Evaluating 5 outperformers asking if “we’ve missed the boat” (APX, WHC, GOOGL US, RWC, ARB, SUL)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Click on the link above to see all companies reporting today. I have covered the following in the recording below: CGC, BLD, NXT, HVN

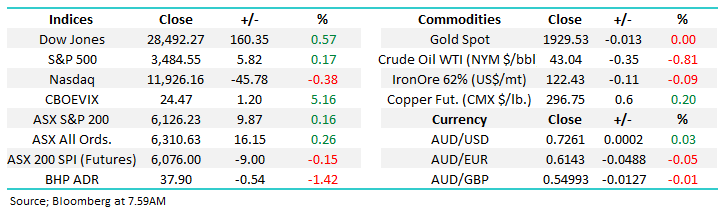

No change with the ASX200 continuing to rotate between 5900 and 6200, we managed to hold onto small gains yesterday after attempting an earlier breakout on the upside, the rhetoric is becoming almost boring! Reporting season wraps up today (Costa Group out with 1H20 numbers) which is likely to see some calm to the market on the stock level, it’s certainly thrown up some standout winners & losers, below is a quick glance at the stocks who have moved by more than 25% over the last month:

Winners – ARB Corp Ltd (ARB), Reliance Worldwide (RWC), Corporate Travel (CTD), IDP Education (IEL), oOh!media Ltd (OML), Mesoblast (MSB), Super Retail Group (SUL), Eagers Automotive (APE), Megaport Ltd (MP1), Nearmap Ltd (NEA), Afterpay Ltd (APT), WiseTech Global (WTC), Zip co (Z1P)

Losers – Whitehaven Coal (WHC).

A clearly positive reporting season with winners thrashing losers 12 – 1, if I was to pick 2 main themes amongst the winners it would top quality IT business continuing to grow and secondly the market underestimating how well some businesses would hold up threw COVIOD-19. However, when the banks drift it’s always hard work for the underlying index to enjoy any meaningful gains. We still, believe the “Big 4” will enjoy their time in the sun when bond yields make some sustained meaningful gains but for that to unfold we need financial markets to embrace a global economic recovery and perceive central banks are considering letting bonds trade without intervention.

Overnight Fed Chair Jerome Powell changed his rhetoric around inflation moving to an ‘average 2%’ hence they will be comfortable pushing inflation above this level in the short-term to average the last few years where we’ve seen depressed inflation across the globe. Basically they are taking on a flexible form of averaging inflation with little detail provided, his speech pushed up US bond yields and the $US sending precious metals and oil marginally lower – no great surprise to MM just logical process from the Fed but the sector implication is buy banks & fund with IT stocks, been a while since we’ve seen that!

At this stage I’m almost throwing up my hands on the index level – we’re bullish medium-term but have no idea week to week! Yesterday we “tidied up” our Growth Portfolio through focusing our Oil & Banking exposure to MM’s preferred stocks while buying Vocus (VOC) as flagged earlier in the week.

MM remains bullish the ASX200 medium term.

ASX200 Index Chart

As we’re focusing on the big winners of the last month in today’s report I thought I would look at the 2 largest losers on the boards yesterday.

Artificial intelligence (AI) business Appen (APX) fell -11% on Thursday after printing lower than expected numbers for the first half at both the revenue and EBITDA line (what was written in the PM note yesterday was incorrect in terms of the 1H20 result). The guidance was also weaker than expected with the range of $125-130m below market expectations of $132m while it also relies on an AUD/USD price of $0.70, below spot, remember MM is bullish the $A so in our opinion this is major headwind for APX.

As we said yesterday AI has seen demand growing throughout the pandemic benefitting from the increased ecommerce usage, among other trends. The stock did find some support late in the session, a good sign a few buyers are considering the stock into weakness, like ourselves. I feel the risk / reward is attractive around $35 or slightly below but we wouldn’t be chasing at current levels – this is an option for our IT allocation currently under pressure in BVS.

MM will be interested in APX around the $35 area.

Appen (APX) Chart

Whitehaven Coal (WHC) has decimated investors trying to pick a bottom, a great illustration of the trend being your friend. This is a business that cannot take a trick, the company’s annual result for the 2020 financial year showed revenue down almost 30% to $1.72bn which flowed down to a net profit after tax of only $30m.The company’s striving to increase mine efficiency and operational performance while doing a rain dance hoping for higher coal prices.

WHC continues to make fresh 12-monmth lows and on traditional metrics the stock looks cheap but coal is very much on the proverbial nose with a growing band of ethical investors banning them from their portfolios – it all seems too hard for WHC and of particular concern was the increase in debt during the period.

MM has no interest in WHC

Whitehaven Coal (WHC) Chart

Overseas Indices & markets

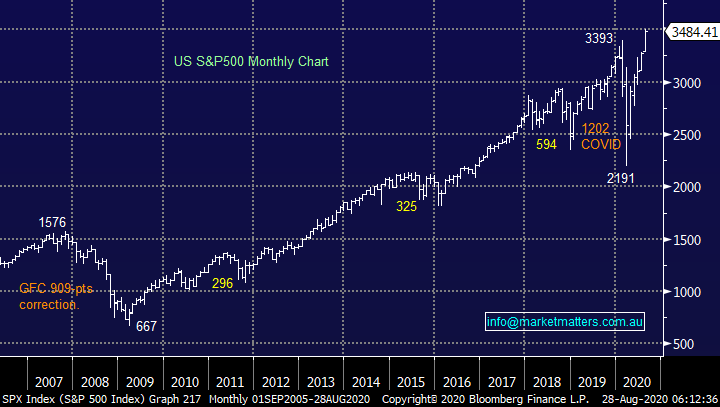

Overnight US stocks again rallied strongly to fresh all-time highs embracing the Feds thoughts towards inflation. The financials were the standout in the US while the IT sector actually closed down -0.4%, remember don’t fight the Fed! Hence MM is considering switching from one of our US IT names in our International Portfolio and allocating the funds to a financial name e.g. Google Alphabet (GOOGL US) to a combination of JP Morgan (JPM US) and Wells Fargo (WFC US) – Jerome Powell’s speech could be the catalyst for the relation trade and banks to finally regain their “Mojo”.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

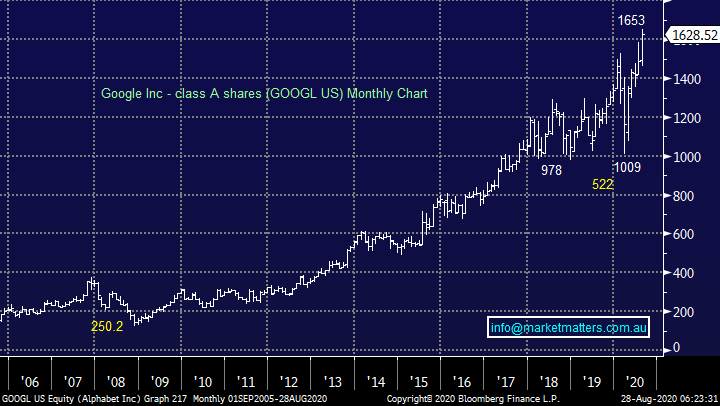

The above mentioned Google has really looked after MM since the aggressive COVID-19 sell-off in March however we’ve now looking to tweak our portfolio, we’ve been looking for a reason to trigger this move and now the Fed has spoken we believe the odds have tipped in favour of the financials – undoubtedly a contrarian call which has threatened to unfold a few times only to fail in 2020.

MM feels the IT sector generally is due for a period of underperformance, however that will not stop us investing in specific stocks

Alphabet (GOOGL US) Chart.

Should we be chasing any of the top performers?

The winners list over the last month contains 3 IT stocks who have soared of late but after the Fed’s comments last night which saw US 10-year bond yields rise we have overlooked these companies and focused on 3 of the less glamorous names.

Winners : ARB Corp Ltd (ARB), Reliance Worldwide (RWC), Corporate Travel (CTD), IDP Education (IEL), oOh!media Ltd (OML), Mesoblast (MSB), Super Retail Group (SUL), Eagers Automotive (APE), Megaport Ltd (MP1), nearmap Ltd (NEA), Afterpay Ltd (APT), WiseTech Global (WTC) & Zip Co (Z1P)

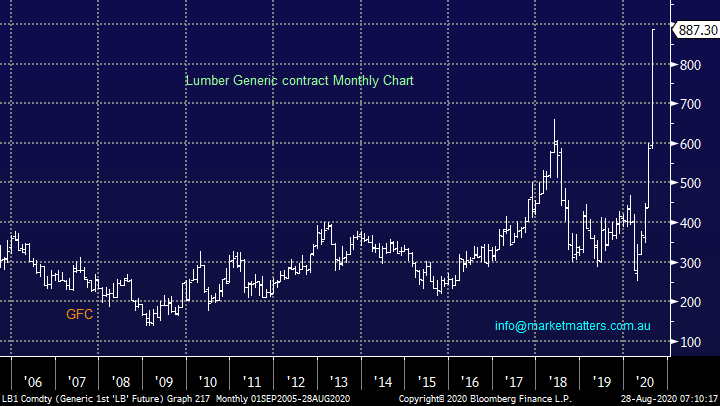

The chart below illustrates to MM that bond yields are “looking for a low” and the comments overnight from Jerome Powell might just have cemented March’s panic spike low as the end of the multi-decade bear market.

MM remains bullish the reflation trade & by definition bond yields.

US 10-year Bond Yields Chart

Subscribers who doubt our reflation view should remember the massive appreciation of lumber over the last few months – it was up another +3.4% last night.

MM is bullish lumber & the “reflation trade” into 2021, and beyond.

Lumber Chart

As we said above this morning, we’ve looked at 3 Australian stocks who’ve soared over the last month to evaluate if we still like them, especially from a risk / reward perspective.

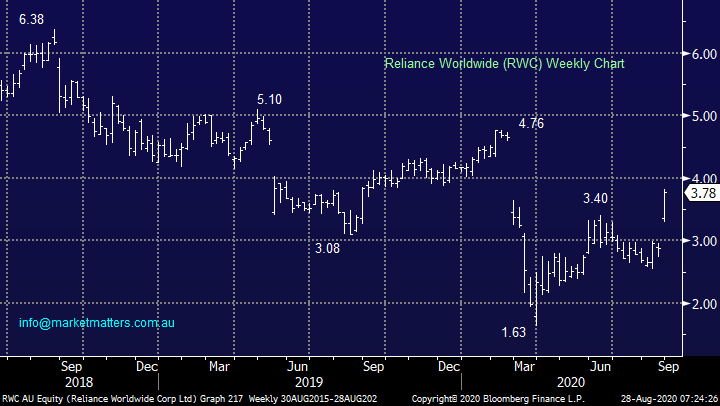

1 Reliance Worldwide (RWC) 3.78

RWC delivered a strong result early in the week with the plumbing brands growth in the Americas driving revenue 5% higher for the year. Costs were higher though, and EBITDA fell 9% on last year, but the result was a ~2.5% beat to expectations. Surprisingly, March and June were record sales months for the group, despite being impacted by COVID, again an illustration that analysts have been too pessimistic in many pockets of the market into reporting season.

Positive momentum has continued into the new financial year with North America witnessing sales 22% higher in July vs the prior year and all geographies trading flat to higher on pcp for the first few weeks of August. The market is expecting just 2% growth at the EBITDA line for FY21 which the company appears to be beating so far. While the business is doing well, the pop on Thursday was largely on the back of the low hurdle the market had in place for RWC however we are believers in the “recovery trade” and in this the continuation there of, we see another 20% upside for RWC in the short-term.

MM is bullish RWC at today’s levels.

Reliance Worldwide (RWC) Chart

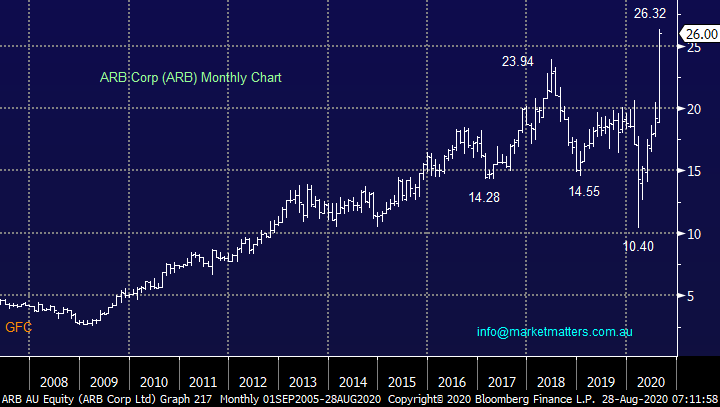

2 ARB Corp (ARB) $26.00

The 4WD accessory business ARB delivered another strong FY20 result earlier in the month with revenue of $467m, 3% above expectations. NPAT came in at $57m v $48m exp (flat year on year) while sales were up +4.8% during FY20 overall, although it was volatile with a weak April / May giving way to record highs for June / July. ARB, like many of the retailers, they used the weakness induced by lockdowns to meet Jobkeeper hurdles before the business reaccelerated – smart move!! The company will provide more in a trading update at their AGM on the 16th October. We like the business with quantifying the optimum entry / risk reward the challenge with the stock not cheap, its P/E for next year is almost 34x.

MM likes ARB ideally under $25 with stops below $23.

ARB Corp (ARB) Chart

3 Super Retail Group (SUL) $11.21.

This week SUL reported FY20 results although they had already updated the market at the end of July so the result was a more a confirmation of existing news. As you’d expect the numbers were in line with current mkt expectations while they also provided an update on the first 7 weeks of FY21 trading, with like for like group sales up 32% yoy (including the impact of Victorian lockdown) as more people travel domestically while exercise and fitness sales have also been strong. One of my favourite stores (BCF) saw sales up +72% - huge! We still hold SUL in the income portfolio.

Technically SUL is still a buy with stops below $10, about a 10% risk and it remains one of our preferred options for exposure to Australian retail.

MM is long and bullish SUL.

Super Retail Group (SUL) Chart

Conclusion

MM is bullish all 3 stocks looked at today with our order of preference at today’s prices RWC, SUL and ARB.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.