Markets reacts to higher rates (Banks, SUN)

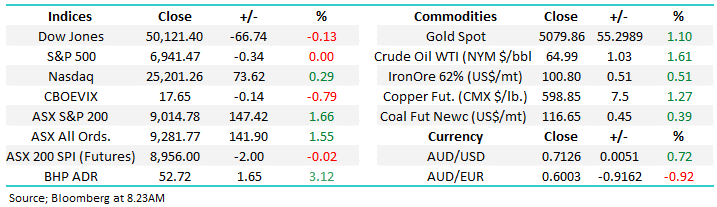

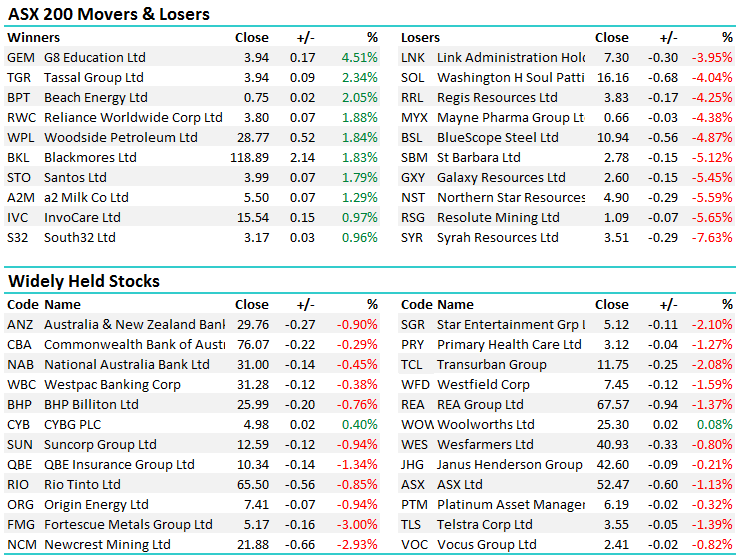

BANG! A fairly quiet trading session on Wall Street overnight gets overshadowed by a big selloff on the Aussie Bourse today with the market grinding lower throughout the session. As we covered in more substance during the AM report today, clearly interest rates are going up – the Fed is telling us an much, and the market will gradually start to take note. Bond yields higher, $US dollar higher and mkt lower are the short term trends we’ve been discussing and this clearly played out overnight and on the Aussie market today. Weakness will become a buying opportunity shortly and our ~20% cash in both MM Portfolio’s feels about right here. We’re targeting a move towards ~5500 however have our targets outlined into weakness (as per recent Weekend Reports).

Overall, the Energy stocks did best, Santos and Woodside the standouts adding 1.79% and 1.84% respectively while the interest rate sensitive sectors struggled– a range of +/- 69 points, a high of 5708, a low of 5639 and a close of 5655, off -53pts or -0.94%.

ASX 200 Intra-Day Chart

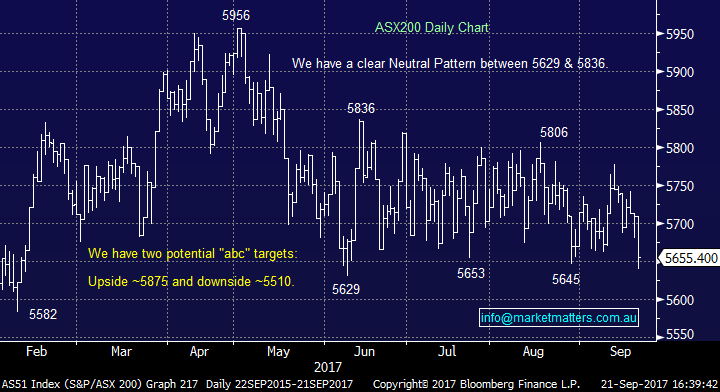

ASX 200 Daily Chart

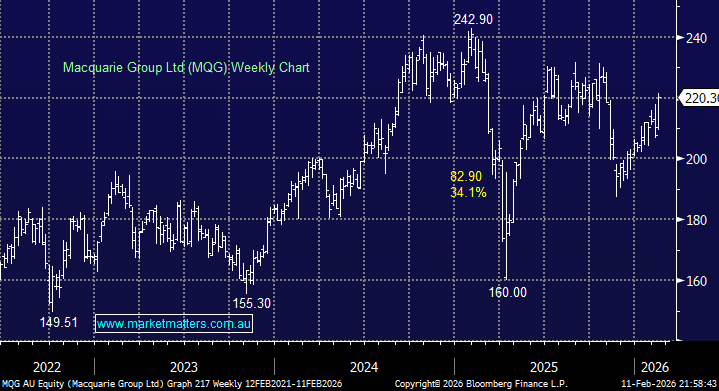

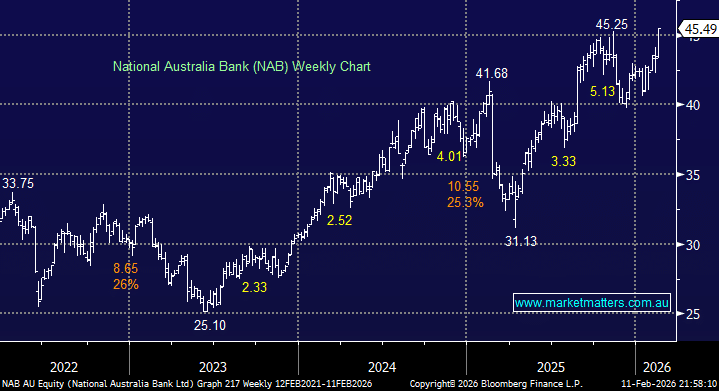

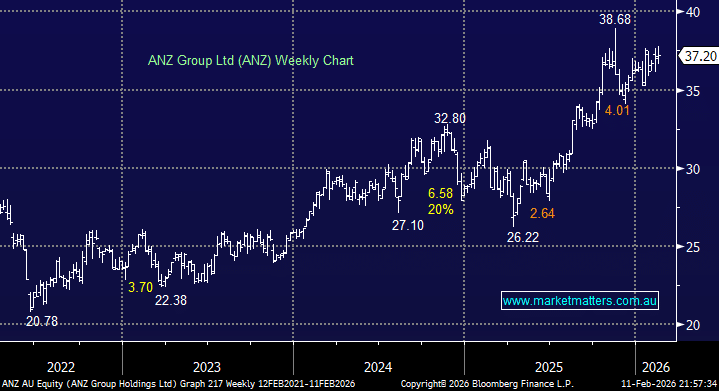

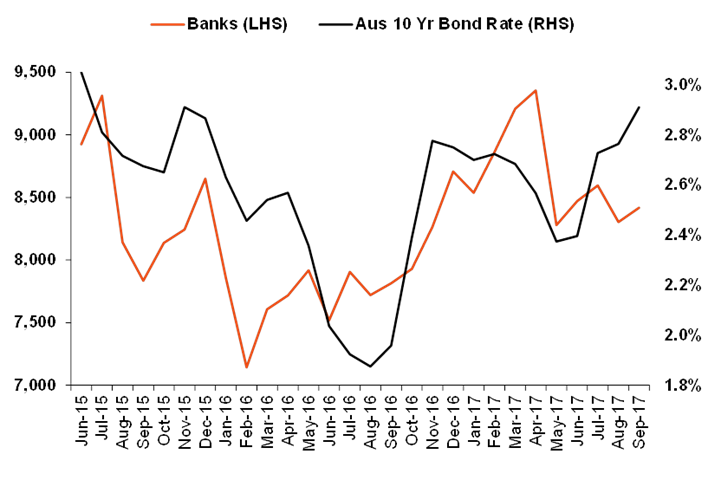

Banks – An interesting flash note out today from David Spotswood at Shaw singing from the same song sheet as the MM Investment Team….There seems to be a pretty good relationship with bonds and bank performance of late – when bond yields lift banks rally. You can put whatever narrative you like around this (stronger growth, less bad debts, helps margins, etc, etc). Last few months has broken down for some reason. We think value is pretty good for the banks, they are cum dividends, and the upcoming result should contain few surprises. A 9.5% gross yield for NAB and 8.9% for WBC are good enough for us, as are 12.3x PE ratios.

Source; Shaw Research

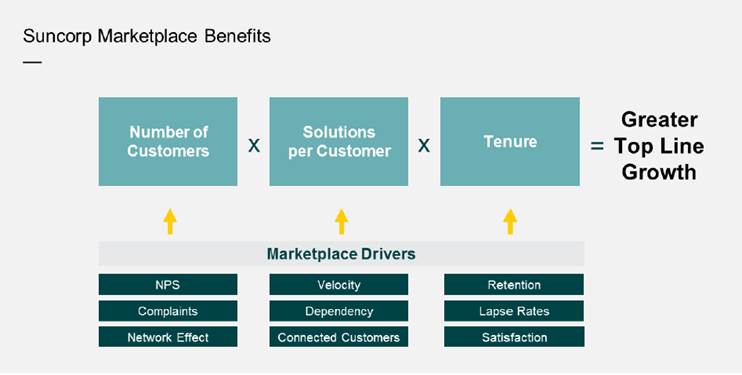

Suncorp (SUN) – Held their AGM and expanded on some of the aspects the market viewed as ‘negatives’ when they released results recently – the biggest of those being an acceleration in costs. At time of reporting, SUN poorly explained the reason underpinning the uptick in costs with analysts’ taking it as a permanent expansion, however more information has flowed, better explanations have been provided with company now saying that costs will return to $2.7bn in 2018/19. The increase in costs was associated with a re-positioning in the mkt, which will ultimately feed through to better top line growth….

The stock is on 12.6x 2019 earnings and 6.5% yield (9.3% gross yield), should grow at low single digits earnings and as we’ve been suggesting, earnings have upside if interest rates go up in Australia ($11.9bn investment portfolio, $9bn in low returning bonds, so +1% interest rates = +5% earnings). The other kicker could come from the sale of their Life Insurance Business. All up, good yield, cheap, benefits from higher interest rates, general insurance premiums going up and we rate management. The stock closed down -0.94% to $12.59…

Suncorp Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/09/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here