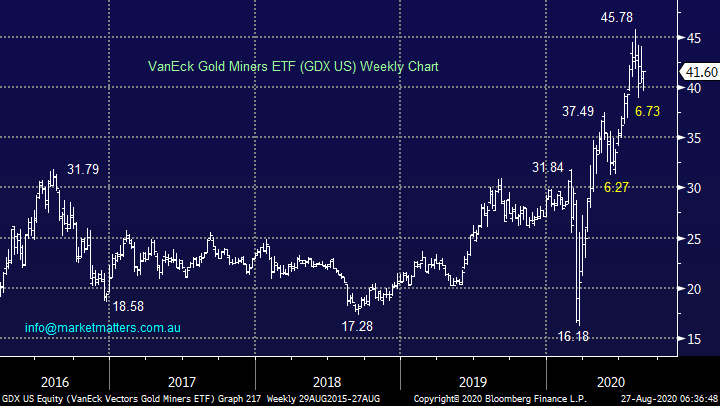

Look at the lumber price when you consider an economic recovery (BVS, AAPL US, GDX US, JHX, BLD, BKW, SOL)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Click on the link above to see all companies reporting today. I have covered the following in the recording below: APT, WZR, Z1P, REH, FLT, DTC.

Link to webinar where we cover DTC – Click Here – I mention in the recording above.

Look at the lumber price when you consider an economic recovery.

The ASX200 continues to rotate between 5900 and 6200, for the last 3-months every time local stocks have felt destined to break away from this comfort area its failed with the last 48-hours no change. The interesting action is unfolding beneath the hood and we believe this is where the main attention should continue to be focused e.g. yesterday alone on MM’s Growth Portfolio, we enjoyed Zip (Z1P) rally 27.5% while Bravura (BVS) fell -13.4%. Fortunately, the net effect was in our favour, but this is a clear illustration that a boring index is not remotely telling even half the tale.

Its not just the index that’s not witnessing follow through, it’s also been a common phenomenon on the stock level with obvious exceptions being stars like Xero (XRO) / Afterpay (APT) and “dogs” like Whitehaven (WHC). I’ve noticed 1-2 days strong up, or down, days is generally being followed by sellers / buyers fading the respective move, it feels like fund managers are fighting extremely hard around the edges to add some alpha / performance to their portfolios – as they should!

Overnight we saw US equities anticipating the Fed chairman Jerome Powell speech tonight which will basically deliver a message of steady as she goes with definitely no rocking of the recovery boat, the one change likely is around how they look at inflation ‘tweaking’ this to be an average inflation target, which allows for overshooting to offset undershooting i.e. giving them the ability to be more tolerant of higher inflation – the $US slipped lower even as bond yields rose helping precious metals rally strongly and the bull market in US tech continue with almost euphoric strength, the NASDAQ is now up 37% in 2020 even with COVID-19.

MM remains bullish the ASX200 medium term.

ASX200 Index Chart

We often say at MM “look after the losers and the winners will look after themselves” hence this morning I’m looking at BVS as opposed to Z1P. Yesterday they announced an inline FY20 earnings result however their FY21 guidance was around a ~12.5% miss to market expectations, hence the sell off but to me it was just common sense prudence in these uncertain times i.e. try and under promise and over deliver:

“While the new sales pipeline remains strong, due to the wider impact of COVID-19 there is greater uncertainty in the timing of deal closures when compared to prior years. It is therefore possible that FY21 NPAT will be similar to FY20”.

We’ve taken this as meaning that a worst-case scenario could be a flat year in terms of earnings, further clarity would always be nice but our inclination is consider adding to our 3% position. Also, importantly BVS is not trading on a hugely inflated P/E, for FY21 they’re now on 22x with – in MM’s view - upside to current FY21 earnings.

MM remains bullish BVS

Bravura (BVS) Chart

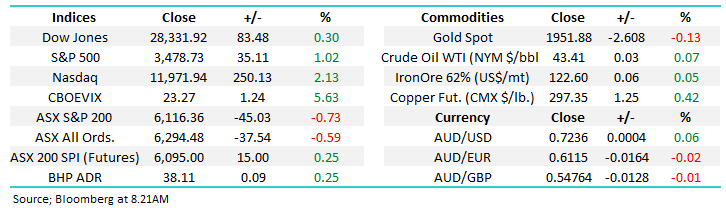

Global juggernaut Apple (AAPL US) continues to charge ahead, leading the NASDAQ from the front. In our opinion this is a clear illustration of the changing of the guard when it comes to stock / sector performance, unfortunately our own market lacks such quality large cap tech stocks hence the ASX is languishing compared to US Indices on the performance front – its why investing overseas is well worth considering for all investors, we are doing more and more international equities in portfolios which aids performance and well as providing greater diversification to themes we simply don’t have in Australia.

I know many pundits keep talking about excessive valuations across the tech sector but they are missing some vital points – these stocks are already generating huge cash profits while growing fast, with bond yields around zero they’re arguably far from too expensive – making comparison to the tech bubble of 2000 I think is irrelevant and actually counterproductive.

I’m confident at some stage in the next 6-12 months stocks like Steve Jobs legacy suffer a ~20% pullback but its likely to be only a blip on the chart like COVID has already become, in our opinion major pullbacks should be bought not sold – MM’s preference is this will probably unfold when markets become scared by an increase in bond yields.

MM remains long & bullish Apple (AAPL US).

Apple (AAPL US) Chart

Overseas Indices & markets

Overnight US stocks again rallied strongly to fresh all-time highs, ongoing impressive performance whatever the economic and social backdrop. As we’ve said previously this is a bull market where the most prudent action over the last 5-months has been to buy pullbacks where its averaged one a month since March and MM sees no reason this rhythm won’t continue into Christmas. Importantly investors should note that the last time the S&P500 broke out to fresh high in April 2019 it rallied for 8-months before having its ascent halted by the global pandemic i.e. our call of an ongoing rally for 12-18 months is statistically nothing unusual.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

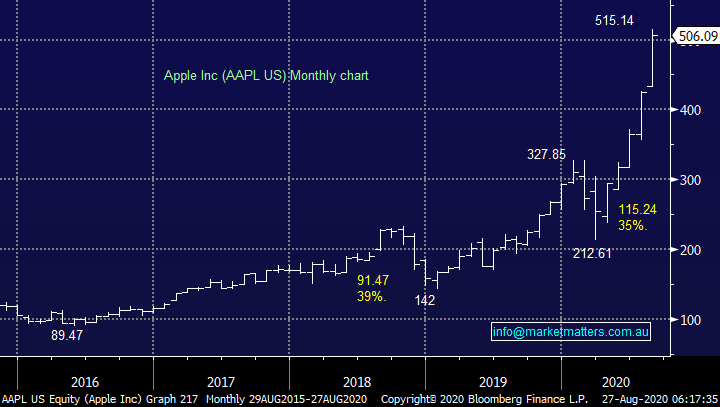

Overnight we saw the $US only dip slightly and gold pop +2% and silver over +3%, in our opinion this remains both the new trend and path of least resistance into Christmas. Our “Gut Feel” in the short-term is the $USD will bounce sending precious metals and most commodities lower i.e. on balance we still believe be patience will be rewarded with regard to accumulating resource stocks in the weeks ahead. However, the surprises in all markets are generally with the trend so opposed to further follow through by the $US it might just rotate around the 93 area before commencing another leg lower which fits our macro thesis.

MM remains bullish precious metals medium-term.

The $US Index Chart

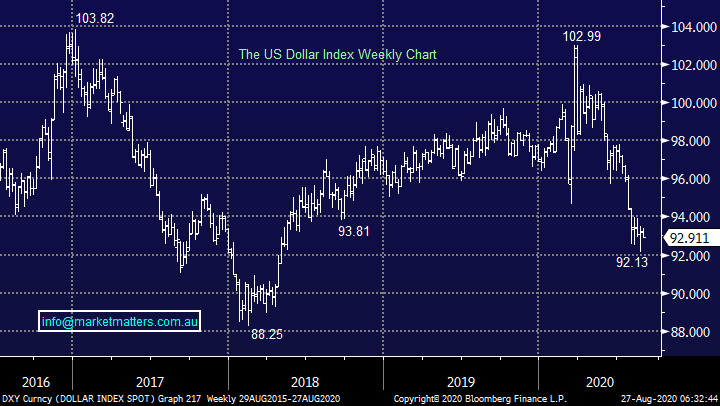

The VanEck Gold Miners ETF (GDX US) continues painting a very clear technical picture for MM – we are buyers below 40 and will be looking to take profit on our sector exposure just under 50 hence the risk / reward still favours the bulls.

MM remains bullish precious metals medium-term.

VanEck Gold Miners ETF (GDX US) Chart

Is lumber painting us a picture?

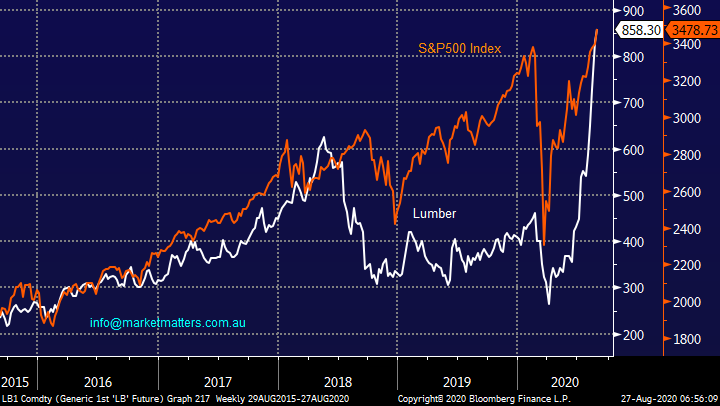

I know when investors look at the surface of the global economy there’s not much to like but all the forward looking signals we look at MM are pointing to areas of boom in the years ahead – there’s certainly been enough money thrown at the problem! Lumber has been going through the roof, the chart below illustrates how its already close to tripling in 2020. Historically this is very bullish both the US economy and the stock market, eventually when lumber prices “roll over”, there’s usually a multi-month divergence between the top in lumber and the S&P500’s equivalent making it a very useful leading indicator.

Undoubtedly part of the appreciation in lumber falls at the door of closed mills due to COVID but there’s actually been a simultaneous increase in demand for home construction in the US – it’s boring old supply and demand yet again. Some of the fuel pushing up prices is the young adults who were born around the 1990’s peak looking for their 1st home, low interest rates are obviously also helping this side of the equation. Construction has actually been a commodity / industry that has benefited from COVID as people in the US look to relocate to the cheaper “burbs” and build their own home, one of the few silver linings of the virus.

At this stage lumber is telling us the next few years will paint a very different picture to the virus influenced 2020, I’m sure a number of us will be saying good riddance over a turkey this Christmas!

MM remains bullish US equities.

Lumber v S&P500 Index Chart

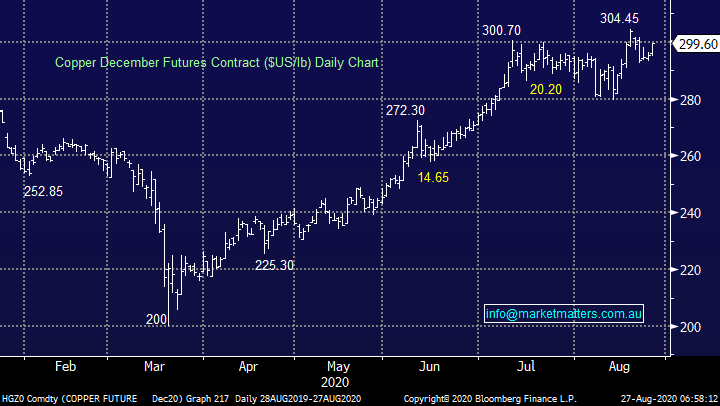

“Doctor Copper” is the more lauded global economic indicator and it’s also rallied in 2020, especially from its panic low in March. In our opinion the industrial metal is telling us all is well with the global economy as opposed to the exciting boom which lumber is portraying, hence it’s to the later that we have directed this morning’s report.

MM is bullish copper & the “reflation trade” into 2021 and beyond.

Copper ($US/lb) Chart

This morning we have simply looked at 3 Australian stocks with exposure to the US building sector where we believe things look good but remember we are bullish the $A which creates an almost new headwind with Australian companies enjoying meaningful revenue from the US.

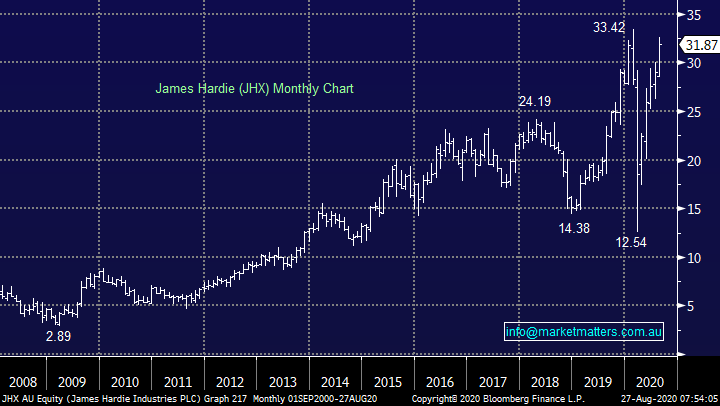

1 James Hardie (JHX) $31.87.

JHX manufactures building products for new home construction & remodelling, a great place to be assuming the lumber price is portraying an accurate picture. The stock is within striking distance of a fresh all-time high and we believe for the reasons discussed earlier it’s a matter of time before JHX punches up towards $40. Earlier in the month the company released its quarterly numbers and all looked good with net sales only down 5% while operating cash flow was up 35% year on year.

MM is bullish JHX.

James Hardie (JHX) Chart

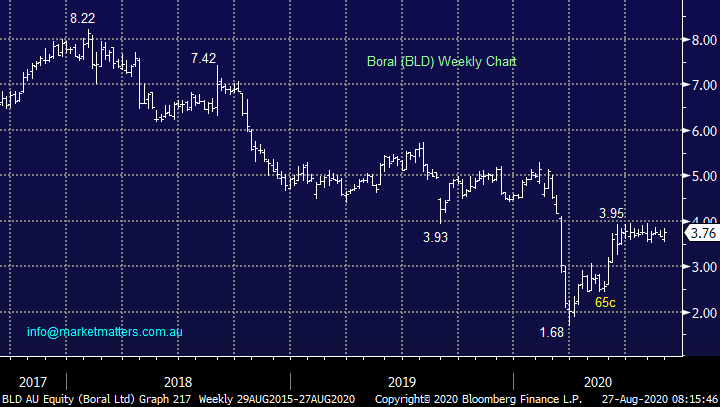

2 Boral Ltd (BLD) $3.76

BLD manufacturers / supplies building materials in Australia and internationally which includes a clay brick business in the US. The stock been a poor performer since 2017 but after Kerry Stokes bought 10% of the company, I feel this may finally be a turnaround story. There is talk of selling off some assets to fix their balance sheet which is/has been under stress.

MM is bullish BLD initially targeting a break above $4.

Boral Ltd (BLD) Chart

3 Brickworks (BKW) $18.03.

BKW manufactures and distributes clay products including brick, paver and floor tile products. Importantly BKW recently invested in 3 brickmaking businesses in the US creating a potentially strong growth channel moving forward plus an apparently sustainable 3.5% fully franked dividend is not to be sniffed at in today’s almost zero rate world. Also, BKW owns 40% of Soul Patts (SOL) which is bullish, we can see it rallying ~20% higher – see 2nd chart below.

MM is bullish BKW eventually targeting a break above $21.

Brickworks (BKW) Chart

Washington H. Soul Pattinson (SOL) Chart

Conclusion

MM is bullish all 3 stocks looked at today with our order of preference BKW, JHX and BLD.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.