The reasons why CYBG has rallied +10% in the last week or so (CYB, TPM, AWC)

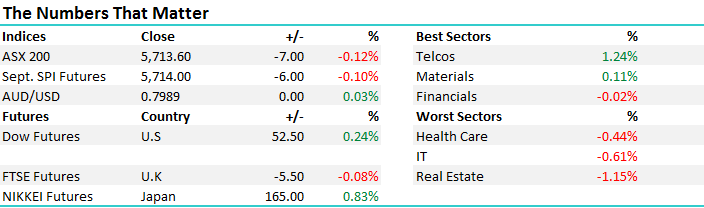

Another soft session for the Aussie market today, failing to hold onto early optimism and closing in the red. The Telco space (thanks to TPG Telecom + a good +1.11% rally in Telstra) provided most support while weakness was felt amongst the Real Estate stocks. Overall, we had a range of +/- 28 points, a high of 5742, a low of 5713 and a close of 5713, down -7pts or -0.12%.

ASX 200 Intra-Day Chart

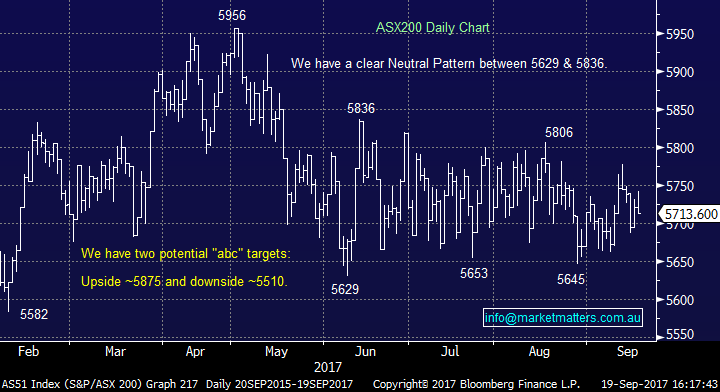

ASX 200 Daily Chart

Direct From The Desk – I took a quick look at CYB today and outlined some of the reasons why it’s been strong in recent times – largely comes down to interest rate expectations in the UK and they’re highly leveraged to it. A 1% hike in rates in the UK gives CYB earnings a +30-40% boost. We have 10% of the MM Growth Portfolio in CYB and enjoying the ride. I cover our target level in the update below.

CYBG Daily Chart

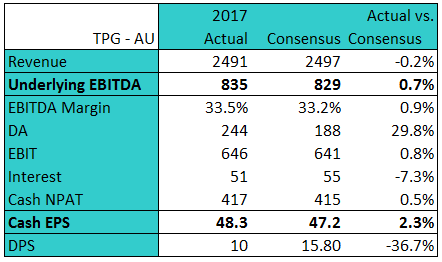

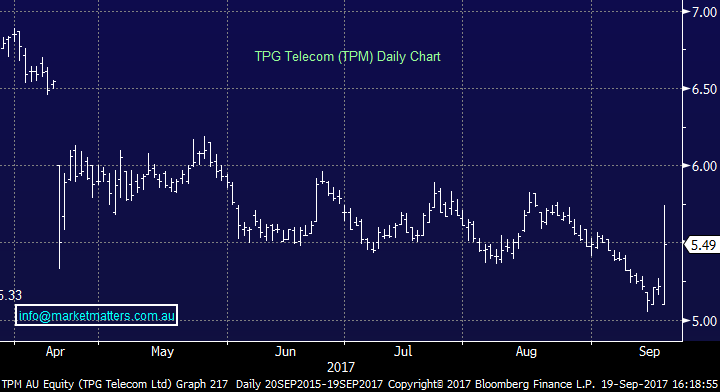

TPG Telecom (TPM) – Reported full year numbers this morning that were ahead of market expectations however their guidance was soft and below consensus numbers. The strength in the stock (+5.08%) was interesting and highlights just how negative the market has gotten in terms of positioning within this sector. In terms of the numbers, earnings were better however as you’d expect with a stock building multiple mobile networks, the dividend was cut fairly substantially – although no one in their right mind will be holding this coy for income! Although it doesn’t show in the table below, the outlook was also less upbeat than expected with the company guiding to EBITDA in the range of $800m-815m while the market sits at $844m. Margins held up well and they’re adding customers so not a bad result from TPM over the past 12 months, however forward guidance is the issue + the company is spending money hand over fist in the next few years. Hard to get excited about it despite a good day today + the mkts negative positioning!

TPG Telecom Daily Chart

….and finally we took a nice profit in Alumina (AWC) in both the income and growth portfolios booking gains of 13% and 10% respectively. Not a bell ringer however we continue to think that Material stocks are showing signs of an overall topping pattern while the banks are showing signs of a bottoming pattern. CYB as outlined in the vid above is your suercharged exposure to higher interest rates in the UK, however it’s a good ‘magnified’ example of the sort of stocks we should be in as external influences track back nearer to normality. QE – Interest Rates etc.

Alumina (AWC) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/9/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here