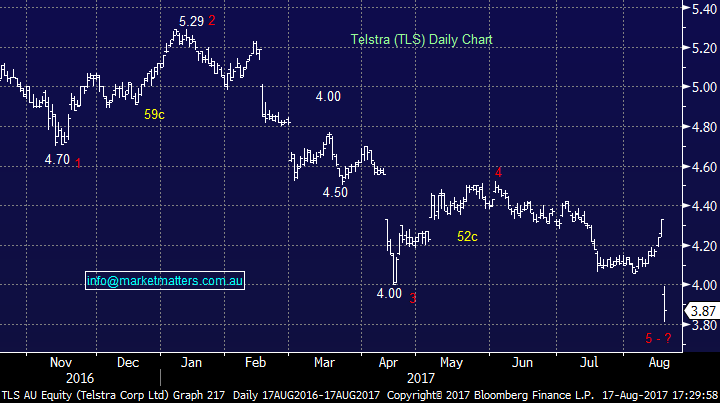

Telstra finally cuts its sacred dividend – & was taken to the cleaners! (TLS, QBE, SUN)

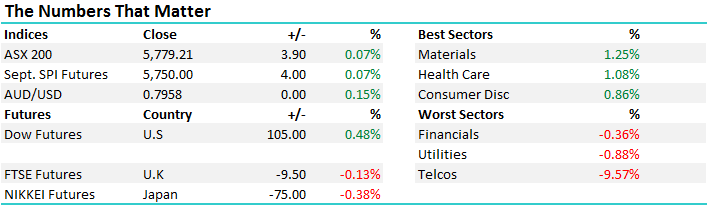

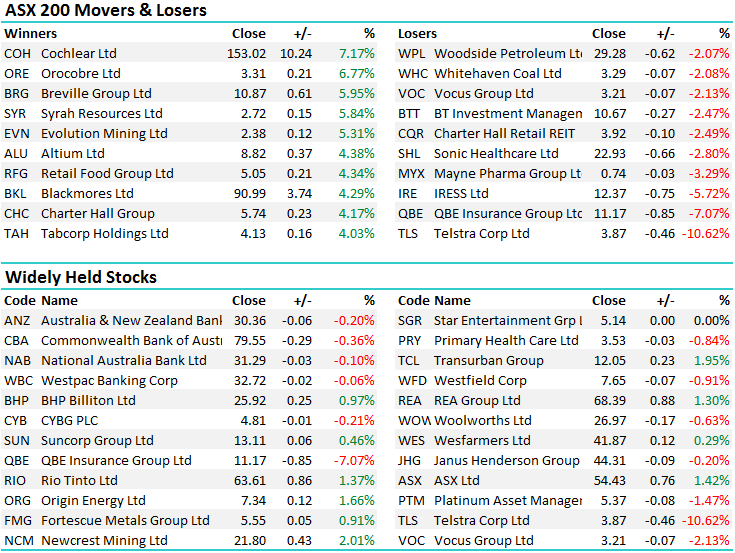

Another session on the mkt that promised so much - looked strong early on for a break out of the trading range but once again failed to go on with it. Obviously Telstra was the big news today down more than 10% after they reported earnings but more importantly, guided to a 22cps dividend for FY18, down from the 31cps they’ve been carrying unsustainably for too long. More on this below however we stepped up and bought Telstra this morning.

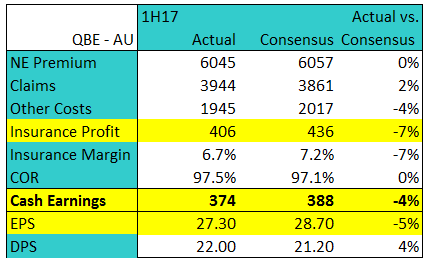

Elsewhere, more big moves from stocks that delivered numbers today with Wesfarmers trading in a big range – very strong early before closing marginally higher, the ASX outlined a solid result however it too had a big intra-day range, finally closing up +1.42% while QBE was clearly a disappointment, missing earnings expectations and dropping -7.07%. We own it unfortunately and have seen a very good profit turn into a slight one – our entry level of $10.98 versus todays close of $11.17.

Other reports of note came from Whitehaven Coal (WHC) which reported earnings below expectations (about a 4% miss) however they announced a nice 20cps cash return to shareholders which the mkt liked early on - however sellers looked through the sugar hit and the stock closed down -2.08% at $3.29.

Overall – the Material stocks were best bid today recovering from some recent weakness, however we continued to see this disparity between the main sectors. Banks rally / resources lag and vice versa leaving the index continuing to trade in this v’tight trading range…an overall range today of +/- 41 points, a high of 5806, a low of 5765 and a close of 5779, off -6pts or -0.10%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

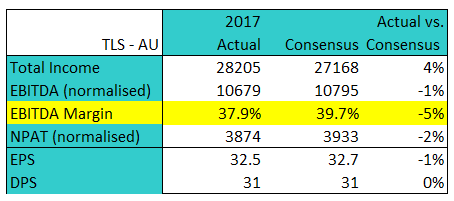

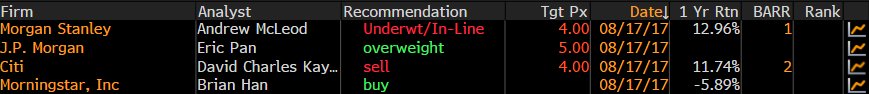

Telstra (TLS) - saw massive volume through the stock today (234m shares) trading within a range of $3.99 and $3.81 as investors dumped the stock following the BIG cut to the dividend. In terms of the earnings themselves, all was okay and they delivered an operating result that was a slight miss in terms of earnings, but not enough to see the stock drop 10%+.

The issue was around the dividend being cut by such a magnitude – from 31cps this year to guidance of 22cps next year while the market was factoring in a dividend of 28cps – a cut, but a lot smaller one. MM bought Telstra this morning at $3.85 in the Growth Portfolio and on the new dividend numbers, this will yield 5.71% plus franking. To us, this looks like a ‘capitulation’ style low in the stock which we view as an opportunity.

In terms of what analysts think, only a few have updated numbers – and clearly there is a big divide between views.

Telstra Daily Chart

QBE Insurance – another weak result with the company missing cash earnings by around 4% for the half. This is a company that promises so much yet struggles to deliver. There is lots to like about QBE, hence why we own it, however they have an uncanny knack of missing expectations. This time it was largely due to previously flagged issues within their emerging markets business so not new news, however the underbelly of the result was soft overall today. Looking at the selling pressure, it was sustained, and it seemed there were some big lines simply exiting the stock throughout the session.

QBE Insurance Daily Chart

I was stuck on the desk today however we had Suncorp Management in to Shaw to discuss their results, and the mkts reaction to them. Harry, one of the very good guys in my team went down to the meeting…. Let’s call it – Harry’s Hard Hitting Hindsight!

Since the Suncorp report, the stock has fallen 5.6% if we strip the value of the dividend inclusive of franking – which is not ideal. We met with Suncorp today to get some insight into what is going on and left feeling much more confident about the stock. In the report, the market focussed on a $122mil additional forecasted after tax cost in FY18 to accelerate their ‘One Suncorp’ model and refreshed strategy the group is executing. Suncorp is a business made up of many moving parts, not just limited to the Suncorp branded bank and insurer, such as AAMI, GIO, Shannon’s just to name a few. The new strategy looks to reduce customer churn and have ‘engaged’ customers holding multiple Suncorp products. Re-insurance is also being employed in the new strategy, reducing the impact of big events on the annual P&L These strategies look to grow the group and reduce volatility in the P&L. Along with this, the groups payout ratio for FY18 dividends will be increased from current levels of 60-80% up to a potential 87% so value for shareholders isn’t lost. They also continue to talk about excess capital on their balance sheet, and they should pay a special dividend in FY18 – all up, I like the stock and remain comfortable here!

Suncorp (SUN) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here