Déjà vu on the market

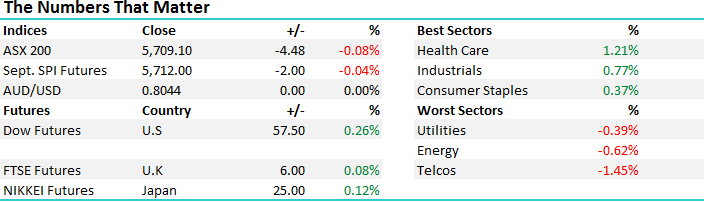

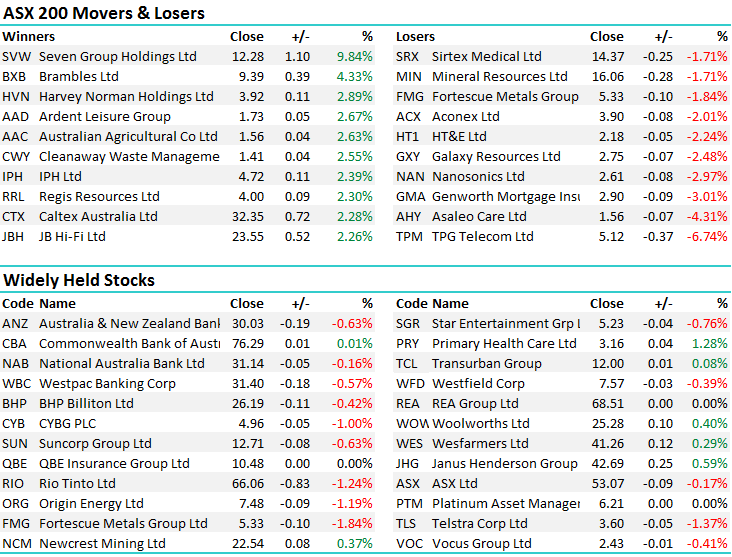

It seemed like a case of déjà vu on the market today, a wave of selling this morning was slowly offset with buying throughout the day and the index finally finishing close to little changed. Despite futures pointing to a higher open overnight, the market quickly took 34 points off the index in the first hour of trading and once again the weakness was bought. Health Care was the best on ground, up 1.21%, and Telcos were the biggest drag on the index down 1.45%. Overall, a range of +/- 33 points, a high of 5713, a low of 5680 and a close of 5709, down 4pts or 0.08%.

ASX 200 Intra-Day Chart

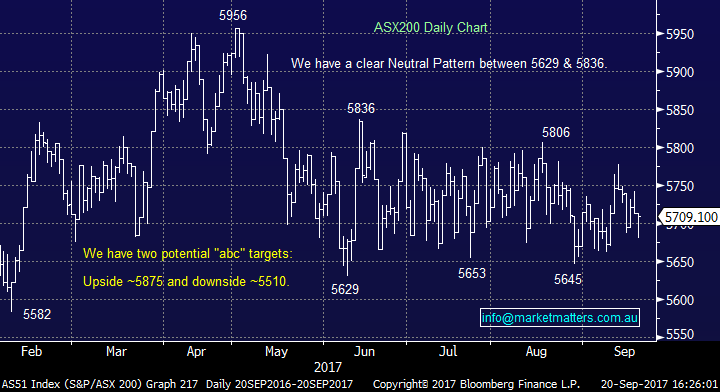

ASX 200 Daily Chart

TPG Telecom (TPM) fell sharply, more than offsetting the gains made yesterday after the lacklustre result. The early optimism of TPG’s growth plans shown by investors yesterday has clearly subsided and selling that was expected after the poor result took over today. Telcos followed the lead with Telstra and Amaysim both closing lower. Clearly volatility has picked up recently in the telco sector and we are watching our position in Telstra carefully, however we see upside in Telstra and believe the market has been too harsh on Australia’s biggest telco.

TPG Telecom Daily Chart

Telstra (TLS) Daily Chart

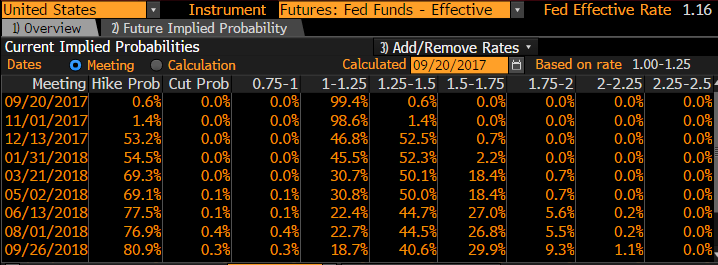

All eyes will be on the US Federal Bank meeting to be held tonight and while we are not expecting a move on interest rates tonight, the market will be watching commentary regarding the $US 4.5trillion worth of government on the Fed balance sheet. Recent meetings by the FOMC have suggested they are willing to play to the market expectations in fear of spiking volatility, and with the VIX currently at 10.15 the market is very complacent heading into the announcements. Any news on the movement of these assets will have longer term macro impacts which we spoke about this in the Income Report published today:

“Investing for income is not about simply looking at yield - it’s about understanding an underlying investment, having a view on the macro backdrop and determining how the market is positioned at any given time. We then need to consider yield in that context. We know bonds are extremely expensive at the moment with prices forced up by a huge wave of global central bank support designed to put downward pressure on interest rates, and help the economy pick itself up off the mat post the GFC. We know central banks are pulling back this support, shrinking balance sheets and the world is diverging towards a more normal path (I get the irony discussing normality when news headlines are dominated by Trump and Rocket Man!). Naturally, interest rates in this environment will go up so we should avoid fixed rate securities which will ultimately loose value as rates rise. We’ve done this by focussing on floating rate debt securities for a portion of the portfolio, however the same thinking should be applied to equities.”

Current Implied Probabilities of Interest Rate Changes (US)

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/9/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here