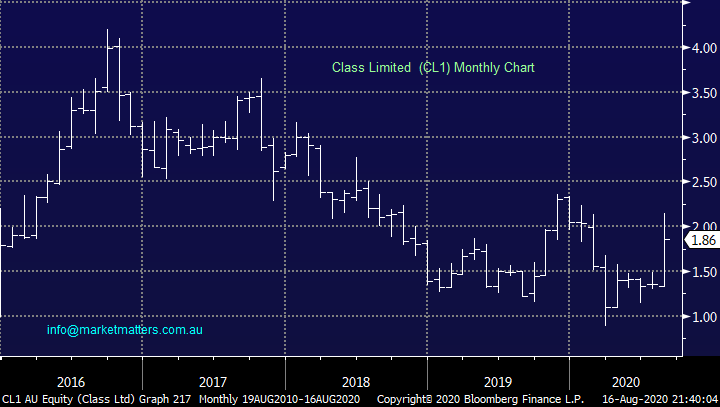

“Hi James, Could you please advise on CL1 (Class Ltd) 25% bounce upwards on Thursday?” - Cheers Mike F.

Morning Mike,

CL1 for those not familiar is an almost $230m Sydney based business which designs / develops application software used in portfolio management and reporting, for both SMSF’s and non-SMSF accounts.

The stock soared last week after delivering an excellent report which showed revenue / income had risen 15% while recurring revenue was up a pleasing 22% plus guidance for 2021 is targeting another 20% increase. I like CL1 at current levels and technical stops can be used below $1.50 - we shouldn’t forget the stocks been falling since late 2016.

This is the type of smaller, emerging, growth orientated business that could find itself in the MM Emerging Companies portfolio launching soon!

MM likes CL1 with stops below $1.50.

Class Ltd (CL1) Chart

Question 5

“A couple of questions for Mondays report. Following the announcement made by Mesoblast 14/8/20 & given the high risk nature of this business do you think investors should "take the money & run" now or wait until the end of September when the FDA decision will be known? Also, can I have your thoughts on Vocus (VOC) below $3.” - Thank you Ian C.

Morning Ian,

We’ve covered MSB earlier hence I will move straight onto Vocus (VOC) which has been falling for over 3-years with the question: is it poised for a turnaround? On the positive side the stock is cheap from an asset perspective when we consider what other enterprise / fibre assets are trading at globally, however VOC have some headwinds in the short term around earnings, hence the stock price is in a trading range i.e. not a lot of obvious conviction either way.

We feel the stock can ultimately rally towards $4 and beyond but MM needs to see VOC get through this COVID-19 period, they do have decent exposure to small and medium sized businesses in Australia and this is an area where they traditionally generate strong margins.

MM has VOC on watch as we look for catalysts to drive the move sooner rather than later, as we said before, the assets look cheap but there are earnings headwinds in the short term.

MM is neutral / positive VOC ~$3.

Vocus Group (VOC) Chart

Question 6

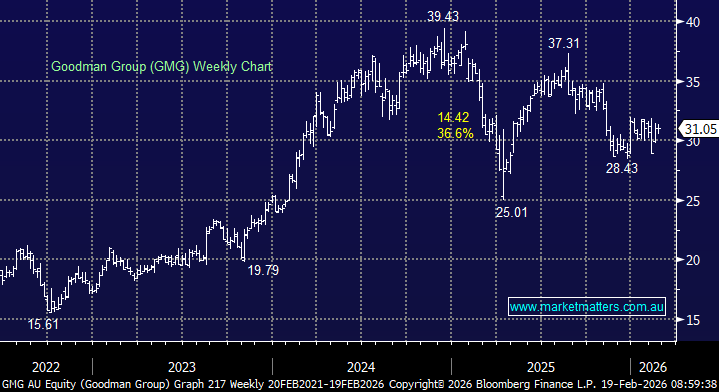

“Hi James, NCM - just came out with results and fell. Gold output to fall in 2021. Can you explain if this will be a problem for the share price as I find it hard to read all the reports and jargon that goes with it. Also, your thoughts on the ETF GOLD compared to buying gold itself or buying into a mining company.” - Thanks heaps, Kim B.

Morning Kim,

NCM has been a serial underperformer over previous years however more recently, they’ve improved operationally and looked to be kicking goals on a more consistent basis, but alas, last week’s result has again disappointed the market with concerns over the Lihir operation resurfacing – i.e. Its “cheap” for a reason! We are going to give the position a little more room, but we’re definitely not married to it and a switch to another member within the sector is not out of the question.

Alternatively investors can turn their attention to gold facing ETF’s, we like 2 traded locally :

1 – ETFS Metal Securities Australia Ltd (GOLD) is a $2.1bn ETF which tracks the gold price – it’s not currency hedged.

2 – VanEck Vectors Gold Miners ETF which follows the US NYSE gold Miners Index, it has a market cap of $390mn with most exposure to North American gold stocks who like a depreciating $US.

MM is bullish both the GOLD & GDX local ETF’s.

ETFS Physical Gold ETF (GOLD) Chart

VanEck Vectors Gold Miners ETF (GDX) Chart

Question 7

“HI James and crew Can I get your thoughts on Pushpay (PPH). Its another IT business that is scalable into global markets or too late for the growth game.” - Paul B.

Hi Paul,

PPH is an IT business that currently facilitates the digital giving to not-for-profits, mainly in the ‘faith sector’ an area which has benefited since COVID-19 but it might face some short-term headwinds when the pandemic is finally controlled. This is a company with both strong growth and impressive margins in the ~65% region and they recently guided well for FY21.

MM likes PPH, ideally into weakness under $7.

Pushpay Holdings (PPH) Chart

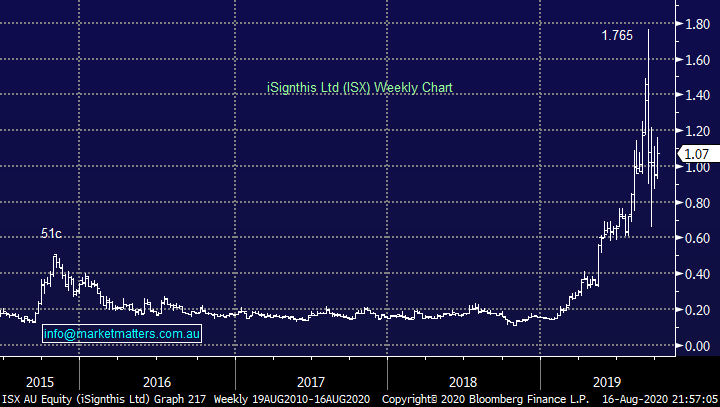

Question 8

“Hi James, thanks for the regular informative commentary. iSignthis (ISX) has been suspended from trading by the ASX for a lengthy period. In recent weeks an Independent Expert Report authored by Clayton Utz partners has been issued to the ASX. Having read the response by ASX, I cannot understand the demands by ASX which remain outstanding. Can you kindly cast your expert eye on the ASX response and their outstanding demands by the ASX?” - Thanks & Regards Ram.

Hi Ram,

ISX is battling away on many fronts from a legal perspective and experience tells me, there are few winners that come out of this other than the lawyers. On one hand ISX are fighting to get back trading (on the ASX) while also suing the ASX for damages. The interpretation of the experts report by the ASX is interesting to say the least, however I haven’t been following the case closely enough to hold a strong view. Disclosure seems to be at the heart of the issue and it’s an area that is incredibly important for financial markets to operate as they should, hence the issue facing ISX.

If ISX trades again, I suspect it will be at prices a lot lower than $1.07

iSignthis Ltd (ISX) Chart

Question 9

“James and team. I am interested in your comments on Iluka (ILU), particularly around their proposed rare earth proposals and the iron ore spin off. Keep up the good work.” - Thanks Colin H.

Hi Colin,

ILU is a stock we’ve been watching carefully as we look to increase and evolve our resources exposure in line with our reflation view for the 1-2 years ahead. The company delivered an ok report last week and the stock voted as such leaving it unchanged for the 5-days. The company showed a more than 16% fall in revenue which dropped down to an improved $46mn free cash flow for the half-year. Their iron ore demerger is set to provide a fresh royalties business called Deterra Royalties with shareholders voting in a few months’ time. ILU is forging ahead with its rare earths plans and are considering building its own plant in Australia but so far only $35mn has been directed towards this initiative.

On the surface we like both corporate initiatives by the board but the stock feels “tired” around current levels after a great recovery since March, we are bullish looking for optimum risk / reward entry opportunities.

**For those looking for a smaller, higher risk, potentially higher return Mineral Sands stock, have a look at Strandline (STA) – this is an interesting one**

MM is neutral / positive ILU.

Iluka Resources (ILU) Chart

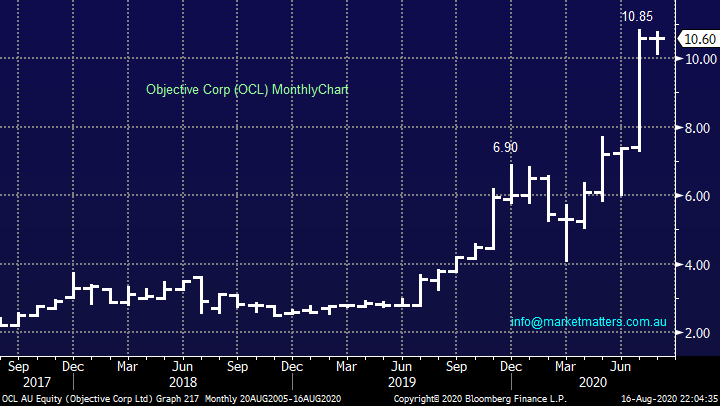

Question 10

“Morning James and Team, really enjoying your ongoing commentary. I would like your view on Objective Corporation Limited (OCL) which has been on my watchlist for some time - I should have bought some time ago! It has run hard, and it appears very expensive on a PE basis, but they do expense their significant R&D budget through the P&L. I think the founder and CEO holds over 50 % of the shares (TBC), ROE is very high, the CEO was very upbeat about performance in 2020/21, I think it can go higher from here, I would appreciate your view” - Many thanks David P.

Hi David,

OCL manufactures knowledge management application software which allows users to access and manage word processing documents, spreadsheets etc. This stock has rapidly become a $1bn business but its kicked the appropriate goals after tapping nicely into both government and financial service organisations. In July the company announced a 22% increase in profit to $11mn following a 21% increase in recurring revenue to $56.6mn – clearly small numbers relative to the market cap however strong growth however the one analyst that covers it has got revenue’s growing 40% in FY21 (they have a price target of $10.16)

From a risk / reward perspective we like the stock into a ~$1.50 pullback.

MM is bullish OCL.

Objective Corp (OCL) Chart

Question 11

“James, Thanks for all your efforts that help us all in these stringent times. Having made some blunders I am trying to align my growth portfolio with MMS. My questions are: What is your target price for MQG (I may need to sell to raise funds), Would you still buy BPT / BIN and LLC at current level or invest money elsewhere and if so where? Have I missed the boat on REH/XRO?” - Cheers Mike D.

Hi Mike,

Lots of questions here rolled into one hence please excuse the brevity:

1 – Macquarie Group (MQG) – we have already taken part profit on our holding and can see a continuation of the current grind higher although we do see potential outperformance from the “Big 4” moving forward which would be a first time for many years.

2 – We particularly like Beach Petroleum (BPT) at current levels and have been discussing increasing our position over the last few weeks.

3 – Bingo (BIN) and Lend Lease (LLC) are stocks we are happy to hold at present but unlike BPT we’re not looking to increase / average either. LLC report today while BIN reports on the 24th. We would wait to view the reports before buying.

4 – Similarly we still like Reece Ltd (REH) and Xero (XRO) at current levels but we’re happy with our current weightings.

Hopefully this helps you align your portfolio but at this stage perhaps the most important point is MQG is the only one we’ve earmarked for selling if / when the index pops above 6200.

Macquarie Group (MQG) Chart

Have a great day & week!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.