A slow start to a big week (KDR, APT, Z1P, WPL)

WHAT MATTERED TODAY

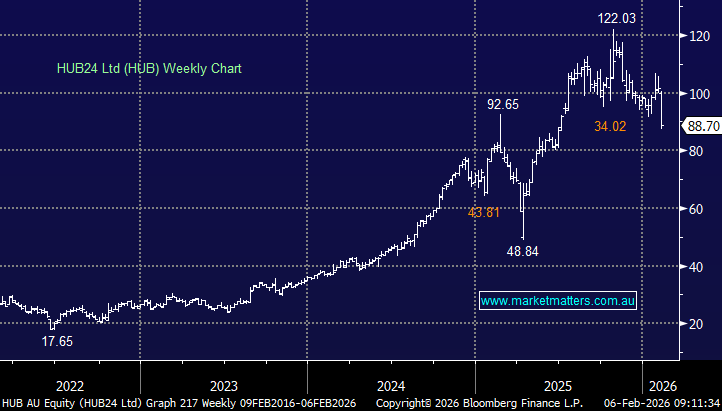

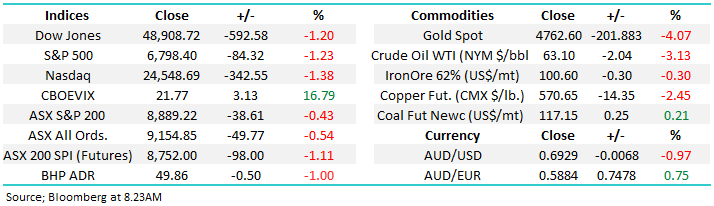

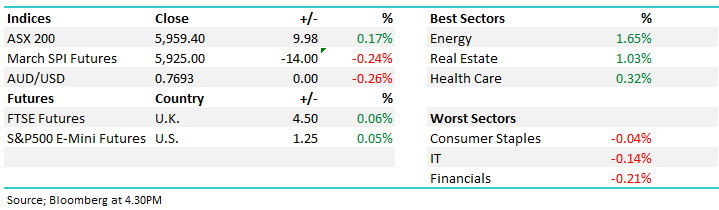

A fairly slow start to the week with the market opening reasonably well, selling off into lunchtime before clawing back up into the close – all up a choppy day with the banks underperforming the resources, energy stocks best on ground while CBA remained in the cross hairs of the banking royal commission, and was again the weakest link in the sector closing down -0.60% at $74.89.

The index finished higher overall by +10pts or +0.17% at 5959

Looking ahead for the week, most interest will be on the US Federal Reserve which is due to hike rates on Thursday – or so the market thinks. The real insight will come from the Fed members dot plot where they set out their expectations for future hikes. We should see a few members pencilling in 4 hikes rather than the 3 currently expected.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

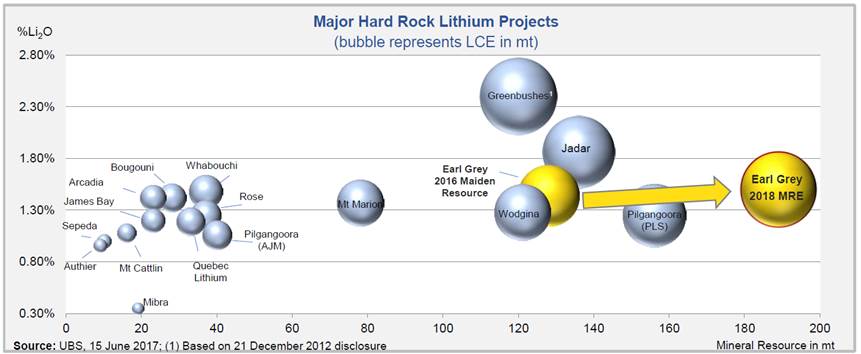

Kidman Resources (KDR) $2.24 / +5.16%;Came out this morning with a good announcement in terms of its Earl Grey Mineral Resource Estimate - essentially showing what we already knew – that it’s a huge resource, one of the world’s largest hard rock Lithium deposits + they dangled the carrot by saying that JV activity is progressing and they’ve had lots of off-take discussions but no deal just yet.

The stock was up on the news versus the sector which was down giving those subscribers who may have missed the boat initially the opportunity to sell around $2.25. We continue to like KDR from an operational perspective however given the relative performances from a sector perspective in recent months we now view ORE as a better risk adjusted bet, although we’re yet to pull the trigger and buy ORE just yet.

Kidman Resources Chart

Orocobre Chart

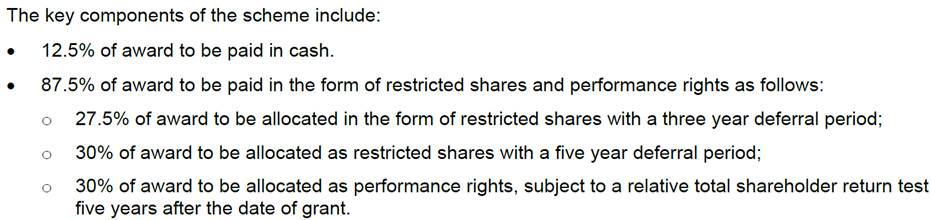

Woodside (WPL) $28.99 / +1.51%; A good day for WPL and other energy names thanks to a strong move in Crude on Friday night…WPL also announced some new incentive structures for its executives which I actually find interesting….and so does the bride so here’s the numbers AG….The CEO can make between 200% & 300% of annual salary through incentives. The key take way to me is a long lead time for incentive’s to accrue and these are tied directly to company performance which creates good alignment with shareholders…we like WPL at current levels.

Woodside Chart

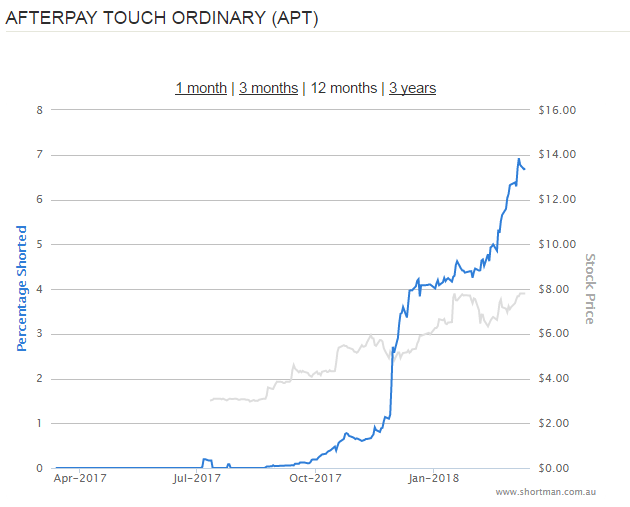

Payment Platforms; We’ve written a few times about Zip (Z1P) + AfterPay (APT), both are big in the payments space and both stocks have done exceptionally well last year but have become less loved in more recent times + APT in particular is getting hit by shorts after the CEO left while there are some obvious issues from a regulatory standpoint that could raise their head this year.

We actually like the space, like these two players, and we tried to BUY Z1P a few months ago but didn’t get set, and we didn’t chase the stock. We covered in the AM report today saying that… We could technically buy Z1P around 90c with stops under 80c but we will not be partaking – simply the trading action on both of these names looks weak for whatever reason and we’re happy standing on the sidelines for now – APT looks particularly weak.

Zip Co (Z1P) Chart

Afterpay (APT) Chart

% Short Sold has increased substantially

OUR CALLS

No trades on the MM Portfolios today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/03/2018. 5.11PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here