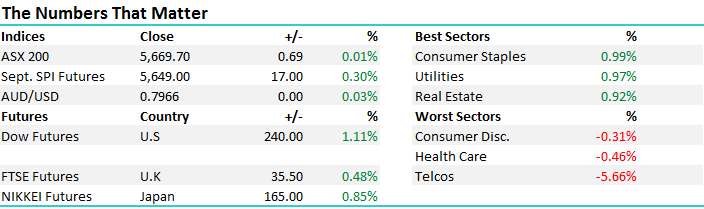

NBNco fails to play ball – Telstra drops below $3.60 (TLS, RHC, HSO, QBE)

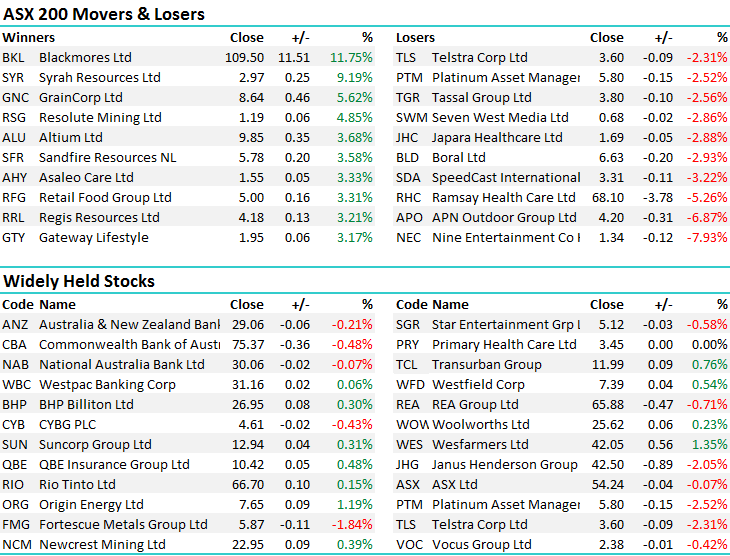

A choppy session played out in on the Aussie mkt today with the index ticking in and out of positive territory before closing marginally higher – Telstra took 9.36 index points from the 200 today after trading ex-dividend (more on that below) while we saw another day of BIG stock moves from companies that reported earnings. Overall, the Supermarkets did best, Wesfarmers the standout adding +1.35% to close at $42.05 while the Telcos provided most drag on the back of Telstra (TLS) – a range of +/- 36 points, a high of 5691, a low of 5654 and a close of 5669, up 0.7pts or flat.

ASX 200 Intra-Day Chart

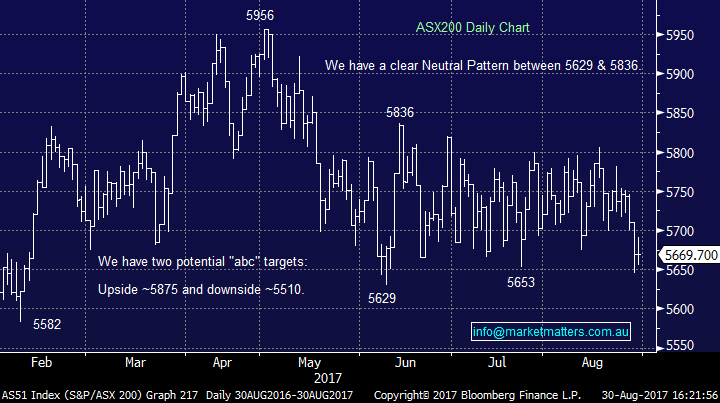

ASX 200 Daily Chart

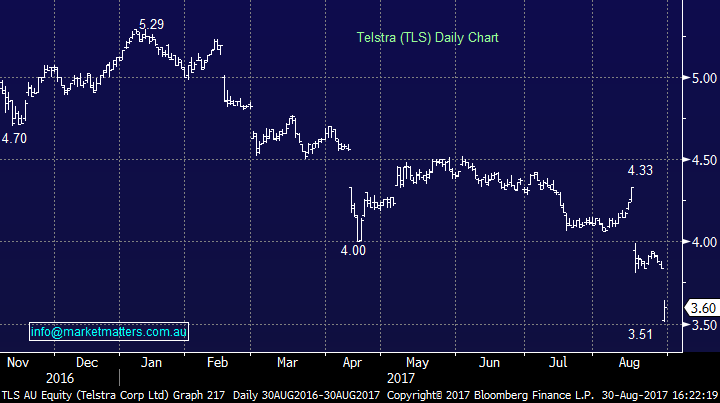

Telstra (TLS) – went ex-dividend today for 15.5cps fully franked which is worth 22cps. The stock dropped by 24cps so was marginally weaker overall. A debacle by the exchange this morning saw a trading halt established, news released, the exchange said to disregard it, but the stock stayed halted anyway – a bit of a debacle by the exchange which sent TLS down to a low of $3.51 in early trade only to see a strong recovery to close at $3.60. We own Telstra in the MM Growth Portfolio from a pre-dividend BUY price of $3.85 and today we increased our exposure by another 2.5% below $3.60. This stock dropped today on the dividend however also a negative knee jerk reaction to news that nbnco has failed to approve a plan by TLS to monetise the nbn receipts through securitisation.

Without getting too bogged down in detail, as part of the telco’s capital allocation strategy review it commenced in November last year they included a potential plan to monetise a portion of locked-in recurring NBN receipts. The plan involved selling off the intrinsic value of the future payments before they are made and buying it back at a later date - effectively bringing forward the $5bn payments…That proposal was subject to a number of approvals, and nbnco has proven a sticking point.

That said, this does not have a large financial impact on TLS and the reaction this morning seems overdone.

Telstra Daily Chart

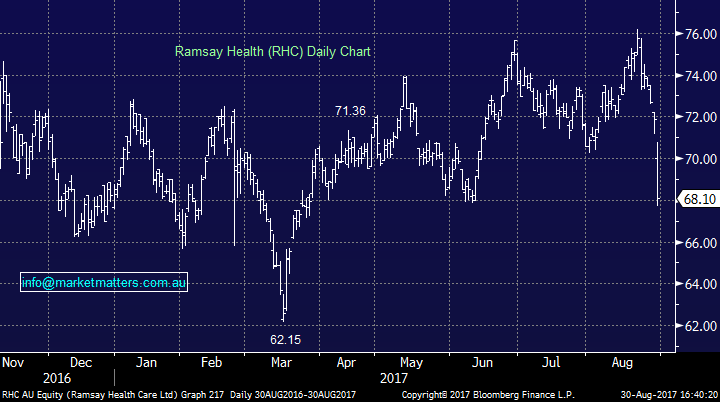

Elsewhere, Ramsay Healthcare was soft – down by -5.26% after their results failed to ignite the mkt. On face value the result was strong with Australia's largest private hospital operator meeting its full-year guidance, posting core net profit growth of 12.7% to $542.7 million. That said, revenue was basically flat at $8.7 billion highlighting the current issues facing the sector around top line growth. Furthermore, in Feb the company upgraded guidance for core earnings to grow by 12-14%, up from 10-12% previously stated, however today they guided for 8-10% which was clearly a downside surprise – and the stock felt the pain as a result. We own Healthscope – buying into weakness last week – and clearly this is also struggling however in our view the market has already re-rated it.

Ramsay Healthcare Daily Chart

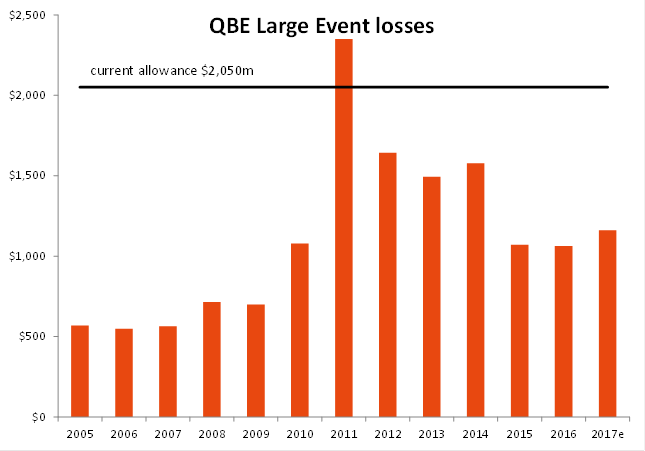

QBE Insurance (QBE) - Clearly a stock that has been under immense pressure of late – a few obvious reasons around earnings disappointment, a drop in US bond yields, weakness in the $US and finally Cyclone Harvey. The first mentioned issues will work themselves out in time, however in terms of the hurricane in the States, QBE has total large event cover (cats) of $2,050m, this includes an aggregate cover they buy for $900m, which they have started doing in the last three years to lower risk. Harvey is estimated to be large but there has been a lot worse in history. Could QBE be at risk if another large event between now and end of year. It’s possible but looks unlikely. In 2015 they had large event losses of $2,350, only time in 13 years over $2,050m! All up, this is unlikely to cost QBE money and the stock bounced from its daily low today – one to watch for tomorrow.

Chart sourced from Shaw and Partners

QBE Insurance (QBE) Daily Chart

Please note – performance is excluding the dividend amount if the stock has traded ex-dividend today

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here